For those invested in land drillers in the last nine months like myself, it should come as no surprise to engaged, active investors that drillers like Patterson-UTI (PTEN), Hemelrich & Payne (HP), and Nabors Industries (NBR) have largely tracked the performance of oil along with more direct energy plays over recent months, in fact even outperforming some of the pure energy play names like Linn Energy (LINE) and Oasis Petroleum (OAS). Picking up these names at cheap prices has been a big benefit to my portfolio returns early on so far in 2015.

The backbone for share price appreciation in these names has been based on the fact that investors see oil price as a function of demand for these companies' drilling services. Higher oil prices - higher demand for company's drilling rigs, services, and other products.

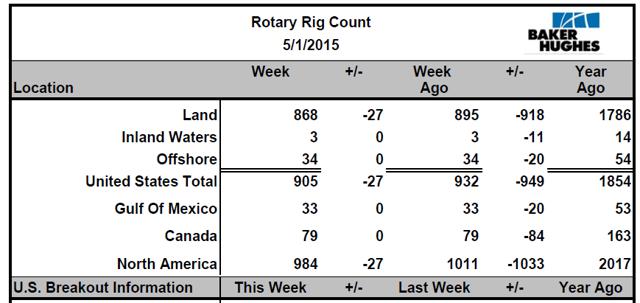

But what has been the driving factor behind higher oil prices? If you asked most of Seeking Alpha, they'd respond with a reference to the expectations of slowing US production, most likely basing part of that argument on the Baker Hughes rig count data as one of the major factors. Every week without fail, investors and day traders alike wait for the weekly figures to see how much rig counts have fallen. The bigger the drop, the bigger the inevitable bounce in WTI price. Overall investor sentiment has cemented the theme I mentioned before: falling rig count, falling US supply leading to a counterbalance to help the overall supply/demand equation worldwide.

Investors also can't ignore the fact that energy companies are drilling less new wells, and in fact, a "fracklog" has emerged in which wells have been drilled but not fracked, as companies wait out oil prices returning to higher levels. Based on estimates from RBC Capital Markets and Wood Mackenzie, there are over 3,000 wells that have been drilled but not fracked. This means a large backlog for other companies like proppant provider U.S. Silica (SLCA) to provide resources for through once oil prices recover and these wells are turned on, but it could leave drillers high and dry with no business in the meantime until those wells are tapped.

What does this all mean? With all these factors in mind, investors should be cautious of an overall market sentiment change in the US energy market. We must keep in mind that a rally in crude does not necessarily predict with certainty a rally in the cash flow of these companies. Recent earnings, propped up by early termination fees, won't last and will have incredibly tough y/y comparables. Companies like the big three land drillers need United States oil production to stabilize and eventually continue to grow - if price stabilization at $60-70/barrel WTI comes at the expense of the domestic US oil market, as it seems big oil players in OPEC like Saudi Arabia want, we could see the US energy sector hurt. This may be compounded in the coming years as price hedges fall off the books of US producers and old contracts go to the wayside. So to justify the rally in these shares, we will need to see an eventual turnaround in rig activity that doesn't predicate drops in WTI prices or a collapse in the margins of these drillers, which may occur if exploration companies push for cost cuts in this tough environment.

There are reasons to be bullish. In this market, demand for rigs is going to go toward high spec rigs as exploration companies try to squeeze out every efficiency they can. In prior downturns big names like Helmerich & Payne have gained market share as a result; sticky gains that tend to remain after the trough is over and the upswing on the commodity roller coaster takes place. Another benefit is that thus far, margins for drilling providers haven't been hurt too badly. Exploration companies are making cuts elsewhere, and rig providers have been doing their own trimming of the fat to run a leaner operation. The industry might be better off for it as years of seemingly endless growth in oil prices and US production led to complacency on the expense side.

Conclusion

According to most recent available data, short interest in these companies is higher now than it was as oil prices collapsed down late in 2014/early 2015. Investors with exposure to these shares should be more concerned with the overall health of the US energy sector rather than a daily glance at crude oil prices, as eventually these will not move in lockstep. For shares to keep the tailwind that they have enjoyed thus far after oil's recent rally, investors must see a drawdown in US stored inventory, healthy local demand oil products like heating oil and gasoline, market share gains, and slowdowns in global production from higher cost areas like offshore and Canadian oil sands.