Recommendation: Sell FWM @ $4.40

Industry Consolidation

Following the Albertson-Safeway (SWY) merger, Delhaize and Ahold announced they had begun discussions regarding a possible merger. The consolidation in the grocery industry is expected, with larger competitors such as Wal-Mart (WMT) and Target (TGT) making a push into the industry.

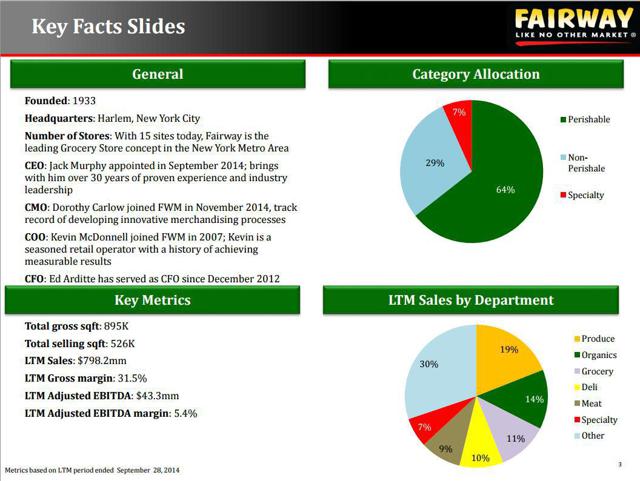

According to Wolfe Research, "There is mounting pressure in the supermarket industry to consolidate operations to drive better purchasing power and leverage distribution and technology platforms." Many of the larger grocery chains, such as Kroger (KR), may look to acquisitions. Some analysts have speculated that Fairway Group (FWM) may be a target, as the company has a strong, well-known brand, delivers impressive sales per store and per square foot, and has a distinctive merchandising strategy.

However, if we look closely at the underlying performance of the company, it is clear that there cost structure is far too high, and that the company will be unable to earn a profit with their current pricing strategy in the highly competitive New York Metropolitan Area market. We think it is unlikely that a potential acquirer would be able to find sufficient cost saving synergies to earn an attractive return in a very competitive and challenging market.

The Bulls Expect A Takeover, But Do Not Realistically Expect Profitability

The bulls are convinced that the company represents a solid growth opportunity for an acquirer and many bulls argue that, at its current valuation, there is no takeover premium built into the stock price. One analyst even indicated that the "storied brand" was undervalued and "a takeout should occur at $10 per share." We disagree. We believe that a transaction will not happen and the company will continue to struggle with profitability beyond FY2016 and FY2017. Fairway is a weak competitor, and Whole Foods (WFM) and Sprouts Farmers Markets (SFM) are far stronger in the New York Metropolitan Area. Additionally, Wegmans announced it will be opening its first store in the market.

Source: January 13, 2015, Fairway Holdings Group Presentation, 17th Annual ICR Xchange Conference.

High Cost Structure: Operating Expense Will Continue To Rise

During the fourth quarter, Fairway Group finalized a new collective bargaining agreement with UFCW Local 1500 with a term three years. The contract covers about three-quarters of Fairway employees and while there were positives for the company with respect to contributions for the Affordable Care Act, the contract effectively eliminates the company's ability to achieve labor efficiencies. Instead we expect to see increases in labor costs this year and the following two years.

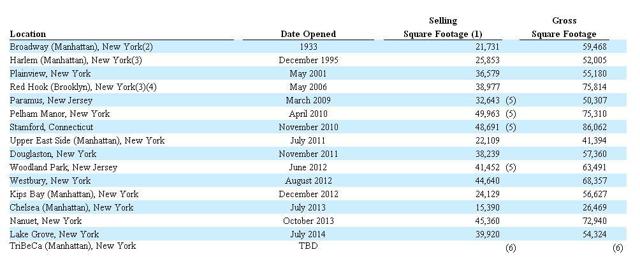

Additionally, the company is faced with increasing rent and occupancy costs and the problem is exacerbated by the size of many of the legacy Fairway Market stores. There are older stores with over 50,000 square feet and are too large and would have significantly improve economics at around 40,000 square feet. Fairway plans to continue opening new stores and this will drive one-time costs such as the $3.5 million lease termination payment in Q4 as well as on-going occupancy and other expenses from each new location. From the company's Q4 press release:

In May 2015 the Company entered into an agreement terminating a lease for a site in the new Hudson Yards development in west midtown Manhattan where it had expected to open a store in late calendar 2015 or early calendar 2016. In connection with the lease termination, the Company has negotiated a limited, conditional right of first negotiation if the developer determines to include a supermarket in the second phase of the Hudson Yards development. The Company will pay the landlord a total of $3.5 million in connection with the lease termination.

Source: SEC 10-K Filing, May 26, 2015.

Furthermore, new CEO Jack Murphy is planning to launch a major, and presumably expensive, marketing campaign to reintroduce Fairway to shoppers. CEO Murphy provided more detail during the Q4 earnings conference call:

We're going to redirect some of the emphasis on some of the things that we have been doing. It's going to be a very significant campaign, which once again is going to remind people why they love Fairway. And this is not a company that needs to be reinvented. This is not a company that needs a whole lot of revolution. This is a company that just needs to be slightly enhanced, remind people why they love Fairway and really then execute, execute, execute. So we are not going to -- at this point now as we go further in and we see the success in certain areas, we may redirect some other moneys.

This campaign is likely to drive already depressed EBITDA margins lower for FY2016 and Fairway already has a significant amount of resources in SG&A and overhead. This additional spending is troublesome and is an indicator that management is not seeing sufficient traffic. We are concerned that management has no clear plan to operate any differently or focus on driving profitability. Instead, we see increased competitive pressures and increased spending by management on new store growth, fixed costs and marketing and advertising. CEO Murphy explains, in the Q4 FY2015 earnings conference call, that Fairway will continue to operate as it has over the past few years:

It's just a real fanatical focus on what I'd call Supermarket 101: making sure that you're ordering the right amount of supplies; making sure simple things like using the right container to put deli salads in; making sure that we have the right people in the right place at the right time on a labor basis, the not convenience scheduling; making sure that the efficiency is there; making sure that we're taking every approach we can to make sure that the ordering is right. And then on the merchandising side with Dorothy and her team, really looking at every single retail, looking at what is the price elasticity of that retail, how are we going to pick up the pennies. So it really is -- there's no magic here and there is no genius here. This is just hard-core Supermarket 101 work that we are digging in. It's pick and shovel work, and the team here in ops and merchandising and finance and marketing and across the board have just embraced this and candidly, we're having some fun at it. I mean, I know it sounds maybe to people on the phone like it's a lot of hard work and it is, but we're actually having fun and I think people are energized again. So it's just a whole bunch of little things. There's no magic formula we've come up with here.

Source: SEC 10-K Filing, May 26, 2015.

The Bottom Line

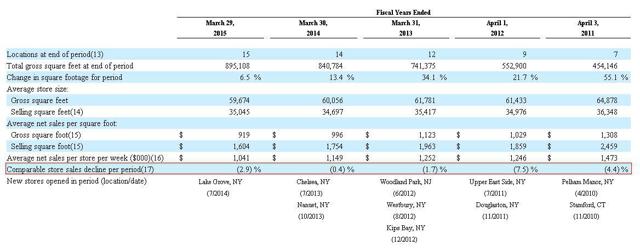

We do not think the operating results will markedly change going forward and we don't see how the company will turn a profit in FY2016 or FY2017 and beyond. Same store sales continue to decline, operating expenses are increasing, and the company has approximately $20 million in interest expense. There is a real concern for investors on the safety of their investment and we do not think waiting for a possible acquisition would be a sound decision. For the aforementioned reasons, we recommend selling FWM @ $4.40 per share.