My first article in Seeking Alpha is dedicated to a thorough analysis of a unique but little known opportunity in the Russian oil industry: Gazprom Neft. This analysis may also be of interest to any investor in Russia oil.

My belief is that the company is currently the most attractive in the Russian oil patch and constitutes a remarkable investment opportunity for private value investors. At the same time, I will try to show that the downside is very limited outside of extreme macro-scenarios.

Having lived 18 years in Russia, I feel obliged to make a preliminary comment about the information bias affecting Russia in the West with doomsayers predicting anything from a potential break up of the country (very popular in the late nineties), to a demographic collapse (the fact that population had started to grow again must have been a great surprise to many) to risks of default (did you know that the much talked about capital flight's biggest component is foreign debt repayment!) and finally of course years of stagnation ahead. The country's economy has in fact always proven resilient and has most often outperformed consensus because the institutions of power are stable, external public debt is very low and the ruble acts as a cushion in case of external shocks. Most financial and strategic investors have made enormous amount of money over the past 15 years, even taking into account the last couple of years poor performance.

A vertically integrated company with a record of steady growth.

Gazprom Neft was born from the acquisition of the private company Sibneft in 2006 and has further developed organically and through limited acquisitions. In 2014, the company produced 66 MTOE, incl. 52 MT of oil and 18 BCm3 of gas (however, gas contributes marginally to revenues and profits due to low domestic prices). Lifting costs are below 6$/bbl. and actually went down slightly in 2014 due to the depreciation of the ruble. The company is a leader in the introduction of new technologies with the highest proportion of horizontal drilling (40% vs. 9% average in Russia) and active R&D activity including for hydraulic fracturing (field testing stage).

The company refined 43 MT of oil in its 2 major refineries in Russia in Omsk and Moscow as well as in three smaller facilities located in Russia, Belorussia and Serbia. With an 84% ratio to production, the company is more vertically integrated than most of its peers with 14% of the refining volumes in Russia versus only 10% of oil production. The refining depth is 82%, still low by Western standards but significantly above Russian peers. Projects are being developed to increase the refining depth to 95% in 2020 with a production of 80% of light products.

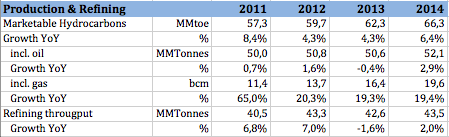

The table below outlines the dynamic of production:

Source: Company Data book

There are four important points here:

- The production growth is significant (6% average over four years) and is accelerating; in Q1 2015 the growth YoY was 14%.

- While production growth was exclusively driven by explosive gas production growth in 2012 and 2013, the oil production has now begun picking up (it was actually up 6% YoY in Q1 2015). This can be explained by the fact that when Sibnet was acquired in 2006, it was operating older fields and focused on cash generation. It took several years of heavy investment to reverse the trend. Gas projects were the low hanging fruits. We are now getting to the point where oil production is starting to grow at a significant pace (see below Reserves and Projects). This is key in terms of profit generation potential, as the profit per TOE is much higher for oil than for gas.

- The refining throughputs have grown at an accelerated pace and then stabilized. The focus was in the recent past and will be in the future on improving refining depth and optimizing the product yields.

In addition to the above, it is important to mention that the company excels and distinguishes itself from the competition on the distribution and retail side. Gazprom Neft controls 1810 service stations in Russia, which have by far the highest throughput in Russia (20T per day vs. 8T average). It has 24% market shares in the regions where it is present, which most of the key economic centers. In addition, the company has developed several high growth premium niche distribution businesses where it holds a very significant market share:

- Aircraft fuelling (25% of market in Russia and presence in 59 countries); 2,8 MT (+ 20% vs. 2013)

- Bunkering (19% of market in Russia and presence in 3 other countries); 4,2 MT (+30% vs. 2013)

- Oils and lubricants (14% of market share in Russia and presence in 52 countries); 0,19 MT (+11% vs. 2013)

- Advanced bituminous materials (polymer modified): at early stage but the company has 30% of the market for bituminous materials in Russia.

The objective of the company is to reach by 2015 the point where 100% of its domestic product sales will be made through its own network and premium distribution channels. It is important to understand that the Russian market is far from saturation (car ownership only came close 300 cars/1000 people in 2014 vs. 500-700 in Western Europe and the USA, but is increasing at 5%+ per annum and the aviation traffic was increasing at double digit speed until last year). Refining and marketing have been contributing around 50% of EBITDA over the past three years, so the company is really walking on two legs, although the upstream should grow in importance over the next 5 years.

Impressive returns and resilience in the face of the crisis.

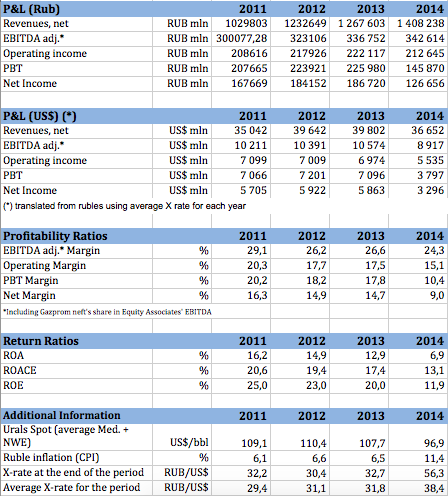

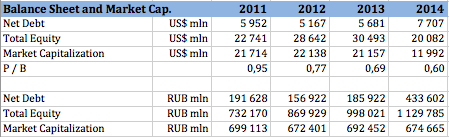

The table below provides numbers in both rubles and US$. Given that the company is preparing its accounts in rubles and that the rubles has dropped considerably against the US$, it is important to take a look at both sets of numbers to understand the dynamic at play.

Source: Company Data book; Translation in $ by the Author

Key points:

- Stable profit margins over the period 2011-2013 (2011 profitability is slightly higher because the ruble had not fully recovered against the $ in real terms after the 2009 crisis, which reduced costs and because oil was trading significantly lower in 2010 which reduced export duties (the time lag is called the "Kudrin scissors" - see below Taxation

- Impressive returns compared to both domestic and international competitors. Last year the company actually generated the highest return on invested capital among Russian oil companies.

- 2014 margins and returns are down due to the lower oil price. However two components of these lower returns are temporary in nature: the Kudrin scissors working against the company as oil prices started to drop in H2 2014, but taxation fully adjusted in 2015 (30 billion rubles or 9% of EBITDA) and a very significant hit at PBT level (52 billion rubles or 36% of PBT) associated with foreign exchange losses, as the company has a significant part of its debt denominated in foreign currencies, but establishes its accounts in rubles;

Source: presentation 3M 2015

In Q1 2015, the company has turned the corner with adjusted EBITDA up 63% against Q4 2014 and 11% against Q1 2014 in ruble terms, as the downward dynamic of oil prices started to slow and the ruble stabilized against the US and in spite of the fact that refining net-backs have continued to drop due to the crisis in Russia. Of course in $ terms, the EBITDA is still down approximately 40% YoY, but should grow strongly QoQ as oil and ruble are up significantly and the structural improvement in underlying profitability will be magnified by the partial reversal of the above mentioned one-off effects.

BCS, one of the biggest broker in Russia expects Net profit at 4.0 B$ and 6.2 B$ in 2015 and 2016 vs. 3.3B$ in 2014; in essence, the profit generation is seen coming back to the 2011-2013 level, even without a major upswing in the oil price thanks to higher volumes and lower ruble costs.

Reserves and projects in place to increase production by 50% by 2020.

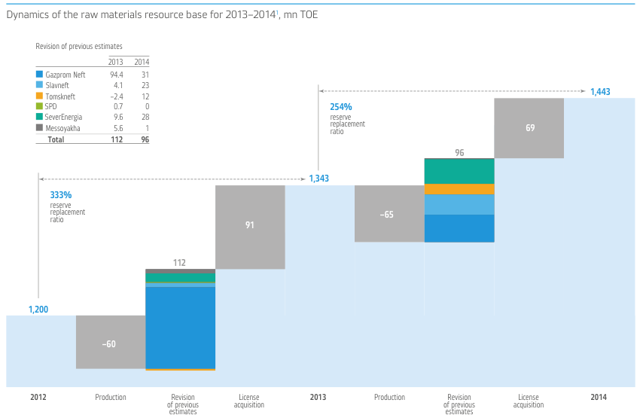

The company had proven reserves of 1443 MTOE of proved reserves as of the end of 2014, representing 20 years of production at the current rate. Besides, the reserve replacement ratio has been consistently above 200% over the last 4 years (254% in 2014).

Source: Company Annual Report 2014

Some of the increase relates to revision on mature fields located mostly in Western Siberia thanks in particular to technology improvement, but most is on account of new projects in new (and harsher) oil regions in Russia (the Artic area, both onshore and offshore and Eastern Siberia).

One of the key strategic goals in the strategy to 2025, defined in 2013, is to reach 100 MTOE of production by 2020 (up 51% from 2014) and then to maintain scale until 2025, while maintaining a 20 years reserves ratio. This requires an average annual growth of 7%; in 2015, the company appears to be heading toward achieving or beating this 7% mark.

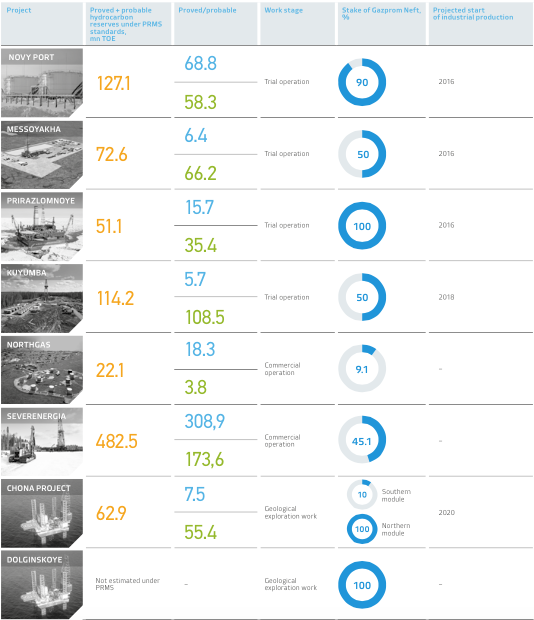

Below some information on the location and characteristics of the projects.

Source: Company annual report 2014

Iraq crude is not booked in reserves to due the nature of the agreement with Iraq Government. The Badra oil field is located in Eastern Iraq (in the Shia heartland) with an estimated 3 billion barrels of oil in place. The contract to develop the Badra oil field was signed 2010 was awarded to an international consortium with Gazprom Neft as lead operator on this project, with a 30% share. The project is expected to last for 20 years with a five-year extension option. The investment is expected to amount to $2 billion. The investors will be reimbursed for costs incurred and paid a bonus of $ 5.5 per barrel of oil equivalent produced.

First production at the deposit took place in 2013 and commercial volumes were reached in 2014. By 2017 production is expected to reach 170,000 barrels per day (about 8.5 million tons per year) and maintain at this level for 7 years. There are also three exploration projects taking place in Kurdistan and Gazprom Neft has a token interest (8%) in a very early stage exploration project in Venezuela.

Transparent dividend policy and high standards of corporate governance.

The company is considered by analysts as one of the best in terms of financial information. Information is available in English and features in particular a monthly reporting in a consistent way over several years with a full range of indicators relating to exploration, production, refining, marketing and financials, which enable the investor to really understand the business model

In 2014 the company earned the Stevie Award (international rating of corporate relations). As far as I am aware, all transactions with Gazprom have taken place at arm's length. The Board of Directors approved a remuneration program for Management that is based on the appreciation of share value. The Company's value is determined on the basis of its market capitalization.

The dividend policy includes a minimum threshold: the greater of 15% of the consolidated financial result determined in accordance with IFRS and 25% of the Company's net profit determined in accordance with RAS (Russian Accounting Standards). In practice, the dividends were between 20 and 25% of consolidated profits according to IFRS from 2010 to 2013 with a tendency to rise in both absolute and percentage terms, reaching 25% and 9,4 rubles maximum in 2013. In 2014 the dividend decreased to 6,47 rubles but remained at 25% of IFRS profits. The dividend is currently paid twice a year and the cumulative payment represented 0,759 $ per ADR in 2014 (there are 5 shares for 1 ADR), a yield of 6% based on current price. It is important to know that there is a willingness at government level to increase the minimum payout by in state controlled companies in % terms over time.

The Company also has a policy to keep the Net Debt/EBITDA ratio below 1.5, which is reasonably conservative.

The Russian tax system

The system is in general and surprisingly for foreigners characterized by a quite high level of stability with many rates being unchanged for the last 5 or 10 years and with recent guarantees that this will stay the same for the next 4 years. Being a French citizen I have to admire this state of affairs!

Direct taxation of the oil industry includes two base components: a fixed one (the Mineral Extraction Tax (MET)) and a variable one (export duties), which differ for crude oil and oil products. The general principle of the system is that the base taxation is low, while the marginal rate of direct taxation is high (59% in 2014 for crude, less for products).

After the creation of the custom union with Kazakhstan and Belarus and to avoid creating loopholes, and also to facilitate development of new fields in harsher regions of the country certain changes were introduced in 2014 (nicknamed "the tax maneuver"), which are overall neutral in the long term, but can create small distortions depending in particular on the degree of vertical integration of the different companies. The amendments provide for a sharp increase in the base mineral extraction tax over a 3 years period and a parallel decrease in export duties on crude oil and light petroleum products. The decrease in oil export duties will result in higher prices on the domestic market for raw oil refining commodities, but the decrease in excise taxes and export duties on petroleum products will compensate for the growth in production costs at the refinery level. There are also mechanisms to reduce the MET in the case of highly depleted and tight oil fields or in certain regions of the artic and Eastern Siberia. Gazprom Neft is eligible to these reductions for several of its projects.

Since export duties are revised every month based on average prices for the last 3 months there is a significant lag effect, which creates temporary positive or negative biases called the Kudrin scissors.

The high marginal taxation rate (which is above 70% when taking into account profit tax) combined with the fact that the ruble X-rate tends to adjust to oil price thereby acting as an additional stabilization factor (through local costs) together explain the rather surprising stability of Russian oil companies profits especially in ruble terms.

The stock trades close to its 5-Years low and at a significant discount to its Russian and Emerging Markets peers.

The current market capitalization is 12 B$ (roughly at the same level as in of the end of 2014) and the free-float represent 500 M$. Investment is available outside Russia through an ADR program (GAZ.LI on LSE and GZPFY on the OTC market) with reasonable liquidity (34 M$ of volumes per month for the ADR).

From the table below, it is visible that the P/B has steadily decreased over the past 3 years, in spite of the fact that the assets are performing excellently and that the drop seen in 2014 and early 2015 is to a significant degree due to one-off effects as explained above and that volume growth is picking up.

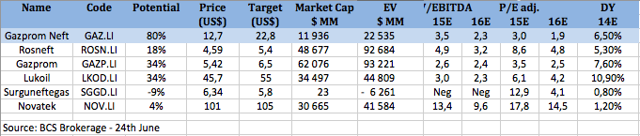

The situation has deteriorated further with the P/B now standing at 0.5 (based on the BS as of 31/03/2015). The consensus target for the ADR is 18,2 $, which represents a 47% upside from current prices. The upside ranged from 5% to 102% among the 12 analysts covering the company (source = 4Traders). Below is an analysis of comparable valuations from the Russian brokerage Broker Credit Service.

Source: Company Data book, translation in $ by Author

This is my view of why Gazprom Neft is the best choice among Russian oil majors:

- Rosneft is way more expensive and is much worse managed, being driven as much by politics as by business considerations; besides the company is highly indebted which is risky and hampering growth

- Gazprom is cheaper but is an instrument of political sovereignty and therefore its decision making process is not fully transparent. Besides, the business is in a mode of temporary negative growth due to problems in Ukraine and Europe and dividends yields may be lower in the next few years due to the huge China and other pipeline projects.

- Lukoil is a very well managed private company with traditionally a high dividend payout ratio but its production is stagnating (will actually decrease 1-2% in 2015) and the P/E ratio is not as attractive as Gazpom Neft. The dividend clearly does not have the upside potential.

- Surgutneftegas is very cheap but has a fairly un-transparent ownership structure and has been accumulating cash for years while maintaining a very low pay out ratio.

- Novatek valuation appears to be based on the value of its major LNG project, but the current valuation leaves very little upside.

In short when buying Gazprom Neft vs. Lukoil or Rosneft, one's gets a cheaper price plus the benefit of growth. The downside is much lower liquidity, but this is not an issue for most private investors. I won't even get into emerging market comparable valuation as the P/E ratio speaks for itself: by this standard Gazprom Neft is 2 or 3 times cheaper than most comparable companies.

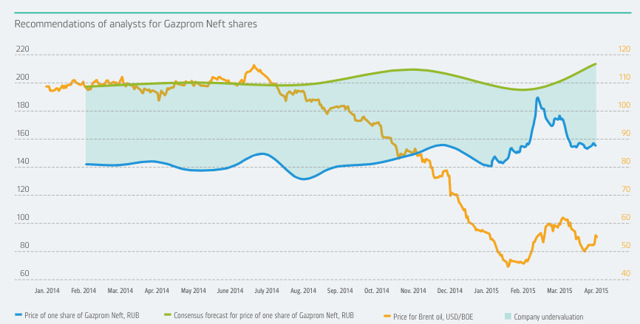

I am not a great chartist so I will leave it to specialists to decide whether it is the right time to invest based on the below graphic!

I would like however to present another graphic, which shows the share ruble prices vs. consensus target: I can't find any explanation to the February-March 2015 spike. My conclusion is that another spike may happen any time, offering a chance for quick capital gains for the short-term investor!

Source: Company annual report 2014

Limited risks

I see the following risks associated with Gazprom Neft:

· Oil prices remaining at a very low level (40-60$ / bbl.) for years: because of the high marginal taxation the effect on E&P segment P&L would be limited. Refining and marketing margins would however likely remain subdued, because Russia's economy would be affected; in such a scenario, the dividend yield may stabilize at around 4-6% based on current price and the share price remain stable or even slightly decrease if Russia remains out-of fashion.

- The Ukraine crisis deepens to the point where Russian ADRs instruments are suspended. I believe it is very unlikely as it would be a blow to the reputation of the relevant Western financial institutions. It never happened before to my knowledge.

- Gazprom decides to delist Gazprom Neft. Unlikely because this would be tantamount to shooting itself in the foot after spending years in building a reputation of good corporate governance and because Gazprom Neft may be a useful instrument to raise liquidity for Gazprom core business if need be. In any way indemnification would need to be supervised by an independent assessor and would not in any way be lower than the average quotation for the last 6 months.

- Dividends pay-out being reduced: it is possible but unlikely as the 2020 production growth target is achievable based on current rates of growth and that the Company has sent a strong message by maintaining 25% distribution yield at the toughest time of the crisis.

CONCLUSION

Gazprom Neft is a well-managed company with a balanced business model, which keeps paying very decent dividends (6% yield) at the peak of the crisis and generating impressive ROCE and ROE. Its growth is steady (7% in volume terms) and even accelerating, but this has not prevented its valuation from going down dramatically in absolute terms and in terms of P/B (to 0.5) and expected P/E of respectively 3.0 and 1.9 in 2015 and 2016. The company is trading 30% below analyst consensus and this situation could correct itself at any point in time as it happened in the recent past. A turn around in the oil market and/or in the perception of Russia could easily lead to a 200% upside on the share price. Risks are either not very material or are, in my opinion, rather remote. The stock is not very liquid, but this is a problem mostly for bigger financial institutions. This stock has its place in the portfolio of value private investors, who are ready to allocate a portion of their capital to Russia.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.