The semiconductor industry has had a rough start to 2015. Always highly cyclical, it appears we are back on a downtrend. Companies like Intel (INTC) and Micron (MU) have been pushing down their guidance, and analysts have been making their cuts to estimates, as PC sales are set to decline 10% y/y. Competition is fierce and blood is in the water. Could there be a safer play out there to play for the rebound, while also having some insulation from further downside?

Enter Teradyne (NASDAQ:TER). Rather than being a direct manufacturer of devices, the company instead sells the systems used to test these products. It is one of the larger players in this semiconductor testing space, overshadowing smaller companies like Xcerra (XCRA) and Advantest (ATE).

On a basic level, Teradyne products are designed to improve product quality and performance, reduce manufacture time, and increase yields. Irrespective of the business environment, but especially in one as competitive on a price level as chip-making, companies are always looking for ways to stay a step ahead of the competition or at least keep even. It shouldn't be a surprise that Teradyne products are in high demand, even from industry giants that you might expect to develop testing in-house. Companies like Apple (AAPL) and Intel have been long-time customers, as well as United States government agencies.

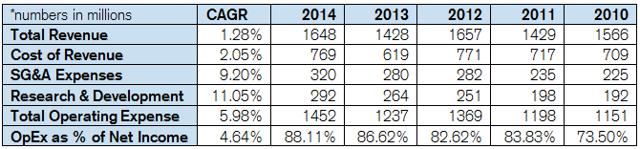

Revenue Growth / Cost Control

Note that 2014 numbers above exclude the $99M goodwill impairment charge the company took on its Wireless Test segment as a result of decreased expected demand. Backing out this figure gives better clarity on the numbers through the years and the trends involved.

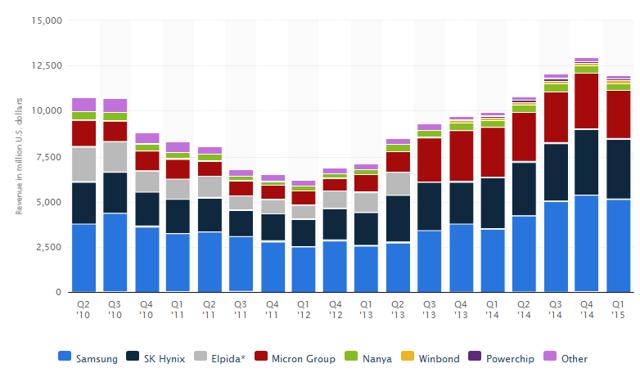

Revenue has been flat throughout this period, much like the broader industry the company provides services to. 2010 marked the beginning of a downtrend in the semiconductor industry that began to reverse course in 2013, but which now appears to be heading back downward.

*Global DRAM revenues, 2H 2010 through Q1 2015

This period of falling revenue has also pressured the company in regard to its expenses. Research and development costs have grown quickly, as the company seeks to make sure it maintains a competitive edge. SG&A expenses are up as the headcount has increased and salaries have risen. In the end, however, shareholders have been rewarded handsomely in regard to their equity share in the business, which has risen from $1.1B in 2010 to nearly $2.1B today.

Healthy Cash, No Debt, $500M Buyback Program

What should draw in investors seeking safety the most is Teradyne's balance sheet. The company carries $1.2B in cash, with no debt, evenly split between onshore and offshore cash - nearly a third of its market cap. The company recently announced a $500M share buyback program ($300M targeted to be purchased in 2015) to put some of this cash to use for generating shareholder returns.

This compares favorably to the heavy debt that most direct manufacturers like Micron or Toshiba (OTCPK:TOSBF) routinely have to bear from operating in the capital-intensive semiconductor industry. This fact, plus the widely diversified customer-base, makes it a safer play going into what may turn out to be another downtrend in this industry.

Conclusion

Teradyne's continued market share gains over the past few years point to a strong business model, and the historically conservative management's recent decision to allocate funds to shareholders in the form of buybacks/dividends shows renewed confidence in their business model, even as the semiconductor industry begins to feel immense pressure. For investors who want exposure to the semiconductor industry, but are afraid of picking a dud, Teradyne is a safe, diversified play.