One of my favorite ETF is the Schwab U.S. Broad Market ETF (NYSEARCA:SCHB). I see this ETF as a great choice for the core holdings in a portfolio. Investors have quite a few options for the core of their portfolio, but all my favorite options will show a strong correlation to the SPDR S&P 500 Trust ETF (SPY) and a lower expense ratio. SCHB is in many ways very similar to the Vanguard Total Stock Market ETF (VTI) and should be seen as a direct competitor for allocations within the portfolio. I'm holding both in my portfolio because I started buying VTI before I moved the accounts over to Schwab. The returns between SCHB and VTI have a correlation higher than .99. I suggest investors use whichever they are able to trade without commissions since both are very highly diversified and both have very low expense ratios.

Expense Ratio

The expense ratio on SCHB is .04%. No typo there, this is an extremely low expense fund and it is highly diversified with about 2000 companies represented in the ETF.

Largest Holdings

The diversification is excellent in this ETF. I'm not sure if I'm more excited by the diversification of the holdings or the low expense ratio. Either way, the ETF has been falling rapidly over the last few days as fears about the state of the American economy drive sellers out of the equity market and into the long term treasury securities.

Building the Portfolio

I put together a hypothetical portfolio using only ETF's that fall under the "free to trade" category for Charles Schwab accounts. My bias towards these ETFs is simple, I have my solo 401k there and recently moved my IRA accounts there as well. When I'm building a list of ETFs to consider I want to focus on things I can trade freely so that I can keep making small transactions to buy more when the market falls.

Within the hypothetical portfolio there are no expense ratios higher than .18%. Just like trading costs, I want to be frugal with expense ratios.

The portfolio is fairly aggressive. Only 30% of the total is allocated to bonds and I would consider that the weakest area in the portfolio. I'd like to see more bond options (with very low expense ratios) show up on the "One Source" list for free trading.

A quick rundown of the portfolio

The Schwab U.S. Dividend Equity ETF (SCHD) is a dividend index. The Schwab U.S. Large-Cap ETF (SCHX) is focused on blended large cap exposure. The Schwab International Equity ETF (SCHF) is developed international equity. The Schwab Emerging Markets ETF (SCHE) is emerging market equity. The Schwab International Small-Cap Equity ETF (SCHC) is developed small capitalization equity. The Schwab U.S. REIT ETF (SCHH) is domestic equity REITs. The Schwab U.S. Aggregate Bond ETF (SCHZ) is a remarkably complete bond fund. The SPDR Barclays Long Term Treasury ETF (TLO) is a long term treasury ETF. The PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF (ZROZ) is an extremely long term treasury ETF.

Notice that the 3 international equity ETFs have only been weighted at 5% while the broad market index has been weighted at 25%. I find heavy exposure to international equity to bring more risk than expected returns so I try to keep my international exposure low. I prefer no more than 20% in international equity. Plenty of domestic companies already have enormous international operations so the benefit of international diversification is not as strong as it would be if the markets were isolated from each other.

Risk Contribution

The risk contribution category demonstrates the amount of the portfolio's volatility that can be attributed to that position. When TLO and ZROZ post negative risk contribution it is because the negative correlation to most of the equity holdings results in the long term treasury ETFs reducing the total portfolio risk. In my opinion, this is the best argument for including them in the portfolio.

Correlation

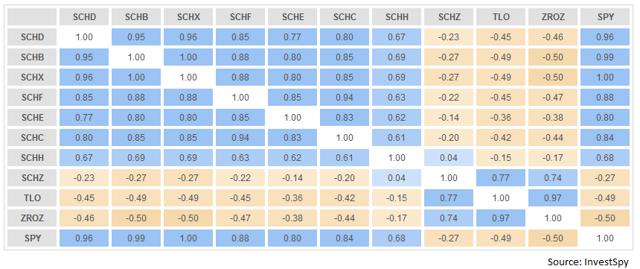

The chart below shows the correlation of each ETF with each other ETF in the portfolio and with the S&P 500. Blue boxes indicate positive correlations and tan box indicate negative correlations. Generally speaking lower levels of correlation are highly desirable and high levels of correlation substantially reduce the benefits from diversification.

One quick thing to take away from this is that mixing SCHB and SCHX does not add any material amount of diversification within the portfolio. Investors could simply pick whether they prefer a broad market ETF or a focus on larger capitalization companies. Historically SCHB has had returns that were just a tiny bit higher to offset having slightly more volatility. I'm long SCHB, but would not feel my portfolio was materially different if I was holding SCHX instead.

Best Partners

Looking at the correlation chart and going to the SCHB line we can see that each of the bond funds has a negative correlation with SCHB. That makes those bond funds a very good match for adding to a portfolio built around SCHB.

When it comes to establish the lowest correlation among other equity ETFs, SCHH (the domestic equity REIT index) is posting a lower correlation than the international equity allocations. If an investor wanted to build the simplest portfolio possible, they might simply use SCHB and add a bond fund. I prefer mixing more ETFs with an eye on lowering the risk further than can be accomplished with a simple two fund strategy, but combining SCHB with a bond ETF does wonders for providing diversification.

When I strip down to a portfolio of SCHB and ZROZ the sample period can reach back to November of 2009. A simple combination of SCHB and ZROZ has thoroughly beat the S&P 500 when it comes to risk adjusted returns.

The total portfolio return beats either of the individual holdings because of the impacts of regular rebalancing.

Conclusion

SCHB is very suitable ETF for reflecting the broad market of domestic equity (non-REIT) investments. The low expense ratio is very attractive and the simple combination of two ETFs may have thoroughly outperformed most investors when it comes to risk adjusted returns.

Seeing how well those ETFs performed together is certainly causing me to reconsider my own investing strategies. If I keep moving cash into the portfolios I should be able to rebalance by simply buying a couple shares of whichever ETF is down.