Introduction

Debt collectors have caught my attention due to their high revenue growth and low valuation. In this article I will compare the two biggest names in the industry: Encore Capital Group Inc. (Nasdaq:NASDAQ:ECPG) and Portfolio Recovery Associates Inc. (Nasdaq:NASDAQ:PRAA). The stocks have been down 25% and 36% from their 52 week highs, respectively. I will start with ECGP and finish with PRAA. The individual company analysis is followed by a comparison and general investing conclusion.

Digression: A famous debt collector that has been out of business for a while.

Encore capital group

ECPG came under my radar due to a rare combination of low valuation and constant revenue and book value per share growth in the last 10 years. The current stock price is $33.43 and it is just 10% above its 52 week low of $30.50. I will further analyze ECPG and see if it has long term, growth at reasonable price investing potential.

Business overview

ECPG is a provider of debt management and recovery solutions for consumers and property owners. The essence of the business is that the company purchases portfolios of consumer receivables from major banks, credit unions, and utility providers, and partners with individuals as they repay their obligations and work toward financial recovery. In simple words ECPG is a debt buyer and collector. ECPG is not only US oriented but has also operations in the UK, Ireland, Spain, Colombia and Peru. In September ECPG announced the acquisition of 50.25% of Baycorp shares. Baycorp is one of Australasia's leading debt resolution specialists. This is an interesting acquisition as Baycorp's previous owners will still remain shareholders and directors of the company. A joint venture approach enables ECPG to keep the necessary local knowledge in house and use the capital and scale synergies to make more profit.

Aggressive acquisition strategy

ECPG has an aggressive acquisition strategy. In February 2014 ECPG's UK subsidiary acquired Marlin Financial Group Limited which is a leading acquirer of non-performing consumer debt in the United Kingdom. In April 2014 ECPG acquired a majority ownership interest in Grove Holdings through its UK subsidiary. Grove Holdings is a leading specialty investment firm focused on consumer non-performing loans, including insolvencies in the United Kingdom and bank and non-bank receivables in Spain. The acquisition is still immaterial to ECPG's total consolidated operating results but shows how the company is also pursuing a small step growth strategy. This is important because it shows that the aggressive acquisitions are not just an ego booster for management but part of a sophisticated growth strategy. In June 2015, Cabot, ECPG's UK subsidiary acquired another UK based debt acquirer and collector for approximately $274 million.

The aggressive acquisition strategy brought to high levels of goodwill and debt but more about that in the fundamental analysis part later.

Another important thing related to acquisitions is that they are accretive much more to revenue than to earnings. Revenue has been growing at 24.5% per year in the last 5 years but earnings have been growing at only 6.7% per year. This shows how ECPG is paying a high price through increased yearly interest payments for the acquisitions. A slight increase in interest rates would quickly make the acquisitions unprofitable and thus ECPG is exposed to high interest rate risk.

Issue with the Consumer Finance Protection Bureau

On September 9, 2015, the Company entered into a consent order with the Consumer Finance Protection Bureau (CFPB) in which it settled allegations arising from its practices between 2011 and 2015 and incurred a one-time, after-tax charge of approximately $43 million in the third quarter of 2015.

Complaints

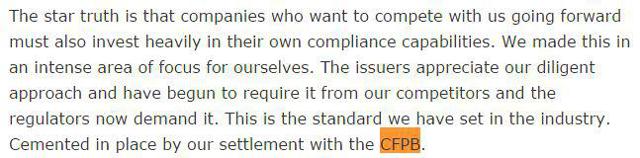

A deeper investigation brought me to findings that show that there might be more trouble for ECPG. The management states that competitors will be the ones that have to invest heavily in compliance capabilities (Figure 1).

Figure 1 Management's quote on CFPB

Source: Seekingalpha

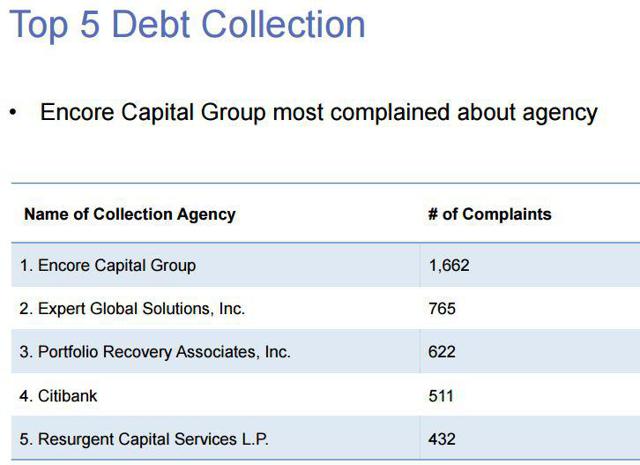

But in the below figure you can see that ECPG is the leader in customer complaints made to the CFPB.

Figure 2 Customer complaints to CFPB

Source: Magnifymoney

This means that ECPG is the one that has to do most of the heavy investing in compliance capabilities and not competitors. For example PRAA is twice as big as ECPG but has just 37% of ECPG's number of complaints.

In its last report the company also does not mention that it will have to pay additional $10 million in penalties and halt collection on more than $125 million in debt. As we cannot know how much of the $125 million will be collected we cannot make a fair cost estimation of the CFPB scandal but it is going to cost, especially as the collecting methods in place will have to be amended. This could mean higher collection costs and lower collection percentages in the future.

Fundamental analysis

At the moment of writing ECPG's share price is $33.53. The last 10Q for Q3 2015 shows that cash per share is $6.88 and investments in receivable portfolios are $91.28 per share. The acquisitions in 2014 and 2015 added $435 million of goodwill or $17.09 per share. In total goodwill is $940 million or $36.3 per share. Total liabilities are $3,443 millions or in total $135.28 per share. I am mentioning assets and liabilities in per share amounts to show that even a tiny influence on the business could have a significant effect on EPS. Total equity is $625 million or $24.55 per share giving a price to book ratio of 1.36. If we remove goodwill from the equity equation we get a tangible book value of -$ 11.75 per share.

As the company is investing outside the US the current accumulated other comprehensive income account is -$29 million or -$1.16 per share. This is not that material but any weakness in the dollar could quickly add a few bucks to ECPG's value. It is better that ECPG invests abroad in times when the dollar is strong than vice versa. A stronger dollar might negatively influence OCI but in the long term it should level out.

The most meaningful account on the Q3 income statement is the General and administrative expenses account where the $43 million settlement charge for consumer refund was charged. Without that one-time charge EPS for Q3 2015 would be slightly up in relation to Q3 2014 and $1.22 per share. If everything stays the same and no other charges are announced ECPG should have normal yearly EPS of around $4 in 2016 giving a forward PE of 8.39.

The cash flow shows some other issues that might worry investors. The total stock based compensation expense in the first 9 months of 2015 was $17.2 million or $0.67 per share or 2% of market capitalization. I would say that such an amount is a little bit high for just three quarters.

ECPG does not pay dividends but has a $50 million repurchase program. In relation to the current market capitalization that is an indirect return of 5.7% and you do not have to pay taxes on it.

Apart from the static fundamental indicators the dynamic ones have been excellent in the past. As already mentioned ECPG has managed to constantly grow revenue and book value for the last 10 years. Revenue growth has been 24.5% per year in the last 5 years but due to the acquisitions being financed by debt earnings have grown at only 6.7% per year.

The debt to equity ratio is 5.5 and the debt to tangible equity ratio is not calculable due to the negative net tangible value. Interest expense was $47 million in the last quarter and as total debt is $3,116 million we can deduct an interest rate of around 6%. This is in line with the effective interest rate the company is disclosing. Beware of the difference between the stated (3%) and the disclosed interest rate (6%). The stated interest rate is the interest rate by which the company tries to issues notes, the disclosed interest rate is the effective interest rate by which the company really issues notes. For me this difference is another warning telling me that the company cannot borrow at market rates and has to chip in a discount. On the other hand with such a high debt to equity ratio this is logical.

Convertible notes

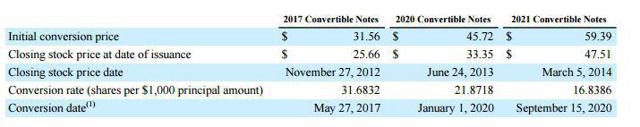

As I was reading the 10Q form I was surprised by the convertible notes mentioned in the notes of the financial statements as in the income statement calculation there was no difference between the net and diluted earnings. The only explanation I can imagine for zero dilution on the income statement is that the share price is below the notes conversion prices but nevertheless investors should be warned about potential future dilution. The below figure shows the potential conversion prices and due dates.

Figure 3 Conversion prices and due dates

Source: ECPG's IR.

ECPG issued $115 million of 2017 convertible notes, $172.5 million of 2020 convertible notes and $161 million of 2021 convertible notes. This means that there is around 10 million of new shares that could be added to the banquet if the loans are converted. In other words a potential dilution of 29%.

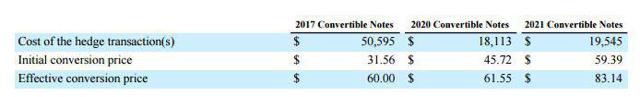

The management has hedged for potential dilution if the stock price should increase and reach the conversion price but that has cost shareholders $3.47 per share or approximately one year of earnings and there can still be dilution if the share price goes above $60 in 2017, $61.55 in 2020 or $83.14 in 2021. With the current management's financing strategy, stratospheric debt, convertible notes and regulatory issues I find it hard to believe that the price will reach those levels but it is good to know that there is potential dilution of 29% if the price goes up. Not to mention the illogical course of action the management has taken of first issuing convertible notes and then increasing even more the cost of that debt by paying $88.8 million for the hedging related to possible future dilution.

Figure 4 Hedging costs for dilution prevention

Source: ECPG's IR

Conclusion

ECPG intrigued me by having 25% yearly revenue growth and a forward PE ratio of 8.39 but after seeing that more collecting issues could arise due to the high number of consumer complaints the CFPB gets on ECPG I am sure this is not a good company to invest in and sleep well. Also we must not forget that ECPG will have to amend its collection procedures that could have significant impact on earnings as the company is highly leveraged. Leverage is ok but when I see that there are convertible notes outstanding that can dilute 29% of the company and then management spends more of shareholders' money in order to hedge the potential dilution I wonder if this is a company that can be a sound fundamental investment even at these low current valuations. Let's see if the biggest competitor could be a better investment.

Portfolio Recovery Associates Inc.

PRAA is in the same business as ECPG. Its market capitalization is greater and around $2 billion in comparison to ECPG's $844 million.

Aggressive acquisitions

PRAA is also aggressively acquiring global debt collectors. In August it purchased a majority position in RCB Investimentos in Brazil. Last year PRAA acquired Aktiv Kapital AS, a Norwegian based debt collector with operations in Europe and Canada for $880 million.

CFPB settlement

PRAA has had the same issue with the CFPB as ECPG but had to pay much less. In total including an $8 million fine PRAA had to pay $28.8 million.

Fundamental analysis

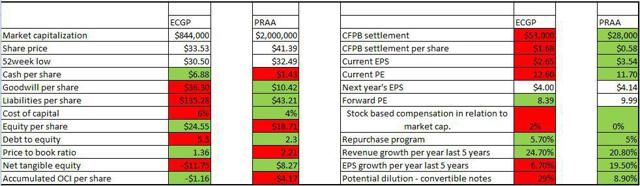

I will use a comparison table for the fundamental analysis as I think this is the best way of seeing what is going on.

Table 1 Fundamental comparison of ECPG and PRAA

Source: Companies' IR and Morningstar.com

Cash per share is lower than with ECPG but this is due to the fact that PRAA is using all available cash to repay debt, thus has a better money management policy. PRAA is also expanding globally but is being much more cautious with its acquisitions. Goodwill is much lower and EPS growth in the last 5 years is in line with revenue growth that means that acquisitions are accretive to earnings. This could be due to the lower borrowing costs PRAA has, 4% in comparison to ECPG's 6%. Repurchases are around 5% with both companies but PRAA has much less potential dilution in relation to the convertible notes issued.

PRAA's convertible notes

PRAA has also $287.5 million of convertible notes issued. The conversion price is $65.42 and the notes are due in 2020. The total possible dilution is 8.9%. The company does not mention any hedges in relation to the convertible notes.

Conclusion

PRAA seems so much more cautious than ECPG and has a similar business model with the majority of its business in the US and also trying to grow globally through acquisitions. Reading ECPG's financial statement looks like walking through a mine field, there are surprises all over the place. On the other hand PRAA has the same positives and practically no negatives for the same business.

Investing comparison and conclusion

I am going to completely avoid ECPG as it does not reach my investment standards. On the other hand PRAA looks like an interesting investment. The current strong dollar gives the possibility to make cheap international acquisitions that in case of a reversal in currency exchanges could be very beneficial. The PE ratio is very low and the share price has been dragged down by the CFPB scandal which is I believe overrated for PRAA. There is some possible dilution in 2020 for PRAA but that could happen only if the price reaches $65.42, or 58% higher than now. I think investors would not mind the dilution if that happens as 58% is a nice increase.

From a technical perspective PRAA has already nicely recovered from its 52 week low of $32.49 that shows that the market has overreacted to the CFPB scandal. I think PRAA is currently undervalued and will slowly come back to its average price for the last 3 years of $55 per share. This gives a potential 34% appreciation and a 5% indirect return through repurchases.

On the other hand ECPG is fairly valued and I do not see catalysts that could work in favor of ECPG.

I will not invest in PRAA at this moment but I will start following it and perhaps buy it in the future. In the below table you can see how both companies stand on my all round stock investing list.

Table 2 Author's stock investing list

Source: Author's calculations