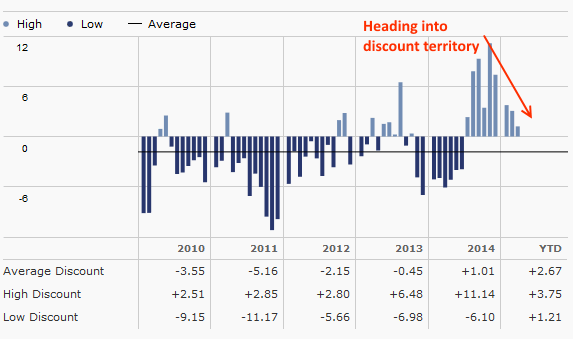

The First Trust Specialty Finance & Financial Opportunities Fund (NYSE:FGB) was launched right before the financial crash of 2008. Bearing the "financial" namesake, FGB was not omitted from the collateral damage of 2008's disaster: Its NAV dropped from 20 to 3. Understandably, investors have long ignored this fund, but these days FGB is looking increasingly attractive. Of notable interest are its 9% dividend and its new break into discount territory (since mid-2014, FGB had been trading at a premium).

The Investment Strategy and Portfolio

As a finance fund, FGB pools most of its assets into financial companies. Theoretically, FGB will allow you exposure to:

- Brokerage firms

- Investment management companies

- Insurance companies

- Banks

- Business development companies

- Financial holding companies

- Mortgage-backed securities.

- REITs

And indeed, FGB practices what it preaches. From the fund's fact sheet, its top three holdings are Ares Capital (ARCC), a finance company; Golub Capital (GBDC), a business development company; and Hercules Technology Growth Capital (HTGC), a venture debt provider. Upon closer inspection, you will find FGB's portfolio to be highly focused on micro-cap value stocks in the business development industry. Only 15% fall into other categories, 10% of which are REITs. Nearly all of its assets are U.S. assets.

From its net investment income, FBG distributes a quarterly dividend of $0.1725 per share (9.2%). Dividend payouts have been on the rise, up 8% from 2012.

The Discount and My Recommendation

Perhaps most interesting is that FGB is finally trading at a discount, albeit a small one. Important to note is the price/discount trend: NAV has been increasing at a pace exceeding the increase of FGB's share price. If this trend continues, we could soon see a significant discount. This, coupled with the ex-dividend date in mid-May, tells us that now is a good of time as any should you be thinking about investing in FGB.

As the history of this CEF shows us, we have few chances to buy FGB at a discount. My suggestion for investors interested in FGB would be to watch the discount/price spread in the coming weeks and buy when the discount seems to hit a peak. Get in before May 22th so you can collect dividends for this quarter.

An Alternative: A Comparison with BTO

Morningstar lists only one other closed-ended fund within its "financial category: the John Hancock Financial Opportunity Fund (BTO). Thus, investors interested in FGB should at least examine BTO to see whether BTO might better meet their needs for a closed-ended financial fund. In comparison to FGB, BTO offers a significant discount, at 8%. This discount is a logical one in terms of relative market value, as the quarterly dividend of BTO is only 5%, compared to FGB's 9%.

BTO's portfolio differs from FGB's in terms of the size of stocks it invests in, though not in the type of stocks. BTO's assets go into all sizes of stocks, from micro-cap to large-cap; JPMorgan (JPM) and Well's Fargo (WFC) are in its top-five investments. This portfolio difference makes BTO the more diversified choice. Despite their differences in portfolios, both FGB and BTO have been rather stagnant in NAV growth.

In any case, for the investor who wants exposure to the financial sector and the consistent dividends it supplies, either of these closed-ended funds would be appropriate. Though I'm partial to emphasizing the dividends more than NAV growth or diversification, other investors weigh these aspects differently. The following chart should help you decide which is right for you:

Fund | Discount | Dividend | NAV Growth YTD | Launch Date | Style |

FGB | 0.92%* | 9.20% | +2.87% | 2007 | Micro-cap Value |

BTO | 8.05% | 5.08% | -0.94% | 1994 | Micro and Large-cap Value |

*According to First Trust, as of 4/20/2015.