By Dean Popplewell

It has been suggested that plunging stock prices, dollar appreciation and other adverse trends have tightened financial conditions to the equivalent of four-rate hikes. If so, will this take Fed Chair Yellen off the hook for a rate hike any time soon?

In her prepared remarks yesterday, Yellen sounded a note of caution and said that financial conditions have become less supportive to U.S. growth. But otherwise, her speech was mostly in tune with her previous statements. Yellen emphasized that monetary policy is not on a pre-set course, reiterated conditions will warrant only gradual rate hikes, and said inflation will pick up once oil and import prices stop tanking. As expected, Yellen offered little color on the timing of Fed rate hikes.

Markets initial read on Yellen’s prepared remarks:

•Fed Chair “not” as dovish as the market had forecasted – but she is dovish.

•Foreign developments pose risks to U.S. economic growth – could weaken exports and tighten financial market conditions.

•Considers those financial conditions “less supportive” of U.S. economic growth today.

•Has not yet backed down from Decembers pledge to removing accommodation.

•She did mention China and their uncertainties.

•U.S. financials direct exposure to oil sector and EM is “limited,” but recognizes could emerge through indirect global financial linkage.

•Rate path hinges on whether market turmoil persists.

Yellen’s prepared remarks suggests that the Fed is still looking to raise rates in a gradual manner, but recent developments are being watched closely and will factor into their March forecasts and decision. In her testimony, Yellen indicated that they could delay (not abandon) planned rate increases in response to recent market turmoil. Many are now taking her responses to suggest a March rate hike is in all likelihood off the table.

Financial Rout Continues

Plummeting stock prices, flatter yield curves and currency safe haven demand very much indicates that investors have lost faith in policy makers’ ability to support the global economy.

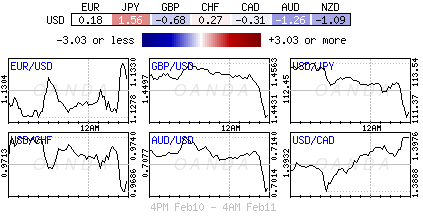

In FX, yen (¥111.69) remains the standout concern as it benefits greatly from the global risk aversion sentiment. The steadily appreciating yen could throw a “monkey wrench” into the works for Abenomics.

U.S. dollar bulls continue to cling to the possibility that Tier 1 central bankers in particular will be required to act to protect their own currencies strengthening much more against the USD. For some time, central banks like the ECB and BoJ have been relying on the Fed to do the work – a slam-dunk tighter Fed rate policy would support the USD on rate differentials. However, the rules seem to be changing and nothing is certain, not even one Fed rate hike, which is now putting the onus back onto the respective central banks to “massage” their own currency values (Sweden’s Riksbank cut their repo rate into deeper negative territory this morning -0.5%).

More Expected From Kuroda

The Bank of Japan’s (BoJ) efforts to avoid a stronger dollar are not working. When Governor Kuroda cut rates into negative territory for the first time last month, it had only a temporary weakening impact on the JPY (¥121.50). This has been a similar story for ECB’s Draghi. The President’s attempt to talk the EUR (€1.1311) lower at their January meet only had a short-lived impact on the currency (Jan. low €1.0850). But this does not mean either Draghi or Kuroda will stop trying.

Due to the swiftness and relentlessness of some of the forex moves, forex dealers and traders remain on high alert in anticipation of an intervention threat by Central Banks, in particular the BoJ.

The type of intervention could take many forms, which would include rhetoric and more rate cuts. But in Japan’s case, the growing event risk is that the BoJ could intervene directly in the FX market.

For many, the unknown factor is China. With the Lunar New Year celebrations ongoing, the People’s Bank of China (PBoC) remains offline. Will their markets play a very “ugly” catch up in their first session after the holidays?