As has been the case for the last ten years or so, the U.S. economy continues to grow at a rate that has failed to meet expectations. The recently released numbers from the Commerce Department show GDP growth is at only 2.3 percent, significantly below the expected 3 percent being looked for.

It has been a full decade since the last time the GDP has grown above a 3 percent rate, making it the weakest recovery in about 70 years. Economic growth hasn't surpassed the 3 percent mark since 2005, according to the Commerce Department.

Another key factor is the continual drop in productivity, which according to the Labor Department, reached a high in 2002. Being a number of years before the Great Recession, it can't be considered the primary source of the drop in hourly output.

In the midst of the recession the appearance of increased productivity emerged because of the numerous job cuts during that period of time, rather than businesses becoming more efficient.

On the wage and compensation side of things, the slight gain of 0.2 percent was the lowest since Employment Cost Index started being used in 1982. Economists had projected a 0.6 percent rate of growth. Worse, those small gains were in the public sector. Private sector wages and compensation, for the first time since being measured, didn't grow at all. In the first quarter employee compensation grew 0.7 percent.

The compensation weakness was the result of diminished bonuses and commissions in the sales, wholesale and information industries. Those sectors helped grow worker compensation in the first half.

Unemployment and wage growth expectations

With unemployment now standing at 5.3 percent, it is closing in on the percentage considered by the Federal Reserve as representing full employment, which is a range of 5.0 percent to 5.2 percent.

There is a caveat there of course, as people that no longer search for jobs aren't counted as among the unemployed. That skews the numbers of course. But in general, there has been job growth.

Now that those who apparently want to work are able to get jobs, it brings up the question of what will happen to wages when the labor market starts to get squeezed.

Expectations are once that level is met, that's when wages should start growing at a quicker pace, which I think will be primarily driven by competition in the private sector. This is what has kept consumer sentiment fairly strong, even though it did drop in the last quarter. If those expectations aren't met, consumer sentiment could quickly reverse direction.

Since I believe we're entering the beginning of the last stage of this business cycle, it could upset those expectations, which would have a negative impact on the economy as consumers cut back on spending. Since consumers account for approximately 70 percent of GDP, that would have a dramatic effect on economic growth in the U.S.

Public vs. private sector compensation growth

There is cause for concern when the public sector experiences wage growth and the private sector doesn't. It gives the sense of a propped-up economy that can't stand on its own merit.

If that trend continues, the government will only be able to do so much before the reality of what is happening with employee compensation becomes widely known and understood.

Also important is the fact most of the drop in compensation came in regard to commissions and bonuses. That suggests sales were down and goals weren't met. With most of that being associated with large-ticket items, it points to a potential slowing growth pattern if it repeats itself in the next couple of quarters.

If the trend does continue, consumer sentiment could start to change. Even with the best eight-month performance in a decade, the University of Michigan's consumer sentiment index for July 2015 dropped from 96.1 in June to 93.1 in July.

Also down was the Current Conditions Index, which when combined with the Sentiment Index, shows consumers weren't feeling as confident as the prior seven months.

The Conference Board Consumer Confidence Index also showed a drop in sentiment in July, declining from 99.8 in June to 90.9 in July. Its Present Situation Index was also down from 110.3 in June to 107.4 in July.

Again, if this trend continues, we will start to see a measurable slow down in consumer spending. That could be a disaster if it happens around the Christmas season. Retailers especially could be hit hard if they have to cut prices to generate sales.

If sentiment continues to fall in the next couple of months, it would point to probable slowing growth for the US economy.

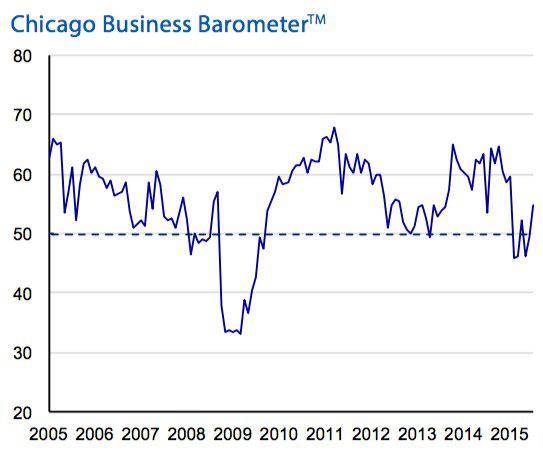

Chicago Business Barometer

Among the strongest economic metrics recently released was that from the Chicago Business Barometer, which exceeded expectations with a gain of 5.3 points to 54.7 in July. That was led by Production, which was up in the double digits, jumping by 12.0 points. Also enjoying solid increases was the New Orders component. Both grew at the fastest level since the beginning of 2015.

While all the components in the Barometer enjoyed gains in July, Employment, Order Backlogs and Supplier Deliveries continue to be in contraction.

There were still some significant weaknesses though. The report said this:

In spite of the increased level of orders and output, Employment improved only modestly and remained below 50 for the third consecutive month with the indicator rising only slightly above June's 5½-year low. Order Backlogs remained in contraction for the sixth consecutive month despite a healthy gain over last month's near five-year low and the increased level of orders in July - the relative slack in recent months appears to have allowed firms to turnaround orders quickly. Supplier Deliveries were little changed and continued to hover just a shade above June's two-year low.

Also of importance was while the Prices Paid was up 1.2 points in July, coming in at 54.5, that didn't include the drop in crude oil prices, which is likely to quickly offset that when the next report is released.

This last report was a reprieve for the manufacturing sector in the Midwest, but it comes off of major weakness and has yet to prove things have reversed direction. The next couple of reports will reveal if this is an anomaly or something more sustainable.

With overall GDP data showing inventories in the first half have increased significantly, they will eventually have to draw that down, which will have a weakening effect on overall production. I'm talking across the country now, not just the Midwest.

source: Chicago Business Barometer

Conclusion

As usual, the economic numbers have generated offsetting data which conclude the economic variables in place will continue to weigh on the U.S. economy, and growth will remain weaker than hoped for.

Consumer sentiment is probably the most important, and if that continues to decline, it will have a strong impact on the GDP. That would lead to consumers getting stingy at the most important season of the year for retailers. That in turn would result in the need to lower prices, which of course would put pressure on margin and earnings.

What may be the tipping point either way there is how wages in the private sector do. If they meet expectations, which are currently high, that would increase sentiment and spending. If not, consumers would pull back and hold on to their money.

We'll have to see if manufacturing production increases in the Midwest are sustainable, and if so, the other components continue to move up with it.

With China continuing to reel and the U.S. dollar remaining strong, there is a lot that will have to be overcome in order for GDP in the U.S. to get any more traction than it has. It looks like economic growth at best, will remain subdued.