Market reaction to Deere's (NYSE:NYSE:DE) fiscal Q4 report strikes me as excessive. Yes, earnings came in considerably better than expected, but this is a stock that the Street pretty much routinely gets wrong, in both good times and bad, so an earnings surprise should not really come as that much of a surprise ─ not 4.8 percent's worth, anyway. Deere's fairly remarkable ability to adjust its cost base both substantially and quickly has confounded analysts' expectations once again: although revenues came in 3% below the average estimate of the eighteen analysts Bloomberg tracks, EPS came in 44% higher than they expected. Short-covering has been credited for most of the price jump. Given that a bit more than 12% of the shares outstanding were held short before the announcement, this is not an entirely unreasonable guess.

Deere is able to achieve control as rapidly and flexibly as it does because it is basically a designer and assembler. It manufactures the diesel heart of most of its products (but not the gasoline engines used in its smaller equipment) and some other key components, but it buys in many of the other parts it uses. Consequently, it can pull in its horns rather quickly when demand softens, and can ramp up production fast when demand firms. An indication of this is that cost of sales for fiscal 2015 declined almost in line with sales (-23% versus -26%); another is that inventories were cut by 9%. Purchased components represent most of Deere's inventory.

Cost-cutting will not return Deere to growth. Its Q4 presentation made clear that the outlook for its business at least through fiscal 2016 is poor, forecasting a 15 - 20% decline in its core U.S. and Canadian farm equipment revenues. This expectation was offered in the context of Deere's prediction that 2016 U.S. farm receipts will be essentially unchanged from 2015, which I believe is optimistic. But optimistic or not, it is farm net income, not revenues, that will determine equipment sales, and the outlook there is for further weakness. Tax incentives for agricultural equipment investment that were put in place during the Credit Crunch have lapsed, and while there are proposals to revive them, or something similar, even if they do materialize they will probably not do much to bolster Deere's fiscal 2016 sales, either.

If, at best, farmers can expect net income to remain at this year's distressed levels, they are unlikely to borrow in anticipation of tax credits or accelerated depreciation which, after all, may not materialize. If I am right that earnings will decline further, then they are all the less likely to. Their balance sheets have already deteriorated to the point that taking on debt to acquire equipment is unlikely to hold many attractions for them, and the prospect of another year of depressed earnings only promises further deterioration.

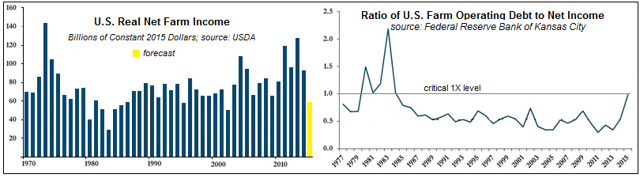

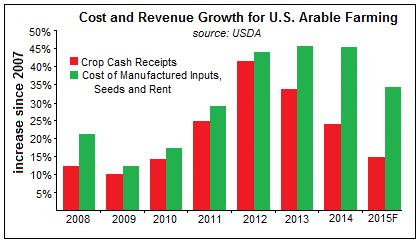

The Kansas City Fed maintains that farms cease to be self-financing when their operating debt exceeds their net income. It is clear from the chart on the right above that this will be the situation of the average U.S. farm in 2016, and already has been the situation of a large number of farms in 2015. If they are to continue farming, these farmers will have to tap into their reserves or borrow, a situation that could easily slip into a downward spiral. If interest rates rise, the problem only becomes more severe. Over the last three years of declining revenues, farmers have been squeezed badly by the 'stickiness' of rents and the costs of other inputs:

Although rents are definitely declining and will continue to do so, the prices of other inputs have not been so accommodating. Diesel costs will continue to decline year-on-year at least through the first half of 2016, but labor costs are rising, if farmers can find workers at all. None of this leaves them much room in their budgets for equipment purchases.

Since the now-lapsed tax incentives were taken up enthusiastically while they were still in effect, equipment needs are in any case largely filled. The tendency for some farmers to replace their equipment every few years was an artifact of the tax treatment of such purchases, and unless such incentives are reinstated, in the current agriculture environment few farmers are likely to continue the practice. In ordinary use, farm equipment takes a considerable beating, but with appropriate maintenance much of it can last indefinitely. Even a farmer who re-equipped seven or eight years ago is under very little pressure to reinvest today, and has plenty of reasons not to.

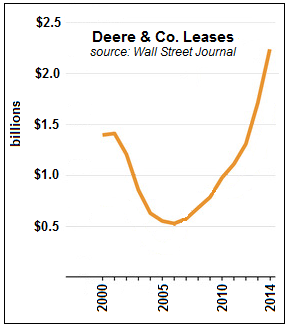

Not surprisingly, farmers who need new equipment are increasingly choosing to lease it:

Thanks to subsidies for new purchases, used equipment markets have become saturated ─ here in the Carolinas, advertising circulars for used tractors and implements run to thirty pages. Prices are accordingly very soft, and likely to weaken further. This, of course, creates great risks for equipment lessors. If prices on used equipment are sufficiently depressed, lessors' customers will buy used equipment rather than buying their leased equipment at residual value (as is usual in other circumstances), landing the lessors with yet more equipment in a falling market for used products. Purchases under the incentive scheme cannibalized future sales, and widespread use of leases, should the market develop in that direction, may make matters even worse.

Clearly, fiscal 2016 will be a difficult year for Deere, but is there light at the end of the tunnel, perhaps in fiscal 2017? I doubt it. I cannot find much of anything to support Deere's forecast of essentially unchanged farm revenues for 2017. The currencies of all the major rivals of America's farmers ─ Canada, Brazil, Argentina, Australia, Ukraine, Russia ─ virtually lock U.S. agricultural produce out of exports, while making all of these countries very competitive in U.S. markets. The situation is corn is dire: inventories had risen more than 40% before this year's harvest, as growers refused to accept low market prices. U.S. farmers have sold only 30% of the 2015 harvest, the third largest in history. With every cubic inch of storage filled, farmers are resorting to plastic sacks and tarpaulins. With well over a year's U.S. harvest in storage and prices cannot recover decisively any time soon. For different reasons, farmers in Argentina are also withholding production, so there is an enormous overhang of corn.

Both wheat and soybean prices spiked during the summer, but resumed their declining trends in time to greet the harvest in September. Beef prices at last seem to be declining (-15% since July) as supplies increase, in part because of the cheapness of feed. Much the same is true of hogs and broiler chickens (whose populations have recovered from the flu-related cull). Dairy's attempt to recover from last year's price collapse fizzled in June and prices are currently setting new lows. Except for dairy, where prices have declined catastrophically, lower feed costs will partially compensate livestock farmers for weaker prices, but not if prices continue to decline, as expected: the USDA expects pork prices to decline by ⅓ in 2016. There is very little arable farmers can do to defend their margins.

So a forecast of flat U.S. agricultural revenues in 2016 is only a dream. Virtually all farmers will suffer, and some severely. Consequently, farm earnings are likely to fall back to the levels of the darkest days of the early 1980s. It is highly questionable whether demand for farm equipment can support even a 15% decline in Deere's revenues. Deere's skill at controlling costs will be challenged by the likely decline in revenues, and margins will almost certainly come under pressure. The analysts' consensus for fiscal 2016 EPS is a 27% decline. A decline in the mid-30s seems more likely to me. Deere gave back today some of what it gained on Wednesday. I think this is entirely appropriate, and I would look for it to give back more. I would not be a buyer of Deere above $72; however, given its propensity to surprise, I would be reluctant to short its shares.