What is going on in the Emerging Markets is the biggest real story out there right now, as the volatility in the US markets, although nerve-wrecking to investors, hasn't really affected the US stocks, yet. The US markets are still at near record levels.

The apparent reason behind the EM crash of this year is the Chinese economic slowdown. Although the Chinese economy is still growing very fast (optimists give it 7% while pessimists give it 5%, and the truth may be 6%), compared to any developed economy, and of course compared to almost all developing countries, it is no longer the huge commodity absorbent it used to be. China's appetite for commodities didn't suddenly crash this year. The decline just culminated this year. This year's crash started in earnest in 2011. Commodities' prices have been falling, one by one, ever since 2011. Most of commodities' prices were actually too high compared to their cost of production up until 2011 and many of them stayed expensive until very recently, and some, I believe, are still quite expensive.

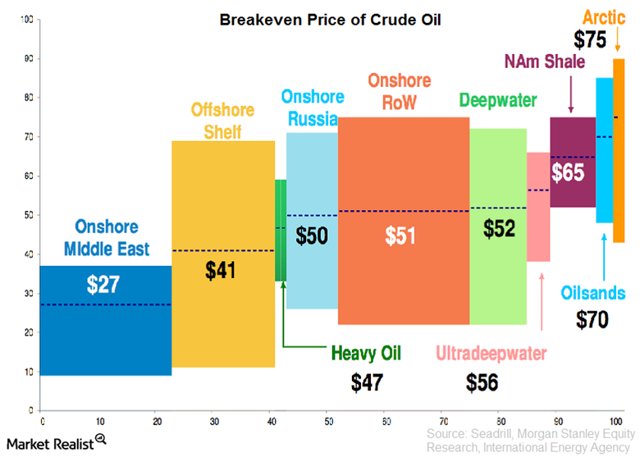

As the chart below (from Morgan Stanley) shows, Middle Eastern oil costs $27, while in reality many Middle Eastern counties can 'profitably' extract and export oil for years even with a price of $15, though I am seriously doubtful their non-democratic regimes (especially Saudi Arabia) can survive with that price long enough to see better days. The $27 mark is the total cost - including exploring and well development costs - which are not operational and can easily be ignored in stressful times. The same can of course be applied for all the other types of oil producers, who can easily ignore exploration costs, as they have long occurred and are unlikely to be needed any time soon given the current excess production.

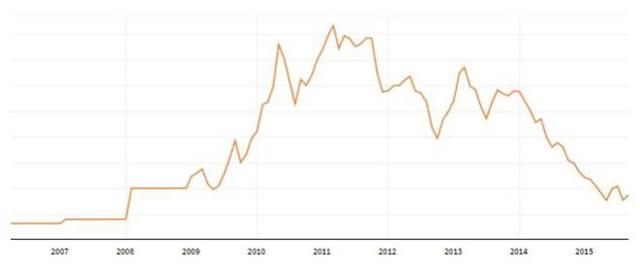

Oil did not start its decline in 2011. It just suddenly crashed in the autumn of 2014. Gold started its descent in 2011 but it has not really crashed yet. Gold is more than double its price from 10 years ago, and it is still about 10% more expensive than its 2007 pre-crisis peak.

Another example can be iron ore, where excess capacity, created mainly to serve China, has been accumulated because of the huge profitability in the good times until 2011. According to Rio Tinto (one of the world's largest iron ore producers), its break-even price is $39 per tonne. This suggests that operational costs are much lower.

As the chart below (source) shows, iron ore prices are still high compared to 10 years ago, or even 2007, just before the financial crisis.

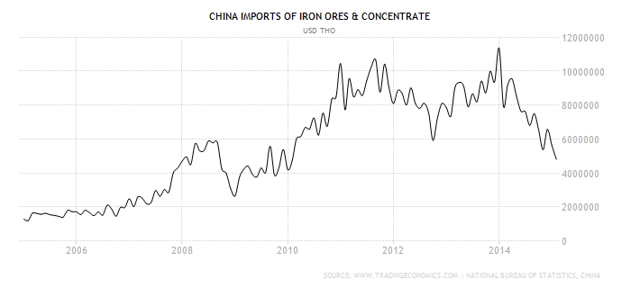

And it is obvious why this commodities' crash has been taking place since 2011, when commodities as a whole peaked. China no longer needed more commodities, though it did not cut its consumption at the beginning. The Chinese economy simply stopped adding to its consumption, toward the second half of 2011.

Chinese leaders were not exactly blind to the fact that their heavy industries could no longer grow and they could no longer achieve their goal of economic growth through investments and related exports. Chinese leaders did not exactly initiate anything. They just noticed what was already taking place. There was no longer enough demand out there for their mega production machines which had been sucking in so much of the world's commodities in an ever growing appetite for decades.

This event also coincided with the regular once-in-a-decade change in leadership. And the new president stated the obvious as government policy, that China would swap its focus on construction and export to consumption and services. It wasn't exactly a choice, but rather a smart and necessary move to 'officially' (i.e. by announcing it) dump what had reached its peak, and focus on what was just starting to show potential.

This move could not be an easy one of course, but when you are not preoccupied about elections and party politics, it is a little bit easier.

So, what actually happened this year that created all this panic about the Emerging Markets? Chinese need for importing commodities has not grown ever since 2011, but it started to fall since the beginning of last year, as it can be seen in the previous chart. While at the same time new and huge investments in the exploration and processing of commodities (oil, metals etc, mostly with the purpose of serving China's apparent insatiable appetite) which had commenced just before the Chinese slowdown, started to come in to production. And now there is a huge commodities glut out there, which has obviously caused all this panic. This excess capacity will take years to clear and the only realistic way of getting rid of the excess capacity is to see the seriously indebted producers go bankrupt. This hasn't happened in a large scale yet, but Western governments are not used to subsidizing their failing businesses, so it is very likely that this process of free market clean-up will take place sooner rather than later.

Like any bear market, this commodities bear market has apparently reached its panic stage. This panic stage may last for a while, but it can definitely be called a panic now. EM stock markets look terrible. EM currencies look even worse. While EM countries do not have the foreign debt pile they had in the EM crisis of the late 90s, and their currencies can fluctuate against the USD more freely, and also their currency reserves are a serious shock absorber now, some of their currencies, bonds, and stocks have been hammered almost like they were in 1997. And this is why I am calling this a panic, because the market has taken a too dim view of what is going on and it has gone too far. Of course the potential of a Fed rate hike has also dampened sentiment, but nobody really knows whether there will be any real consequence of a Fed rate hike to EM markets or economies, in case it does take place, which looks unlikely in the coming months. Emerging Market economies are not all about commodities, nor is China all about construction and exports. They have their own consumers too, and their economies still have the potential of growing more than developed economies. Of course some Emerging, or Frontier, Markets like Egypt, Iraq, Pakistan, Venezuela and so on are inherently risky due to their potentially deadly political and social instabilities, but there are many EM countries which are very likely to remain stable, and stability can bring growth. Of course most of the EM that have been recently affected are the stable ones, because the non-stable ones do not have liquid enough markets to be seriously taken into consideration in the world currency, bond, or stock, markets.

What I recommend - if you can stomach some more potentially wide swings - do your research and buy some EM stocks, especially H shares in Hong Kong, which are among the safest, considering that China is a very stable country and its economy is still going to grow more than the US and the power of its consumers is going to have an extraordinary growth rate over the next years. Chinese H shares in Hong Kong are trading at an average 30% discount to their A share equivalents in Shanghai.

It is very interesting that up until autumn 2011 almost everybody was talking about the potential of the EM. Analysts had even come up with a new name for what was supposed to be the new growth engine of the world, BRICS (Brazil, Russia, India, China, South Africa). Now it almost seems blasphemous to mention such an absurd idea. I do agree that it was stupid back then, when they had richer valuations than the US, while many of them (all except China and India) mostly depended on commodities for their exceptional growth. But it is not stupid now, because they are so cheap, while the US is so expensive, compared to 2011, and compared to almost anything one can find in the Emerging Markets.