Expected earnings reports and the whisper number impact for February 1st, 2012, after market close.

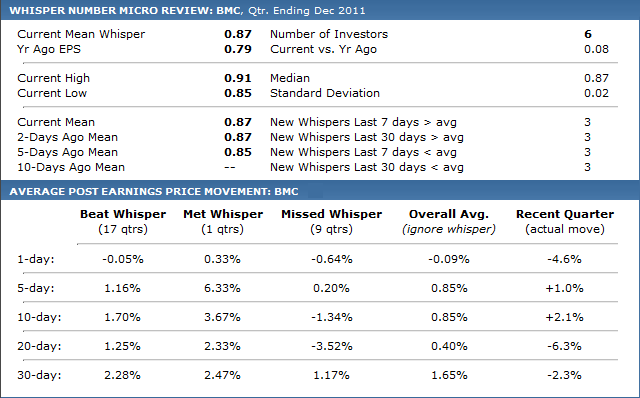

BMC Software (BMC) reports earnings Feb. 1st, after market close. The whisper number is $0.87, five cents ahead of the analysts estimate. BMC has an 63% positive surprise history (having topped the whisper in 17 of the 27 earnings reports for which we have data). The average price movement (starting at next market open) within ten trading days of these twenty-seven earnings reports is +0.9%. The strongest price movement of +2.3% comes within thirty trading days when the company reports earnings that beat the whisper number, and -3.5% within twenty trading days when the company reports earnings that miss the whisper number. Last quarter the company reported earnings six cents ahead of the whisper number. Following that report the stock realized a 2.1% gain in ten trading days before giving it back and seeing a 6.3% loss in twenty trading days.

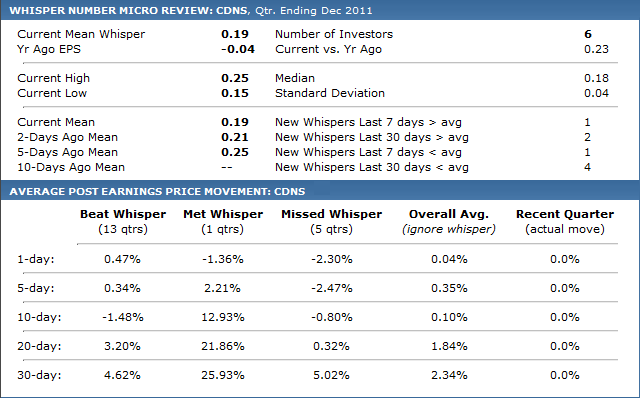

Cadence Design Systems (CDNS) reports earnings Feb. 1st, after market close. The whisper number is $0.19, four cents ahead of the analysts estimate. CDNS has an 68% positive surprise history (having topped the whisper in 13 of the 19 earnings reports for which we have data). The average price movement (starting at next market open) within ten trading days of these nineteen earnings reports is +0.1%. The strongest price movement of +4.6% comes within thirty trading days when the company reports earnings that beat the whisper number, and -2.5% within five trading days when the company reports earnings that miss the whisper number.

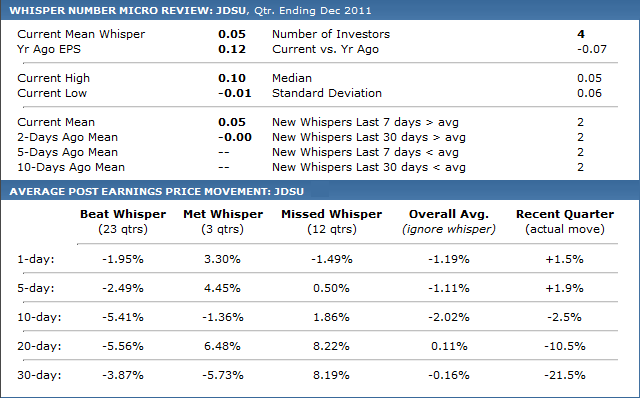

JDS Uniphase (JDSU) reports earnings Feb. 1st, after market close. The whisper number is $0.05, five cents short of the analysts estimate. JDSU has an 61% positive surprise history (having topped the whisper in 23 of the 38 earnings reports for which we have data). The average price movement (starting at next market open) within ten trading days of these thirty-eight earnings reports is -2.0%. The strongest price movement of -5.6% comes within twenty trading days when the company reports earnings that beat the whisper number, and +8.2% within twenty trading days when the company reports earnings that miss the whisper number (opposite reactor). Last quarter the company reported earnings six cents ahead of the whisper number. Following that report the stock realized a 21.5% loss in thirty trading days.

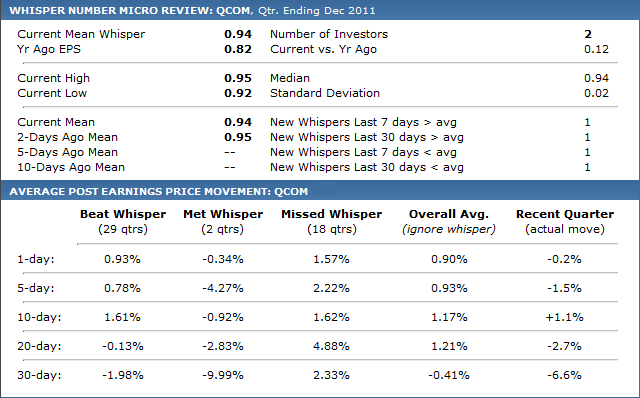

Qualcomm (QCOM) reports earnings Feb. 1st, after market close. The whisper number is $0.94, four cents ahead of the analysts estimate. QCOM has an 59% positive surprise history (having topped the whisper in 29 of the 49 earnings reports for which we have data). The average price movement (starting at next market open) within ten trading days of these forty-nine earnings reports is +1.2%. The strongest price movement of +1.6% comes within ten trading days when the company reports earnings that beat the whisper number, and +4.9% within twenty trading days when the company reports earnings that miss the whisper number. Last quarter the company reported earnings in-line with the whisper number. Following that report the stock realized a 6.6% loss in thirty trading days.

Disclosure:

I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.