Shares of cigarette giant Philip Morris (NYSE:PM) hit $80 at Tuesday's low. This is a key level for the stock, because it is the point at which the $4.00 annual dividend yields 5.00%. When I stated that investors should not celebrate just yet after Q1 results, I received a lot of criticism. However, my caution was justified, as shares have lost a large share of their earnings gains. Today, I'd like to discuss where things stand with the company and stock as Q2 comes to a close.

The first thing investors want to know about is currencies, as they heavily influence the cigarette giant's global results. Since the company reported Q1 results, the Dollar Currency Index ("DCI") has weakened by about 2%, which is good for Philip Morris. That's primarily thanks to the Euro strengthening by a few percent. On the flip side, the Yen has weakened by a few percent, and the Ruble has weakened by about 12%. The currency situation remains as cloudy as ever. Given all of the recent volatility, I don't see the company changing the "currency impact" portion of its EPS forecast in a major way at the Q2 report.

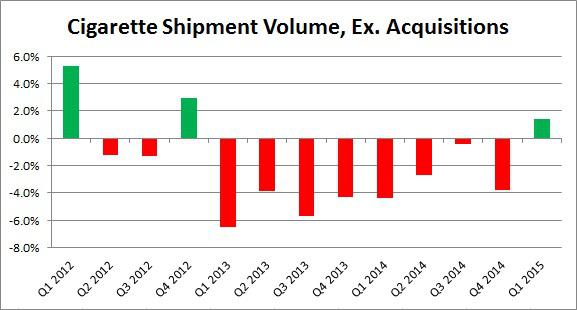

While the currency situation is extremely important in regards to reported results, the item I'm most interested to hear about is cigarette volume. As you will see in the chart below, the company saw an increase in shipments, excluding acquisitions, during Q1. This was only the third quarterly increase since 2012, and it ended a streak of eight straight declines. Will the momentum continue, or will we see another red figure?

(Source: PM quarterly earnings site)

Investors will also want to hear about the company's balance sheet and cash flow. Net debt rose above $29 billion at the end of Q1, with the debt (liabilities to assets) ratio hitting a new high. With cash flow being hurt again this year by currency movements, the company has suspended its buyback program. I also believe a smaller than expected dividend raise is in the cards, unless things really change in the next few months or management wants to push the envelope.

In terms of current estimates, analysts are looking for net revenues to plunge by 14.1% to $6.69 billion in Q2, with EPS falling from $1.41 to $1.13. These drops are primarily due to currencies, as the dollar is well above where it was at this time last year. This will be a big down year for revenues and earnings unless the dollar weakens significantly in the second half of 2015. Hopefully, things will improve next year, but it is too early to tell.

Philip Morris ended Tuesday's session with a dividend yield just below 5.00%, topping US peers Altria (MO) at 4.25% and Reynolds American (RAI) at 3.59%. At this point, the international giant Philip Morris continues to be hurt by currencies, with revenues and earnings both expected to show big declines in Q2. I'm interested to hear if cigarette volumes show another increase, and investors will be looking into key balance sheet and cash flow data. I've consistently stated that a 5.00% annual yield is a good starting point for investors, as it is much better than US fixed income.