Because cash is king and companies with reliable cash flows are viewed favorably, one of the most preferred ways to value companies is by using their cash flows.

Levered free cash flow is the cash flow available after subtracting interest payments on debt for a given year – this is a relevant cash flow measure to shareholders because shareholders are always paid after debtholders in the event of bankruptcy.

Looking at the ratio of levered free cash flow to enterprise value, we get a valuation ratio – enterprise value is the company’s value from all sources of ownership, and companies with higher levered free cash flow relative to enterprise value are more likely to be undervalued, because the company’s value is smaller relative to its cash flows.

To illustrate this, we ran a screen on the tech sector for stocks with the highest ratios of levered free cash flow to market cap.

Interactive Chart: Press Play to compare changes in analyst ratings over the last two years for the top six stocks mentioned below. Analyst ratings sourced from Zacks Investment Research.

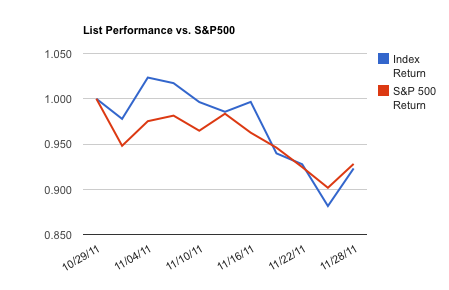

We also created a price-weighted index of the stocks mentioned below, and monitored the performance of the list relative to the S&P 500 index over the last month. To access a complete analysis of this list's recent performance, click here.

Do you think these stocks should be trading higher? Use this list as a starting point for your own analysis.

List sorted by levered free cash flow/enterprise value.

1. Insight Enterprises Inc. (NSIT): Provides information technology (IT) hardware, software, and service solutions to businesses and public sector clients. Market cap of $605.54M. Levered free cash flow/enterprise value at 22.69% (levered free cash flow at $142.86M and enterprise value at $629.52M). This is a risky stock that is significantly more volatile than the overall market (beta = 2.46). The stock is currently stuck in a downtrend, trading 14.39% below its SMA20, 13.11% below its SMA50, and 17.97% below its SMA200. It's been a rough couple of days for the stock, losing 10.74% over the last week.

2. SeaChange International Inc. (OTC:SEAC): Develops, manufactures, and markets digital video systems, as well as provides related services to cable system operators, and telecommunications and broadcast television companies worldwide. Market cap of $247.62M. Levered free cash flow/enterprise value at 22.25% (levered free cash flow at $30.50M and enterprise value at $137.10M). The stock is currently stuck in a downtrend, trading 7.19% below its SMA20, 5.6% below its SMA50, and 16.65% below its SMA200. It's been a rough couple of days for the stock, losing 7.9% over the last week.

3. Agilent Technologies Inc. (A): Provides bio-analytical and electronic measurement solutions to the communications, electronics, life sciences, and chemical analysis industries in the United States and internationally. Market cap of $12.21B. Levered free cash flow/enterprise value at 21.35% (levered free cash flow at $2.22B and enterprise value at $10.40B). The stock has performed poorly over the last month, losing 12.1%.

4. Teradyne Inc. (TER): Provides automatic test equipment products and services worldwide. Market cap of $2.23B. Levered free cash flow/enterprise value at 21.08% (levered free cash flow at $236.11M and enterprise value at $1.12B). The stock is a short squeeze candidate, with a short float at 10.91% (equivalent to 5.06 days of average volume). The stock is currently stuck in a downtrend, trading 12% below its SMA20, 6.27% below its SMA50, and 17.41% below its SMA200. It's been a rough couple of days for the stock, losing 8.05% over the last week.

5. Western Digital Corp. (WDC): Engages in the design, development, manufacture, and sale of hard drives worldwide. Market cap of $6.21B. Levered free cash flow/enterprise value at 19.73% (levered free cash flow at $479.50M and enterprise value at $2.43B). The stock has lost 21.23% over the last year.

6. Neutral Tandem, Inc. (TNDM): Provides voice, Internet protocol (IP) transit, and Ethernet telecommunications services worldwide. Market cap of $306.01M. Levered free cash flow/enterprise value at 19.61% (levered free cash flow at $39.83M and enterprise value at $203.13M). It's been a rough couple of days for the stock, losing 5.99% over the last week.

7. Rudolph Technologies Inc. (RTEC): Designs, develops, manufactures, and sells process control defect inspection, metrology, and process control software systems to microelectronics device manufacturers. Market cap of $236.72M. Levered free cash flow/enterprise value at 19.39% (levered free cash flow at $22.49M and enterprise value at $115.98M). The stock is a short squeeze candidate, with a short float at 8.61% (equivalent to 11.12 days of average volume). It's been a rough couple of days for the stock, losing 7.01% over the last week.

8. QAD Inc. (QADA): Provides enterprise software applications, and related services and support for manufacturing companies. Market cap of $185.96M. Levered free cash flow/enterprise value at 19.38% (levered free cash flow at $23.09M and enterprise value at $119.17M).

9. USA Mobility, Inc. (USMO): Provides wireless communications solutions to the healthcare, government, enterprise, and emergency response sectors in the United States. Market cap of $299.15M. Levered free cash flow/enterprise value at 18.56% (levered free cash flow at $51.33M and enterprise value at $276.58M). Offers a good dividend, and appears to have good liquidity to back it up--dividend yield at 7.39%, current ratio at 1.42, and quick ratio at 1.38. The stock is a short squeeze candidate, with a short float at 5.06% (equivalent to 6.21 days of average volume). The stock has lost 14.8% over the last year.

10. MagnaChip Semiconductor Corporation (MX): Designs and manufactures analog and mixed-signal semiconductor products for high-volume consumer applications. Market cap of $297.96M. Levered free cash flow/enterprise value at 18.55% (levered free cash flow at $60.99M and enterprise value at $328.71M).

11. Brooks Automation Inc. (BRKS): Provides automation, vacuum, and instrumentation solutions primarily to the semiconductor manufacturing industry worldwide. Market cap of $593.87M. Levered free cash flow/enterprise value at 18.29% (levered free cash flow at $77.99M and enterprise value at $426.49M). It's been a rough couple of days for the stock, losing 10.49% over the last week.

12. MedAssets, Inc. (MDAS): Provides technology enabled products and services for hospitals, health systems, and other non-acute healthcare providers in the United States. Market cap of $553.22M. Levered free cash flow/enterprise value at 18.20% (levered free cash flow at $254.73M and enterprise value at $1.40B). The stock is currently stuck in a downtrend, trading 11.29% below its SMA20, 7.16% below its SMA50, and 27.77% below its SMA200. The stock has lost 48.89% over the last year.

13. Tekelec (TKLC): Engages in the design, development, manufacture, marketing, sale, and support of telecommunications products and services. Market cap of $768.68M. Levered free cash flow/enterprise value at 17.65% (levered free cash flow at $86.09M and enterprise value at $487.89M). The stock has lost 11.55% over the last year.

14. Applied Materials Inc. (AMAT): Provides manufacturing equipment, services, and software to the semiconductor, flat panel display, solar photovoltaic (PV), and related industries worldwide. Market cap of $13.70B. Levered free cash flow/enterprise value at 17.61% (levered free cash flow at $1.59B and enterprise value at $9.03B). The stock is currently stuck in a downtrend, trading 12.12% below its SMA20, 8.3% below its SMA50, and 19.51% below its SMA200. It's been a rough couple of days for the stock, losing 6.73% over the last week.

15. Dell Inc. (DELL): Provides integrated technology solutions in the information technology (IT) industry worldwide. Market cap of $26.91B. Levered free cash flow/enterprise value at 17.57% (levered free cash flow at $3.55B and enterprise value at $20.20B). The stock has gained 10.39% over the last year.

16. Communications Systems Inc. (JCS): Manufactures and sells modular connecting and wiring devices, and media and rate conversion products. Market cap of $109.26M. Levered free cash flow/enterprise value at 17.42% (levered free cash flow at $12.40M and enterprise value at $71.18M). The stock is currently stuck in a downtrend, trading 10.91% below its SMA20, 10.14% below its SMA50, and 17.6% below its SMA200. The stock has performed poorly over the last month, losing 22.57%.

17. Telecom Argentina S.A. (TEO): Provides fixed-line telecommunication services and other related services in Argentina. Market cap of $3.47B. Levered free cash flow/enterprise value at 17.34% (levered free cash flow at $508.12M and enterprise value at $2.93B). The stock is currently stuck in a downtrend, trading 8.15% below its SMA20, 8.45% below its SMA50, and 22.2% below its SMA200. The stock has performed poorly over the last month, losing 17%.

18. Mediware Information Systems Inc. (MEDW): Develops, markets, licenses, implements, and supports clinical management and performance management information software systems and solutions in the United States and the United Kingdom. Market cap of $112.80M. Levered free cash flow/enterprise value at 17.20% (levered free cash flow at $12.94M and enterprise value at $75.22M). The stock has had a good month, gaining 11.34%.

19. Sykes Enterprises, Incorporated (SYKE): Provides outsourced customer contact management solutions and services in the business process outsourcing arena. Market cap of $666.47M. Levered free cash flow/enterprise value at 17.05% (levered free cash flow at $70.37M and enterprise value at $412.72M).The stock has lost 16.76% over the last year.

20. OmniVision Technologies Inc. (OVTI): Designs, develops, and markets semiconductor image-sensor devices. Market cap of $698.63M. Levered free cash flow/enterprise value at 16.55% (levered free cash flow at $39.99M and enterprise value at $241.58M). The stock is currently stuck in a downtrend, trading 14.96% below its SMA20, 22.79% below its SMA50, and 55.26% below its SMA200. The stock has performed poorly over the last month, losing 32.29%.

*Data from 11/25. Levered free cash flow and enterprise value data sourced from Yahoo! Finance, all other data sourced from Finviz.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.