By David Foulke

The Best Investment with the Worst Performance

We are huge believers in value investing. I personally started off as a fundamental value guy, spending twenty-plus years trying to pick stocks. I eventually ran into Wes, who convinced me that a systematic approach to value investing was the way to go. Wes, as many of you are probably aware, co-wrote the book on a systematic approach to value investing, "Quantitative Value."

There are a lot of fun stories in the book, but I wanted to highlight a story in the book that is particularly instructive for those selecting active funds that can deviate wildly from standard benchmarks.

The book describes the experience of Ken Heebner, who ran the CGM Focus Fund (CGMFX), a diversified mutual fund that was Morningstar's highest performer of the decade ending 2009, yet whose investors lost 11% annually over the period.

Huh? How can this be?

A Wall Street Journal article referred to the fund's "hot and cold performance" and Heebner was quoted as saying, "a huge amount of money came in right when the performance was at its peak." Conversely, investors pulled a lot of money out when fund performance was at its worst. In the final analysis, investors' so-called "dollar-weighted" returns were some of the worst of the decade in the Morningstar universe.

So investors in the best fund actually had the worst performance.

Diving a little deeper into this story

In "Timing Poorly: A Guide to Generating Poor Returns While Investing in Successful Strategies," by Hsu, Myers and Whitby (a copy is here), the authors, using data from 1991-2013, investigate the effect experienced by Heebner's fund.

Focusing on value investing strategies, which have been successful over time, they note that, consistent with Heebner's experience, the dollar-weighted return, or IRR, for investors in many value investing funds, is frequently inferior to buy-and-hold or "time-series" returns. From the paper:

…over time periods with a documented high value premium, the average value investor in mutual funds has actually done worse than a buy-and-hold investor in an S&P 500 index fund.

Not only were investors unable to reap the benefits of value investing's outperformance (which they lagged substantially), but they also lagged the S&P 500 itself. Why? Because they tried to time their exposure to value, and chased returns. They systematically allocated to the strategy when value investing offered low premiums, and left the strategy when it offered high premiums.

The authors made some startling observations about how this could be interpreted.

These "market timer" investors are clearly not earning excess profits from the value anomaly. In fact, they may be funding excess profits for value investors who stick with the strategy, and may thus be contributing to the persistence of the value anomaly.

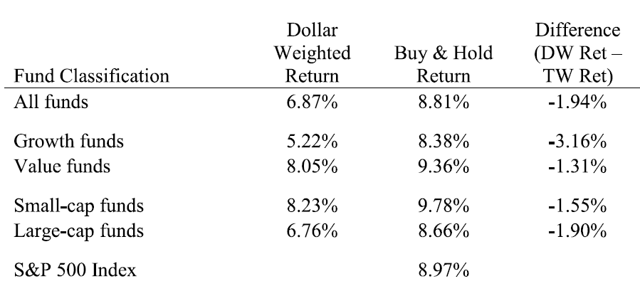

Additionally, the so-called "return gaps," reflecting the difference between the time-series (buy & hold) and dollar-weighted returns, were found to be more pronounced for growth funds and for large-cap funds (Table 2 from the Hsu, Myers and Whitby paper):

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Note that dollar-weighted returns for growth funds (5.22%), and for large-cap (6.76%) underperformed the S&P 500 (8.97%) by 375 basis points, and 221 basis points, respectively. Thus, even as growth and large cap Buy & Hold underperformed the S&P 500, the the market timing effects made things even worse for these investors. Talk about bad strategies! Meanwhile, dollar-weighted returns for value funds (8.05%) also lagged the index, by 92 basis points, but the worst "market timing" behavior was exhibited by large cap investors, and by growth investors.

Which brings us back to Heebner. Heebner's fund was both of these - it was a large-cap growth fund, suggesting that, if observations in this paper held, Heebner's investors may have been much more prone to such "timing" misadventures. Heebner's fund was also highly concentrated, holding only 25 stocks. It thus had high tracking error versus the index. As we know, when it was up versus the index, money poured in, but when it lagged the index, money left in droves. The fund's high tracking error likely magnified the effect of these flows in and out of the fund. The fund also had strong time series returns, when viewed from a Buy & Hold perspective, which attracted a lot of interest, and money. The thinking might have been: "I see good performance in this mutual fund, therefore I can probably get even better performance by timing it." What a disaster. It was the perfect storm - a behavioral witches' brew - for poor timing. And that is exactly what happened.

Market Timing Often Means Market Pain

It is a strange, and somewhat tragic reality that investors' "timing" behavior is not reflected in the time-series performance numbers of value investing funds. One wonders if people would do better, and be less active, if they knew how much they were hurting themselves through their timing efforts, and all their buying and selling. Probably not. But maybe that's a good thing for committed, hard-core value investors, since this may be a source of sustainable alpha in the value anomaly. Under this interpretation, in a sense, value works because value underperforms at times, and return-chasing fund investors get discouraged and leave the strategy, setting the stage for outperformance for those who remain.

While this is just an interpretation, it does suggest, however, that the most important decision one can make when choosing a value investing fund is simple: The decision to STICK WITH THE STRATEGY.