By Raul de Frutos

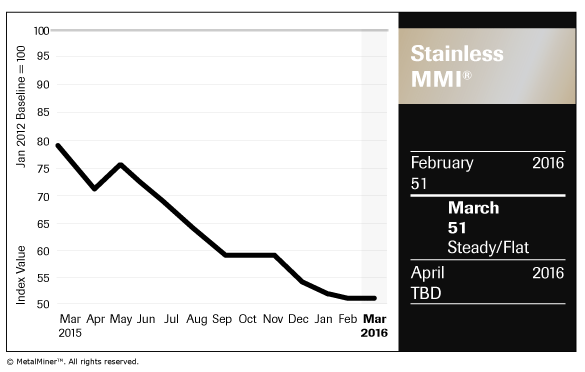

Our Stainless MMI remained steady at 51 points. However, we currently see some factors that could lift prices in the short term.

Stainless Anti-dumping Case

On March 4, the U.S. Commerce Department launched an anti-dumping and countervailing duty investigation into Chinese imports of stainless steel sheet and strip, for possible illegal subsidies and selling prices at below cost to illegally gain market share. A preliminary determination of injury to U.S producers is scheduled by March 28.

China's Ministry of Commerce didn't respond well to this new case, arguing that simply restoring prices via protectionist means is not the solution. Chinese steel firms have already been impacted by trade cases. Recently, the Commerce Department had imposed 266% preliminary duties on imports of cold-rolled steel from China, punishing Chinese steel makers for dumping or selling below cost. In December, China received a dumping margin of 266% on corrosion-resistant steel products.

These tariffs have helped U.S. imports come down this year. That led to lower inventory levels here and have given U.S. mills the ability to raise prices. Steel prices climbed over the past few weeks, and stainless prices could follow. With the threat of anti-dumping lawsuits looming, the volume of imported stainless sheet and strip had already been diminishing, which should be seen in the upcoming months. The lack of imports has already pushed out domestic lead times and could create a supply shortage once service center restocking starts. However, it's still questionable whether prices will hold just on import tariffs alone. Low international prices will add downside pressure if stainless domestic prices rise, especially since China is the only named party.

Nickel Prices Could Rise Short Term

Nickel is the worst performer among base metals this year. However, we are seeing some price strength in the industrial metal complex that could push nickel prices higher in the short term, especially if the US dollar continues to weaken.

Indonesia's energy minister said in February that the country could ease the ban on nickel ore exports. Indonesia was China's top nickel ore supply country prior to the ban, which enabled the Philippines to catch up.

Back in 2014, when the ban was implemented, nickel was trading above $15,000 per metric ton. However, Indonesian companies didn't expect that nickel would be trading today at half that price.

Indonesia Might Ease Export Ban

Because of falling nickel prices, many of the smelters that miners intended to develop have not materialized. Now, the government is going to review its export ban policy as miners struggle and Indonesia's smelting capacity will not be sufficient by next year amid miners' unwillingness to develop those costly smelting operations.

The removal of the export ban would add more nickel supply to international markets, possibly driving prices down while demand is weak, especially in the energy sector.

What This Means For Metal Buyers

Stainless prices could experience a short-term bounce on new import tariffs and overall strength across the base metal complex. However, prices will likely struggle to rise longer term while demand remains weak and producers don't cut production in a big way.