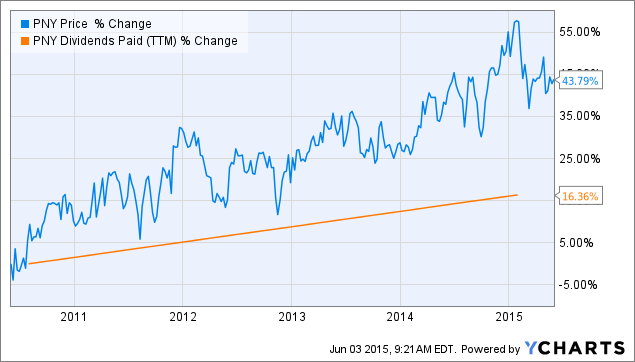

Natural gas distributor Piedmont Natural Gas (PNY) has been a rare double-earner for its investors over the five years, returning a share price gain of 44% even as its dividend has increased by 16% over the same time period (see figure). Its share price has declined substantially since reaching an all-time high in January, however, as a strong move upward by natural gas has raised concerns that natural gas consumption could stabilize in response even as higher interest rates cause investors to turn away from dividend stocks. This article evaluates Piedmont as a potential long investment in light of its historical performance and energy price volatility.

Piedmont Natural Gas at a glance

Piedmont Natural Gas distributes natural gas sourced from the U.S. Gulf Coast to more than 1 million customers in North Carolina, South Carolina, and Tennessee (primarily within the Nashville metro). Its business is divided into three segments: regulated utility operations, regulated non-utility activities, and unregulated non-utility activities. While its distribution of natural gas to end-users generates the large majority of its income, it also owns an expanding pipeline and storage portfolio that are categorized within its non-utility segments. In addition to owning 36.1 million dekatherms of natural gas storage capacity, Piedmont owns shares in a number of pipeline, transmission, and storage joint ventures. Of these the largest contributor to income, recording 9% of Piedmont's pre-tax earnings in FY 2014, is its 15% stake in SouthStar Energy Services LLC, which owns a service network of 20 interstate natural gas pipelines. Of the remaining JVs, which recorded 4% of the company's pre-tax earnings in FY 2014, Piedmont also owns a 45% stake in a liquefied natural gas [LNG] facility (Pine Needle LNG Company LLC), a 21% share of the 105-mile Cardinal Pipeline in North Carolina, and a 50% share of Hardy Storage Company LLC.

Piedmont is also a shareholder in two ventures to construct large pipelines out of its primary service area, including the 124-mile Constitution Pipeline project in Pennsylvania, which will move inexpensive natural gas into the more expensive New York and New England markets (Pennsylvania fracks whereas New York has banned most fracking projects) and the proposed Atlantic Coast Pipeline project, which will connect the Marcellus and Utica regions to customers in North Carolina and Virginia. The Constitution Pipeline is in the final stages of the permitting process and, while an earlier permitting delay caused the JV to push back its expected start-up date, the pipeline is now anticipated to be operational in the second half of 2016. The Atlantic Coast project is still in the pre-construction phase and not expected to become operational until November 2018. Piedmont expects to spend $250 million in capital expenditures on all of its JVs through FY 2018, with its shares of the JVs behind the new pipelines comprising much of this amount.

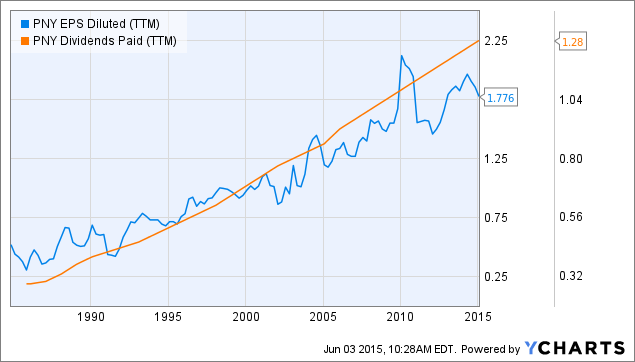

By deriving most of its income from regulated utilities (approximately 85% of EPS), Piedmont exists in a very stable market. As with other regulated utilities, regulators in the Carolinas and Tennessee set the rates earned by Piedmont's operations at levels that minimize price volatility while allowing the firm to earn an authorized return on equity of approximately 10%. This arrangement has allowed the company to achieve a fairly steady earnings growth rate since the 1980s (excluding a period of volatility in 2010 - see figure) that has in turn allowed it to increase its annual dividend every year since 1978, resulting in a 4.6% dividend CAGR over the last 20 years. Its dividend payout ratio has averaged roughly 67% over the last several years.

PNY EPS Diluted (NYSE:TTM) data by YCharts

Piedmont reported improved operating conditions in the Carolinas and Tennessee in its FQ1 earnings report (the company's first fiscal quarter ended on January 31), which was released in March. While its revenue of $607.3 million (see table) missed the consensus estimate by $29.4 million and fell by 7.7% compared to the previous year, this was largely the result of the presence of cheaper energy prices across the board during the quarter. Its cost of gas, for example, fell by 15% YoY, and combined with the presence of higher rates in North Carolina in CY 2014 to more than offset the revenue decline by generating margin of $270.1 million, or $8.6 million higher YoY. Net income ultimately fell by 3% YoY to $93.0 million due to a 9% increase to O&M expenses resulting from higher labor costs, a 67% increase to interest expense resulting from a substantial increase to long-term debt in FQ3 2014, and a 17% decline in the pre-tax earnings from its shares of the JVs resulting from lower hedging values as natural gas prices fell. Diluted EPS came in at $1.18, down 6% YoY and missing the consensus estimate by $0.04. Management attributed the earnings decline to the record performance of its wholesale operations in FQ1 2014, however, which proved to be too high to top. While the most recent winter was colder than average in the company's operating area, it wasn't as cold as the previous year.

Piedmont Natural Gas Financials (non-adjusted)

| FQ1 2015 | FQ4 2014 | FQ3 2014 | FQ2 2014 | FQ1 2014 | |

| Revenue ($MM) | 607.3 | 185.8 | 164.2 | 462.2 | 657.7 |

| Gross income ($MM) | 270.1 | 112.3 | 104.8 | 211.5 | 261.5 |

| Net income ($MM) | 93.0 | -9.0 | -7.3 | 62.5 | 97.6 |

| Diluted EPS ($) | 1.18 | -0.11 | -0.09 | 0.80 | 1.27 |

| EBITDA ($MM) | 145.4 | 24.6 | 44.7 | 111.1 | 140.0 |

Source: Morningstar (2015).

The revenue and EPS misses aside, however, Piedmont reported a general improvement to broader market conditions as economic growth in the Carolinas and Tennessee improved during the quarter. The company increased its customer base in FQ1 by 15% over its FY 2014 growth level, causing it to revise its guidance on gross customer additions in FY 2015 higher to up to 2%. It reported 1% more billed gas customers in FQ1 YoY and 3% higher system throughput YoY. Management felt confident enough in the improved conditions to increase the company's quarterly dividend from $0.32/share to $0.33/share even as it embarked on a $585 million utility and JV capital expansion program, including $265 million in system integrity expenses. Management also reaffirmed its FY 2015 EPS guidance of $1.82 to $1.92, the upper range of which would mark its best year since FY 2010. With only $19.9 million in total cash at the end of FQ1 (see table), however, Piedmont will need to raise additional cash to finance its planned expenditures. This shouldn't be difficult given its strong credit rating, although a secondary offering is also an option given that the company's number of shares outstanding is currently at approximately its FY 2010 level.

Piedmont Natural Gas Balance Sheet (restated)

| FQ1 2015 | FQ4 2014 | FQ3 2014 | FQ2 2014 | FQ1 2014 | |

| Total cash ($MM) | 19.9 | 9.6 | 18.4 | 13.8 | 16.2 |

| Total assets ($MM) | 5,049.0 | 4,784.3 | 4,659.5 | 4,578.9 | 4,726.3 |

| Current liabilities ($MM) | 782.9 | 622.0 | 741.1 | 659.5 | 882.9 |

| Total liabilities ($MM) | 3,664.6 | 3,475.7 | 3,323.7 | 3,217.2 | 3,409.5 |

Source: Morningstar (2015).

Outlook

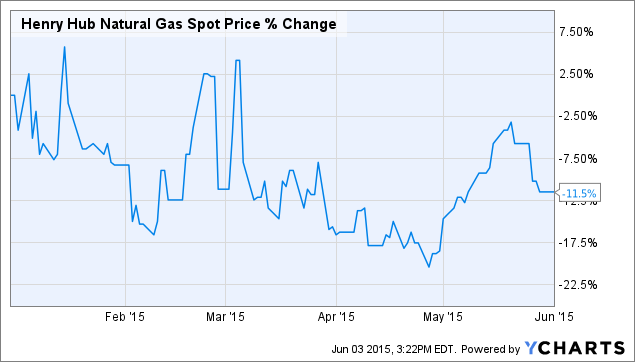

Investors should be aware of three macroeconomic factors that will have the greatest impact on the earnings Piedmont Natural Gas over the course of the next year. The first is the price of natural gas, which is sharply below its 2014 highs after experiencing a period of substantial volatility. Inexpensive natural gas generally results in greater consumption, the obvious exception being during especially harsh winters when greater consumption leads to higher regional prices. On the other hand, higher gas prices over longer periods of time lead to improved energy efficiency and ultimately reduced consumption per customer. While last year's decline in natural gas prices across of the U.S. will be a boon for the company if they remain low, they have rebounded since the end of April (see figure). A return to their previous highs, on the other hand, would likely result in lower throughput, other things being equal.

Henry Hub Natural Gas Spot Price data by YCharts

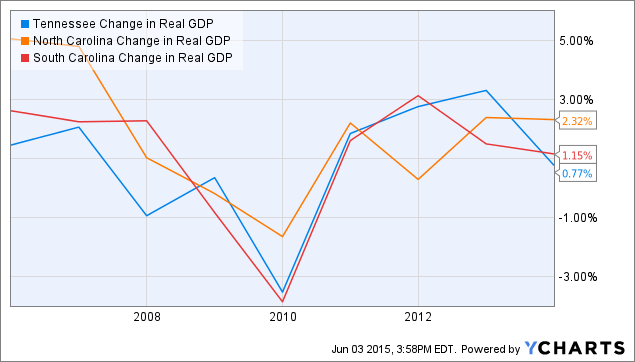

The second factor to consider is economic growth in the Carolinas and Tennessee. The recent strength reported by the company comes on the heels of multiple years of relatively slow growth (see figure). Piedmont's recent customer growth has been driven in particular by new residential construction, with single-family homes using more natural gas per person than multi-family apartment complexes. While the company's operations proved resilient enough during the 2008 crisis and subsequent recession to allow the company to continue increasing its dividend at a time when many firms were reducing or outright skipping their own dividend payments (homes need to be heated even during economic downturns, after all), its share price fell by 33% from peak to trough and didn't set a new high until late 2011. A repeat of 2008 is unlikely, of course, but potential investors in Piedmont should be aware of its heavy exposure to economic growth in general and residential construction in particular in the Carolinas and Tennessee.

Tennessee Change in Real GDP data by YCharts

The third factor to be aware of is the prospect of higher U.S. interest rates sometime in 2015 or 2016. Piedmont's shares trade at a premium to those of its peers due to its extremely impressive dividend growth history at a time of very low interest rates. Dividend stocks have historically fared poorly when interest rates rise, however, and indications are that this underperformance is already beginning even before the Federal Reserve announces its first rate increase in many years. Utility stocks in general and Piedmont in particular could see lower valuations (although this doesn't necessarily require a share price decline) as investors move back to bonds. Such a move could have a substantial impact on Piedmont's share price in the event that it coincided with continued price strength in the natural gas markets.

Investors can expect Piedmont's new pipeline JVs to begin contributing to earnings beginning in FY 2017, assuming that there are no additional permitting or construction delays. The addition of earnings from the Constitutional and Atlantic Coast pipelines will be an important milestone for the company since it will reduce the sensitivity of its earnings to the performance of its regulated utility operations segment. At this point, however, the pipelines' completion dates are too far in the future to impact investment decisions at this time.

Valuation

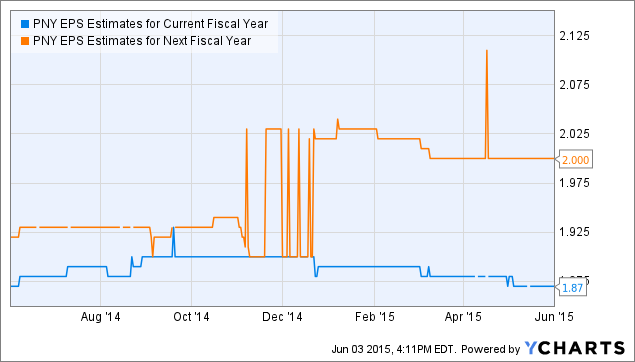

The consensus analyst EPS estimate for Piedmont Natural Gas in FY 2015 is in the middle of the company's own guidance at $1.87 (see figure). This has declined slightly from earlier in the year, although this reflects analysts bringing their estimates down closer to management's guidance rather than any substantial deterioration in the company's outlook. Its FY 2016 consensus estimate has also declined in recent months to $2.00, although this is still higher than at the end of 2014 and would represent a very strong year for the company.

PNY EPS Estimates for Current Fiscal Year data by YCharts

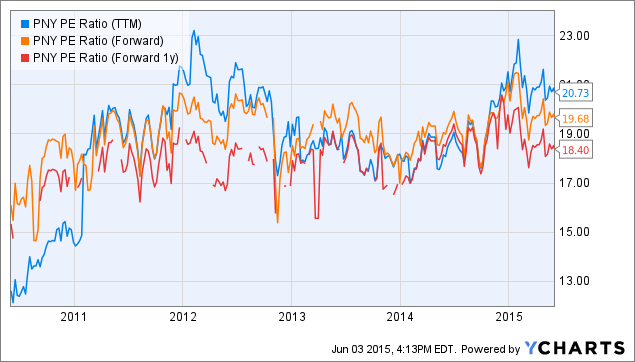

Piedmont's share price at the time of writing of $36.82 results in a trailing P/E ratio of 20.7x, which is high both compared to its historical range (see figure) as well as the industry average of 18.5x. Its forward ratios for FY 2015 and FY 2016 are lower due to expected earnings growth, although they are still in the middle of their historical ranges. The company's shares do not appear to be undervalued as a result. While the arrival of earnings generated from Piedmont's shares of the Constitution and Atlantic Coast pipelines in FY 2017 and FY 2019, respectively, will likely result in earnings growth, the time frames involved are too far in the future to support a growth investment thesis for Piedmont at this time.

PNY PE Ratio (TTM) data by YCharts

Conclusion

Piedmont Natural Gas has a stellar record of returning increasing amounts of cash to its shareholders via dividends while also, in recent years, achieving substantial share price gains. The company is taking the necessary steps to continue this growth by investing heavily in both its existing operations as well as new natural gas pipelines in underserved markets. The company's strong record has pushed its trailing valuation above both the industry average as well as the S&P 500. While such a price premium is merited by its past performance, I am concerned that it will shrink or even disappear relative to the S&P 500 in coming quarters as interest rates rise. Barring a magnitude of earnings growth that I don't expect to see until the Constitution pipeline is brought online in FY 2017, such a declining premium will lead to a declining share price, at least relative to the S&P 500. Piedmont Natural Gas is an ideal investment for conservative investors but I recommend waiting until after interest rates rise and it begins to underperform versus the broader index before purchasing shares, as I believe that they will be available at a more attractive valuation at that time.