The investment thesis about 150 points and a name ago was that the stock of Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) would soar based on a grownup running the show. The prediction was that the stock had significant ability to not only grow earnings, but obtain higher multiples from the market with better financial stewardship.

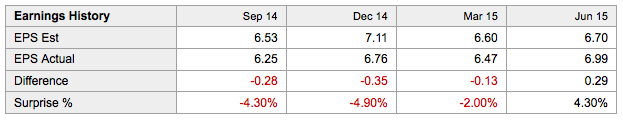

As Google, the company routinely missed analyst estimates while growing substantially. With CFO Ruth Porat in charge, the stock quickly soared following the previous recommendation as Q2 results actually exceeded analyst estimates. Forward ahead to a name change to Alphabet and a stock rally to over $740 in after hours and the question is now whether the market is overreacting to the theory of a grownup in charge going forward.

Q3 Signals

The quarterly release provided several signals that a new day of financial responsibility has started at Alphabet.

The first signal that the situation is improved for the better is that Alphabet actually exceeded analyst EPS estimates again. The company reported a Q3 EPS of $7.35, compared to the $7.21 analyst estimate. The $0.14 surprise didn't match the $0.29 beat for the prior quarter, but the number is still solid and preferable to the previous three quarters where the company under the Google name missed estimates by an average of $0.25.

Source: Yahoo! Finance

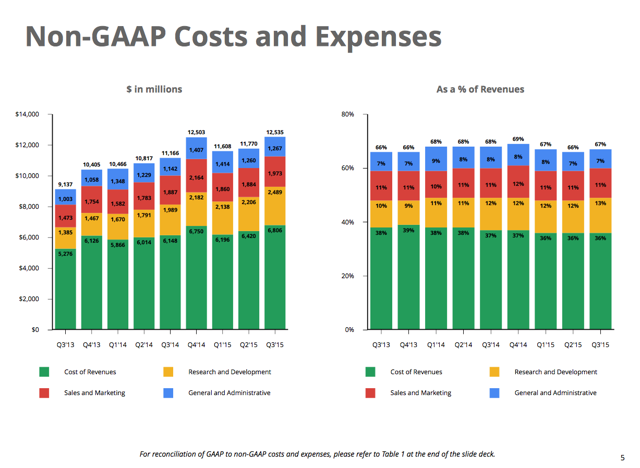

The second signal were the slightly improved margins despite major currency headwinds. The company estimated it took a $1.3 billion currency hit to revenues despite hedging gains of $286 million. Regardless, the margins improved over last year showing financial discipline.

The third signal is the decision to implement a stock repurchase plan. Alphabet is authorized to spend roughly $5.1 billion on stock buybacks over an unspecified period. The company is approaching a valuation of $500 billion and has $72.8 billion in cash to end Q3.

In reality, the amount is insignificant compared to the size of the company now and the ability to generate $3.6 billion in free cash flow for Q3 alone. Of course, Apple (AAPL) started small with its capital return plan and eventually expanded to significant amounts. The fact the new CFO has convinced the leaders to relinquish some cash is a positive signal.

Other Bets

While the Q3 results were chock full of signals that Alphabet has more financial responsibility, some troubling signs continue to linger.

The company ended Q3 with a head count of 59,976, up from 51,564 to end the prior-year period. The original thesis was bolstered by the fact that hiring had slowed down with two consecutive sequential declines from the massive 3,000-employee addition during last Q3. With only 1,819 employees added during Q1 this year, the financial discipline signs were starting to emerge prior to the hiring of the new CFO.

The company added 1,729 and 2,828 employees in the last two quarters, respectively, all but squashing the concept that financial discipline was truly emerging. Sure, the Q3 employee additions are typically the highest each year, but the quarter was supposed to have the stamp of the financial discipline from the new CFO.

The margins took a hit from the prior quarter due to the increased headcount. As mentioned above, the YoY margins were improved, but the QoQ numbers took a hit. For Q3, total expenses increased to 67% of revenues for an operating margin of 33%. The prior quarter that brought so much promise and jumped to an impressive 34%.

Source: Alphabet Q315 presentation

Another lingering concern is that share counts continue to surge. The diluted share count hit 694.3 million at the end of Q3, up 6.1 million shares from last year. To place the number in perspective, the new $5.1 billion share buyback will only purchase 6.9 million shares at the current stock price of $742, as of after hours Thursday. In essence, the pace of share issuance will fully dilute this meager buyback attempt.

In general, though, any time a company calls a new segment "Other Bets" one has to wonder about the management in charge. Investors don't want a company taking their capital and making bets. Something like "Futuristic Investments" might provide a better ring for investors than an all right admission that the company is gambling with shareholder cash.

Takeaway

While the initial indications of financial discipline were welcomed by the market, once digging into the Q3 numbers, the discipline isn't so apparent. A lot of the positive trends in Q2 took place prior to the arrival of CFO Ruth Porat and ironically didn't continue into Q3.

If anything, the split of the business into the Google and Other Bets segments appears a covert opportunity to increase spending. The ability to hit quarterly financial targets shows possibly better internal controls on hitting spending targets, but all indications are that discipline doesn't exist. The Google CEO all but said in the earnings call that capital expenditures would increase for the Other Bets segment next year.

After the big rally, Alphabet now trades at roughly 22x increased 2016 EPS estimates of $34. The stock is fully valued at this level, but the chances exist for a rally to $800 as investors discount the Other Bets spending with the focus on the highly profitable core business. Ultimately, though, investors will eventually come back around to the reality that heavy spending isn't good whether in a different business segment or not.

The recommendation is to hold onto Alphabet as the stock runs into year-end.