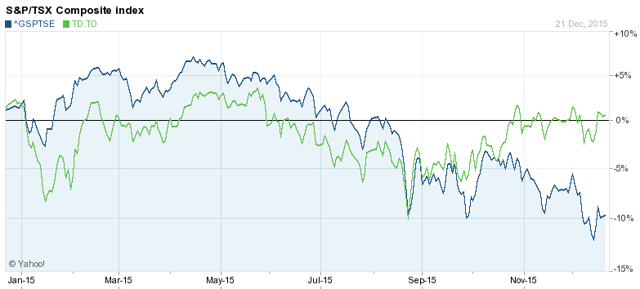

Overall, the Canadian market has been crushed in 2015 due to the reliance of its economy on oil & gas as well as other natural resources. The TSX is down almost 10% year to date and will likely struggle to the finish line in the final trading days. One sector of the Canadian economy I have always been quite fond of is Banking, and I believe TD Bank (NYSE:NYSE:TD) is the golden goose of the Big 5.

Note: I've used the TD.TO ticker, which is CAD versus the NYSE ticker, for this chart so it could be better compared against the TSX Composite.

Not only have the banks been struggling this year due to the headwinds in oil and low interest rates, but also they cannot seem to build any momentum even though they have had great quarterly results and dividend yields as well as strong balance sheets.

TD Bank is one of the top Canadian banks in terms of market cap and assets, and it services both the Canadian and foreign markets in retail as well as wholesale banking. The company has differentiated itself in the Canadian space by focusing on its retail operations and strives to make TD the Big 5 bank of choice. This has let it to be ranked highest in customer satisfaction among Big 5 Canadian banks for 10 straight years as well as being Reader's Digest Most Trusted Brand (Banking/Trust company) for four straight years.

Over the past five years, earnings have grown at a CAGR of 8% while the stock has appreciated only 5.2% per year (based on adjusted close prices) coupled with dividend growth of 11.7%.

In its Q4'15 results last month, TD boasted C$2.177B in adjusted net income and over C$640M of it from its US retail operations. With the weakness in the Canadian dollar, its US operations are going to be a great opportunity for the company to pad its bottom line as it translates those earnings into CAD. As well, the company recently announced in its Q4'15 MD&A an intention to buy back shares in the coming months, which is a great sign that management believes the shares are undervalued in the current market.

Some of the drivers that I believe will push TD Bank much higher in 2016 and make it my top pick include its strong balance sheet, lower-than-peer loan exposure to the oil & gas industry, the implications of a weakening Canadian dollar. The strong underlying fundamentals of the company seem to be much more discounted due to the poor year the stock has had.

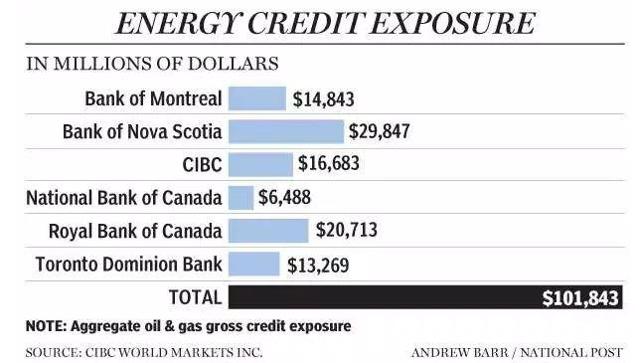

Balance Sheet & Loan Exposure

Compared to its Big 5 counterparts, it has been noted that TD is not as exposed to potentially bad debt in Alberta and the oil & gas industry as a whole. In a note from the Financial Post, you can see that TD has the least amount of exposure to the Energy sector (of the Big 5 banks). Keep in mind as well that TD is the second biggest bank, so a ratio of this exposure to overall credit levels would likely strengthen this story for the bank.

I believe this is one of the biggest risks to the Canadian banking industry as more layoffs and spending cuts continue to take their toll on the economy as a whole, and it is encouraging to know that TD is less exposed than some of its largest competitors.

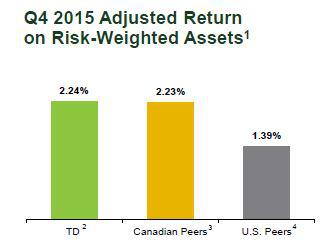

Furthermore, the company presented in its Q4'15 Investor Presentation a graphic that showed TD's ability to earn returns on its risk-weighted assets.

I believe this is important to help show the relatively safe nature of TD Bank and part of the reason it has been considered one of the safest banks in the world.

Weakening Canadian Dollar

As I briefly mentioned above, approximately 30% of TD's earnings (in CAD) came from its US retail operations. With this kind of exposure to a strong US dollar, TD is in a great position to capitalize on these earnings and profiting from the depreciation of the Canadian dollar.

In addition, from an economic standpoint, weakening currencies historically have helped boost economies in some ways. Considering the Canadian economy has struggled due to the headwinds from oil, this is an opportunity for the weak dollar to attract more investors, tourists, and exporters to help boost spending within the Great White North. Since the country recently got out of its technical recession, with GDP growth of 0.6% in the third quarter, I take this as a sign that the economy is beginning to learn how to operate without the lift it is used to in the Energy sector.

Underlying Fundamentals

Although TD's stock has just recently pared gains but mostly struggled throughout the year, I believe much of this can be attributed to the economy as a whole that has slowed down in Canada due to the country's reliance on oil. Since financials tend to be leading indicators, this headwind has muted any potential gains for TD Bank even with strong quarters. In its four quarterly results, the bank has two earnings releases that were positive surprises and two that were in line with analyst estimates. Combine that with the 3.73% dividend yield, and it is hard to argue that the stock isn't in a great position to rally into 2016.

There's no point in crying over spilt milk, and in this case, it has led to a great opportunity for investors - undervalued fundamentals. The price multiples have been steadily heading lower over the course of the year, which presents a great buying opportunity.

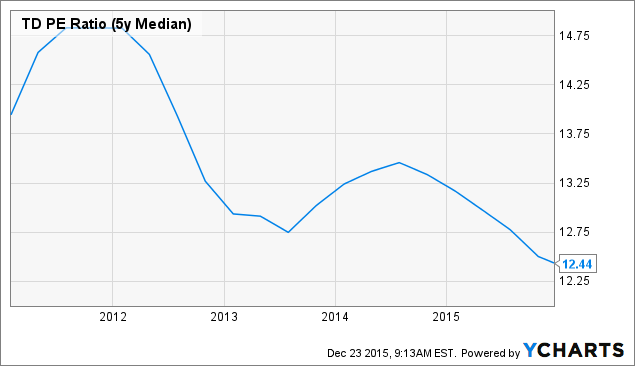

TD PE Ratio (5y Median) data by YCharts

The P/E (5-year median) has been steadily declining since the middle of 2014, showcasing an ability for investors to purchase earnings of TD at a lower price.

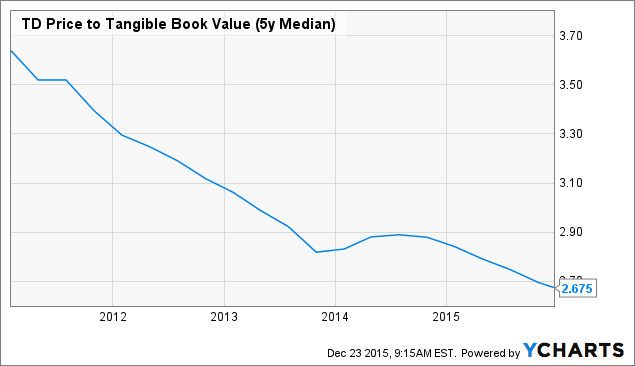

TD Price to Tangible Book Value (5y Median) data by YCharts

In addition, the balance sheet and cash flows remain strong and growing for the company. I believe strongly in looking at the financial institutions' P/B ratios, and the trend in the recent years paints a good value story for TD. I look at this as a signal of the strength of TD as a whole and its management's ability to weather the tough and turbulent economic conditions in the Canadian marketplace.

Risks

The risks to TD, and the Canadian economy as a whole, are probably quite obvious by this point. There are no signs that oil prices will recover and that is going to put a lot of pressure on the big Canadian oil players to cut their costs of production. In addition, the loans that these companies have are tied to asset values, and those assets are valued based on the price of oil. Therefore, the big banks are keeping a close eye on defaults and other credit events that may result in write-downs on bad loans. Similarly, the overall Canadian economy has been in a technical recession due in part to the developments in the oil market. With this kind of slowdown, there are questions around whether TD and its competitors should be bracing for a more serious correction or if this is truly a concentrated issue with oil and natural resources. My opinion is that the issue lies in Canada's reliance on these industries and so there should not be significant impacts to TD's operations. Also, the low interest rate environment is seen as a significant headwind for TD and its peers. Even as the Fed raised rates, there are still talks of Canada potentially exploring negative interest rates like we have seen in Europe over the course of 2015. Although this is unlikely given Canada's tendency to follow the US economic actions, there is still risk that low interest rates will make it difficult for the company as it relates to its book of loans. One final risk, which I haven't previously mentioned, is the housing bubbles of Toronto and Vancouver which have gotten a lot of attention as of late. There are two competing views and no clear consensus as to whether the Canadian market will have a housing crash, which would be a huge issue for TD and its exposure to the mortgage market. As much as these housing markets do appear to be hot, I don't see a hard landing happening anytime soon and it won't affect TD's ability to be an outperforming stock in 2016.

Conclusion

Overall, I firmly believe that there have been too many over-exaggerated headwinds affecting TD's stock price over the 2015 year. For a stock with dividend growth of 11.7% and earnings growth of 8% as well as a strong balance sheet that seems to be well positioned to deal with any issues coming from the Oil Crisis, I believe TD is a great pick for 2016. When we take into consideration the struggle of a year that has allowed pricing multiples to come into an undervalued range, it would be fair to say that a 20% upside would be possible in 2016.