This article is part of a series that provides an ongoing analysis of the changes made to William Von Mueffling's US stock portfolio on a quarterly basis. It is based on Mueffling's regulatory 13F Form filed on 05/04/2015. Please visit our Tracking Stocks In William Von Mueffling's Investment Funds series to get an idea of his investment philosophy and our previous update highlighting the fund's moves during Q4 2014.

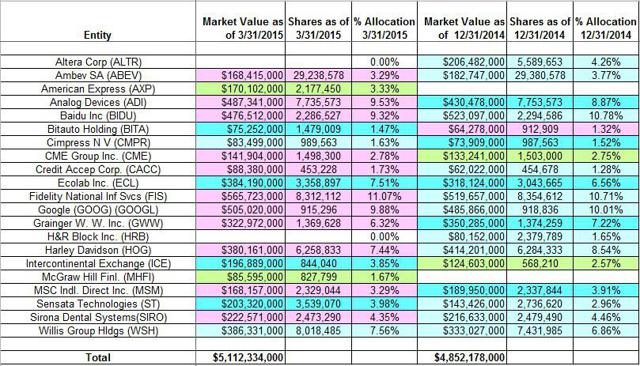

This quarter, Mueffling's US long portfolio increased from $4.85B to $5.11B. The number of holdings remained steady at 19: new positions in American Express and McGraw Hill Financial replaced Altera Corporation and H&R Block. The portfolio continues to be heavily concentrated with the top five holdings representing 47.35% of the total US long holdings. The largest position is Fidelity National Information Services which accounts for 11.07% of the US long portfolio. The largest five positions are Fidelity National Information Services, Google Inc., Analog Devices, Baidu Inc., and Willis Group Holdings.

Stake Disposals:

Altera Corporation (ALTR): ALTR was a 4.26% of the US long portfolio stake first purchased in 2011. The position was almost doubled in Q1 2013 at prices between $33 and $36.50. Q3 2013 saw a 25% stake increase at prices between $33 and $39. This quarter, the entire stake was eliminated at prices between $32.93 and $44.39. The stock currently trades at $45.02.

Note: The stock experienced a one-third price-spike in late March following disclosure of merger discussions with Intel Corporation (INTC) - the talks ended soon after as they could not agree on price.

H&R Block (HRB): HRB was a small 1.65% of the US long portfolio position established in Q2 2014 at prices between $27.40 and $33.52. The stake was eliminated this quarter at prices between $31.58 and $35.64. The stock currently trades at $30.85. The quick turnaround indicates a bearish bias.

New Stakes:

American Express (AXP) & McGraw Hill Financial (MHFI): AXP is a 3.33% of the US long portfolio position established this quarter at prices between $78 and $93. The stock currently trades near the low end of that range at $78.28. The 1.67% MHFI stake was established at prices between $85.76 and $109 and the stock currently trades at $106.

Stake Decreases:

Ambev SA (ABEV): ABEV is a 3.29% of the US long portfolio position established in November 2013 as a result of a stock-swap merger transaction that resulted in ABV holders receiving 5 shares of Ambev SA for each share they held. Q1 2014 saw a one-third stake increase at prices between $6.23 and $7.45. Last four quarters have seen only minor activity. The stock currently trades at $6.27. Mueffling continues to be bullish on ABEV.

Analog Devices (ADI): ADI is a long-term position that has been in the portfolio since 2010. At the time, it accounted for just over 10% of the US long portfolio. The stake was increased by two-thirds in 2011 as well. Since then the position had been kept relatively steady. Last quarter saw a ~18% increase at prices between $43.10 and $57.49 and this quarter saw marginal selling. The stock currently trades at $63.25. The top-five position now accounts for 9.53% of the US long portfolio.

Baidu Inc. (BIDU): BIDU is Mueffling's fourth-largest position at 9.32% of the US long portfolio. It was a ~5% stake first established in 2012. The position was increased by over 30% in Q1 2013 at prices between $84 and $113 and another 30% in Q2 2013 at prices between $83 and $103. Since then, the activity has been very minor. The stock currently trades at around $204. Mueffling is sitting on huge gains as the stock has doubled from his purchase price ranges.

CME Group (CME): CME is a medium-sized 2.78% of the US long portfolio stake established last quarter at prices between $78.26 and $92.91. This quarter saw a very minor reduction. The stock currently trades at $90.82.

Credit Acceptance Corporation (CACC): CACC is a 1.73% of the US long portfolio position first purchased in 2012. The original stake was increased by around 50% in Q2 2013 at prices between $96 and $122. The position has since been kept relatively steady. The stock currently trades well above his most recent purchase price range at $228.

Fidelity National Information Services (FIS): FIS was a minute 0.20% of the US long portfolio position established in Q1 2013. In Q2 2013, the position was increased to a large 6.11% of the US long portfolio stake at prices between $39 and $46. Q3 2013 saw a 15% stake increase at prices between $42.50 and $47.50 and the following quarter saw another 44% increase at prices between $48.87 and $56.55. Last four quarters have seen only minor activity. The stock currently trades at $63.25 and is Mueffling's largest position at 11.07% of the US long portfolio.

Google Inc. (GOOG) (GOOGL): GOOG is Mueffling's second-largest position at 9.88% of the US long portfolio. Last three quarters have seen only very minor activity. The stock currently trades at around $541. The original stake was established in 2010 and doubled in 2011 at much lower prices. The last significant buying happened in Q2 2014 when the position was increased by ~14% at prices between $510 and $580. Mueffling is sitting on large long-term gains from this position.

Grainger W. W. (GWW): GWW was a 6.32% of the US long portfolio stake established in Q3 2013 at prices between $247 and $274. The position was almost doubled in Q4 2013 at prices between $248 and $272 and increased by 50% in Q1 2014 at prices between $229 and $266. Last quarter saw another ~36% increase at prices between $230 and $259. This quarter saw a very minor reduction. The stake currently accounts for 6.32% of the US long portfolio. The stock is trading well within Mueffling's purchase price ranges at $249. For investors attempting to follow him, GWW is a good option to consider for further research.

Harley Davidson (HOG): HOG is a large 7.44% of the US long portfolio position. The stake saw a marginal reduction this quarter. The original position was established in Q2 2013 at prices between $50 and $60. The stake was increased by 56% in Q3 2013 at prices between $54 and $65. Q2 2014 also saw a ~16% increase at prices between $65 and $74. The stock currently trades at $56.70.

MSC Industrial Direct Inc. (MSM): MSM is a 3.29% of the US long portfolio position established in Q4 2013 at prices between $75.50 and $83.50. Q1 2014 saw an 84% stake increase at prices between $80 and $89. Last quarter, the position saw another ~145% increase at prices between $77 and $86 and this quarter saw a very minor reduction. The stock currently trades below his purchase price ranges at $72.71.

Sirona Dental Systems (SIRO): SIRO is a 4.35% of the US long portfolio position established in Q4 2013 at prices between $67 and $75. In Q2 2014, the stake was increased by ~40% at prices between $73.33 and $82.53. The stock currently trades well outside those ranges at $94.53. This quarter saw a minor decrease.

Stake Increases:

Bitauto Holding (BITA): BITA is a small 1.47% of the US long portfolio position established in Q3 2014 at prices between $46 and $96. This quarter saw a ~60% increase at prices between $47.39 and $89.11. The stock currently trades at $62.81. The activity indicates a bullish bias.

Cimpress (CMPR) previously VistaPrint (VPRT): CMPR was a minutely small 0.17% of the US long portfolio position established in Q3 2014 at prices between $37 and $55. Last quarter, the stake was increased to a 1.52% of the US long portfolio position at prices between $52.63 and $75.98. This quarter saw very minor buying. The stock currently trades well above those ranges at $86.06.

Ecolab Inc. (ECL): ECL is a 7.51% of the US long portfolio stake first purchased in 2012. The original position was increased by around 75% in Q1 2013 at prices between $72.50 and $80. Since then the stake had been kept almost steady. Last quarter saw a ~21% increase at prices between $101 and $115 and this quarter saw a further ~10% increase at prices between $99 and $117. The stock currently trades at $114.

Intercontinental Exchange (ICE): ICE is a medium-sized 3.85% of the US long portfolio stake established last quarter at prices between $194 and $227. This quarter, the position was increased by ~50% at prices between $205 and $240. The stock currently trades at $227.

Sensata Technologies Holding N.V. (ST): ST is a 3.98% of the US long portfolio position established in Q2 2014 at prices between $44.50 and $50. The stake was increased by ~30% this quarter at prices between $48.98 and $57.74. The stock currently trades at $55.43.

Willis Group Holdings (WSH): WSH was a 2.41% of the US long portfolio stake established in Q3 2013 at prices between $40.50 and $45. The position was increased by ~78% in Q4 2013 at prices between $42 and $46.50 and another one-third in Q1 2014 at prices between $41 and $45. The following two quarters saw an additional ~50% stake increase at prices between $40 and $44 and last quarter saw minor additional buying. This quarter saw a ~8% increase at prices between $42.84 and $49.36. The position currently accounts for 7.56% of the US long portfolio. The stock is trading near Mueffling's purchase price ranges at $47.90 and so is a good option to consider for further research.

Kept Steady:

None.

The spreadsheet below highlights changes to Mueffling's US stock holdings in Q1 2015: