The magic formula is an invention of Joel Greenblatt, which he explains in The Little Book That Beats the Market. The basis is ranking stocks according to earnings yield (EBIT/EV) and returns on capital. Greenblatt has a website that does this for us for free and provides a list of up to 50 (statistically) undervalued companies. The stock screen can be found here. This method of stock picking has been highly successful according to Greenblatt, who claims returns of 30% a year up to 2008.

I have already written about the (alphabetically) bottom 9 tickers (article 1 and article 2) of the recent screen and today look into the next 4 stocks to see whether they deserve further research.

TiVo (TIVO)

Industry - Cable TV systems

TiVo Inc. provides television software services and cloud-based software-as-a-service solutions that enable to view video content through various screens.

Stats

| Market cap | 865 |

|---|---|

| Net debt | -357 |

| EV | 508 |

| EV/EBIT | 8.3 |

Figures in millions USD, except ratios.

| EBIT | Net income | EPS | Sales | |

| 2012 | -0.3 | -5.3 | $ -0.04 | 304 |

| 2013 | 107.3 | 271.8 | $ 1.99 | 406 |

| 2014 | 61.0 | 30.8 | $ 0.28 | 451 |

Source: 2014 10-K. Figures in millions USD, except EPS.

Information of interest

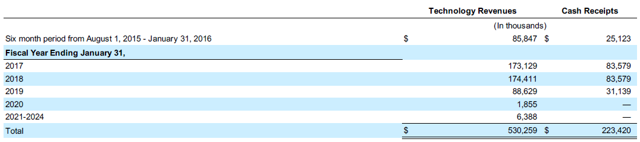

In H1 2015 46% of revenue came from licensed technology (patents). While, as you can see in the table below of minimum contractual payments, this revenue stream will dry up in 2020. Revenue has been 26.6% higher than the minimum for H1 2015. Without these revenues, TiVo has a hard time posting positive operating profit. Gross margin on technology revenue was 86% in H1 2015, or $93.7m.

Source: Q2 2015 10-Q

Also note how in the table above cash receipts differ from revenues. The company received a great part of its technology revenues in 2013 and this is parked on the balance sheet as deferred revenues. Generally there are two ways to deal with this 1) include deferred revenues as a liability 2) look at the firm from a cash flow perspective. In the first case, enterprise value increases by $408.4m, brining net debt to $51m, and EV/2014 EBIT to 15. The quality of earnings and net debt position are enough for me to conclude that TiVo is not the value stock it seems to be and should not be in the magic formula list in the first place.

NeuStar (NSR)

Industry - Telecommunications

Neustar provides a range of analytical and information services related to internet and telecommunications. The main activity since its inception is handling number phone number registration for people who change service providers but want to keep their phone number. Neustar also handles internet domain name registry for .biz, .us, .co, and .nyc domains while also providing other services like blocking DDoS attacks.

Stats

| Market cap | 1,492 |

| Net debt | 359 |

| EV | 1,852 |

| EV/EBIT | 7.1 |

| P/E | 9.9 |

Figures in millions USD, except ratios. Earnings in P/E are from 2014.

| EBIT | Net income | EPS | Sales | |

|---|---|---|---|---|

| 2012 | 276.7 | 156.1 | $ 2.34 | 831 |

| 2013 | 289.3 | 162.8 | $ 2.46 | 902 |

| 2014 | 261.3 | 163.7 | $ 2.75 | 964 |

Source: 2014 10-K. Figures in millions USD, except EPS.

Information of interest

Something strange is going on with NeuStar. While revenue has been growing for the past 3 years, operating income has declined. EPS has also shown y-o-y growth in 2015. A big driver of revenue increase is M&A with a total spend of $225m in 2013 and 2014. But the real catch is that the profitability of Neustar is heavily dependent on this service, which is a $450m annual revenue contract awarded by the FCC. They lost that lucrative contract which they held for 18 years, so the numbers we see here are not those of an actual value stock. On top of that, the company decided to stop publishing segment information in 2013. This makes the stock harder to asses, especially because it did not even report operating profit by segment. We can compare numbers of 2014 to 2010, when numbering services were 361/520 revenue. As it turns out, operating margin was 39.5% in 2010, versus 27% in 2014. From all I can see it looks like NeuStar is scrambling for diversifying its operations and is accepting low returns on capital in the process. I don't think this stock should be on the magic formula list and conclude my investigation here.

Outerwall (OUTR)

Industry - Specialty retail

Outerwall operates Redbox and Coinstar machines/kiosks.

Stats

Market cap | 1080 |

Net debt | 673 |

EV | 1753 |

EV/EBIT | 7.1 |

P/B | 44.7 |

Figures in millions USD, except ratios.

EBIT | Net income | EPS | Sales | |

|---|---|---|---|---|

2012 | 279.4 | 150.2 | $ 4.67 | 2,200 |

2013 | 261.0 | 174.8 | $ 6.16 | 2,307 |

2014 | 248.4 | 106.6 | $ 5.15 | 2,303 |

Source: 2014 10-K. Figures in millions USD, except EPS.

Information of interest

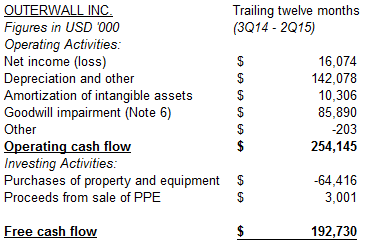

The business model of Outerwall is outdated and won´t last another 20 years. In this light it has been a smart move by Outerwall to cut back on capex this year (-24% YTD). For this investment I want to know the cash flow yield. I calculated the free cash flow, as can be displayed in the table below. This free cash flow excludes items that are costs to shareholders like share/based compensation and also ignores changes in working capital.

Source: author's own calculations.

The table above suggests a (trailing) cash flow yield of 17.8%. At the same level of profit it takes 5.6 years to earn back the market cap. I'm not impressed by this figure as there is a lot of net debt to cover, as well as negative working capital (which will decline as the company shrinks). This stock is obviously not priced for a drastic decline in cash flows. So if you think free cash flow of Outerwall is sustainable, it might be a stock for you. I think the Redbox business model is outdated and won't last another 20 years and further research is an unfruitful use of time.

PDL BioPharma (PDLI)

Industry - Biotechnology

PDL pioneered the humanization of monoclonal antibodies and, by doing so, enabled the discovery of a new generation of targeted treatments for cancer and immunologic diseases for which it receives significant royalty revenue. Their most important group of patent expired in 2014.

Stats

| Market cap | 890 |

| Net debt | 38 |

| EV | 928 |

| EV/EBIT | 1.7 |

| ttm P/E | 2.9 |

Figures in millions USD, except ratios.

| EBIT | Net income | EPS | Sales | |

|---|---|---|---|---|

| 2012 | 355.4 | 211.7 | $ 1.45 | 375 |

| 2013 | 426.5 | 264.5 | $ 1.66 | 430 |

| 2014 | 546.3 | 322.2 | $ 1.86 | 487 |

Source: 2014 10-K. Figures in millions USD, except EPS.

Information of interest

The earnings yield seems juicy, but it will grind to a halt in 2016. The patent that was responsible for $486.9m revenue in 2014 expired at the end of that year and the revenue stream it produces will dry up by the end of 2016. The management of PDL is not planning to cease operations after that date, however. They acquired a number of loans and royalty rights that generate income. That income (including interest income) is recorded in the operating income of PDL. In this respect PDL is transforming into a closed-end investment fund. It makes little sense for an investment fund to trade at a premium to the value of its assets and liabilities. I calculate net asset value at $615m, while equity is $527m. The difference comes largely from dividends payable, uncertain tax liabilities, and a $10m guarantee. The market value is $890m and the Queen et al cash flows should make up the difference between the market value and asset value.

The after-tax cash flow from Queen et al. patents was $74.0m in Q2 2015. Other income items are SG&A, other royalty revenue and interest. The company needs another 3.7 quarters of $74m cash flow to bring the net asset value to enterprise value. I don't think that cash flows will remain this high and this deal does not look attractive to me. Besides this shallow valuation, some knowledge of the investments by the company could make a difference in the valuation, but that requires expertise and a great amount of time and I would not recommend spending time on that.