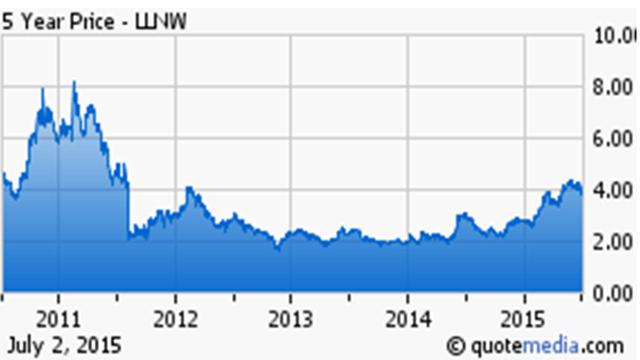

It has been almost two years since I first shined the spotlight on a small content delivery network (or CDN) named Limelight Networks (LLNW). The stock was selling at a little less than $2.00 a share at the time after falling on some hard times. At the time of my profile, the company was just initiating a turnaround strategy and had brought in a new CEO to deliver improved shareholder returns. I thought the strategy had a good chance to succeed and liked the risk/reward profile of Limelight from an investment perspective.

It turned out to be a correct call as new leadership has improved the company's underlying business fundamentals. The stock has more than doubled since that article ran to over $4.00 a share. As a nice of return as that has been, I still have a small stake in this small-cap play. The story still has many positives to it and further upside could well be ahead. Here are some of things I still like about Limelight Networks.

Insider Buying and Cash Balance:

One of the things that gives me confidence holding my stake even though the stock is up more than 100% over the past couple of years is insiders have confidence in Limelight Networks' future. You can see this being demonstrated by the myriad directors who have continue to make frequent purchases of the shares in 2015 even as the stock has rallied substantially. In addition, the company has a pristine balance sheet with some $80 million in net cash on the books which is almost 20% of the company's overall market capitalization of ~$425 million.

The Trend Is Your Friend:

Since I penned that article in August of 2013, the company has done a good job improving its operational efficiencies. Expenses have gone from roughly 60% of revenue to 55%. Gross margins have improved from approximately 35% of sales to almost 40%. Quarterly customer churn in the first quarter was the lowest since 2009 within the results reported in late April.

EBITDA has gone from just under a negative $4 million per quarter to right around $1 million as of its last quarter. Adjusted EBITDA has been positive for several quarters. The company has done a good job of upgrading and rolling out new products and infrastructure including improved cybersecurity capabilities.

The company has weather the loss of the business from Netflix (NFLX) in 2014 well. Excluding revenue from Netflix, sales growth was 17% year-over-year last quarter and posting slight gains even with the low margin Netflix business in 2014 included. Limelight also posted a record breaking traffic day, month and quarter in its latest quarterly results. The company also achieved new records for speed and petabytes served.

Recent Positive Catalysts:

The stock went further in rally mode when Limelight reported quarterly earnings on April 30th. The company also hiked forward guidance. In addition, the stock had a positive reaction this week when Cowen initiated the shares as a Buy with a $5.00 a share price target. Two months ago in the last analyst action on this stock, B. Riley upgraded Limelight to a Buy as well with a $6.50 a share target and that call has been a good one in the two months that has followed as the stock has rallied nicely over the past 60 days.

Outlook:

Limelight's business metrics are definitely moving in the right direction. Analysts are starting to notice the company in a positive way. CDN traffic continues to grow impressively as more and more video gets distributed around the web. Mobile traffic and game traffic also continue to grow nicely. Given the small size of Limelight, I could easily see a larger player like Akamai (AKAM) make a play given the huge volume of M&A activity in the market in 2015. Macquarie recently speculated Limelight would be a great acquisition target for Level 3 (LVLT).

In short, I see no reason to sell Limelight at this time as capital appreciation still appears to be in front of it. The company should soon see positive earnings after posting small losses in recent years. I believe the company will continue to grow or be bought out by a larger competitor at a nice premium.