With its first quarter earnings report, Ship Finance International Ltd (NYSE:SFL) has again increased its quarterly dividend rate and again shown that the market is undervaluing this high yield stock. Yet the market continues to price SFL to yield over 10%, much higher than you would expect for a stock with this company's dividend paying history.

There are a couple of reasons for the low relative valuation on Ship Finance. First, the company generates over 70% of its revenue from offshore rigs and crude oil tankers that it owns and puts out on lease contracts. This apparently large exposure to the energy commodities markets results in a sell-off of SFL when energy prices drop as they did in the latter part of 2014. Second, GAAP accounting practices do not show the actual cash flow strength of the Ship Finance business model.

Tanker Business In Recovery Mode

In the Q1 earnings report, Ship Finance details the restructuring of its leases with Frontline Ltd. (FRO). Base lease rates were reduced about 10% to $20,000 per day for VLCCs and $15,000 for Suezmax tankers. The trade-off is 50% profit sharing for Ship Finance when tankers earn above the base rate, compared to the previous 25% share for SFL. Ship Finance will also receive 55 million FRO shares, for a 28% share of the tanker company.

According to CEO Ole Hjertaker during the earnings conference call, the VLCCs earned $50,900 per day during the first quarter and the Suezmax's pulled in $28,600 per day. The forward market has VLCCs priced at $44,000 per day through 2016. Ship Finance should do very well with the restructured Frontline agreement.

With Ship Finance's offshore business, one rig was purchased by the lessee in the first quarter and leases on the remaining are structured with declining payments to match the amortization of SFL's debt against the rigs. Structuring long-term leases in this manner makes it easier for lessees to profitably run the rigs and keep up with lease payments, even when energy prices decline.

Cash Flow Covers Dividend and Is Growing

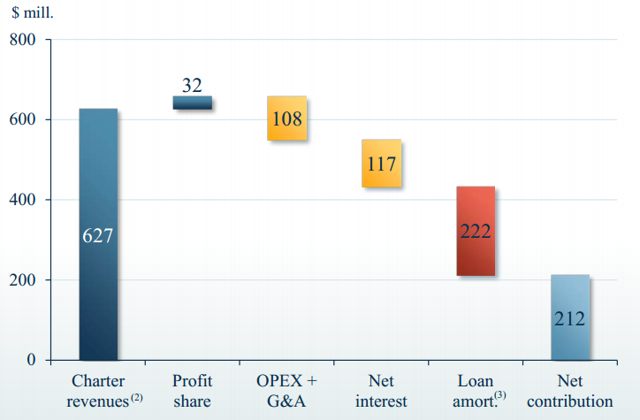

With a large portion of its contracts classified as repayment of investment in finance leases, results in associates and long-term investments, and interest income from associates, the revenue, earnings per share and GAAP net income are of little use when evaluating the dividend-paying ability of Ship Finance. When I make presentations on high-yield stocks at conventions like the Orlando and Las Vegas Money Shows, I like to show the following chart that SFL provides ever quarter:

The chart handily shows the company's free cash flow with the final, furthest right bar: $212 million over the previous four quarters. Total dividends of $156 million were paid over the same period. Ship Finance generated 1.35 times coverage over the trailing one-year period, which is a very healthy level of coverage. A year ago, the trailing year's cash flow was $176 million. The number of shares outstanding has not increased and the free cash flow is up 20% over the last year. While the share price is down 11% over the last year, SFL has significantly strengthened the financial position and dividend-paying capacity of the company's operations. I also like to point out the amount of loan amortization in the chart. Ship Finance structures its leases to pay down debt to leave the company in strong vessel value equity positions when leases terminate. This practice allows SFL to recycle capital without constantly going to the equity and debt markets for growth capital. Most high yield companies could not grow without the capital raised in the stock and debt markets.

Dividend To Increase Again

For the second quarter dividend to be paid at the end of June (June 15 record date), the rate was increased a penny to $0.43 per share, compared the previous payment. This will be the second quarterly increase in a row, and the dividend is now 5% higher than a year ago and up 10% over the last two years. Not bad for a company that the market likes to prices for a double-digit yield.

Last summer before Ship Finance was sold off as a energy price proxy (which it is not), SFL was at about $18 to $18.50 per share and carried an 8.5% to 9% yield. That yield range is much more appropriate for a company with the cash flow coverage and recent dividend growth shown by Ship Finance. A return to this yield level (and possibly with another dividend increase in 2015) would put SFL's share price over $20.