Albemarle Corporation (NYSE:ALB) is a manufacturer and marketer of specialty chemicals across a range of markets, including the petroleum refining, consumer electronics, plastics, construction, automotive, lubricants, pharmaceuticals, crop protection, food-safety and custom chemistry markets.

ALB's top-tier Lithium assets are the focal point of this article. The market opportunities in energy storage, automotive electrification, and consumer electronics are immense. Previous articles highlight the impact of automotive electrification (article), as such, this article will dig into the energy storage and distributed grid market opportunities.

Quick Take

ALB currently trades and forward PE of 13.98 against forward PEs of 18.62 and 18.20 for the S&P BMI Materials sub-index and S&P 500 index, respectively. Additionally, ALB trades at a discount to competitors BASF (OTCQX:BASFY) (PE: 15.05), Dow (DOW) (PE:17.23), W.R. Grace (GRA) (PE: 22.24), and Israel Chemical (ICL) (PE: 17,831) (Market data was sourced July 10th 2015). Topline ratio comparisons are further summarized in the table below.

| Ratio | ALB : Albemarle Corp NYSE | S&P United States BMI Materials | S&P 500 Index |

| Price/Earnings | 24.77 | 36.24 | 18.66 |

| Price/Forecasted Earnings (FYF) | 13.98 | 18.62 | 18.2 |

| Price/Tangible Book (MRQ) | -- | 3.14 | 2.9 |

| Price/Sales | 2.27 | 1.25 | 1.81 |

| Price/Cash Flow | 20.81 | 11.69 | 16.74 |

| Return on Equity (%) | 7.96 | 9.96 | 14.12 |

| Dividend Yield (%) | 2.1 | 1.99 | 2 |

ALB also pays a dividend with shares currently yielding 2.09%. The dividend has grown 120% since 2009 to annual $1.10 dividend per share in 2014. The dividend has grown while payout ratio remains at a reasonable 52%. The lower payout ratio leaves room for further dividend increases while providing a buffer in the event earnings temporarily deteriorate. The firm's dividend track record is impressive with 21 years of increasing dividends since 1994.

The Distributed Generation Opportunity

What is distributed generation? Distributed generation (DG) is the production of power at the site of consumption. The transformation of the grid to interconnect and leverage distributed generation is beginning and lithium powered battery systems are going to play a major role in this transformation. Two recent regulatory events in California are painting a picture of this change.

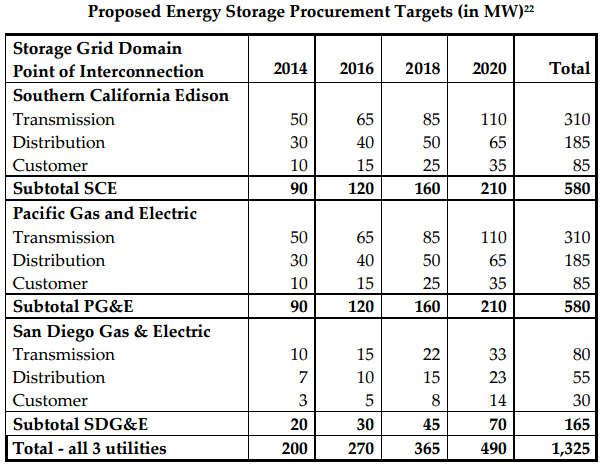

Long a pioneer in energy regulation, California recently passed Assembly Bill 2514 (AB 2514) mandating 1,325 MW of energy storage by 2020 for the state's three largest utilities (procurement by 2020, installation by 2024). The procurement requirements are skewed toward "utility scale" storage. Transmission level storage is 53% (700 MW) of the required storage capacity with Distribution is 46% (610 MW) and Customer level energy storage a distant third at 1% (15 MW) of required storage. This allocation makes sense given the mandate is geared toward the utilities and not the customer base.

While AB2514 doesn't mandate battery storage, for illustrative purposes I will assume 50% of the mandate will be fulfilled through utility scale battery storage.

How much lithium does it take to get to 663MW (1,325/2=663) of battery storage? It's hard to say as batteries can take a range of lithium to generate 1 kWh of capacity. Additionally, utility scale battery storage raw material requirements are not well publicized; however, will electric vehicles taking off those figures are available. According to EVworld.com, which cites a research report by the Department of Energy funded Argonne National Laboratory, the average EV battery takes 113-246 grams of lithium per kWh of capacity. Taking the midpoint, that would be 180 g/kWh of capacity, or 180,000 g/mWh of capacity or .18 tons per mWh. To reach the assumed 663 mWs of capacity under assumed AB2514 resource mix, there would need to be 119 tons of lithium produced just for CA's pilot project.

To put the AB2514 requirement in perspective, CA's 2014 installed in-state power generation capacity was 78,865 MW and total generation was 198,871 gWhs. That means only 1.7% of CA's power generation capacity could be stored for future deployment. Still a lot of room for growth in the storage market, and that's just California.

Part of the distributed grid is the development of solar. ALB's Performance Chemicals and Catalyst Solutions business services the solar industry by providing high-purity metal organic products used in solar cell production. By offering services to the solar industry, ALB is doubly positioned to benefit from the burgeoning energy storage industry as solar is fast becoming the perfect and preferred companion for battery storage. For example, SolarCity (SCTY) recently launched a program introducing backup batteries to pair with their solar installations.

The opportunity in solar is immense. The International Energy Agency (IEA) forecast solar to grow to 27% of the world's electricity production by 2050. That's more than 11,000% growth from IEA's stated 2013 solar electricity generation.

Why Go For The Supplier?

There is currently no clear winner on the hardware side of the market. Tesla (TSLA) gets a lot of play for its Powerwall and Powerpack products but bigger players like AES Corp. (AES) and General Electric (GE) are throwing real money at the storage market as well. AES Corp already has its successful utility scale product, Advancion, which has already delivered 2 million mWhs. GE just came out with a statement highlighting its desire to be a "sizable player" in the energy storage market.

The same report highlighting GE's reboot of its energy storage business points out the fragmented storage market and cites "as many as 20 significant players vying for deals." With a fragmented market for storage devices, the winner is the supplier, in this case Albemarle. Additionally, as one of the largest suppliers of Lithium, ALB will be well positioned to maintain pricing power and maintain higher margins.

Summary

Albemarle is a great opportunity to gain exposure to the developing distributed grid as a battery storage lithium supplier and specialty chemical supplier to solar cell manufacturers. The battery storage opportunity will be a core component of the firm's growth following the merger with Rockwood and recent opening of the La Negra mine in Chile. As the largest lithium producer, ALB is better positioned to maintain pricing power in the fragmented battery manufacturing market as the technology to be developed with lithium as the catalyst of choice. Furthermore, look to state governments to follow California's lead by pushing energy storage mandates that will further push the growth of battery storage. Coupled with the growth of solar firms like SolarCity offering supplemental backup battery offerings to increase their appeal to residential consumers.