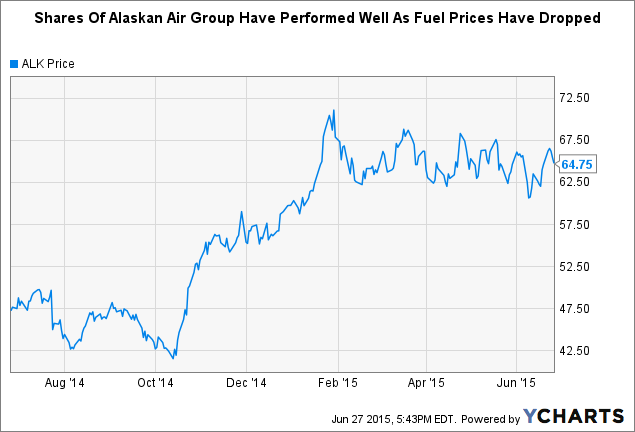

Since late 2014 when the energy industry entered a period of turmoil driven by declining oil prices, many airlines received a tremendous windfall profit boost as their fuel costs declined significantly. Sustained lower fuel costs for airlines has propelled the shares of many publicly traded firms higher as this boost in profitability has drawn in many investors who have traditionally avoided the industry due to the many external factors that seemingly control industry trends. North American airlines are now seen as an attractive way to benefit from lower energy prices and there are a number of firms with growing businesses that could be attractive for investors.

Based in Seattle, WA, Alaska Air Group (NYSE:ALK) and its subsidiaries: Alaska Airlines and Horizon Air Industries have served the Pacific Northwest market well for many years yet the firm has flown under the radar of many investors. Despite this, the company has posted strong EPS growth in recent years and has benefited meaningfully from recent trends in the industry. This strong performance has been exhibited in the company's aggressive fleet expansion plans that will see the firm take 81 aircraft deliveries through 2022 which will be instrumental its fleet modernization efforts. Moreover, management has continued to show their confidence in the business with strong capital returns through the company's dividend and share repurchase program which has reduced the firm's shares outstanding in recent quarters.

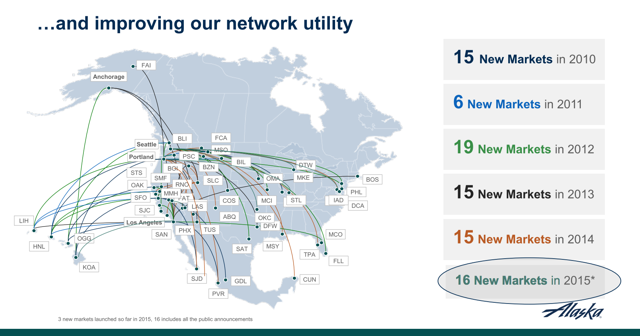

Source: Alaska Air Group Investor Presentation

Strong Q1 Results Support Bull Case

When Alaska Air Group reported its Q1 earnings results at the end of April; investors were pleasantly surprised by the firm's performance as it meaningfully boosted its net income with a large jump in capacity. While the company's load factor did slip, the astounding 40.4% drop in the airline's economic fuel cost per gallon overshadowed this and other metrics. The drop in fuel cost was the main drive behind the jump in net income and should fuel prices remain depressed, Alaska Air Group could be able to sustain such performance. In Q1, the firm's net income margin came in at a strong 11.7%, which may come under pressure as further expansion plans however it is certainly a very impressive rate. Currently, Alaska Air Group offers a 1.2% dividend yield while trading at 13.3x TTM earnings.

Fleet Modernization To Drive Efficiency Gains

One of the more exciting factors of Alaska Air Group's fleet modernization is the fuel efficiency gains that the company anticipates. As the airline slowly integrates its 737-900, 737 MAX and Q400 aircraft into its fleet through 2022 and retires its 737-400 planes by 2017, Alaska Air Group sees a meaningful jump in some of the company's efficiency ratios. For example, the firm sees a 25% jump in seats per flight and a 14% increase in per flight revenue with just a 2% rise in per flight costs. The airline sees its average seat miles per gallon or ASM/Gallon move from its already strong industry position of 77.8 to meaningfully ahead of competitors with an ASM/Gallon ratio of 85. This further solidifies Alaska Air Group's position as a low cost structure airline with a strong cushion to endure headwinds that it may face in the future.

Low Leverage Gives Firm Future Flexibility

Despite Alaska Air Group's major fleet modernization efforts, the firm has taken steps to reduce its financial leverage and keep it within a healthy range. With the firm's investment grade credit rating it has avoided exposing itself to further leverage, which will likely insulate the firm relative to its peers in an industry downturn. Since 2008, the airline has taken significant steps to reduce its debt and has reduced its debt to capitalization ratio from 81% in 2008 to 29% in Q1 of this year. This leaves the firm with many options should it desire to take on debt to further build out its business as opportunities arise, yet in its current position investors should find comfort with its low leverage levels.

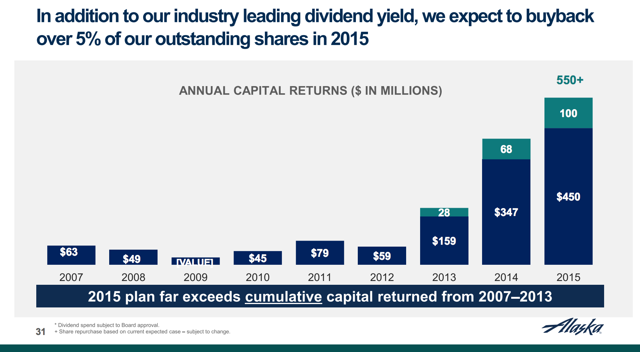

Strong Buyback And Dividend Growth Should Attract Investors

In recent years, Alaska Air Group has distinguished itself as a strong source of shareholder returns of capital as it has meaningfully grown its dividend payments to shareholders and the size of its share repurchase program. With its 1.2% dividend yield and plans to buy back roughly 5% of the firm's outstanding shares this year, shareholders will be rewarded. This seems like a prudent use of the airline's excess cash flow in this time of industry outperformance and exhibits management's desire to maximize shareholder value. Future returns of capital to shareholders can be expected given the firm's strong profitability trends and manageable CAPEX commitments. From 2015 to 2018, Alaska Air Group sees CAPEX declining annually to $505 million in 2018 as fleet modernization expenditures decline.

Source: Alaska Air Group Investor Presentation

Fleet Modernization And Strong Margins To Drive Share Price Returns

Alaska Air Group has a lot of momentum with the tailwind of lower sustained fuel prices and efficiency gains that will be felt with the implementation of its 737-900, 737 MAX and Q400 aircraft. The firm's Q1 results confirmed the underlying business trends and should give investors confidence in the firm's future. When you combine Alaska Air Group's exciting operational potential with management's shareholder friendly attitude, it is easy to see why investors would be drawn to the firm. Trading at 13.3x TTM earnings with a 1.2% dividend yield, an investment in Alaska Air Group could produce strong returns.