Ventas (NYSE: NYSE:VTR) CEO Debra Cafaro spoke at a Citi conference back in early March of this year and more recently presented at a BofA Merrill Lynch conference.

One of the main themes Cafaro hammered home during her Citi talk was the Ventas approach to achieving risk adjusted returns through diversity of product type, geography and conservative management of the balance sheet.

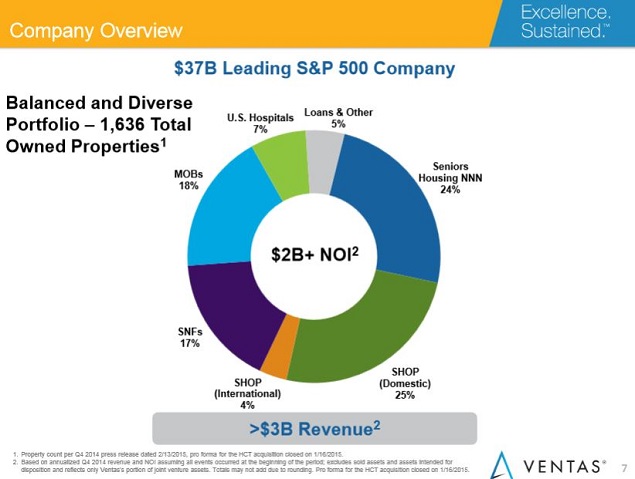

Source: Ventas - Citi presentation March 2015

At that time, the Ventas portfolio contained over 1,600 properties. During 1Q15 Ventas derived 7% of revenues from hospitals vs. 17% for skilled nursing facilities (SNFs).

Source: Ventas - Citi presentation March 2015

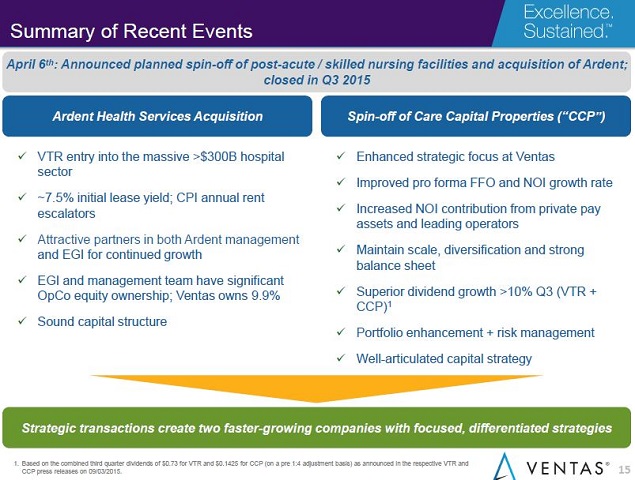

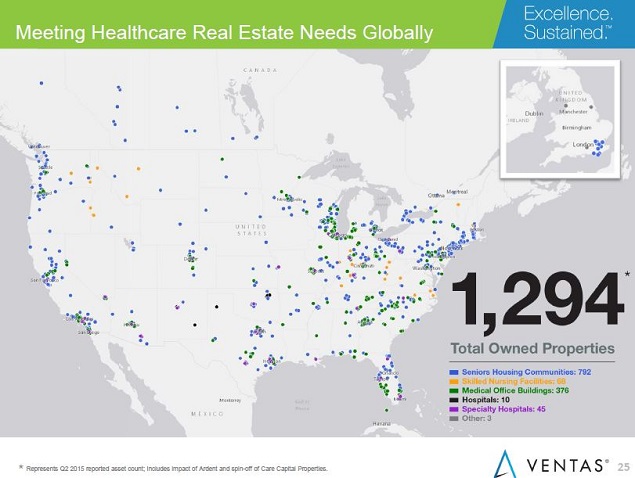

However, the Ventas portfolio and strategic focus has now changed with the completion of the Care Capital Properties (NYSE: CCP) skilled nursing REIT-spin and Ardent hospital acquisition.

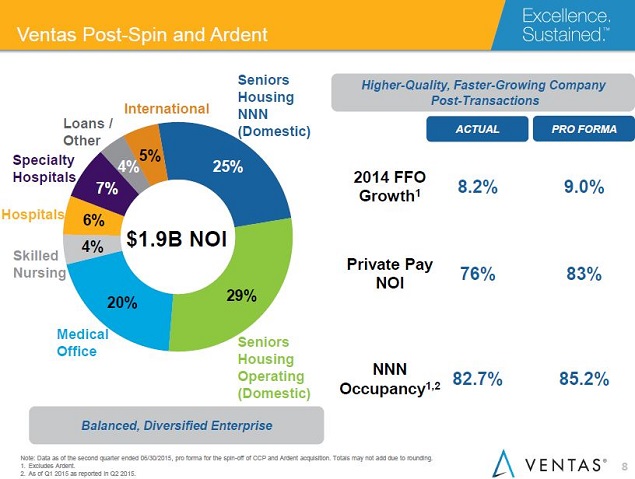

Source: Ventas presentation BAML Sept 2015 (including all slides below)

The current Ventas portfolio contains just under 1,300 properties.

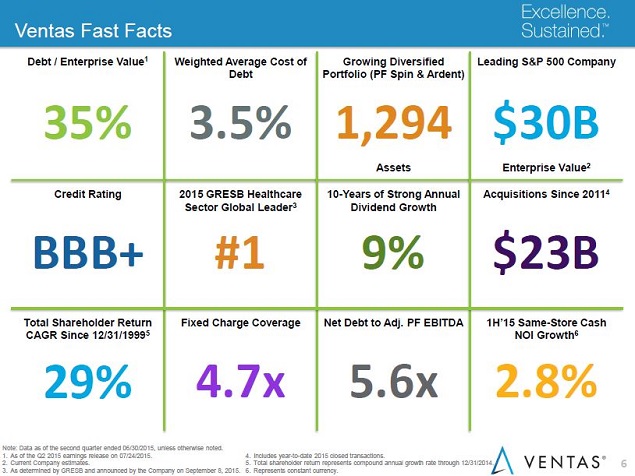

The Ventas "Three Pillar" approach hasn't changed: 1) Low Cost of Capital, 2) Invest Wisely, and 3) Manage Assets Productively. However the asset mix now reflects a new strategic focus on hospitals as an area for accretive growth moving forward.

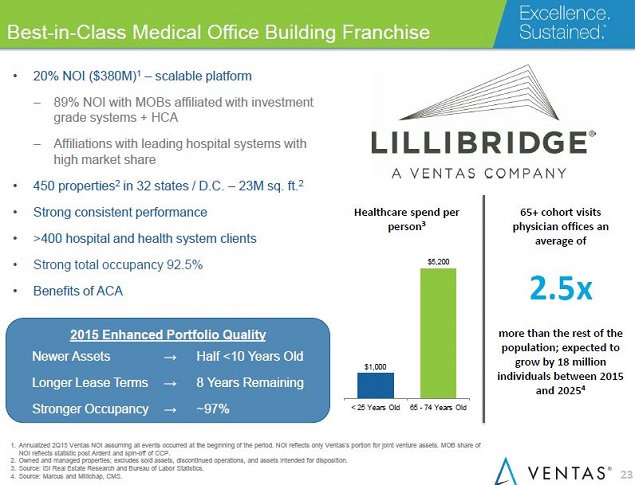

Notably, hospitals now account for 13% of revenues vs. 4% from the remaining SNFs. Revenue from MOBs also has risen slightly from 18% to 20%.

The largest segment of VTR revenues continues to come from senior housing, with 54% from the combined domestic SHOP and NNN portfolios, plus another 5% from Canada and UK assets.

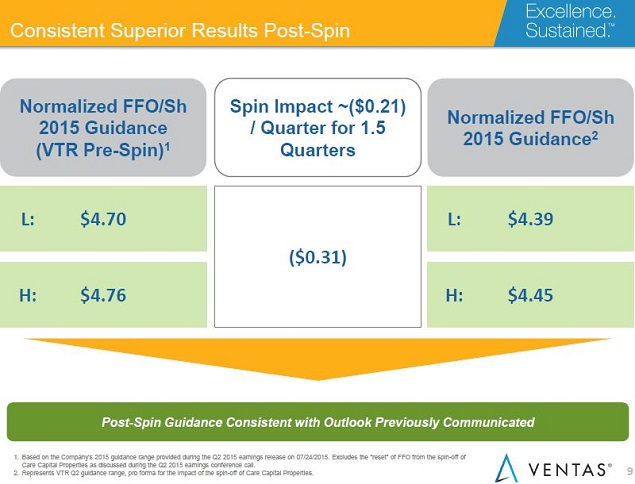

Ventas post-spin remains on track to achieve FY 2015 FFO of $4.42, at the mid-point of company guidance.

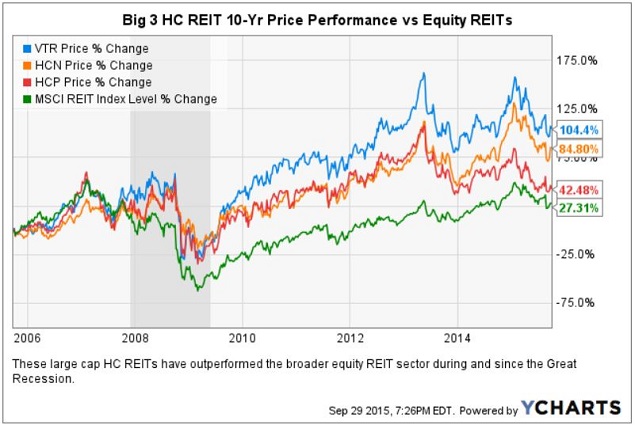

Ventas Has Historically Outperformed During All Cycles

The "Big 3" large-cap healthcare REITs refer to Ventas and its peers: Health Care REIT (NYSE: HCN), which is being rebranded as Welltower Inc., and HCP, Inc. (NYSE: HCP).

The health care REITs were sold off after the May 2013 Fed "taper tantrum." They recovered during 2014, peaked with the rest of the REIT sector in January, and then have underperformed the broader market 2015 YTD.

Ventas - Interest Rate And China Concerns Weigh YTD

During the past 52 weeks Ventas has traded in a range of $51.80 - $79.22 per share. The gap down in mid-August on the chart reflects the skilled nursing REIT-spin.

Back in July, BMO Capital analyst John P. Kim upgraded Ventas to outperform, breaking out the value of VTR and CCP separately. Kim noted that VTR historically has traded at 24% premium to consensus NAV per share. In the BMO report, the 2016 consensus NAV per share for the remaining Ventas assets was $56.01 per share. Kim also noted that the Ventas weighted-average cost of capital (WACC) was 5.5%, the lowest in company history.

Connecting those dots, Ventas shares are currently trading near or below NAV, which essentially gives no credit for on-going development, or an acquisition pipeline which will be accretive to earnings, and its top notch management team.

Ventas has a BBB+ credit rating. The VTR current quarterly distribution of $0.73 per share equates to a forward annual dividend yield of 5.2%, or 315 bps higher than the 10-year Treasury yield as of this writing.

Notably, Ventas has grown its dividend distribution at a CAGR of 9% over the past 10 years.

Ventas - BofA Merrill Lynch Conference Highlights

On September 16, Cafaro and her management team presented at the BAML Global Real Estate conference. The webcast is available on the Ventas IR website.

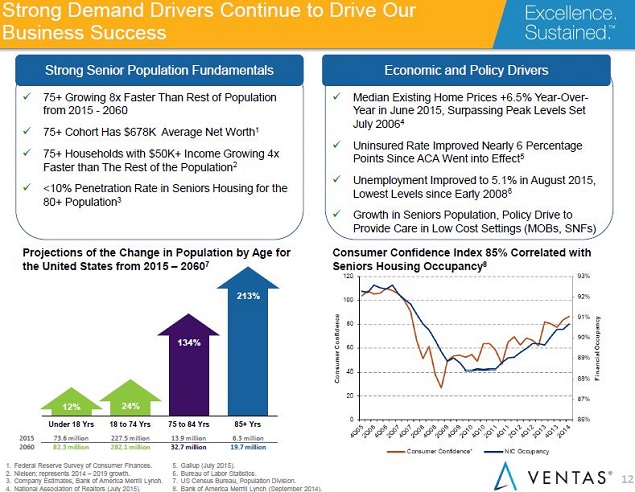

Spoiler Alert: America has an aging population. There are 10,000 Baby Boomers a day that become eligible for Medicare, and folks 65-plus spend 2.5x as much per year for healthcare.

HC REIT Sector Tailwinds

The Ventas presentation and Q&A session highlighted: favorable demographics, improving employment, the Affordable Care Act increasing the access to healthcare for 25 million Americans and the expansion of Medicaid as four sector tailwinds.

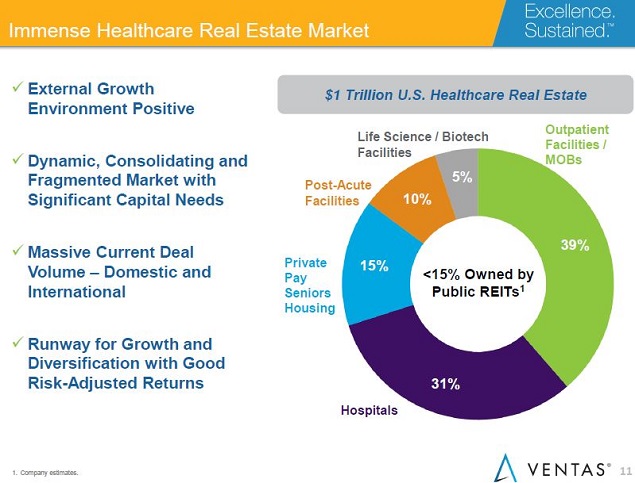

Huge Growth Opportunities

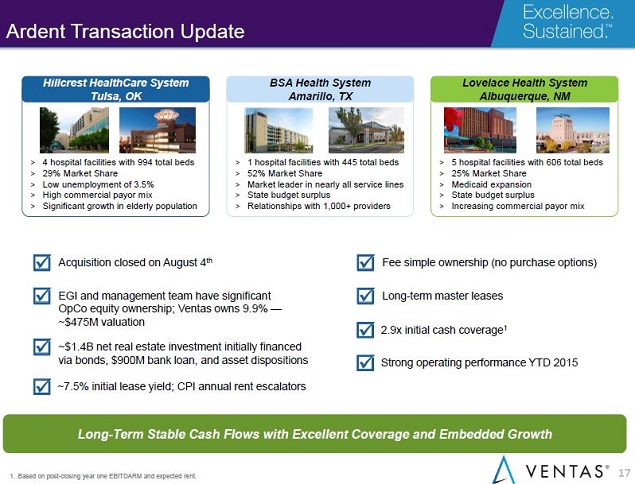

The Ardent hospital acquisition was structured as a PropCo/OpCo transaction. Ventas owns 9.9% of the OpCo and became the landlord for $1.4 billion of hospital real estate assets, with an initial cash yield of 7.5%. The leases include annual CPI rent adjustments.

During the Q&A, Cafaro was asked to describe what makes "a good market" to own hospitals. She explained that it can be a bit counter-intuitive. Chicago was given as an example of a poor market due to fragmentation of ownership and the relatively poor reimbursements available in Illinois.

On the other hand, she pointed out Amarillo, TX, as an example of a terrific market because 1) Ardent has a market share of over 50 percent, 2) Ardent has an exclusive relationship with Blue Cross Blue Shield in the Amarillo market, and therefore, 3) no employer will buy a plan that doesn't include Ardent.

Ardent has a market share of 25% or more in all three Ventas-owned health system markets.

Senior Housing

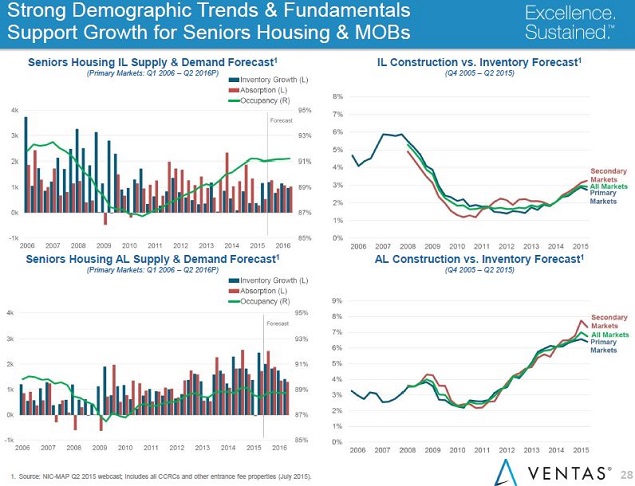

Ventas management acknowledged that the company "wasn't immune" to the increase in supply in certain markets.

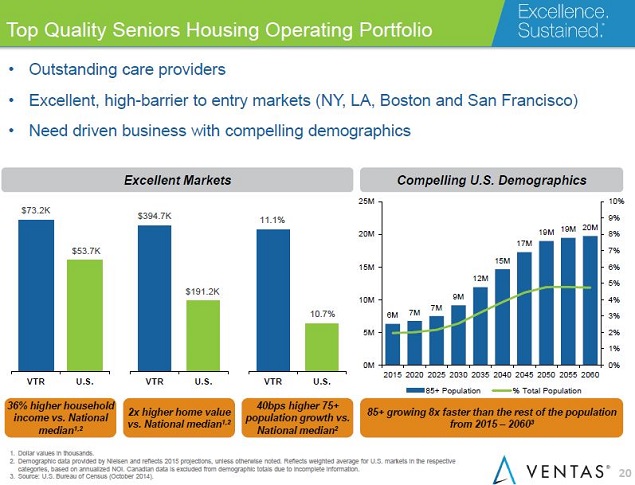

However, they were quick to point out that 25% of the SHOP portfolio was located in high-barrier to entry markets in New York.

Management also pointed out that the demand side of the seniors housing equation was not being fully considered by many industry observers.

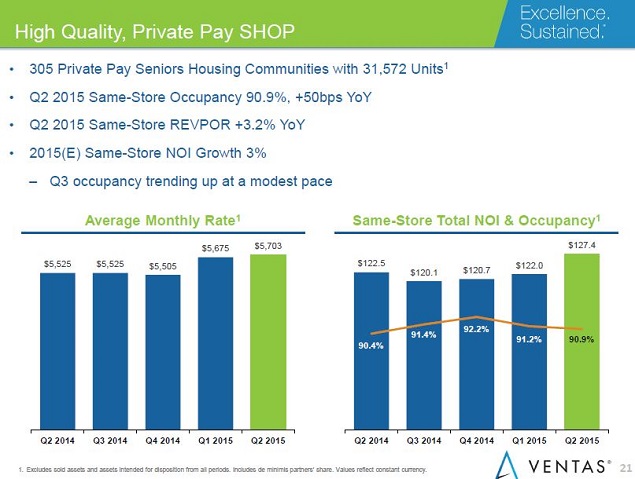

Management noted that with a current occupancy of 90% to 91% there was still a large upside in the Ventas portfolio. Additionally, operators were able to get 3% to 4% rate increases during 1H15.

Moving forward, best-in-class operators are putting revenue management systems in place. As the quality of the data improves, this will allow operators to raise rates "…intelligently, without being ruthless," (a very apt turn of the phrase).

Development

Ventas is able to get better going-in yields from selective development than by acquisitions.

Ventas also has access to third-party capital for development JVs with pension funds and other institutions. This helps Ventas to manage the risk of new development while providing a higher upside through "promotes."

Foreign investors also appear to have an increasing appetite for U.S. healthcare assets of all types.

Medical Office

Ventas has been very active since the financial crises in acquiring both seniors housing and MOBs. Subsequently, multiples have increased while cap rates have decreased.

Institutions have a strong interest in this asset class, so there's a lot of liquidity. While that has created a lot of value in the portfolio, it also made acquisitions more challenging.

International Exposure

In the UK and continental Europe there is strong governmental support for healthcare. This results in government pay seniors housing assets being viewed as a "bond-like" income stream. Therefore, public housing in the UK sells at lower cap rates than private pay communities.

Ventas is interested in acquiring more assets outside of the U.S., but only if they meet the following criteria: it must be a good deal, with a strong operating partner, in a good jurisdiction, and in markets that have the potential for future growth.

Ventas is pleased with its Canadian assets and observed that the market was under-penetrated compared to the growth in the senior population. There was discussion regarding the economic slowdown in Canada due to lower energy commodity prices.

That said, there is strong investor demand for existing assets, most notably, a recent large portfolio having been sold at a sub-5 cap rate. More typical deals would be closer to a 6 cap rate.

Ventas At A Glance

Investor Takeaway

Ventas is an S&P 500 company. It has a fortress balance sheet, with a low cost of debt and low overall WACC. This well managed REIT will certainly be able to grow accretively in the gently rising rate environment that most pundits are predicting.

Ventas shares are currently selling at a ~25% discount to historical pricing based on both NAV and FFO multiples.

The company has the ability to buy shares through its ATM program. Given Ventas' low payout ratio of ~66%, management also has the flexibility to raise its dividend distribution, fund growth from cash flow or pay down debt to further reduce balance sheet leverage.

Meanwhile, long-term investors are being paid a 5.2% yield while they wait for Mr. Market to look at this HC REIT stalwart in a more constructive and balanced manner.