The Reserve Bank of India cut policy rates by 75 bps during 2015 to 7.25% currently. The moves were prompted by lower CPI inflation which came down to below 6% for the past few months. Jun'15 recorded an inflation print of 5.4% YoY. The central bank's aim is to maintain the real policy rates at 1.5-2%, while targeting inflation rates of 6% (midpoint of +/-2% range) by Jan'16 and 4% from 2017 onwards. This means that we are moving towards a lower policy rate environment in India, going forward.

Investors are concerned that lower interest rates could hurt net interest margins/NIM of banks. This concern is real, as banks borrow money from customers for shorter durations, and lend money for long durations at a higher rate. Interest rates on the longer maturities tend to move more rapidly than those with shorter tenors. This leads to faster fall in loan yields than customer deposit rates, leading to narrowing of net interest margins.

Here, we are analysing how a lower interest rate environment affects HDFC Bank (NYSE:HDB) - one of the most expensive banking stock in the world in terms of price-to-book ratio. We will first show how much NIM contraction can affect the bank's profits and RoE:

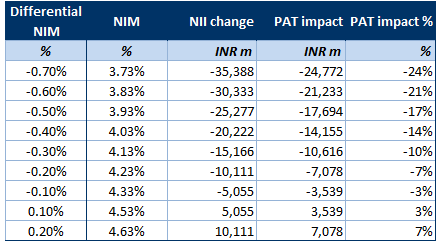

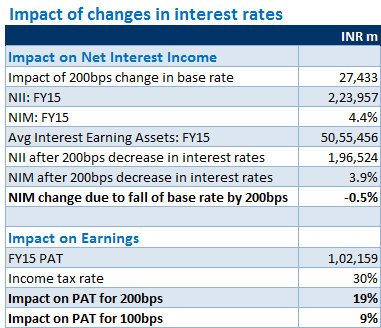

Impact on profits:

Bank earnings are highly sensitive to even small changes in NIM. Our analysis shows that every 10 bps change can lead to roughly 3% fall in HDFC Bank's earnings (based on FY15 numbers). A 50 bps fall can lead to erosion of 17% of earnings.

Source: Author's computations

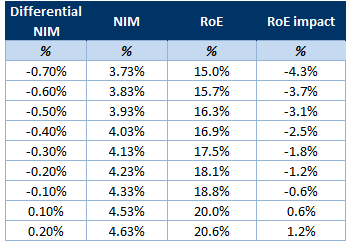

Impact on RoE:

HDFC Bank's RoE of 19.4% for FY15 is one of the highest among banks globally. Every 10 bps impact can bring down RoE by 60 bps - implying a factor of 6 times. A 50 bps fall can lead to RoE plunging by 3% to 16.3%.

Source: Author's computations

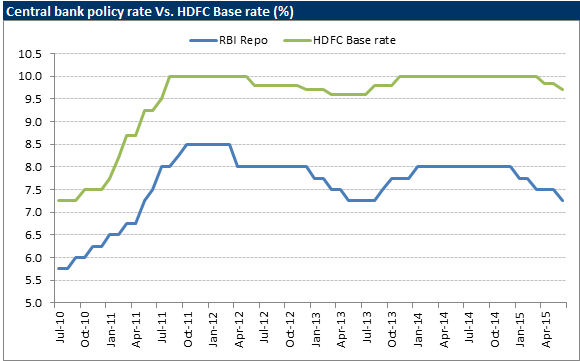

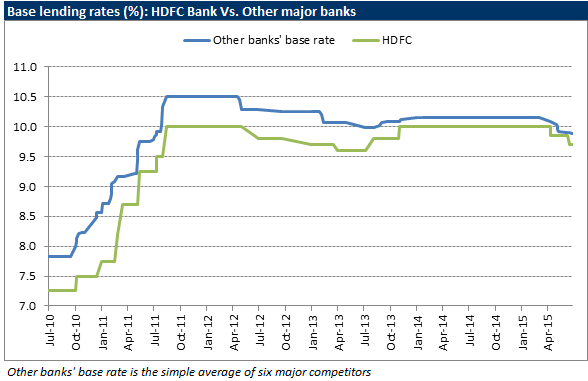

HDFC Bank has cut base rates recently

The loan assets of Indian banks are priced based on "base rate", a mechanism introduced in July 2010 by the central bank. According to base rate mechanism, banks should establish a "base rate" - which is basically the cost of funds - below which they should not price their loans. Earlier, banks used to have freedom in determining the so-called "Base Prime Lending Rate (BPLR)" which was the rate at which they used to lend to their high-quality customers - mostly corporates. Banks also used to provide loans to their prime corporate customers at rates below BPLR. After the introduction of base rate, banks have to adopt a formula to determine the base rate, which has to be later followed consistently.

HDFC Bank adopts "marginal cost of funds" to determine base rate, which currently stands at 9.7% after a 15 bps cut in Jun'15. But the bank has cut rates only by 30 bps in response to the policy rate cut of 75 bps in 2015.

As seen in the above chart, HDFC Bank's base rates have moved mostly in sync with the direction of central bank rate movement. But after 2012, the bank has not changed rates to the extent of RBI repo rate changes. This is due the fact that HDFC Bank is retail focused, and its cost of funds will be determined by the changes in term/fixed deposit rates.

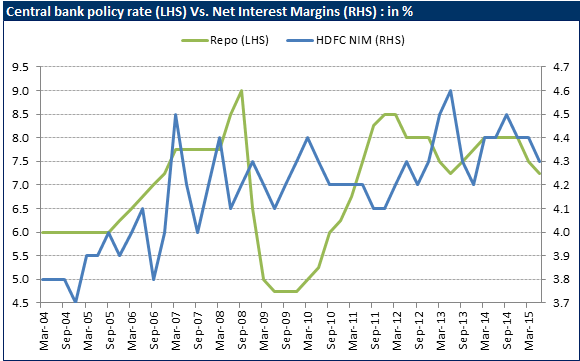

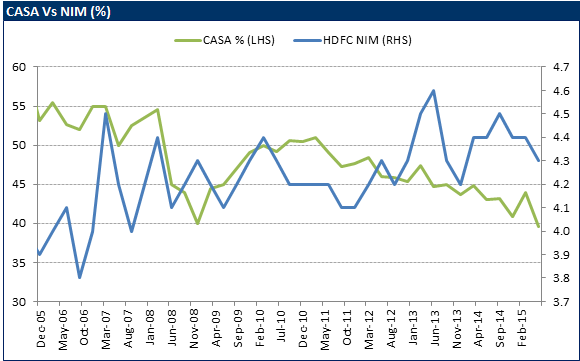

Despite the changes in central bank policy rates, HDFC Bank's net interest margin (NIM) has been quite resilient. In response to global financial crisis, the RBI cut rates from as high as 9% in Sep'08 to 4.75% by Jun'09. Yet, HDFC Bank's NIM fell by just 30 bps during the same period to 4.1%.

Source: RBI, Reuters

Historically, the impact of a lower rate environment appears to be moderate on NIM. But history could be misleading. A 200 bps fall in market interest rates could lead to net interest income falling by as much as INR 27 billion (US$ 430 million at current exchange rates) as per HDFC Bank's own sensitivity analysis conducted in Mar'15. Our calculations show that this could mean an impact of 50-55 bps on NIM, and 19-20% fall in earnings (based on FY15 earnings). Hence every 1 ppt (ppt means percentage point) fall in base rates could lead to 25 bps fall in NIM and 8-10% impact on bottom line. However, a 25 bps impact on net interest income can be offset by growth of 6-7% in the interest earning asset portfolio.

Source: HDFC Bank, Author's computations

But, we believe that a reduction of 1 ppt in base rate appears unlikely in the near term. This is because HDFC Bank is a retail-focused bank and does not depend on wholesale/central bank borrowing for funds, and hence its marginal cost of funding does not depend directly on RBI policy rates. Rather, its base rates are changed in response to competition in the loan market by tweaking the fixed/term deposit rates.

Source: Reuters

We also tried to analyze whether the high NIMs are achieved by the relatively good CASA franchise. We looked at the industry leader - State Bank of India - which has similar CASA ratio (43% in March 2015), yet achieved a NIM of 3.5% during Jan-Mar'15 quarter, compared to HDFC Bank's 4.4%. ICICI Bank - the biggest private sector lender - had 45.5% CASA but was able to achieve NIM levels similar to SBI at ~3.6% in Jan-Mar'15 quarter. We also analyzed the historical relationship between CASA ratios and NIM levels:

Source: HDFC Bank

The results were counter intuitive - CASA profile has been deteriorating from 55% (in 2005) down to 40% currently, but the bank surprisingly managed to maintain NIM above 4%. HDFC Bank's term deposit rates are on par with SBI and ICICI. This shows that high NIMs are maintained by a combination of loan mix and efficient treasury management.

What we expect from RBI and possible follow up action from HDFC Bank

We do not expect any policy rate changes from the central bank in 2015 due to upside risks to inflation as lower monsoon rainfall could lead to spike in food prices (which have ~46% weight in CPI). The first half of 2016 could see policy rate cut of 25-50 bps at maximum if inflation remains below RBI target of 6%. In our view, this could lead to HDFC Bank responding by cutting base rates by 10-15 bps, which will have hardly any impact on NIM or earnings. We will continue to see HDFC Bank's industry-high NIM of above 4% for at least the next 12 months.

Hence we believe that the current trend towards lower interest rate environment in India will not have a significant impact on HDFC Bank's earnings - especially in the next one year (till H1CY16). In the unlikely scenario of rates falling by 100 bps, HDFC Bank's proven track record of growing the loan portfolio ahead of the banking system growth rates will easily offset any pressure on NIM.