I've got a problem. I want to invest in well established dividend paying companies with predictable earnings. The trouble is that few of the companies on my watchlist are growing their core business at a satisfactory rate. Fortunately the company at the top of the Moaty Chowder rankings, T. Rowe Price (NASDAQ:TROW) is growing by leaps and bounds. The company's operating earnings grew at an annual rate of 11.2% from $655 million to $1.89 billion over the ten year period beginning 2005.

Core growth of 11.2% is quite unusual for a company like T. Rowe, but that's not what earned it a spot on my watchlist. Recent dividend growth and the presence of a wide economic moat earned the company an evaluation and ranking on the Moaty Chowder watchlist. Past performance doesn't guarantee future results, but durable advantages over the competition should allow it to continue growing at a similar rate going forward.

I want to show you how a profitable company can provide satisfactory returns well above growth of its core business. To do so requires significant levels of free cash flow, so lets begin there.

Cost of Core Growth

Free cash flow can be measured as cash from operations minus the capital expenditures required to maintain those operations. You can also think of FCF as cash that a company can -- at least in theory -- safely return to shareholders. Yet another way to think of FCF is as management's main tool for raising shareholders' total return above the rate of core growth. As you can imagine companies with established, and highly profitable operations can grow those operations at relatively little cost.

Period | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | TTM |

Free Cash Flow | 488 | 499 | 612 | 598 | 402 | 615 | 866 | 826 | 1,127 | 1,165 | 1,206 |

Net Income | 431 | 530 | 671 | 491 | 434 | 672 | 773 | 884 | 1,048 | 1,230 | 1,235 |

FCF/Net Income | 113% | 94% | 91% | 122% | 93% | 91% | 112% | 93% | 108% | 95% | 98% |

Source: Morningstar, figures in millions of USD

At T. Rowe this is clearly the case. The company has produced FCF at a median of 94.5% of earnings over the past decade. This suggests that management has nearly all of the company's bottom line available for increasing total shareholder return. Let's see how that can be used to boost our total return well above core growth of 11.2%.

Adding up returns

As a dividend growth investor, I'd like to begin with the current dividend yield of 2.63%. If we project the past decade forward, we can reasonably expect operating earnings to rise at about 11.2% annually. Now, here's where a lot of readers get excited about what is additive and what isn't. Over the past twelve months T. Rowe used 39.9% of earnings to pay dividends. Assuming the payout ratio remains constant -- as it has been over the past 5 years -- the total dividend payout should rise at the same pace as operating earnings. This allows us to add the current yield to core growth and brings our total return to 13.83%, but we're not finished yet.

Remember how I defined FCF as cash that can be returned to shareholders. Dividend payouts almost never exceed FCF, so what are the leftovers worth? To answer that we first need to find out how much is left over. We can find our required reinvestment ratio by dividing expected core growth by the company's return on equity. Over the past twelve months T. Rowe's ROE has been 24.5% suggesting a 45.7% required retention ratio.

From the $4.59 in EPS that T. Rowe produced over the past twelve months, $2.08 is marked for dividend payments, and $2.10 is required for reinvestment. To find the third component of total return we'll err on the side of conservatism and assume the leftovers will be used to repurchase shares. As you should be well aware by now, EPS is net income divided by the number of shares outstanding. We all prefer growth of the numerator, but reducing the denominator does the job just as well.

The $0.41 per share remaining after required retention and dividend payments is enough to reduce the total number of shares outstanding by 0.52%. This means that even if net income comes in flat, the reduced share count would boost next year's EPS by more than half a point. Adding this third component brings us to a total return of 14.35%.

If reality happens

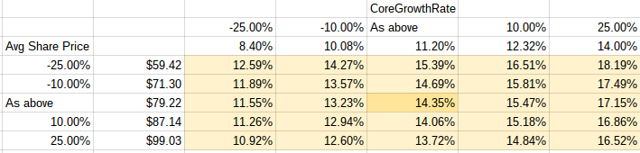

All these calculations seem nice and tidy, but a great many assumptions about the future have been made. In particular, a lower share price going forward might not help your blood pressure, but it does increase the number of shares likely to be repurchased. It would also give us a higher current yield at the time of purchase. This is why I like to include a sensitivity table that incorporates potential changes in core growth rate on top, and average share price going forward on the side, with the total return as derived above in the center.

Note that average share price is also purchase price. As you can see the price paid, both by you and the company buying its own shares significantly affects total return. Here's the spreadsheet if you want to play around with it.

As you can see with mature, profitable, dividend paying companies the price paid affects total return almost as heavily as operating income growth. If you've ever wondered how a company with single digit growth can produce double digit returns for its shareholders, I hope you found this exercise illuminating.