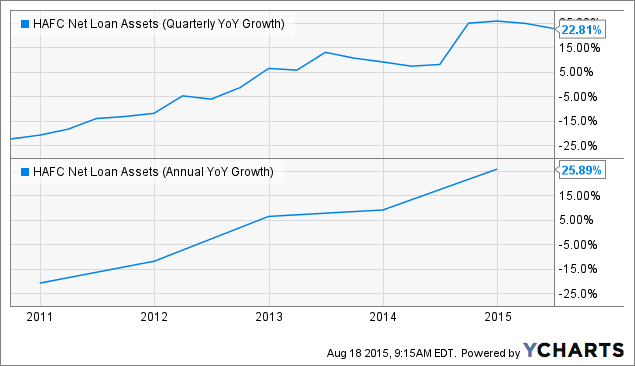

The valuable missing piece in the earnings reports of Hanmi Financial (NASDAQ:HAFC) had been its inability to generate loan portfolio growth until the end of 2012. From 2013, things started changing, and there is no looking back from that point on. The company's recent move (in Q2) to expand its reach and exposure into two different markets through new loan production offices is one key initiative to keep the loan portfolio growing at an exceptional rate and to improve it whenever possible. It also helps HAFC to sustain some percentage of growth it is already generating by having exposure to different new markets, including the two newly covered markets (New York and Georgia); the company has exposure to nine different states. Loan portfolio grew by 23% (YoY) and total deposits grew by 35.2% (YoY) in Q2 2015. YoY numbers were mostly driven by the CBI acquisition that was completed in Q3 2014. Loan portfolio grew by 2% in Q2 2015 from the preceding quarter.

HAFC Net Loan Assets (Quarterly YoY Growth) data by YCharts

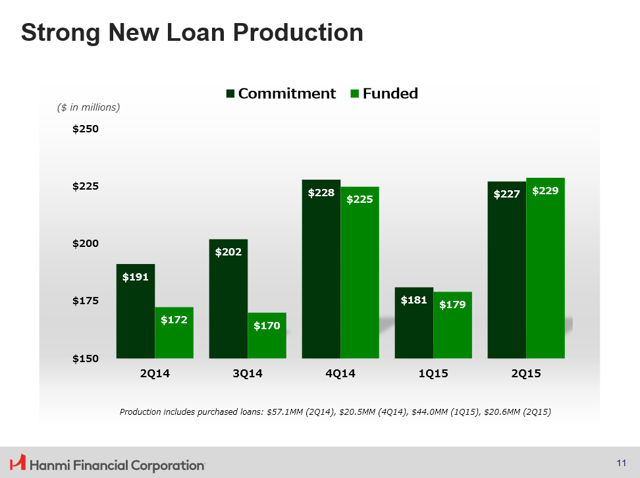

As explained earlier, HAFC's efforts to grow its loan portfolio are clear. In line with its efforts, organic loan production continues to improve.

Source: Presentation

"During the second quarter of 2015, we achieved strong loan production along with improvements in our overall deposit mix. New loan production for the second quarter was comprised of $208 million in organic loan production and $21 million of loan purchases, primarily comprised of residential mortgage loans, for a total of $229 million.

Compared to the second quarter last year, organic loan production increased 81%. As I noted earlier, our new operations in Texas and Illinois made solid contributions in the second quarter and we expect production in these markets to continue to increase as the year progresses. Overall, the loan pipeline entering the third quarter is strong." - Source: Earnings Call

The company's net income grew by 26.6% YoY in Q2 2015 and 26.5% from the preceding quarter. Earnings growth from the preceding quarter was mostly driven by cost reductions. The positive impact of the recent acquisition on quarterly YoY earnings has helped HAFC to post excellent earnings growth in the past four quarters.

Net interest margin improved significantly from 3.82% in Q2 2014 to 3.97% in Q2 2015, well above the average net interest margin of 2.95% for all U.S. banks registered in Q1 2015. The cost of interest-bearing liabilities has declined significantly from 0.74% in Q2 2014 to 0.64% in Q2 2015; that is some good improvement to save some earnings.

Asset Quality and Efficiency Ratio

With more than enough reserves to cover its nonperforming loans, the company's future earnings are fully protected from the risk of existing nonperforming loans turning bad. Further, its high nonperforming loans give HAFC the opportunity to work on them to find their current position, which is mostly positive as per the recent trend. If that's the case, then the negative provision amount is going to be much higher than what the current excess reserves allow. HAFC's existing reserve account covers almost two times (181.35%) of its existing nonperforming loans, due to its high nonperforming loans (0.97% at Q2 2015) and substantial reserves. Large negative provisions are expected in the coming quarters as the management has indicated. Some well-managed banks have nonperforming loan percentage in the range of 0.45% to 0.65%. By having higher percentage of loans as nonperforming, HAFC has to hold a large amount of reserves that will undermine the earnings the loan portfolio has generated in the recent past.

Efficiency ratio deteriorated by a negligible percentage YoY, but improved from Q1 2015 and Q4 2014. Further improvements are expected as the management is planning for the closure and consolidation of four additional branches. That will generate more cost savings, meaning more earnings, and the savings might be used to grow earnings by opening new loan production offices or branches. Efficiency ratio (lower is better) deteriorated slightly from 55.34% in Q2 2014 to 55.95% in Q2 2015 and significantly improved from 62.30% in Q1 2015 and 73.39% in Q4 2014. If HAFC maintains its current cost structure going forward (that is mostly likely), the improved cost structure will help it to post some valuable earnings growth (YoY) from Q4 onwards with little help from revenue growth and asset quality. Considering the recent changes in cost structure, I think management took too much time to gain the cost savings it achieved until Q2 2015; that has cost investors some valuable earnings.

While the direction in which the management is moving in terms of loan portfolio growth, asset quality and efficiency ratio is something valuable to investors over the long term, the slow movement is something that is not allowing me to put HAFC at the top in my recommendations list. But, there is no doubt HAFC is one of the excellent opportunities one will find in the banking space for the next one year at least.