Genuine Parts Company (NYSE:NYSE:GPC) is a four-segment business that distributes and sells car replacement parts, industrial replacements parts, office products and electrical/electronic materials. It operates about 2,600 stores in the United States, Canada, Mexico, New Zealand and Australia.

If you love spectacular growth, Genuine Parts Company is not for you. But for income investors, GPC is a great bargain. First, I want to briefly review the issues that have accounted for the company's so-far middling performance, and then I will tell you why I think it's a fantastic buy right now.

Bear Problems

Let's take a look at why GPC hasn't exactly been crushing it. As you can see below, the stock has not only lagged its major competitors, but has also trailed its industry benchmark in the past 6 months (GPC is blue, ORLY is orange, AZO is brown, LAD is green and their industry, Specialty Retail, is cyan and set as a baseline).

The main reason GPC has underperformed has been the market's perception that it is a low-growth company. And there is some truth to that. For example, the company's net sales for 2015 Q3 declined 1.6%, while its net income declined 1.3% YoY. Additionally, this year's sales are projected to grow at a miserly 0.2%, as shown below:

However, even though GPC has a low growth rate, it has not had declining annual sales since 2009. Instead, the company has slowly and steadily recorded rising yearly sales, as shown by the chart below (in millions of dollars):

GPC's sales growth, while not breakneck, has been consistent; in 2012 sales were up 4%, in 2013 they rose by 7% and in 2014 they increased 9%. The consistent growth rate has also been translated to the bottom line. Net income has also been steadily rising, as shown below (in millions of dollars):

Aside from GPC's slow (but steady) growth rate, why else has the company underperformed? For one, it's in auto parts, a low-visibility sub-industry of the specialty retail industry. According to Stock Rover Markets, there are only 9 analysts covering a big cap like GPC (market cap $13.7B) in auto parts, while a small cap stock like Bill Barrett (BBG) (market cap $317M) in oil & gas has 17 analysts. Additionally, auto parts as a whole has been taking a beating relative to its larger industry context. The returns versus the industry returns in recent months for most of GPC's competitors have been negative:

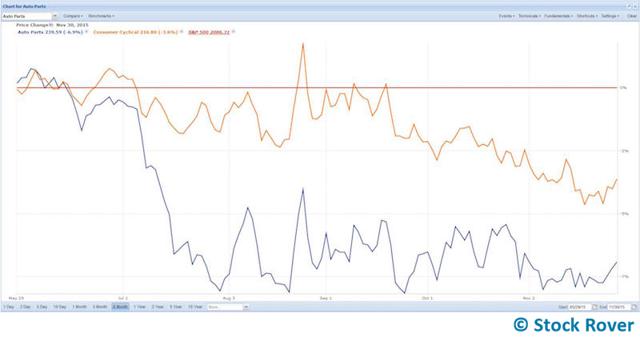

The downturn has not been restricted to the auto parts industry; the consumer cyclical sector in general has also been underperforming the market in the past 6 months, as seen below (the S&P 500 is set as a baseline in red, and the consumer cyclical is in orange).

So, if GPC is an underperformer in an underperforming industry, what makes it a catch? There are a lot of good reasons, starting with dividends.

Consistent Dividend Growth

An earlier chart shows the company underperforming its industry and primary competitors, but that chart only shows price performance and leaves out dividends, making the situation look worse for GPC than it actually is.

GPC outperforms its peers in dividends. The following table shows it is ahead of the pack in dividend yield:

Not only does it have the highest yield at 2.7%, but GPC has continually grown its dividends for the last ten years:

To get a better view of the data, I charted the above dividends. As shown, GPC has continually grown its dividends in the past ten years.

In fact, out of the 87 years of the company's existence, it has grown dividends for the past 59 years. Below is the dividend record from GPC's 2014 investor presentation:

It has managed this without veering into dangerously high payout ratios, maintaining its payout ratio around the 50% mark for the last 10 years.

GPC's dividend track record should remain intact, and the likelihood of dividends being cut in the near future is low, as the company is in solid financial health. It has a high quick ratio (a ratio greater than 1 indicates a safe investment, but given GPC has the highest, it can withstand liquidity problems better than its peers) and a high Altman Z score (a Z score greater than 3 means it is unlikely to go bankrupt) compared to its peers, as shown below:

So, GPC is clearly hitting the right notes for those who favor dividend stocks, but that's not the whole story. There is more that the market is missing right now.

Why GPC is a Bargain

Turned off by GPC's low, but steady, growth rate and the boring industry it is in, the market has missed the following points about the company that make it a great bargain.

Growing Domestic and International Sales

As I mentioned earlier, sales revenue for 2015 Q3 went down, and that is important to note. However, that is not the only number we should note. Comparable sales (same-store sales) increased by 5% in 2015 Q3, up from 3% reported in Q1 and Q3. Additionally, sales in the US - GPC's main market, accounting for 81.9% of sales in 2014 - were up 4%. Moreover, the main reason sales went down at all was the dollar's recent rally. In fact, international sales (which are the sales that declined, not US sales) increased in local currency terms, i.e. Australian dollar, Canadian dollar and Mexican peso. Without the US dollar's appreciation, the company was would have recorded a growth in sales.

Still, with the Fed speaking of possibly normalizing monetary policy in December, dollar appreciation will continue to be an issue for GPC in the near term. In spite of further dollar appreciation, I believe rising sales in the US market will counter currency effects in the international markets. At same time, rising in international markets such as Australia - which are new markets - will further counteract the drag from currency fluctuations, and GPC should be able to maintain its steady sales growth rate.

Acquisitions will Grow Sales and Increase Market Share

This year, the company acquired GPC Asia Pacific, formerly Covs Parts, in Australia. The acquisition significantly increases GPC's market share in Australia, because Covs Parts was its major competitor. Covs is a leading distributor in Western Australia that supplies auto parts, industrial consumables and truck parts. For the nine months ended of 2015, GPC has pumped $115.4M into acquisitions and other investing activities and made acquisitions in each of its product segments: industrial, electric/electronics, office products and automotive parts. Partly because of such acquisitions, sales are up. For example, sales in the automotive parts segment grew by 4%, but were offset by a 6% decrease because of US dollar appreciation. Even in product categories like industrial, where sales declined by 4%, they were offset by a 1% increase in sales from acquisitions. Going forward, the acquisitions will continue to increase sales.

Attractive Current Valuation

GPC had a big rally at the end of 2014 and climbed to an all-time high of $108.32, but in 2015 the stock has pulled back, and it is currently trading at $90.07 as of November 25th, 2015. While the company may have been overpriced then, that has changed. GPC is now very undervalued when compared to its major competitors. In fact, initially I had considered writing about O'Reilly because of its great price performance, but a look at the company's valuation convinced me it is currently overvalued. GPC is the real sleeper.

GPC is especially undervalued considering the large cash flow the business generates. Take a look:

GPC is only trading at 19.5 times earnings compared to O'Reilly (NASDAQ:ORLY), which is trading at 30.7 times earnings. And although it may seem Lithia (NYSE:LAD), trading at 18.8 times earnings, is more undervalued, it is highly overvalued when compared to GPC on price-to-cash flow and price-to-free cash flow. GPC is trading at 12.7 times cash flow, compared to LAD's 67.1 times cash flow. On a stricter valuation metric like price-to-free cash flow (P/FCF), which excludes capital expenditures from price-to-cash flow - because companies need to maintain or expand capital in order to sustain and grow existing cash flow - GPC is trading at only 13.9 times free cash flow. At 13.9 times FCF, it is at the top of the pack, ahead of LAD, which has negative FCF. If GPC was valued at ORLY's 31.9 times FCF, it would be trading at $208.3, and if it was valued at AutoZone's (NYSE:AZO) 24.5 times FCF, it would trade at $159.99. Thus, GPC is trading far below its fair value, compared to its peers.

The company also tops the tables on the EV/EBITDA metric (at 11), and this low number indicates GPC is valued inexpensively. Furthermore, it has the lowest debt-to-equity ratio, tied with TSCO at 0.2, which means GPC has been financing most of its recent acquisitions with cash. If the company needs to borrow in the future to increase growth, its low debt-to-equity ratio tells us it has room to do so, because currently, it only has $500M in long-term debt.

The only metric where GPC lags its eight peers is the PEG forward ratio, which is based on expected earnings for 5 years. At 4, GPC comes in last because of its modest expected growth. While of course I would be happier with a lower PEG forward, I don't believe that the current number adequately accounts for the company's multi-pronged approach to growing its business in the future. As its international presence continues to grow and US sales fire up, the PEG forward should come down sharply.

The Auto Parts Industry is Poised for a Comeback

As mentioned earlier, the auto parts industry has taken a beating lately. But because the total number of miles driven (an indicator we can use to gauge whether cars will need repair in the future) in the US hit new highs, there will be many new customers for the auto parts industry. Data from the Federal Highway Administration shows the total Vehicle Miles Traveled surpassed its 2007 high of 3,038,866 and came in at 3,120,976 as of September, 2015. The chart below shows this increase:

According to management, on the 2015 Q3 earnings call, the fundamental drivers in the automotive parts remain positive, as "the average age of the fleet remains in excess of 11 years. The size of the fleet continues to grow. Lower fuel prices remain favorable for the consumer and miles driven continue to post substantial gains."

A Solid Global Business with a Long History

GPC, founded in 1928 in Georgia, is one of the oldest (if not the oldest) auto parts companies. Its long history has allowed the company to build valuable brands, create a large comprehensive inventory and diversify the business. GPC has created brand, such as NAPA, that are recognizable not only in the US but also in Canada and Mexico. Through its many years in the industry, the company has developed an inventory of about 459,000 automotive parts, while peers like O'Reilly only have an average of 146,000 parts. Geographically, GPC operates in the US, Canada, Mexico, Australia and New Zealand, while a competitors like AutoZone operates only in the US, Mexico and Brazil (O'Reilly only operates in the US). The company's global reach not only expands its inventory, but increases the inventory's diversity. Additionally, the global reach diversifies its revenue streams. The combination of valuable brands, a varied and complete inventory and a diversified business (geographically and product-wise) gives GPC a competitive advantage over its peers.

Areas for Improvement

I think GPC is a solid, very much under-the-radar pick. However, one area of improvement for the company will have to be margins. As shown below, GPC's margins are average among those of its major competitors:

Among the eight competitors, GPC has the fourth-highest return on assets and return on invested capital, and the third-highest return on equity.

Management can do better, and has already begun to improve margins. For instance, even though sales in the automotive segment went down 1.7% in 2015 Q3, the company's operating margin went up 4.5%, showing a clear increase in operating efficiency. As management streamlines operations, especially in new international markets, GPC's margins should significantly improve.

Conclusion

GPC is currently very undervalued. The company has great free cash flow and is in sound financial health. It has had a low, but consistent, growth rate. The sales decline in 2015 Q3 was because of significant currency headwinds. However, comparable sales were up 5%, and the US market (the main market) is still roaring. Increasing sales from new acquisitions, same-store sales growth and US growth should check currency headwinds in the future, and as those headwinds die down, revenue will improve. The major risk with GPC is that the market may keep it undervalued for a long time. However, growing domestic and international sales, new acquisitions, a great industry outlook and an attractive valuation make "boring" GPC a bargain. Why not take it for a spin?