Northern Tier Energy (NTI) is one of those stocks you wish you could own more of, but is too risky to do so. The company is an downstream (refiner) MLP with a variable rate distribution. This means it pays out nearly all of its cash flow out every quarter, leading to wide swings in its unit price, but also hefty amounts of income.

A few weeks back, Northern Tier reported its Q1 2015 results. Overall, the numbers were solid, with across the board increases in net income, operating income, adjusted EBITDA, and cash available for distribution.

Source: NTI First Quarter 2015 Earnings Call Presentation

Furthermore, Northern Tier's operating metrics all improved significantly compared to prior year levels. Margins per throughput barrel increased, as well as throughput barrels per day and crack spreads. This lead to much higher margins not seen since 2013.

Source: NTI First Quarter 2015 Earnings Call Presentation

Strong distribution for Q1 2015

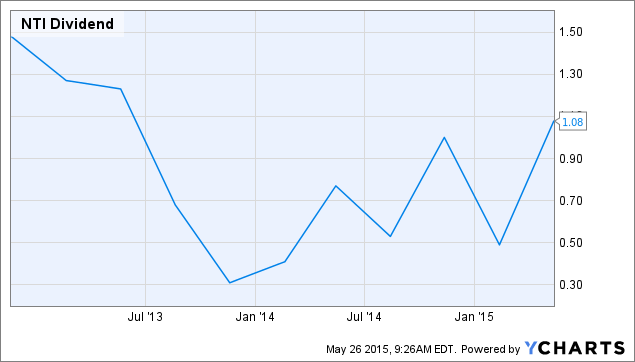

Perhaps the highlight of Northern Tier's quarter was its distribution. As shown above, the company declared a distribution of $1.08 per unit, more than double the $0.49 per unit distribution for last quarter. This represents a nearly 4.5% quarterly distribution, or 18% annualized. Since its IPO in 2012, Northern Tier has averaged a quarterly distribution of $0.84 per unit, or $3.36 per unit annualized, good for a ~14% distribution yield.

Below are the quarterly distributions for the company.

Q1 2015: $1.08

Q4 2014: $0.49

Q3 2014: $1.00

Q2 2014: $0.53

Q1 2014: $0.77

Q4 2013: $0.41

Q3 2013: $0.31

Q2 2013: $0.68

Q1 2013: $1.23

Q4 2012: $1.27

Q3 2012: $1.48

NTI Dividend data by YCharts

Distribution could have been even higher if not for capex

Impressively, Northern Tier could have paid out an even higher distribution if it were not for the $6.2 million set aside for future capex. This would have added ~7 cents to the distribution.

The company is planning to use this cash for two upgrades to its refinery, an upgrade/revamp of its No.2 Crude unit and Diesel Hydrotreater and replacing its single stage desalter with a modern two stage unit. These projects will cost $19 million and $30 million and will add $10 million and $22 million to annual EBITDA, respectively. Both these projects are expected to be done in 2016

Q2 2015 outlook

Northern Tier also provided guidance for Q2 2015, as shown below:

Source: NTI First Quarter 2015 Earnings Call Presentation

This is extremely strong guidance, especially for the throughput number. While I am wary of giving a precise estimate given the volatility with crack spreads and oil prices, this guidance is actually better than the Q1 2015 numbers. I think we'll see at least an above average distribution for Q2, from $0.75 to $1.25 per unit.

Conclusion

Overall, I am pleased with Northern Tier. The stock has performed was YTD, despite the large decline seen in oil prices. I think the stock should be able to return at least 10% per year as long as crack spreads remain high. This seems likely given Northern Tier's location next to discounted Bakken and Western Canadian crude oil and the wide Brent/WTI differential.

Disclaimer: The opinions in this article are for informational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Please do your own due diligence before making any investment decision.