The diagnostics area of the health care market has mildly flown under the radar as the sector has been primarily focused on the biotech industry. We wrote about little-followed Alere (ALR) back in early September with our thesis resting on an oversold market reaction, several upside catalysts, balance sheet deleveraging aided by non-core asset sales, and activism within the shares would push up the share price.

Since our analysis, the share price has risen nearly 36% in nine months. We believe the market is finally recognizing the upside ramp in the current calendar year driven by the first analyst day under the new CEO of the company. Our bullish thesis was reiterated, and apparently the market further recognized the potential, following the presentation.

The Transformation of Alere Is Progressing Well

The transition of the company's business model towards a concentrated portfolio of products with the objective of focusing on the rapid diagnostics area of the industry has progressed well. Management now has three primary areas of focus including cardiometabolic disease, infectious disease, and toxicology.

The focus on those three businesses is no accident as these are markets where they already have the number one share position. In infectious diseases, the company has increased their market leadership to 49%, well ahead of the number two player. We see this being led by the growth in their liver, HAIs, and sexual health product lines, all of which contain expected growth CAGRs above 13%.

The shift towards rapid diagnostics should be a boon to the business driven by the ACA reform actions. We believe, and have already started to see, reform responses by providers shifting more diagnostics to outpatient care. This shift plays into Alere's strengths as ~61% of their product portfolio is directed towards outpatient-focused business. We see this as a massive market opportunity as testing shifts to a decentralized structure.

Today, commercial labs and hospital labs conduct 90% of all point-of-care medical diagnostics. This is likely to shift towards physician offices as more private practices conduct these tests in-house. Additionally, rapid care clinics (urgent care facilities) and other small triage offices will start performing these tests as well. This is a rapidly growing addressable market that with lower product costs will likely move their diagnostics into small offices and hospitals.

Another aspect of the transition is the razor-blade business model it is producing. At the end of 2014, 76% of the revenue now is derived from consumables while just 20% is coming from services. We think the strong increase in recurring revenue will produce a stickier customer-base and reduce quarter-to-quarter volatility of the company's performance.

This shift should produce better quality revenue which was evident in the first quarter results. The company delivered higher earnings on a lower revenue base as the low-margin Alere Health was unloaded to Optum. We see the company continuing the shift to these focused markets and benefiting from that shift. The tailwind effect to their core business should accelerate as they move into these decentralized MDx markets, namely small hospitals with less than 150 beds, and urgent care clinics - and as such they should be able to realize better margins through some pricing power.

Total adjusted operating expense trends continue to illustrate the progress the firm has been making. The 31.7% figure in the first quarter, while up slightly from the fourth quarter, shows the trend lower from 34.8% in 2012, and 33.7% in 2013. We see EBITDA margins inflecting higher while top line revenues will likely languish on a reported basis due to divestitures. Organic revenue should continue to see traction from their slew of new products and market positioning capturing greater share. A lot of moving pieces are starting to come together for the company and produce a more focused, clean, and efficient business.

Non-Core Asset Sales And Balance Sheet Progress

To date, the company has sold off several pieces of the business inherited from the nearly 100 acquisitions undertaken in the last decade. These divestments include the sale of Alere Health and its subsidiaries to Optum, the PBM unit of UnitedHealth Group (UNH). The company used the proceeds from the transaction in addition to the proceeds from the sale of Bionote, Vedalab, and Alere ACS, to reduce their outstanding debt load and decrease future contingent payments.

Management highlighted key aspects within their non-core assets that are on the table for divestment including the BBI business, Wampole/TECHLAB, and Swiss Precision Diagnostics. We think the company will sell all three of these businesses sometime this year and that the proceeds of the sales will exceed $500 million, which is additive to the $650 million already realized to date. Like the previous proceeds, management has indicated that they will use the capital to reduce their balance sheet leverage, still over 5x net debt/EBITDA.

Collectively, the three businesses generated $184 million in revenue and $59 million in EBITDA last year. Our $500 million is likely a floor to the net proceeds that are likely generated as we think the businesses could be sold for as much as 15x EBITDA, given other recent sales for similar businesses. At 15x, the proceeds would total $885 million to pay down the debt on the balance sheet further.

Progress on the balance sheet is starting to accelerate. From Q1 2013 to the end of last year, net debt declined from $3.53 billion to $3.35 billion. However, since the end of the year, the company had reduced the net debt position another ~$600 million as the divestitures reduced the net debt to $2.77 billion.

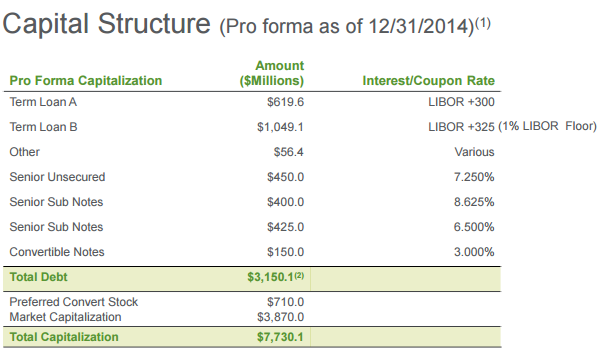

(Source: Investor Day Presentation)

The company is still spending approximately $210 million per year in interest expense, mostly due to the senior unsecured and sub notes with interest rates between 6.5% and 8.625%. Those issues should be retired in the near term, which will reduce interest expense significantly as their term loans have very low coupon rates.

Organic Growth Driven by Emerging Markets and New Product Launches

The Alere platforms continue to gain momentum including the i-business which was just launched at the end of last year. The company noted that they doubled their installed base on the i-platform and had approximately 1,000 instruments in the market. While a small contributor to revenue, at $4 million, we see the platform ramping significantly, especially in the back half of the year. In the first quarter, the company received news that they received 510(k) approval for the Strep A menu expansion to the business. We think if they get the Strep A CLIA waiver from the FDA, the company will fully launch Strep A by the fourth quarter of this year.

As we noted several months ago, organic growth will be driven by expansion into emerging markets where the total market opportunity is truly massive. The company noted that they experienced strong growth in Latin America at +17% followed by Asia at +5% and the developed areas at low-single digits. The growth was driven by strong triage sales in China and sales of infectious diseases in Latin America.

With the growth in blood-based diseases in the emerging world, we see continued support for their products. The company is expanding sales and distribution to exploit this opportunity, which we believe will be a long-trend tailwind to the business and a source of organic growth for many years to come.

Valuation Bridge To 2017

Shares are beginning to re-rate higher with the EV/EBITDA and P/E increasing. Free cash flow should jump this year to over $340 million, up from just $131 million last year. While revenue should be fairly stagnant over the next two years as organic growth is offset by revenue lost to divestitures, we see core earnings inflecting higher. The consumer diagnostics business should cease being a drag on the top line (mostly due to the lack of any size to the business any longer). Lastly, infectious disease should continue to see strong organic growth while toxicology and cardiometabolic will likely be small contributors.

However, our margin estimates are likely to drive earnings results. Operating expenses should continue to boost margins although we believe we won't see the same sort of large gains made since 2012. In the first quarter, the company's streamlining and efficiency initiatives have shown through with SG&A falling to $167 million, down from $219 million in the first quarter a year ago. In addition, as we noted in the prior write-up, R&D has become more focused and declined to $26 million, from $36 million a year ago.

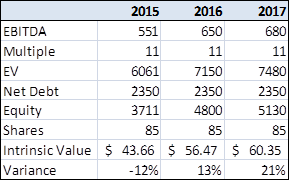

As revenue fell from $717 million in the first quarter of 2013 to $610 million in the first quarter of this year, operating profit rose to $117 million, up $3 million. We think EBITDA should be above $550 million this year and rise to $650 million next year and $680 million by 2017. Using a 11x multiple to those estimates, we get a strong upside case for enterprise value. We ran two scenarios, one with continued net debt declines and another with net debt static.

In the first, with static net debt, we think the shares still have some upside left in them with a $56.50 intrinsic value. However, we see upside to that forecast, should the company continue to delever their balance sheet and drive down their net debt. In that alternative scenario, we think the shares are worth closer to $60 per share for upside of nearly 20% between now and the end of next year.

(Source: Author's Calculation)

Conclusion

Shares of Alere have responded favorably to the restructuring of the business towards a rapid diagnostic company. That transition appears to be well on track and thus, the shares have responded to the decreased risk of execution missteps. While the easy money has been made, there appears to be some meat left on the table as the company de-risks its balance sheet as well as its business volatility, lowering their cost of capital and improving returns on invested capital. We think the shares are worth approximately $55 per share by the end of the year and near $60 by the end of 2016.