Clean Energy Fuels (NASDAQ:CLNE) has been a buy for me despite the stock price stagnating over the last couple of years at the ~$8-$12 levels. The stock took a big hit when crude oil prices crashed last year, leading to a carnage in energy stocks. However, CLNE has bounced back by more than 100% since it reached its 52-week lows, as the long-term fundamental growth story remains intact. CLNE is not for the impatient investor looking to make a quick buck. The company's investment thesis is based on developing a market for natural gas vehicles in the USA. This will take a lot of capital investment and change in customer behavior. The US government is also not aggressively pushing its transportation industry to convert to natural gas from gasoline. This is surprising, given the abundance of natural gas in North America. Many countries with much higher natural gas prices (almost 4-5 times more) have mandated that vehicles use gas as it is a much cleaner source of fuel (e.g. India).

CLNE has been performing well despite not being profitable and burning cash to roll out natural gas infrastructure in the US. The company is continuously getting traction as more and more big customers like United Parcel (UPS) and others covert their massive fleets to natural gas. The inflection point for CLNE's stock will be when the business starts to generate operating cash flow. I think that CLNE is well positioned to take advantage of natural gas usage growth and would advise investors to keep holding on to their positions despite the 2 years of stagnation.

Natural Gas is both cheaper and cleaner than gasoline

Natural gas has an advantage over gasoline both in economic and environmental terms. Natural gas is ~40% cheaper than gasoline and is considerably cleaner than crude oil and its derivatives. Many countries have mandated public vehicles to use CNG (Compressed Natural Gas) in order to curb pollution. As climate change concerns become more pressing, natural gas usage should increase. The rollout of natural gas infrastructure makes the transformation easier for large customers. Some companies such as UPS are already converting to natural gas in order to being seen as environment friendly. Some companies such as Apple (AAPL), Google (GOOG) (GOOGL), etc., are sourcing all their power from renewable energy. The pressure is increasing on both the government and large corporates to increase their usage of green products and services. Converting to a cheaper option which is greener is a no-brainer in my view.

Clean Energy Fuels is getting more and more traction

Clean Energy Fuels reported another quarter of strong growth, with volumes increasing by 27% and good growth seen in all major segments such as trucking and refuse. Though revenues did not increase at the same pace, the reason was a fall in natural gas prices. The main metric of profit per gallon showed an increase both on a yearly and quarterly basis to 28 cents/gallon.

More large fleet owners are converting to LNG

Large fleet owners are converting more of their trucks to use CNG and LNG. Raven Transport, UPS, Dilon Transport, etc., are all increasing their usage of natural gas. Vehicle and engine manufacturers such as Ford (F) and Cummins (CMI) are also coming out with newer products which use natural gas. Westport (WPRT) is developing a spark ignited natural gas engine which should enable more natural gas conversions. A new area that has opened up for CLNE is the railways industry, where locomotive makers are looking to churn out LNG powered locomotives. The rationale for doing the conversion is the same as with the vehicle industry. There are savings in using natural gas as well as environmental benefits.

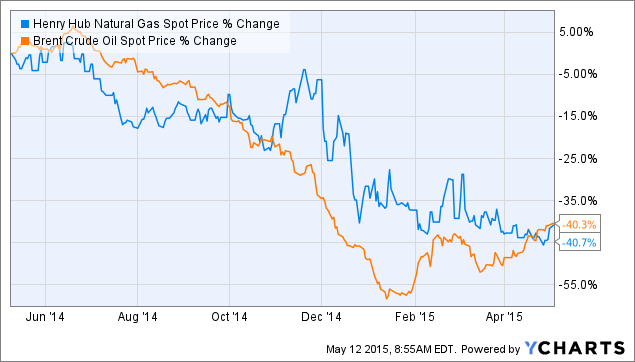

Natural gas is still cheaper than crude oil despite the oil price crash

Natural gas prices in North America have become extremely cheap due to the shale gas revolution and the prices should remain subdued for the medium term as well. This gives a huge advantage to natural gas users in the country. A lot of power plants have already converted from coal to natural gas. The transportation industry has taken some time to do the same because it is more fragmented and the conversion is not that convenient. However, the trend towards more gas usage is irreversible.

Henry Hub Natural Gas Spot Price data by YCharts

Clean Energy Fuels Risks

a) Liquidity Risk - Clean Energy Fuels has been burning cash over the last 2-3 years as it continues to develop LNG stations across the length and breadth of the country. The returns on the LNG stations have not been that high as there is not enough volume generation. The number of LNG vehicles is still small, and it will need a critical mass of LNG vehicles before the LNG network can sustainably generate cash. Clean Energy Fuels is well funded for now, but if the increase in the natural gas fleets is less than predicted, then CLNE will face liquidity issues. This is a problem with all small companies in a new market. Stockholders might face huge losses if CLNE is forced to sell its assets or equity at distressed valuations. The company has plans to spend ~$59 million this year, while the cash on hand is $220 million. The capex will come down by ~35% from last year. The liquidity position is comfortable at present, but it cannot afford too many non-profitable years. The management is predicting that it will turn EBITDA positive by the end of the year.

Overall, our core business is doing very well with growing volumes and expanding margins in relatively difficult environment. Although there was pressure on EBITDA this quarter, I want to reiterate that we still expect to be adjusted EBITDA positive for the full year.

Source - Clean Energy Fuels transcript

The immediate risk facing the company are $145 million of convertible notes that become due in August 2016. The company does not generate positive cash flow so it will have to refinance the debt either through more debt or through equity.

b) Crude Oil Price Risk - Crude oil prices have rallied by almost 50% since touching new lows in 2015. The increase in crude oil price has been due to the weakening of the dollar, a rally in major commodity prices, and indications of strengthening demand in Europe and China. However, crude oil price can again fall drastically if growth slows down dramatically in China. There is also the risk of a supply spike if a deal is reached with Iran. If crude oil price falls to $20/barrel, then natural gas will not have a big advantage over gasoline. This will mean that major vehicle customers will have less of an incentive to convert their vehicles from gasoline to natural gas.

Stock Performance and Valuation

Clean Energy Fuels' stock has rebounded sharply from a low of $3.99, as crude oil prices have increased and the energy sector has shown signs of recovery. The company is cheap with a P/S ratio of ~1.9x and P/B ratio of ~1.8x, with a market capitalization of $800 million.

CLNE data by YCharts

The company's valuation has come down based on P/B multiple.

CLNE Price to Book Value data by YCharts

Summary

Clean Energy Fuels' stock price has not improved much in the last couple of years as investors keep waiting for the company to become profitable. However, the low stock price was to be expected, given that the company needed to make large investments to build natural gas infrastructure. Most of the capital investments have been made and the company is predicting that it will turn EBITDA positive by the end of the year. CLNE is riding a wave of increasing natural gas usage in the transportation industry. The trend is irreversible in my view because natural gas is both cheap and clean. More industries and companies are increasing their usage of natural gas. The recent sharp rebound in CLNE's stock price shows that investors still believe in the CLNE story. The company performed well in the last quarter, growing both volumes and per gallon margins. I would look to keep adding CLNE on dips.