Randgold Resources (NYSE:GOLD)

Recent Stock Price: $72.94

Shares Outstanding: 92.9 million

Market Cap: $6.78 billion

52-Week Range: $58.0 - $89.89

Randgold Resources has announced its first quarter 2015 financial results, and I think investors should be quite pleased as Rangold posted another very profitable quarter.

In the quarter, Randgold says its profit from mining operations increased 5% to $143.9 million, despite slightly reduced gold production of 279,531 ounces as a result of lower grades (this was expected).

Profit for the quarter came in at $53.1 million, compared to a profit of $54.4 million in the fourth quarter, which was impacted by higher exploration expenses and corporate costs, and adverse exchange rate movements in the period. Basic earnings per share came in at $.52.

Total cash costs per gold ounce came down to $708 and net cash generated by operations increased from $69.3 million to $101.7 million. This boosted the company's total cash balance by 71% to $141.2 million. Randgold is a debt-free company, and the annual dividend of $.60 per share - a 20% increase - was also recently approved, so the company is both increasing its cash balance and its dividend at the same time, which is a good sign.

I think this was a pretty strong performance for the quarter, and it was led by the company's Gounkoto mine, which produced 58,168 ounces of gold, a big increase from last quarter's 42,166 ounces, due to a 50% increase in tonnes processed. Total cash cost per ounce at this mine was just $681, a drop of $9 from last quarter.

Reserves also increased to 3.2 million ounces at Gounkoto due to further drilling and an updated modeling of the open pit reserves, according to the quarterly report.

The Tongon mine was also a strong performer for Randgold. Gold production increased in the quarter by 2% to 57,271 ounces of gold, while total cash costs decreased to $798 per ounce, down from $811 a quarter ago.

CEO Mark Bristow says the underground development at the Kibali mine is advancing ahead of schedule and the company's continued expansion at Tongon is delivering an improved performance.

Meanwhile, a number of the company's capital projects are still in progress, including the construction of a second hydropower station at the Kibali mine, and a completion of the new crushing circuit at Tongon.

Randgold has a five-year plan to increase its gold production to about 1.3 million ounces annually, while also reducing total cash costs to about $600 per ounce.

With $1,200 an ounce gold, the company is very profitable, but even if gold dropped another $200 an ounce or so, the company would still turn a decent profit, giving investors protection against a potential drop in price. That's because Randgold has wisely only focused on high-quality, low-cost and high-margin assets, such as the mines previously mentioned.

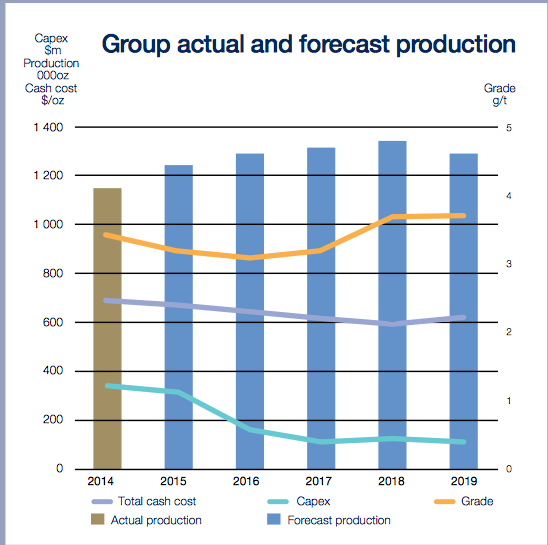

You'll see in the above chart that each year the company expects a slight increase in production, with a corresponding decline in total cash costs as well as a big drop off in capital spending (CAPEX) beginning in 2016. This should mean higher free cash flow in the coming years, a higher dividend per share, and a stronger company financially.

You can make the case that shares of Randgold are fairly valued, or even overvalued, based on several metrics. For example, the company trades at a P/E of 29.38, a forward P/E of 22.55, and an EV/EBITDA of 16.2, according to Yahoo Finance, which is high compared to peers such as Newmont (NEM), which trades at 5.97, and Barrick Gold (ABX), which trades at 6.45.

However, Randgold is more profitable than these companies and has zero debt, unlike Newmont ($6.45 billion total debt), and Barrick ($13.08 billion). So I believe Randgold is a safer investment than many of its peers for these reasons.

Randgold remains one of my favorite major gold miners as the company is profitable with strong margins (26.09% operating margins), pays a sustainable dividend, has a solid balance sheet with no debt and $100+ million in cash, and has gold operations with substantial exploration upside.