Trueblue (NASDAQ: NYSE:TBI) is a workforce solutions provider with the stated goal of helping clients to "improve growth and performance by providing staffing, recruitment process outsourcing, and managed service provider solutions." The company assists over 135,000 businesses and helps to connect nearly 750,000 people to work each year. In June 2014, Trueblue acquired Staffing Solutions Holdings (Seaton) and thereby added a full service line of temporary blue-collar staffing to its wide range of services.

Year to date Trueblue is up almost 35% on the back of Seaton-driven growth, evidenced by record-setting first-quarter results. Still, even at these levels, Trueblue's valuation appears to discount the immense strengthening in the company's fundamentals.

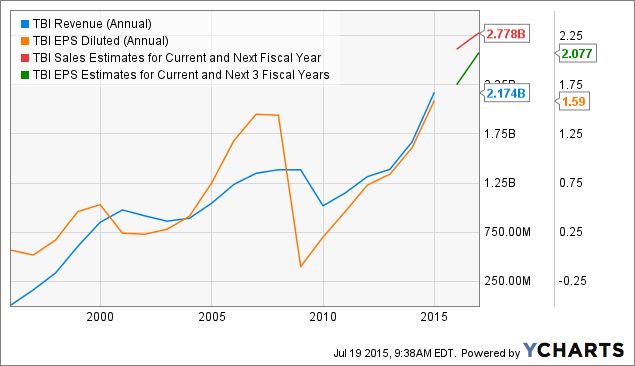

TBI data by YCharts

Fundamental Quality

Once a company that lagged behind its industry significantly in operational and management efficiency metrics, Trueblue is today very close to pulling in-line with the staffing and outsourcing industry.

Trueblue's TTM operating margin of 3.70% still lags the overall industry mark of 5.18%, but is up nearly a full percentage point over the past two years. Trueblue's TTM return on equity has also shown tremendous strengthening, rising from below 10% to now 15.86% since just 2013. Still Trueblue's ROE marginally trails the industry average of 17.50%.

Meanwhile Trueblue's asset utilization mark of generating $2.60 in revenue for every dollar in assets trumps the industry average of $1.95.

The company balance sheet was debt free as recently as 2012, but now sits with $127 million in total debt on its book, which creates no problems with the company possessing $158 million in total liquidity and a current ratio of 1.86.

Growth

Post the Great Recession Trueblue has done a tremendous job of returning both its top and bottom lines to growth.

TBI Revenue (Annual) data by YCharts

The staffing industry itself has grown 8% annually since 2010, outpaced by the 18% annual growth seen in Trueblue's revenue. This outperformance speaks to the effectiveness of Trueblue's strategy of expanding into complementary workforce services through acquisitions. Over the past decade alone Trueblue has made 18 acquisitions with a total of $550 million invested, growing the revenue derived from its acquired assets to over $1.2 billion in 2014.

Trueblue's Seaton acquisition allows the company to continue to execute on its acquisition-based strategy. In this year's first quarter alone Seaton generated 44% revenue growth while the company's Legacy Trueblue operations were roughly flat.

Although largely dependent on the strength of the overall economy, at least according to leading projections Trueblue will to continue to operate in expanding markets for the foreseeable future, as this slide from the company's investor presentation depicts.

With these opportunities available and solid enough financial footing to capitalize on them through more acquisitions, analyst estimates for the company to grow revenue 20.1% this year and 6.4% in 2016 seem more than attainable for a company that has proven itself to be capable of significantly outpacing the overall industry.

Valuation

TBI | Staffing & Outsourcing Industry | |

Price to TTM Sales | 0.527 | 0.784 |

Price to TTM Earnings | 17.79 | 22.39 |

Price to Tangible Book Value | 12.31 | 15.05 |

Assuming the growth estimates analysts have outlined for Trueblue are accurate, the company's valuation is rather reasonable. In comparison to the overall staffing and outsourcing industry Trueblue actually trades at a marginal discount as is depicted above.

Much of this discount is tied to the past weak operational efficiency metrics for Trueblue. As Trueblue has pulled back in line with the overall industry and could soon surpass the average in terms of margins and ROE, the company's stock will command a higher multiple.

By year's end I can see shares extending their rally with shares trading between $35 (2015 EPS estimate * 20 P/E ratio) and $41 (2015 sales estimate * 0.65 P/S ratio).

The Takeaway

The recent rise in Trueblue's stock price can be credited to the company's acquisition-based strategy having one of its biggest successes to date with the acquisition of Seaton. As Trueblue further grows to take advantage of the ample opportunities available in such times of strong economic expansion, I believe the company will further come in line with the overall industry in operational efficiency metrics, allowing the stock to command a higher multiple.