Important Note: This article is not an investment recommendation or research report. It is not to be relied upon when making investment decisions - investors should conduct their own comprehensive research. Please read the disclaimer at the end of this article.

The prove-up of the deep Utica concept is perhaps the most exciting recent development in North America's shale gas. However, the really important question that remains open is:

Is the dry gas Utica a macro-disruptive phenomenon similar to the Marcellus or just a "nice to have" backlog addition that will not be developed in earnest for another two decades?

The Deep Utica Breakthrough

While the shallower western edge of the Utica's dry gas window was tested reasonably well in the past three years, the deeper eastern portion of the play has remained an uncharted territory until very recently, due to the formation's significant depth and associated technical challenges and cost to drill.

The deep Utica concept is not new. It has been actively discussed by the industry for several years, since the moment when the commerciality of the Utica was demonstrated in the liquids-rich window. However, the deep gas play was proven up with well results only recently.

Three recent deep Utica tests spanning a large area in Central Pennsylvania (EQT Corporation's (EQT) Scotts Run well; CONSOL Energy's (CNX) Gaut well; and Range Resources' (RRC) two Claysville Sportsman's Club wells) show excellent petro-physical correlation and, in two cases of the three, excellent performance correlation with the earlier successful tests drilled in areas where the formation is significantly shallower.

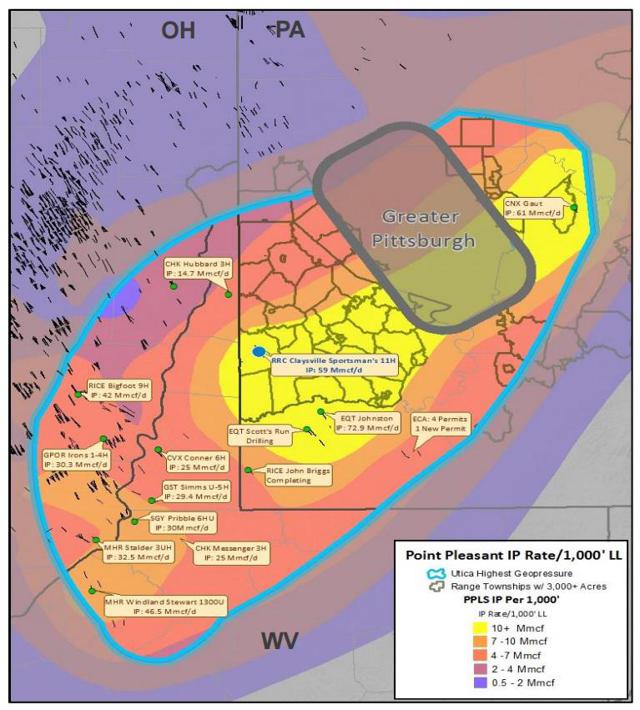

In total, the industry has brought on production close to a dozen medium-deep and deep tests delineating the eastern edge of the deep Utica play (the map below).

(Source: Range Resources, November 2015; Note: the 72.9 MMcf/d IP rate for EQT's Scotts Run well appears inadvertently misplaced and attached to the Johnston well - please see another map below for additional detail)

Deep Utica Testing Gaining Momentum

Encouraged by the initial successes, several large operators have accelerated their deep Utica evaluation programs. Leading the effort are EQT Corporation, CONSOL Energy, Range Resources , Southwestern Energy (SWN) and Antero Resources (AR). In Northwest Pennsylvania, Royal Dutch Shell (RDS.A) (RDS.B) has drilled at least seven deep Utica tests which I will discuss in a separate note.

Half a dozen additional new test results, in addition to performance updates for the already existing wells, are expected within the next three months.

The industry's 2016 drilling campaign may yield another two dozen well results, which may be sufficient to form a preliminary view with regard to the play's extent and the operators' ability to handle technical challenges.

There is little doubt already at this point that the natural gas resource offered by the dry gas Utica is enormous and prolific. However, the industry still has a tremendous amount of work ahead of it to fully delineate the deep Utica and prove that the play can be commercial in a low-price natural gas environment.

EQT's Scotts Run Deep Utica Test - Performance To Date

EQT Corporation's Scotts Run well is perhaps the most convincing demonstration so far that the deep Utica may actually work and work well.

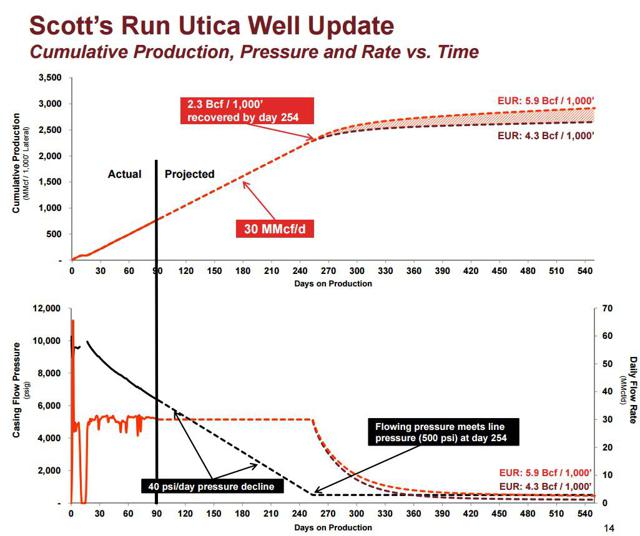

EQT has recently provided an update with regard to the well's performance that indicates significant performance similarity to the very strong shallower dry gas Utica wells drilled by Rice Energy in Belmont County, Ohio. At the time of EQT's update, the Scotts Run well had been flowing into the sales pipeline at a choke-restricted rate of about 30 million cubic feet per day for about three months (except for the seven days that were required to install the wellhead equipment).

(Source: EQT Corp., November 2015)

As a reminder, the well's initial 24-hour flow was 72.9 million cubic feet of natural gas with an average flowing casing pressure of 8,641 psi.

The most relevant data point describing the well's performance is the casing pressure decline rate. The pressure drawdown at 30 MMcf/d flowing rate has averaged 40 psi per day (at the time of EQT's update at the end of October, sales volumes were 30.4 MMcf/d and the casing pressure was 6,320 psi and cumulative production from this well had totaled 2.6 Bcf in the first 86 days of production).

EQT now expects that the daily production rate will not decline until the well pressure declines to the pipeline pressure, which is ~500 psi. Based on an extrapolation of the current pressure decline rate, EQT estimates that line pressure will be reached after approximately eight months of production, which will be at late March 2016. The cumulative production at that time would be approximately 7.4 Bcf.

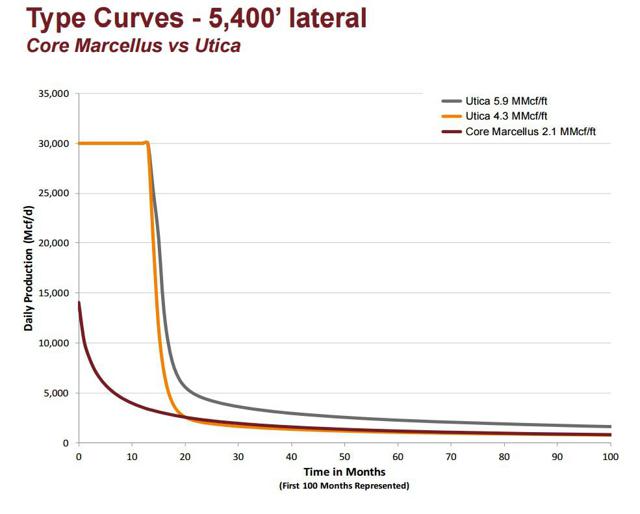

The rate of decline beyond the plateau period is difficult to predict as no analogous decline data to rely on currently exists. In its presentation, EQT showed a range of possible decline curves. The company's reservoir modeling suggests an ultimate expected recovery for this well in a range between 13.9 Bcf and 18.8 Bcf or a range of 4.3 Bcf to 5.9 Bcf per thousand foot of lateral. As a reminder, the Scotts Run well has a short lateral, ~3,200 feet.

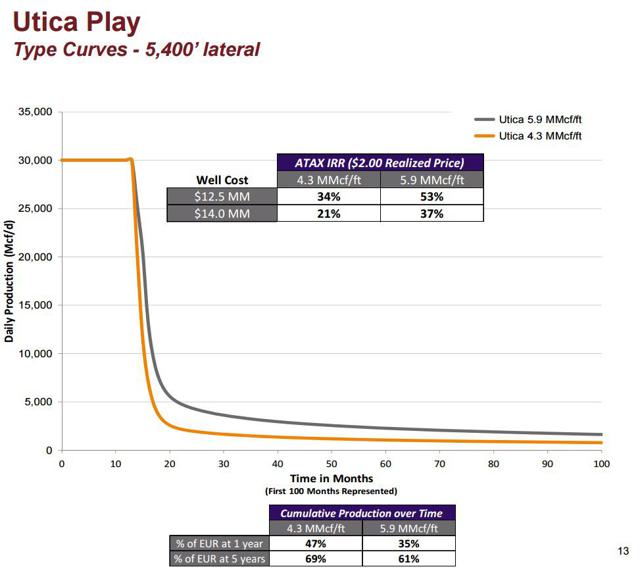

Using the lowest EUR in this range and assuming the high end of its cost per well target of between $12.5 million and $14 million per well, EQT estimates returns at a $2 wellhead gas price to exceed 20% for a 5,400 foot lateral-well.

EQT Has A Large Deep Utica Program Planned

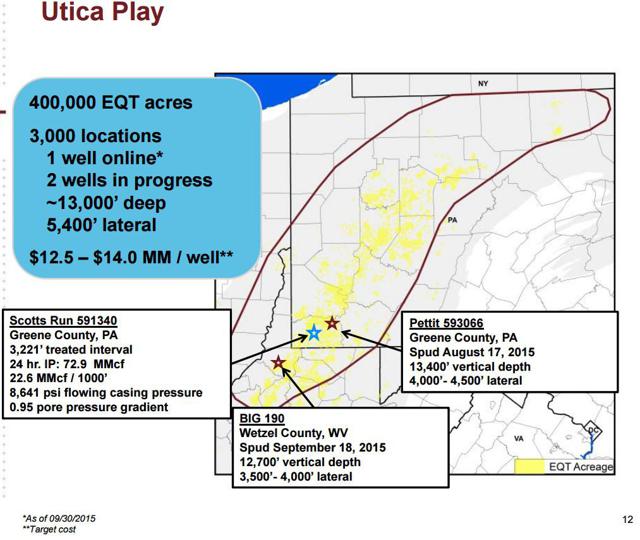

Perhaps the most convincing signal with regard to deep Utica's economic potential is EQT's decision to scale up its testing program.

EQT has spudded two additional Utica wells. In August, the company spudded the second Greene County well, the Pettit #593066, which is located approximately five miles northeast of the Scotts Run well. The well is expected to be on production before the end of the year.

The third well, the BIG #190, was spudded in September in Wetzel County, West Virginia, and is located approximately 30 miles southwest of the Scotts Run well. The deep intermediate hole has been drilled and the rest of the drilling will be completed when the Pettit well is drilled and the big rig is moved to West Virginia later this year.

Completed well costs may remain high in the immediate term. For example, EQT indicated that it had spent approximately 22% less the intermediate deep hole than it did on the Scotts Run well at the same point. By comparison, EQT targets completed well cost between $12.5 million and $14 million in development mode.

In 2016, EQT preliminarily targets to drill 10 to 15 deep Utica wells. The target is flexible, depending on the results of the initial three deep Utica wells. The purpose of the 2016 deep Utica campaign will be to determine economics, size of resource and future midstream requirements. The company will also targets to lower the cost per well towards its target range.

EQT indicated that its testing will cover the area from southern Allegheny County and southwestern Armstrong County in Pennsylvania to southern Wetzel and western Marion County in West Virginia, with the focus on areas where the company has significant acreage positions. Expectations for the Utica potential in Allegheny County is high, based on the results of CONSOL Energy's Gaut well. Based on its own and peer results, EQT may step further out into the Northern Allegheny County.

Given that the cost of deep Utica wells remain quite high, EQT's significant capital allocation to the play in 2016 (albeit preliminary and conditional on continued success) signals the company's optimism with regard to the play's economics.

Deep Utica Well Costs

Given the technical challenges of drilling in the deep Utica, well costs are difficult predict. EQT spent ~$30 million on the Scotts Run well whereas CONSOL's Gaut well came in at ~$26 million.

EQT indicated that its AFEs are currently in the low-$17 million per well, which is encouraging. The cost depends on the ultimate lateral length.

Ultimately, EQT estimates that a $12.5 million completed cost per well should be achievable, based on the company's bottoms-up analysis of what it should cost to drill these wells once it works through all of the problems and gets the non-productive time down to a minimum. Provisioning for the risk of unexpected technical problems due to the formation's depth and pressure, EQT derives the high end of its estimate range of $14 million per well. EQT expressed high confidence in the high end of this range.

Is The Deep Utica A Price-Impacting Source Of Supply?

It is still too early to be confident that the play will be economic. However, the early results are certainly encouraging.

Assuming the Scotts Run's results to date are indicative of future well performance in deep Utica, EQT estimates that the play can generate returns in the ~20%-50% range, using the estimated development mode well cost of $12.5-$14.0 million per well and realized wellhead price of $2.00 per Mcf (which, I would argue, would correlate with a ~$2.75-$3.00 per MMBtu future NYMEX price).

(Source: EQT Corp., November 2015)

Given the size of the deep Utica resource, EQT has expressed a concern that in the event the play's economics prove to be comparable or better than in the Marcellus Core, the Utica's low breakeven price may put pressure on natural gas pricing in the region and potentially nationwide. As a result, some of other inventory in the Marcellus/Utica region that requires higher prices to make economic returns would be deferred, possibly for many years.

The concern is valid. However, for the deep Utica to have a noticeable impact on natural gas pricing, it must yield risk-adjusted drilling returns equal or better than the Marcellus Core, which is a tall order. The deep Utica's economic core must also be large enough to matter. In this regard, many stars must come in alignment.

First, there is a natural limit on how big the EUR per well can be. The industry's petro-physical estimates for the Original Gas in Place ("OGIP") in the deep Utica/Point Pleasant suggest ~a range of ~70-150 Bcf per section in the areas that are currently targeted for evaluation. Assuming the whole section can be effectively drained by four wells and assuming a 60% recovery factor (each of the assumptions may be overly optimistic), the EUR per well at the high end of the OGIP range comes out at ~22.5 Bcf per well, or 4.2 Bcf per 1,000 feet of lateral length.

Based on this "back of the envelope" calculation, EQT's Scotts Run well appears to be performing at the higher end of the EUR expectation.

Is it possible that the OGIP estimates for the Utica/Point Pleasant are overly conservative? Is it possible that a larger area than quarter-section can be drained by one well? I would say, certainly possibly, but only time will tell.

The second concern relates to the risk-adjusted well cost. It is important to remember that in the Marcellus's sweet spots operators are able to drill 10-15 Bcf wells for under $7 million per well. In Susquehanna County, the metrics are even more competitive: Cabot Oil & Gas (COG) has reported an average well cost of $5.6 million, while the company's wells appear to have EURs in the 15-20 Bcf range.

In other words, given that deep Utica wells are likely to be two times more expensive than similar lateral length Marcellus wells, they need to yield EURs that are also substantially higher than in the Marcellus. Assuming that at least a 1.5 times EUR improvement is required, the deep Utica needs to yield EURs in the 20-30 Bcf range for one-mile laterals.

So far, both EQT's Scotts Run well and CONSOL's Gaut well appear to have a good chance to fall within that category (as illustrated by the slide below). However, there is significant risk in setting the expectation too high.

(Source: EQT Corp., November 2015)

The third concern relates to infrastructure availability in the areas that prove to be the deep Utica's sweet spots. While in some areas the infrastructure currently designated for Marcellus production can be used, there is certainly a chance that certain other areas will have to wait for an extended period of time on additional infrastructure to be put in place.

All the concerns notwithstanding, the dry gas Utica has already become a factor in the regional supply.

Rice Energy (RICE) is already moving full steam ahead developing shallower Utica in Belmont County, Ohio, with returns expected to match or exceed the company's returns in the Marcellus (which is a top quality asset).

Assuming that the industry's deep Utica program in 2016 is successful and a total of 20 additional wells are brought on production, with a 25 MMcf/d restricted rate each, the total production from those 20 wells alone could be 0.5 Bcf/d.

If The Deep Utica Works, Will The Takeaway Be Sufficient?

In the event the deep Utica proves economically competitive, the play would have significant strategic implication for the midstream in the Northeast region. It would mean that low-cost volumes from the Marcellus/Utica are "higher for longer." The industry will need to once again re-assess future inter-regional natural gas flows and required transportation solutions. The Utica's success may re-invigorate growth outlook for the regional midstream providers and postpone the saturation point that appears to have become a major concern for the market in the past twelve months.

In Conclusion…

A year ago, it would have been hard to imagine a more prolific play than the Marcellus. However, there is a school of thought within the industry that if the deep Utica works, it may become comparable, if not larger than the Marcellus over time.

While in the short term the Utica's impact on natural gas prices is negligible, in my opinion, as Utica wells simply displace Marcellus wells in operators' drilling plans, in the longer term Utica's success may certainly mean "lower for longer" for natural gas prices.

There is a good reason why the phrase "the dawn of the Utica Era" has found its way into EQT's presentations.

The fundamentals discussed in this note may be relevant to natural gas-focused ETFs, such as:

- The United States Natural Gas ETF, LP (NYSEARCA:UNG)

- VelocityShares 3x Inverse Natural Gas ETN (DGAZ)

- VelocityShares 3x Long Natural Gas ETN (UGAZ)

- iPath DJ-UBS Natural Gas Total Return Sub-Index ETN (GAZ)

Disclaimer: Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment, tax, legal or any other advisory capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings, and consult a qualified investment advisor. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.