Cal-Maine Foods (NASDAQ:CALM) announced record Q4 and FY15 results on Monday, July 20th. Revenues came in at $403 million for the quarter and $1.576 billion for the year, a 8.5% and 9.4% YoY increase, respectively. EPS came in at $0.95 for the quarter and $3.33 for the year, a 46.1% and 47.3% YoY increase, respectively.

Estimates going into Q4 and FY15 estimates were particularly high due to the Avian Influenza (AI) that wiped out 13% (~40 million) of all laying hens and pullets in the upper Midwest region of the US. Analysts were expecting CALM to have a blowout quarter with EPS of $1.04 on revenues of $417.95 million - a 60% and 12.5% YoY increase, respectively. We were a little bit too bullish on the amount they would be able to capitalize on Avian Influenza's effect on supply-demand fundamentals; however, we feel that this record quarter is much more than just an estimates miss.

Regarding fears over a potential AI outbreak in CALM's operations, management has ensured in a Q4 and FY15 press release that they "have significantly increased [their] biosecurity measures at every location, and [they] continue to monitor the situation every day." Based off of management's sentiment, we do not believe AI should pose a serious threat to CALM.

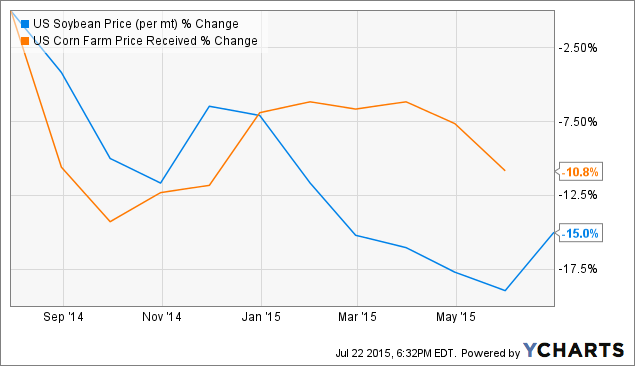

Operating income came in at $235.3 million for the quarter, a 61% YoY increase due to a 10.9% feed cost decrease. The abundant harvest of corn and soybean crops in Fall 2014 translated to better feed costs in CALM's Q2 FY15.

US Soybean Price (per mt) data by YCharts

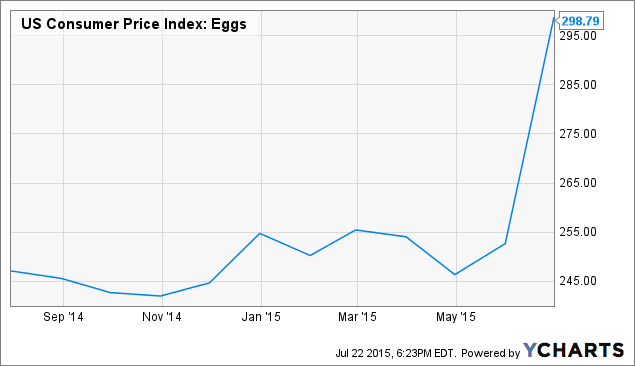

The lack of egg-producing hens and pullets is having a drastic impact on egg prices. These prices are expected to stay high until the laying hen and pullet population will recover, which could take some time.

US Consumer Price Index: Eggs data by YCharts

Q4 and FY15 ended on May 30th, missing the realized increase in shell egg prices. The record quarter was attributed to a 6.2% increase in dozen shell eggs sold coupled with a 2.6% increase in average selling price, but this was a factor of an improved product mix more than a small increase in egg prices. The impact of the recently spiking egg prices will be reflected more accurately in the coming Q1 FY16 earnings report.

Product mix is a crucial metric for CALM. There is a growing demand for specialty eggs (such as nutritionally enhanced, cage free, organic, and brown eggs) in the US. Roughly 20% of CALM's total shell egg sales were specialty eggs, and they accounted for 27.2% of revenues, up from 24.3% in FY14. This improved product mix will mean boosted revenues for CALM as domestic health-conscious trends continue. To aid supply of specialty eggs, CALM has entered a partnership with Indiana-based Rose Acre Farms, Inc. to build a shell egg production complex in Texas by November 2015 with the capacity for 1.8 million cage-free eggs. This partnership will ensure that CALM can keep up with the increased specialty egg demand.

Looking forward, we believe that CALM looks favorable to post more record quarters. Egg prices, improved product mix, and low feed costs position CALM perfectly for future growth. AI's effect on the supply-demand fundamentals of eggs bodes well for CALM shareholders looking forward.