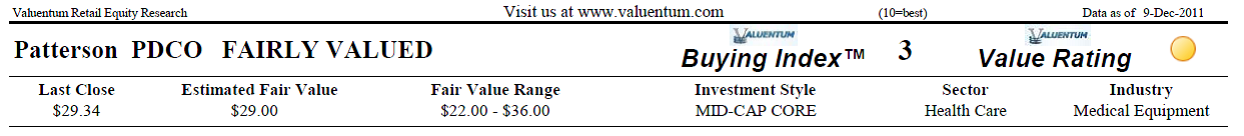

As part of our process, we perform a rigorous discounted cash-flow methodology that dives into the true intrinsic worth of companies. In Patterson's (NASDAQ:PDCO) case, we think the firm is fairly valued at $29 per share (our report on Patterson and hundreds of other companies can be found here).

For some background, we think a comprehensive analysis of a firm's discounted cash-flow valuation, relative valuation versus industry peers, as well as an assessment of technical and momentum indicators is the best way to identify the most attractive stocks at the best time to buy. This process culminates in what we call our Valuentum Buying Index (click here for more information on our methodology), which ranks stocks on a scale from 1 to 10, with 10 being the best.

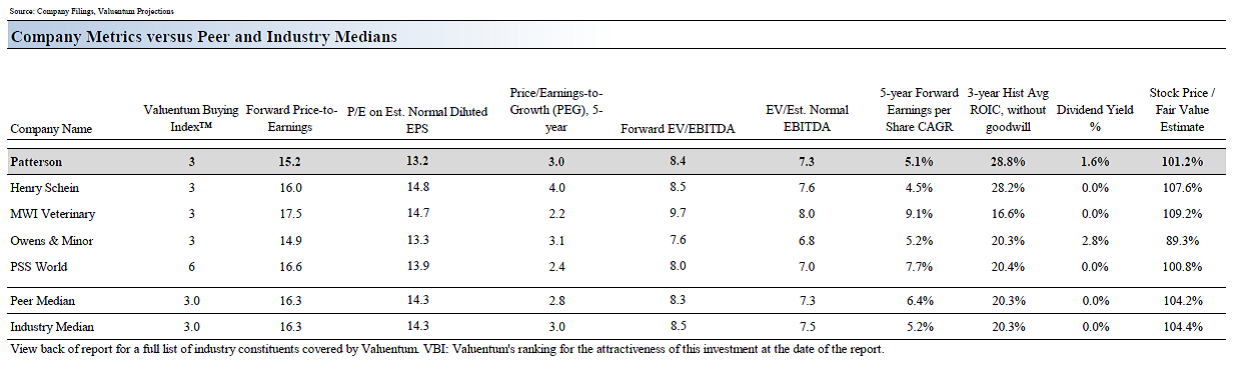

If a company is undervalued both on a DCF and on a relative valuation basis and is showing improvement in technical and momentum indicators, it scores high on our scale. Patterson scores a 3 on our scale (reflecting its fairly-valued DCF status, neutral, relative valuation and bearish technicals).

Our Report on Patterson

images

Investment Considerations

Investment Highlights

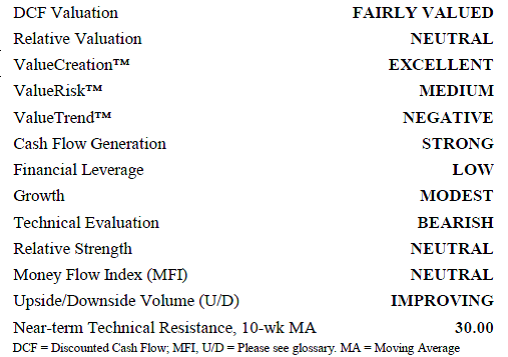

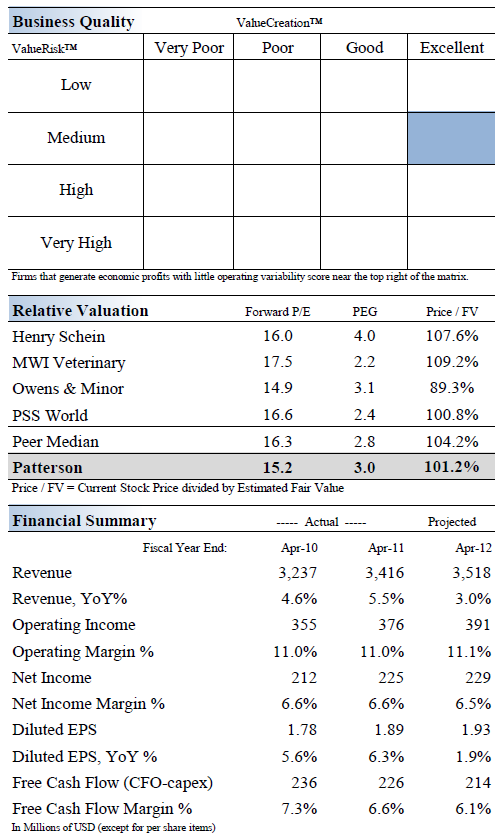

Patterson earns a ValueCreation™ rating of EXCELLENT, the highest possible mark on our scale. The firm has been generating economic value for shareholders for the past few years, a track record we view very positively. Return on invested capital (excluding goodwill) has averaged 28.8% during the past three years.

The company looks fairly valued at this time. We expect the firm to trade within our fair value estimate range for the time being. If the firm's share price fell below $22, we'd take a closer look.

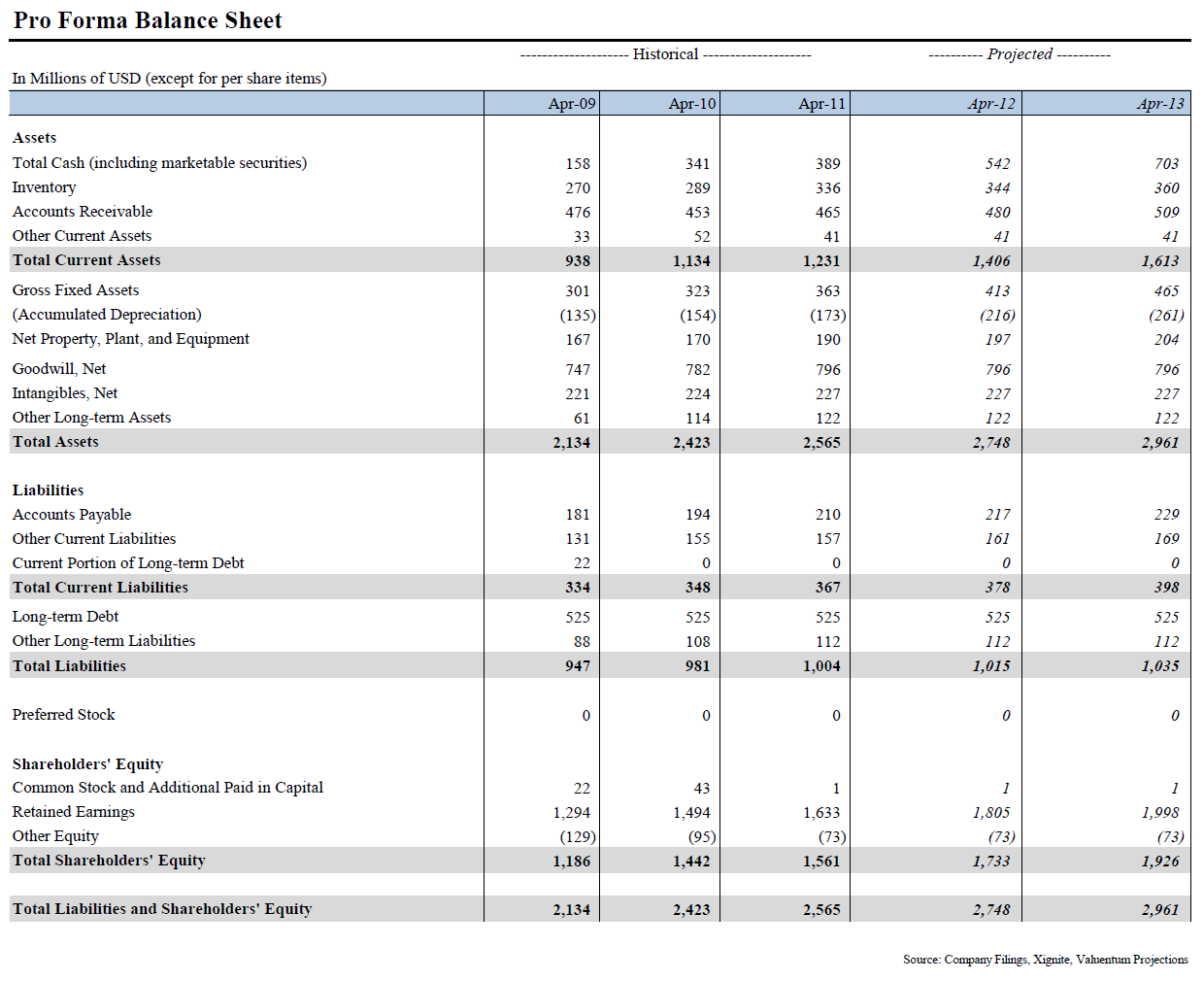

Patterson has an excellent combination of strong free cash flow generation and low financial leverage. We expect the firm's free cash flow margin to average about 6.3% in coming years. Total debt-to-EBITDA was 1.3 last year, while debt-to-book capitalization stood at 25.2%.

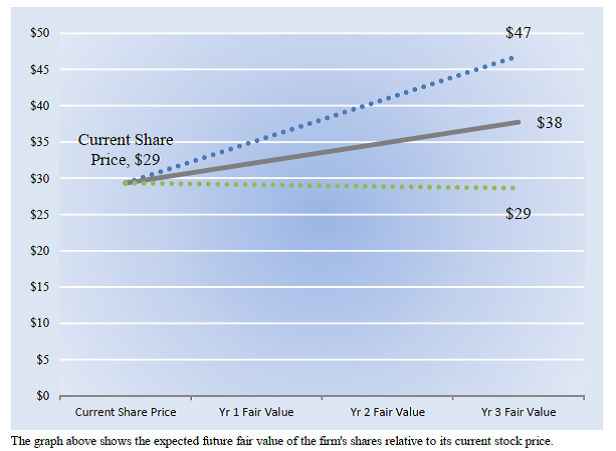

The firm's share price performance has been roughly in line with that of the market during the past quarter. We'd expect the firm's stock price to converge to our fair value estimate within the next three years, if our forecasts prove accurate.

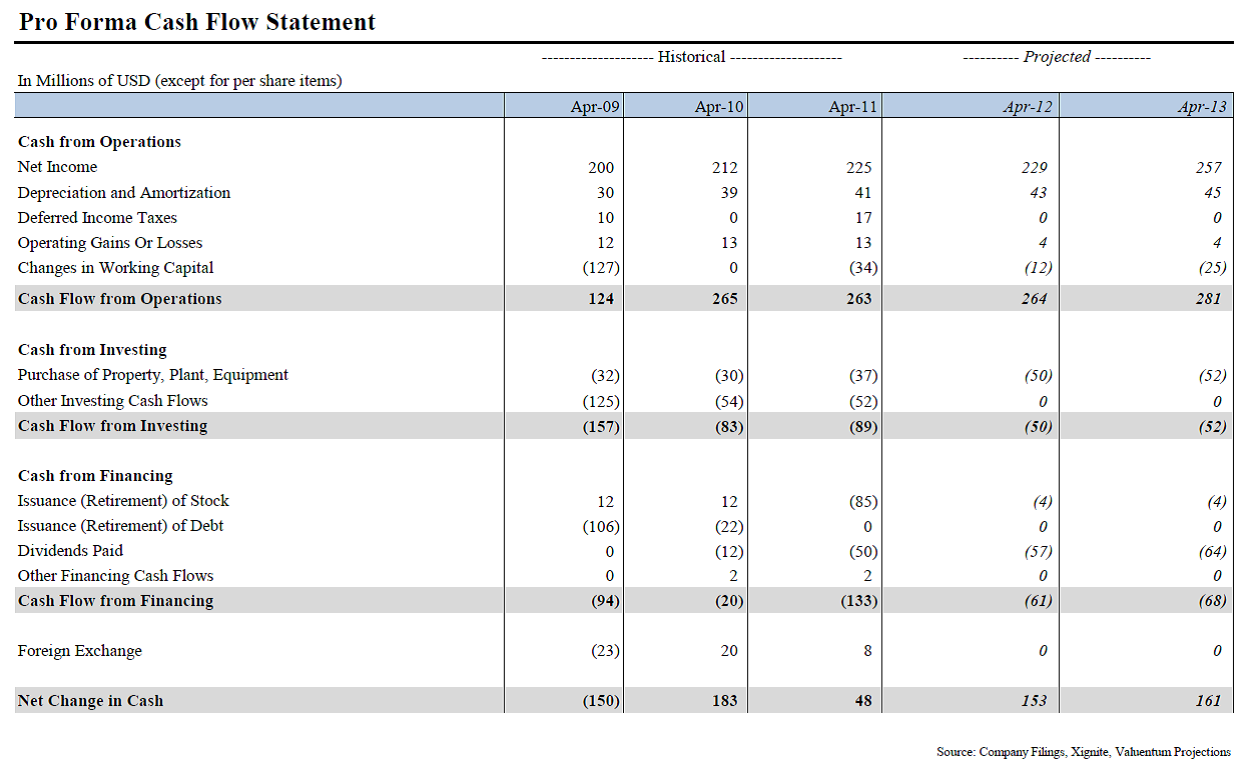

The firm experienced an operating cash flow CAGR of about -0.3% during the past 3 years. We expect its operating cash flow growth to be better than its peer median during the next five years.

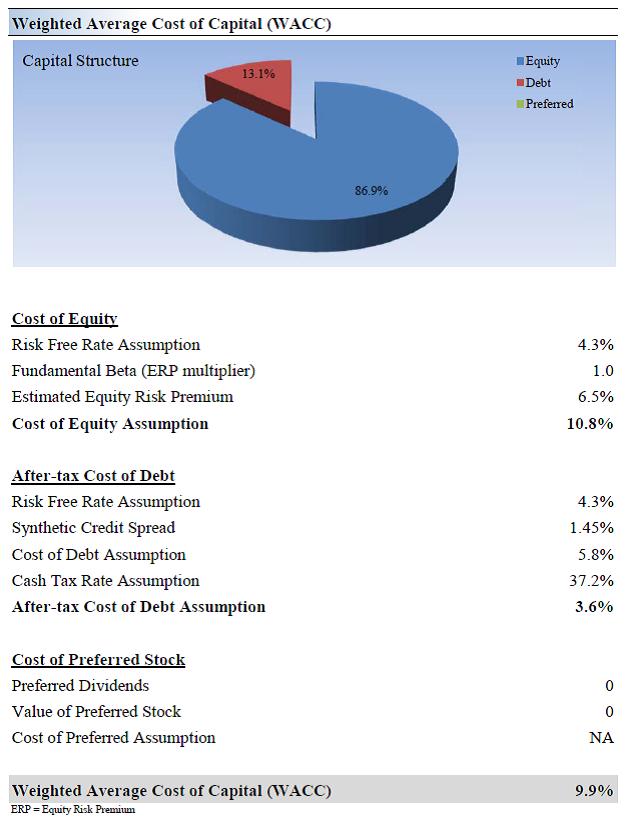

Economic Profit Analysis

The best measure of a firm's ability to create value for shareholders is expressed by comparing its return on invested capital (ROIC) with its weighted average cost of capital (OTC:WACC). The gap or difference between ROIC and WACC is called the firm's economic profit spread. Patterson 's 3-year historical return on invested capital (without goodwill) is 28.8%, which is above the estimate of its cost of capital of 9.9%. As such, we assign the firm a ValueCreation™ rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate.

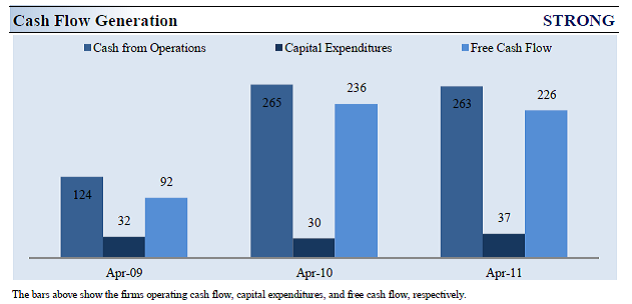

Cash Flow Analysis

Firms that generate a free cash flow margin (free cash flow divided by total revenue) above 5% are usually considered cash cows. Patterson 's free cash flow margin has averaged about 5.6% during the past 3 years. As such, we think the firm's cash flow generation is relatively STRONG. The free cash flow measure shown above is derived by taking cash flow from operations less capital expenditures and differs from enterprise free cash flow (FCFF), which we use in deriving our fair value estimate for the company. For more information on the differences between these two measures, please visit our website at www.valuentum.com. At Patterson , cash flow from operations increased about 112% from levels registered two years ago, while capital expenditures expanded about 14% over the same time period.

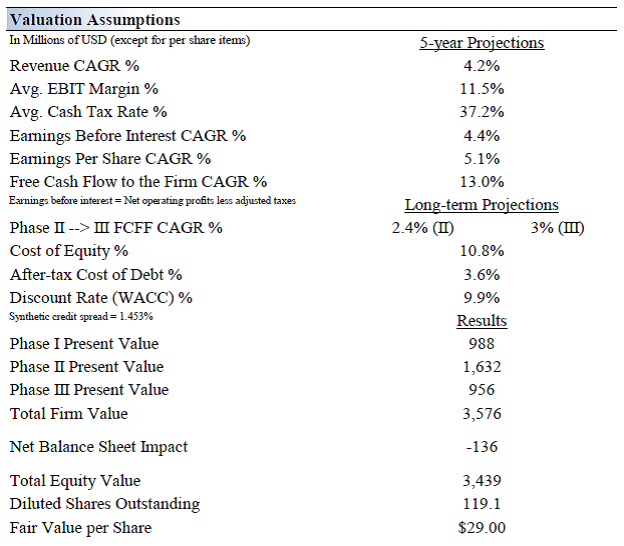

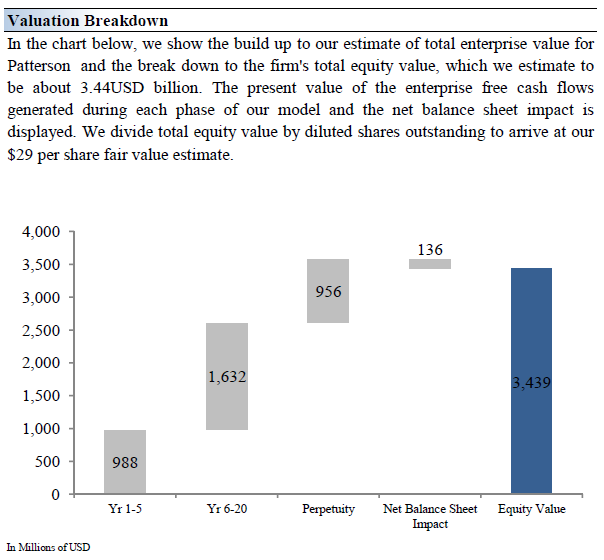

Valuation Analysis

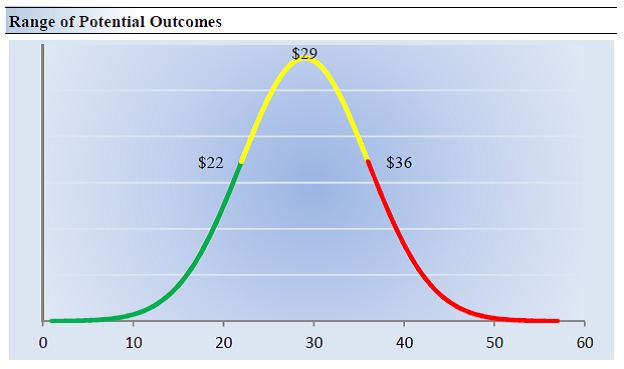

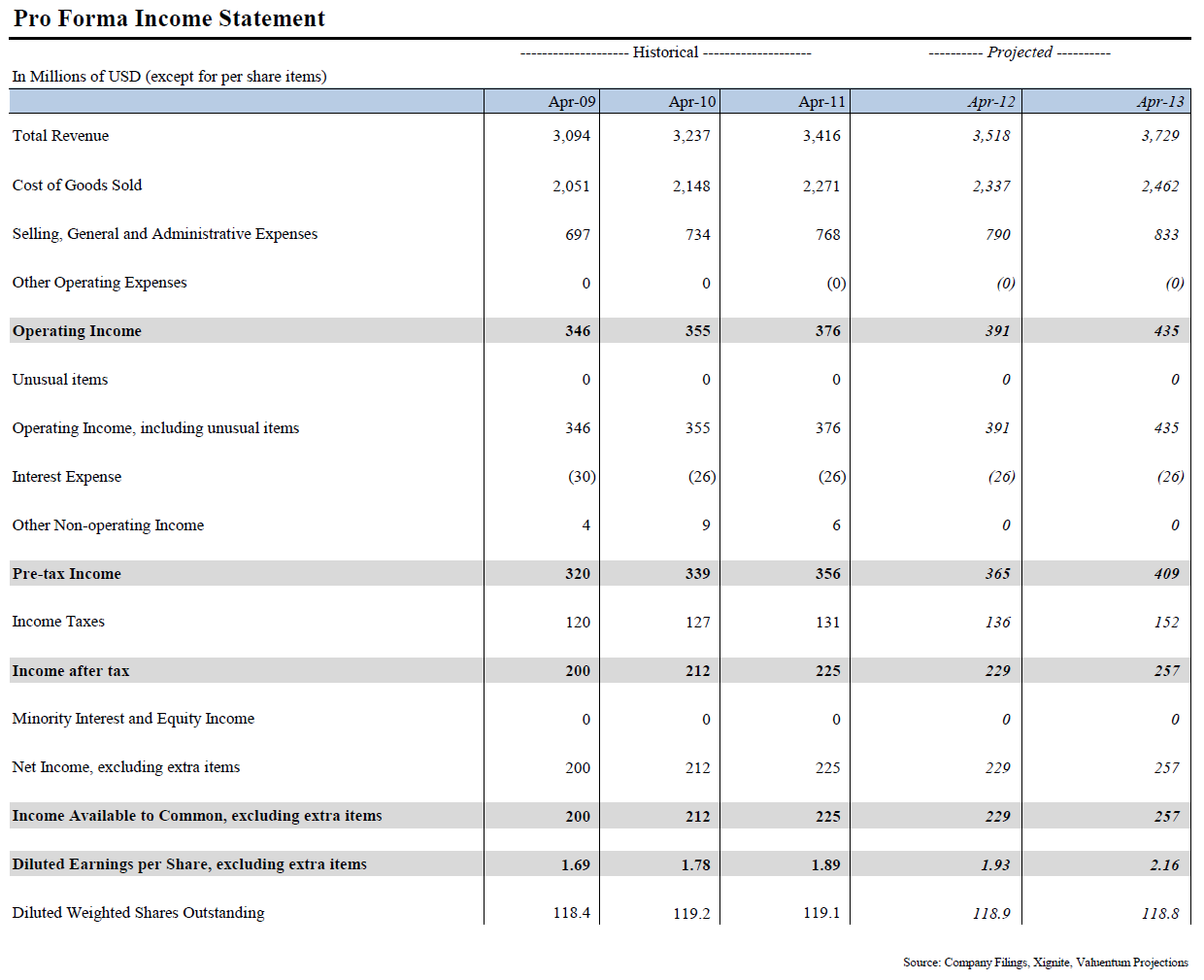

Our discounted cash flow model indicates that Patterson 's shares are worth between $22.00 - $36.00 each. The margin of safety around our fair value estimate is driven by the firm's MEDIUM ValueRisk™ rating, which is derived from the historical volatility of key valuation drivers. The estimated fair value of $29 per share represents a price-to-earnings (P/E) ratio of about 15.3 times last year's earnings and an implied EV/EBITDA multiple of about 8.6 times last year's EBITDA. Our model reflects a compound annual revenue growth rate of 4.2% during the next five years, a pace that is lower than the firm's 3-year historical compound annual growth rate of 4.4%. Our model reflects a 5-year projected average operating margin of 11.5%, which is above Patterson 's trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 2.4% for the next 15 years and 3% in perpetuity. For Patterson, we use a 9.9% weighted average cost of capital to discount future free cash flows.

Margin of Safety Analysis

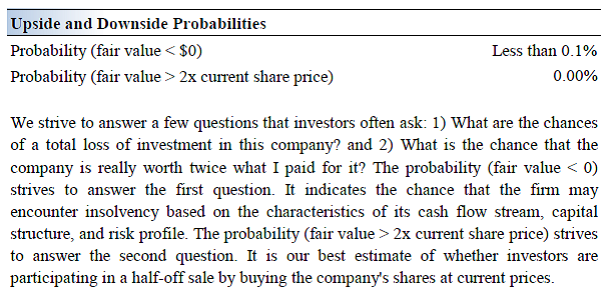

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate the firm's fair value at about $29 per share, every company has a range of probable fair values that's created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future was known with certainty, we wouldn't see much volatility in the markets as stocks would trade precisely at their known fair values. Our ValueRisk™ rating sets the margin of safety or the fair value range we assign to each stock. In the graph below, we show this probable range of fair values for Patterson . We think the firm is attractive below $22 per share (the green line), but quite expensive above $36 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Future Path of Fair Value

We estimate Patterson 's fair value at this point in time to be about $29 per share. As time passes, however, companies generate cash flow and pay out cash to shareholders in the form of dividends. The chart below compares the firm's current share price with the path of Patterson 's expected equity value per share over the next three years, assuming our long-term projections prove accurate. The range between the resulting downside fair value and upside fair value in Year 3 represents our best estimate of the value of the firm's shares three years hence. This range of potential outcomes is also subject to change over time, should our views on the firm's future cash flow potential change. The expected fair value of $38 per share in Year 3 represents our existing fair value per share of $29 increased at an annual rate of the firm's cost of equity less its dividend yield. The upside and downside ranges are derived in the same way, but from the upper and lower bounds of our fair value estimate range.

Pro Forma Financial Statements

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.