Although the thought of investing in a cemetery operator or other death service provider may come across in your mind as grim, there's something settling about owning shares in a business that there will always be a demand for. For investors who are comforted by this concept, some excellent companies to consider include Service Corporation International (SCI), Carriage Services (CSV), StoneMor Partners, L.P. (STON) and Matthews International Corporation (NASDAQ:MATW). While it may not be a bad idea to own a piece of each of these for diversification purposes, the one investors may be most interested in is Matthews due to what appears to be some under-appreciation Mr. Market currently has for the business.

Matthews is mostly cheaper than its peers

Looking at all four companies on a price/sales basis, we find that Matthews is considerably cheaper than its peers. Currently, shares of the company are trading for just 1.32 times revenue, which means that investors are paying just $1.32 for every dollar in revenue the company is attracting from its customers. The closest competitor to this using the price/sales metric is Carriage, which is 48% higher at 1.95 times sales, followed by Service Corporation, which is 51% more expensive at 2.00 times revenue. Meanwhile, StoneMor is going for a hefty 2.83 times revenue, which implies a premium of nearly 114% compared to Matthews.

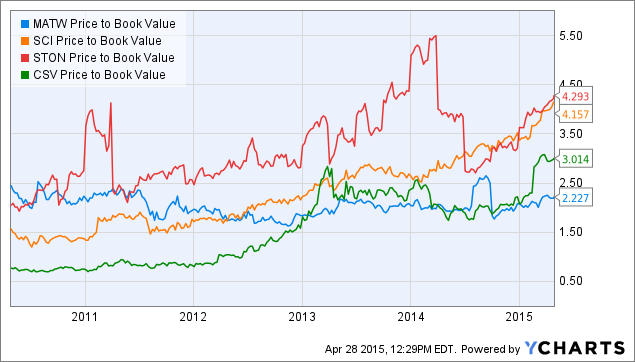

Another way to assess the difference in value between these entities is to look at each one's price/book value ratio. At the moment, shares of Matthews are going for 2.23 times its net assets, which means that investors are paying $2.23 for every $1 in assets (less liabilities) the company has on its books. Utilizing this metric, Carriage is the next closest in terms of price with its shares going for 3.01 times book value (a 35% premium to Matthews), while Service Corporation is trading 87% higher at 4.16 times book value. StoneMor, however, is the most expensive, with shares going for a 93% premium at 4.29 times its asset value.

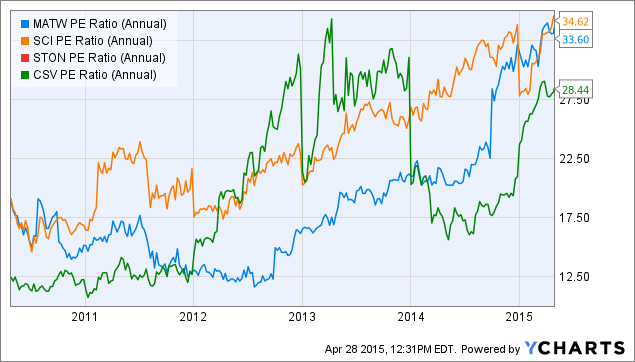

Of the three metrics I usually use for an industry like this, the only one in which Matthews is trading in-line with its peers is the price/earnings ratio. Right now, shares of the business are trading at a very high price/earnings multiple of 33.60, which is higher than Carriage's 28.44 times earnings and just a hair under Service Corporation's 34.62 times earnings. None of these are, in any way, on the cheap side of things but they sure do beat out StoneMor, which doesn't have a price/earnings ratio since it has been losing money for at least the past five years.

Why this difference in price?

There's no denying that, with the exception of profitability, Matthews is trading far cheaper than its peers but why is this? Personally, I believe this comes down to a misperception by Mr. Market. While Service Corporation, Carriage and StoneMor all derive essentially all of their revenue from funeral products or services, Matthews isn't what investors would call a pure-play in this space.

During 2014, Matthews received 54% (or $598.18 million) of its $1.11 billion in sales from three segments that have nothing to do with the funeral business; Graphics Imaging, Merchandising Solutions, and Marketing and Fulfillment. These segments focus largely on branding solutions for customers who are in need of a suite of specialty services such as packaging, display services and laser printing. Over the past three years, a combination of organic and acquisition-based growth has pushed sales in these segments up nearly 47% while the company's three death services segments (Cemetery Products, Funeral Home Products, and Cremation) have seen revenue climb just 3%.

To make things worse, these faster-growing segments are also generating lower margins for the business (2.3% operating margin compared to 13.6% for death services), which is also having a perceived negative impact on the company's value. While this is certainly far from great, this high-growth, low-margin business may not be costing investors much. Taking the price/operating income ratio of each of Matthews' peers above, we find that the market values these businesses at, on average, 28.32 times operating income.

Applying this same multiple to the operating income of Matthews' death services operations, we would have a market value on the business of $1.96 billion, which is nearly 17% higher than the company's current market cap. Using the (very loose) assumption that the stock market is generally efficient regarding these peers, it looks as though investors may actually be getting a discount on the company's death services operations while getting its fast-growing, low-margin branding business for free.

Takeaway

Moving forward, it will be rather interesting to see what transpires with all of these companies but Matthews especially. On a price/earnings basis, all of these providers are too rich for my blood but, given the seeming disparity in value between Matthews and its peer group, it looks as though it may provide investors who are interested in this space the greatest opportunity to make a profit.