Imagine playing a football game in a driving rainstorm on a muddy field. Players slip and slide all over the place. The quarterback has trouble throwing the ball. Receivers can't grip thrown balls. Running backs are virtually skating on the field and can only occasionally get good footing. Kickers can't judge the wind as it shifts at a moment's notice.

That was the story of disappointing returns in 2011 for many hedge fund and active investment managers, which I wrote about last week.

Consider the experience of star hedge fund managers like Mark Kingdon and John Paulson, who can be described as the proverbial smartest guys in the room. The Wall Street Journal reported that Kingdon and Paulson were whipsawed by the market action in 2011:

Like other high-profile investors, Kingdon has been whipsawed throughout the year by stock market swings that have been hard to predict, turning on a dime. John Paulson (who had a terrific 2008) has had the most humbling year of his own storied career, with his largest funds sinking in value amid wrong-headed bets on an economic recovery.

Indeed, the chart below of the S+P 500 shows that the stock market was trendless in the first half of the year and trendless and marked by extreme volatility in the second half. Investable swings, shown in red, were few in number. Many of the swings seen in the second half, shown in green, lasted less than a week – and woe to anyone who tried to invest on news flow in the second half as whipsaw would be the inevitable result.

2011 was an extremely unfriendly environment for investment managers because politics and policy, not fundamental and economics, drove market returns. The market began to worry about an extreme tail-risk, or black swan, event such as a Lehman-like crisis in the second half of 2011. Every news headline moved the markets and it, in a binary risk on/risk off framework, it was virtually impossible for an investment manager to discern direction.

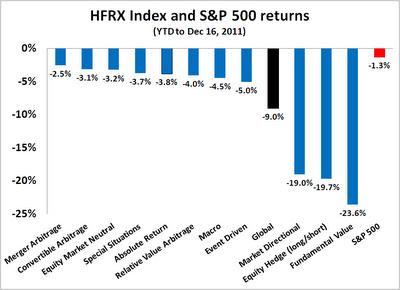

It is therefore no surprise that managers with the freedom to be long or short performed poorly in 2011 because of the lack of a trend, or direction in the market. On my previous post, I showed that the worst performing hedge fund managers were Market Directional, Equity Hedge, or long-short equity managers, and Fundamental Value.

Bimodal distributions and multiple equilibria

Like the metaphor about the football players, the reason why hedge fund managers had disappointing returns in 2011. The environment was unfriendly to their approach. Like the football players, it didn’t matter how skilled they were, they kept slipping in the rain.

That’s because most managers are trained to focus on fundamentals and economics while largely ignoring politics. In a year where politics and policy decision dominated the investment environment, it is no wonder that managers showed disappointing returns. Moreover, the investment term “multiple equilibria” or “bimodal distribution” began to pop up in year-end letter to investors. As an example, Pimco manager Vineer Bhansali wrote about this topic in an article entitled Asset Allocation and Risk Management in a Bimodal World. In the article he wrote:

For example, the policy risk that pervades the markets today causes high correlations among asset classes and a temperament of “risk on/risk off” among investors. This phenomenon can be traced to the connectedness of markets, the ease by which market participants can access these connected markets, and the speed of assimilation of information in response to political events. (See V. Bhansali, The Ps of Pricing and Risk Management, Revisited, Journal of Portfolio Management, Vol. 36, No. 2, Winter 2010.) This environment creates the possibility of multiple equilibria in the market, as well as trends that move markets between these equilibria, and once settled, restraining forces that trap markets in those equilibria (See V. Bhansali, Market Crises -- Can the Physics of Phase Transitions and Symmetry Breaking Tell Us Anything Useful?, Journal of Investment Management, 2009).

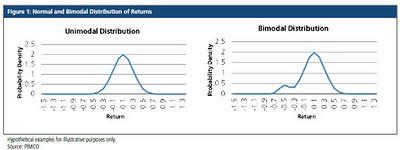

Even though predicting which force will win is next to impossible given the real-time evolution of the interaction between markets and policy, we can still ask an important question: What would happen if the distribution of returns from a hypothetical portfolio looked more like the one shown in the chart on the right of Figure 1, i.e. a “bimodal” distribution with more than one peak? The bimodal distribution has two peaks, and interestingly, even though it is generated as the result of mixing two normal distributions, each from a different regime, it can exhibit both fat tails (a higher probability of larger losses due to unusual events results in a “fat tail” on the left side of the distribution curve) and skewness (a lack of symmetry between the left and right sides of the peak).

In other words, classical investment theory posits that investment returns follow a bell-shaped distribution, like the figure above on left. In the current environment where investors oscillate between a “risk-on” and “risk-off” trade, the true distribution may look like one with two peaks like the figure on the right. Under these circumstances, techniques used to manage funds assuming a bell-shaped distribution will not work in a multiple equilibrium world (like 2011).

The outlook for 2012

What happens now? Will the environment of 2011 persist into 2012 and the future?

The market should return to focusing on fundamental and economics in 2012. The financial market was largely driven by European news in 2011 as it was concerned the possibility of a Lehman-like market crash. When the news flow indicated that the Financial Apocalypse might be near, stocks sold off. When the European governments tabled a plan that indicated that the day of execution might be delayed, the markets rallied.

The events of 2008 are instructive for evaluating the current market environment. In 2008, the markets were concerned about the housing collapse and its effects on the markets and economy. Fast forward three years, the problems with the US housing market hasn’t gone away, nor have the concerns about the weakness of the American consumer and his balance sheet. But the fear of another Lehman-like Apocalypse in the United States is gone today.

Similarly, the ECB’s Long-Term Refinancing Operation (LTRO), which offers to lend eurozone banks unlimited amounts of money for up to three years, has largely taken the risk of Lehman-like event off the table. The long term problems of over-indebted eurozone sovereigns, weak European banking system and the competitiveness and productivity gap between Northern and Southern Europe remains.

Is the panic getting overdone? Probably. Given that the ECB has taken the market crash scenario off the table, the markets can now go back to focusing on what matters, such as earnings, growth outlook, interest rates, etc.

Under these circumstances, fundamentally driven investment strategies that depend on traditional techniques such as valuation, growth, momentum and trend spotting are likely to perform better in 2012 and beyond.

Disclaimer: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.