General Thoughts On Natural Gas Prices

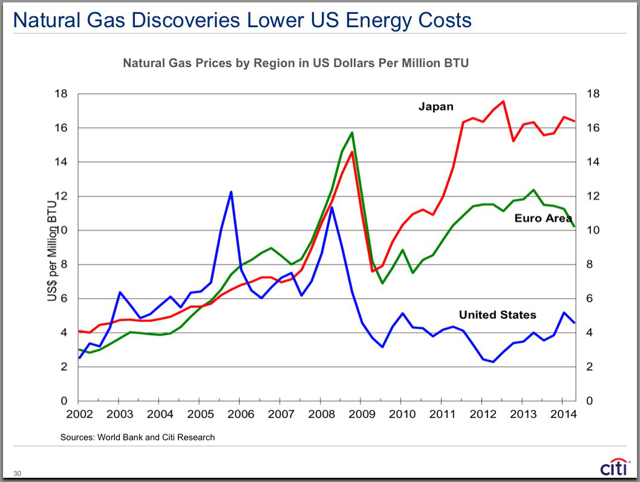

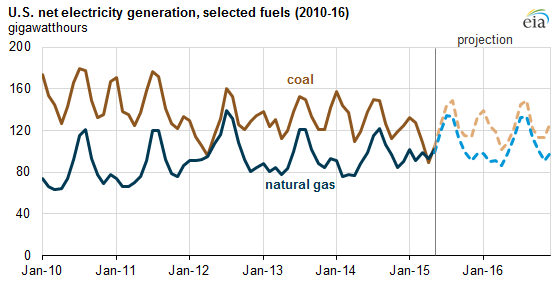

The boom in U.S. domestic natural gas production over the past decade has brought down Henry Hub spot prices.

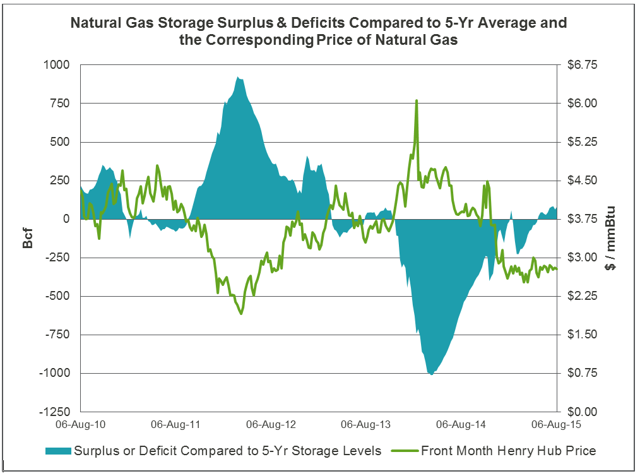

The current natural gas supply glut is expected to approach historic highs by the onset of winter creating prices that are low even by the standards of recent history. (It is important to note excess supply can clear quickly due to the high decline rate of unconventional gas fields.)

Source: Energysmart.enernoc.com

Source: Energysmart.enernoc.com

There are good reasons to believe that (after the short-term pain has passed) natural gas prices will trend up over the intermediate to long-term.

For one, U.S. natural gas prices remain much lower than the rest of the world.

This gap should begin to narrow as LNG export terminals in the U.S. become operational (though not entirely given ~ $4 / MMBtu in liquefaction, shipping and regasification cost). It is estimated by the end of 2019, 8.5 billion cubic feet per day will be exiting the U.S. via these LNG export terminals. This should push up price as producers drill in more costly areas to meet the additional demand.

A second issue with current natural gas prices is it simply isn't profitable long-term to extract natural gas from most production regions under $3 / MMBtu. While technological advances may continue to lower extraction costs, this is offset by the fact the cheapest / easiest-to-access resources are already being tapped.

Playing Low Natural Gas Prices

I believe the best way to play (eventually) rising natural gas prices is a short position in VelocityShares 3x Inverse Natural Gas ETN (DGAZ). The VelocityShares 3x Inverse Natural Gas ETN is a medium-term note from Credit Suisse AG, the return on which is linked to the performance of the S&P GSCI® Natural Gas Index Excess Return. The goal is to provide -3x the daily performance of the front-month futures contract on natural gas.

I recently wrote about the benefits of shorting leveraged funds like DGAZ (see my write-up on its sister fund, the VelocityShares 3x Inverse Crude Oil ETN (DWTI), here). In short, combining DGAZ's leverage with volatility in the underlying natural gas index produces long-term losses independent of the actual natural gas price movement. There are multiple scenarios to win. Natural gas prices move up… short DGAZ wins. Flat (or somewhat down) yet volatile natural gas prices… short DGAZ does just fine. The fundamental downside would come from a sustained, non-volatile drop in natural gas prices, which I believe is unlikely.

To illustrate this point, between February 2012 and April 2015, Henry Hub natural gas spot prices began and finished around $2.50 / MMBtu. Over that period, DGAZ returned -84%.

Where To Put The Short Proceeds

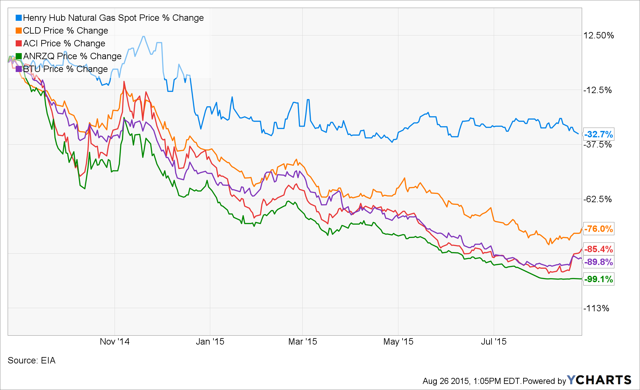

Thermal coal stocks have been crushed over the past year due to a number of long-term (environmental regulation) and short-term (low natural gas prices) headwinds.

I am not trying to dispel the long-term headwinds, but I do believe the price of more than a few coal stocks now factors an immediate and apocalyptic industry collapse rather than a steady long-term decline.

I have no interest in the coal companies who decided to massively over-leverage during the past decade. I do have interest in Cloud Peak Energy (CLD), whose management team has shown great discipline in the manner they've managed their costs and balance sheet. I do not plan to re-write the long thesis here regarding the merits of CLD's equity, as many have done that recently on Seeking Alpha. I recommend you read this write-up from J Mintzmyer and this one from Stephen Simpson. (I also recommend this article for a fantastic and succinct overview of the U.S. coal industry.)

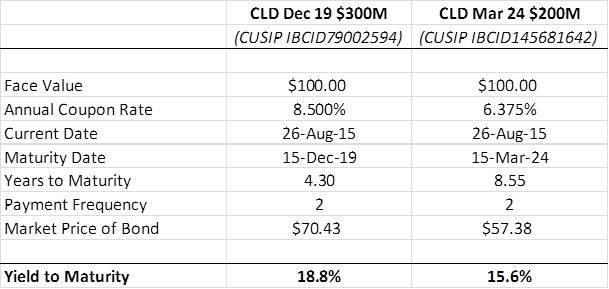

What I will note is, despite the strength of Cloud Peak's balance sheet and capability of producing $200M+ in free cash flow to firm in 2016, its bonds currently trade as follows:

I don't know what justified such a decline in the value of these bonds (moral divestment?), but I am happy to go long them against my short DGAZ position.

Risks To A Short Position In DGAZ

- Volatility is central to this trade's success (and potential failure). Greater volatility enhances the positive long-term effects of being short DGAZ (see constant leverage trap). It also means short-term swings can be huge. For perspective, the 52 week range on this security has been $2.50-$9.19. Covering this short position at the wrong time would be bad, whether an issue with finding stock to borrow - a substantial risk - or risk management controls kicking in because the exposure becomes too large relative to the overall portfolio. For most, a 1% position makes sense for a security which can move 10x against you before coming back down to earth.

- DGAZ is an ETN and carries credit risk related to its issuer, Credit Suisse AG.

- The largest fundamental risk would be a combination of natural gas prices continuing to trend lower over the long-term in a manner characterized by low volatility.

Conclusion

Natural gas is unsustainably cheap. VelocityShares 3x Inverse Natural Gas ETN is structural flawed as a long-term investment, thus a good short. Cloud Peak Energy bonds have over-corrected. Short DGAZ, go long CLD bonds.