During the last year, the USD had a massive rally. The USD Index hit a multi-year high in March 2015 of 98.66, up 23.6% from the 79.81 level in June 2014.

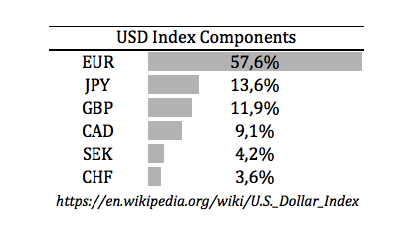

Why did the USD have this strong rally? To answer this question, it is good to look at the USD Index breakdown. The Euro has a weighting of 57.6%, and is therefore able to move the USD Index very easily.

One of the reasons why the USD rallied is the fact that the Fed started tapering. It stopped doing POMOs (Public Open Market Operations). During the taper phase, traders and investors expected the ECB to do QE. This would put double pressure on the EUR/USD. Fed tapering lowers the money growth rate of USD in the markets, and the ECB's QE would push the EUR even lower. The BoJ is doing stimulus too. The main target: devalue the JPY to stimulate exports.

QE from both BoJ and ECB means that the two biggest components of the USD Index are too high according to BoJ and ECB. The fact that the USD soared was therefore not really a surprise.

Of course, it is easy to predict things after they happened. So that is not the reason I write this article. I want you to understand which asset classes are affected by the USD, so you can avoid "stupid" mistakes and make trades to profit from central planning and major macro changes.

Rising USD

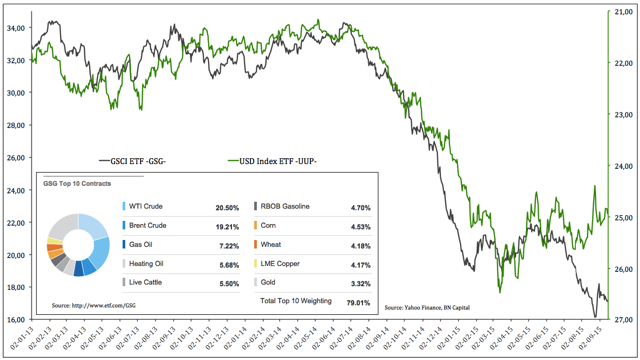

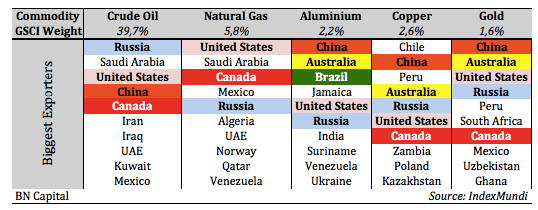

When the US Dollar rises, commodities, which are priced in USD, will get relatively more expensive. Therefore, demand will decline, which will put downward pressure on commodities. The chart below shows the correlation between USD and commodities. I used the iShares S&P GSCI Commodity-Indexed Trust ETF (GSG) to display the Goldman Sachs Commodity Index (GSCI) and the PowerShares DB USD Bull ETF (UUP) for the USD Index.

Commodities have a high correlation with the USD as shown above. With this info in mind, it makes sense that commodity-related countries and companies have a high correlation too. A country which highly depends on commodity exports will suffer when commodity prices decrease.

Most of the commodity-dependent countries are emerging markets. The emerging market is therefore a good tool to trade an USD impact. Not only do many emerging markets export commodities, but they also have a part of their debt in USD because it is cheaper to borrow. If the USD gets more expensive, their debt will weigh heavier and put pressure on their balance sheets.

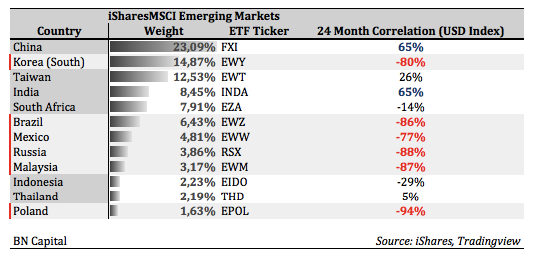

If you want to trade emerging markets, it is very important to know where to invest. Not all emerging markets are the same. If you look at the correlation vs. the USD, you will see huge differences.

Brazil, Russia, Malaysia and Poland have by far the highest (negative) correlation vs. the USD. It would not make sense to short an ETF like EWT when you are bullish USD.

In fact, it is all about leverage and volatility. Let's say you expect the USD to rally. Therefore, you want to short emerging markets. There are a few options you can choose from (and many more):

- Trade the iShares MSCI Emerging Markets ETF (EEM)

By shorting EEM, you short an emerging markets ETF. By doing so, you are shorting all emerging markets, in particular China, because the weighting of 23% is by far the heaviest. Why would you want to short? You have less volatility because the ETF contains many countries, and therefore a huge amount of companies. On the other side, you are shorting countries that have a low correlation vs. the USD.

- Trade the iShares MSCI Brazil Capped ETF (EWZ)/the Market Vectors Russia ETF (RSX)/the iShares MSCI Malaysia ETF (EWM)

As mentioned in option 1, by shorting, you short countries that have almost no correlation with the USD. You solve this problem by shorting a country like Brazil or Russia. The volatility is higher, but you get way more momentum in case of bigger changes to the USD.

- Trade single stocks

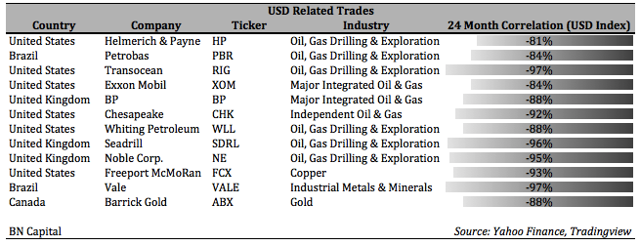

If you have a strong feeling about a certain USD move, i.e. a rally, you can choose to short a single stock. This can be a component of one of the most affected ETFs like EWZ/RSX/EWM or stocks from developed countries that are affected by the USD changes. The table below shows a few options:

As you can see, most of the companies in my list are oil and gas drilling related. Most of them offer drilling services or provide drilling equipment. These companies are more dependent on a high oil price than the actual drillers.

Since drillers can cut production easily when oil prices decline, the actual providers of the services and drilling products however lose a tremendous amount of business.

With this in mind, you can short oil drillers in a USD rally or choose to short a Brazilian company for example. Itau Unibanco Holding S.A. (ITUB) has a weighting of almost 10% of EWZ and a 24-month correlation of 90% (Sources: iShares, TradingView).

ITUB data by YCharts

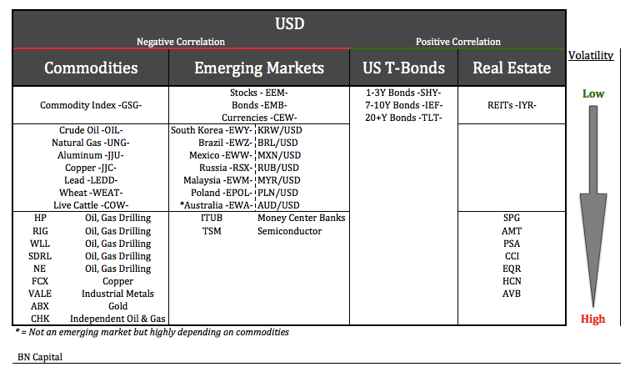

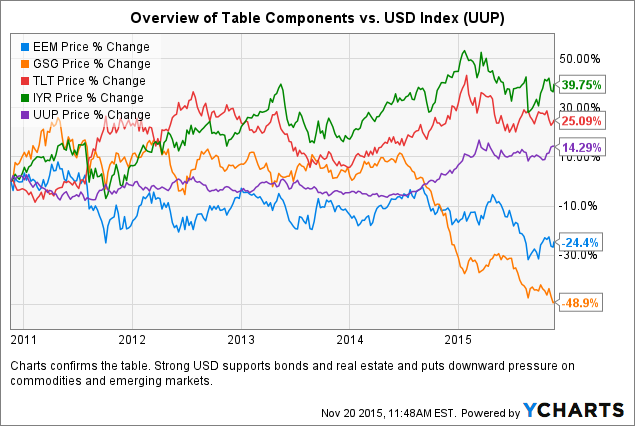

To summarize everything, I made an easy overview:

On top, you see USD. That's what it is all about. When the USD rallies, commodities and emerging markets are likely to dip since the correlation is negative. US Bonds and real estate however will profit when the USD goes up. Hence the positive correlation.

The table above gives you an overview of possible trades. The higher the position in the table, the lower the volatility. For example, shorting commodities can be done by shorting GSG. If you do so, you are shorting an entire basket of commodities, and have therefore lower volatility.

The next step is trading a single commodity. By doing so, you increase not only the potential returns, but also the volatility. If you want to maximize returns, trading a single stock gives the highest potential returns.

The chart below confirms the table above:

EEM data by YCharts

This article gave you an overview of the different asset classes that can be traded in case of an expected USD change. Both the long- and short-side deliver interesting choices that can be trades as outright long/short trades as well as spread trades.

Of course, there are way more options than I discussed in this article, but these are the basics of understanding price changes and researching profitable trades.