By Parke Shall

Exxon (NYSE:XOM) is set to report on Thursday. It is one of the biggest corporations on Earth, sporting a monstrous $364 billion market cap. Exxon was once pushing for the biggest company in the world with Apple (AAPL), but the recent downturn in oil prices has crippled the company's value for the time being.

Even in the age of Tesla (TSLA) and solar power, we feel a security with oil & gas stocks. Knowing you have one of the world's richest and most intrusive lobbies on your side of the argument always helps rest your head on top of a pile of energy stocks. We still feel this way, despite the recent dip due to oil prices, which, history tells us, could simply just be a fantastic chance to buy.

We believe oil is going to eventually recover, and Exxon will once again grow significantly from this point forward. Our dividend portfolio is on its way to becoming "overweight" dividend-paying oil names like BP Plc (BP), Chevron (CVX), and XOM, though we're only currently long BP.

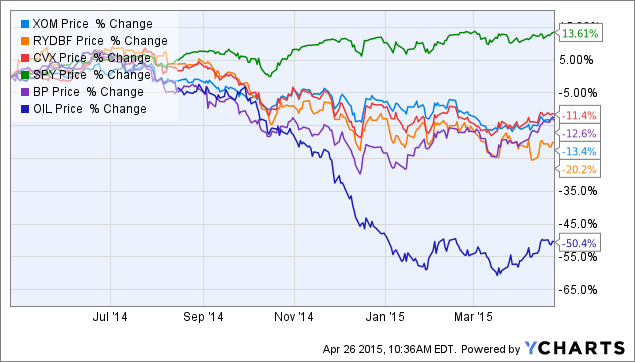

Here's a look at how the oil players have stacked up against the price of OIL, a crude ETF. The pressure that oil prices have put on these stocks, while the S&P rallies, is evident. In the last year, the S&P average has been up about 13%, while OIL has fallen an astounding 50.4%

XOM data by YCharts

Over the last 12 months, XOM has fallen 10.9%. Since the beginning of 2015, the company has been off 5.6%. We think the price of crude has since settled, however, and we believe that T. Boone Pickens' (bias? what bias?) prediction of a recovery in oil prices will prove to be correct in the coming 12-18 months.

Another part of the reason we want to get some exposure to oil & gas is the notion that these lower prices will result in restructuring, as well as potentially huge M&A opportunities. Shell's (RDS.A, RDS.B) acquisition of BG Group (BRGXF) last month, we believe, could set off a chain reaction of M&A in the sector as larger players look to solidify who their allies and enemies are at a time where oil prices have made all companies vulnerable. This USA Today article contends that Exxon could be one of the next names to be involved (including, of course, BP and CVX) heading forward.

Oppenheimer agrees, stating, "there will be an increased wave of mergers and acquisitions, among other things. Exxon would be one of the companies looking to benefit the most from this."

For the coming quarter, analysts have been expecting $0.82 on revenue of $51.22 billion, compared to $2.10 on revenue of $106.77 billion in the year prior. XOM is expected to earn $3.71 this year and $5.16 next year. The biggest factor continues to be whether or not the price of crude has bottomed, and oil companies' playbooks in dealing with the recent and rapid decline.

BNO data by YCharts

The above chart shows how dramatic the drop-off in Brent pricing was from the middle of 2014 until current. Chevron, like most oil stocks, is exposed almost fully to the price of oil.

Here's how analysts see Exxon heading into earnings,

- Analysts at Vetr upgraded shares of Exxon Mobil from a "buy" rating to a "strong-buy" rating and set a $93.97 price target on the stock in a research note on Friday, March 13th.

- Analysts at Goldman Sachs initiated coverage on shares of Exxon Mobil in a research note on Monday, March 9th. They set a "buy" rating and a $97.00 price target on the stock.

- Analysts at TheStreet downgraded shares of Exxon Mobil from a "buy" rating to a "hold" rating in a research note on Thursday, March 5th.

- Finally, analysts at Evercore ISI reiterated a "hold" rating on shares of Exxon Mobil in a research note on Thursday, March 5th.

We like Exxon as a buy here. Take a look at the company's consistent history of paying and raising dividends over the course of the last 10 years, despite dips in the equity price and oil. This leads us to believe the dividend is safe here, and that XOM can continue to be a great long-term hold.

XOM data by YCharts

The company's valuation, on top of its dividend, is also attractive. Its P/E multiple is in a bit of a contango, but taking the average of its past 12 months and its forward P/E gives us a multiple somewhere around conservative 13.75x. At a forward P/E of about 16x and a trailing P/E of about 11.4x (due to the falling oil prices), Exxon is cheap.

To make our case even more, XOM is trading at about 0.99x sales and only 2.1x book value. It has a book value of about $41 per share, even after taking into account the $29 billion the company has in debt. Its operating cash flow of $45 billion over the trailing 12-month period will likely move lower as time goes by, but remains adequate to satisfy the company's debts and give it leverage when it needs it moving forward.

Generally, we put XOM in with "staple stocks". It's a company that we'd be likely to buy with far less scrutiny on its multiple, due to the fact that it has a long operating history and a past of being a fine investment vehicle for long-term dividend investors.