In a previous article, I outlined my approach for analyzing CoT data to reveal how different types of traders are positioned in the futures markets. If you missed it, give the article a read to see the method behind my analysis.

This is the third in a series of weekly updates that will outline how traders are positioned, and how that positioning has recently changed. I break down the updates by asset class, so let's get started.

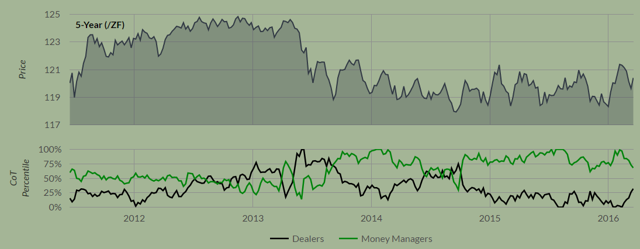

Bonds

No real extreme positioning. Sell-side dealers have quickly gotten long both short-term (NYSEARCA:IEI) and mid-term (NYSEARCA:IEF) Treasuries.

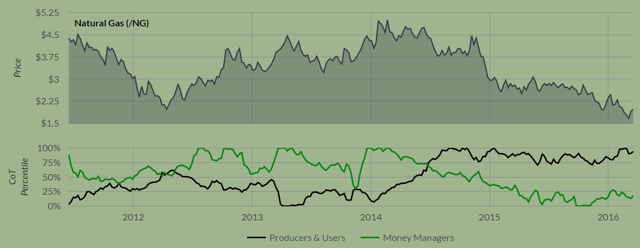

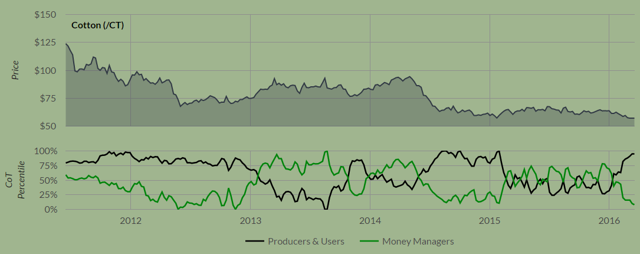

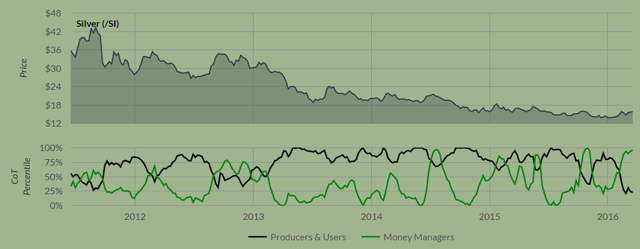

Commodities

Producers and users are extremely long natural gas (NYSEARCA:UNG).

Producers and users are also extremely long cotton (NYSEARCA:BAL) as prices approach a six-year low.

Money managers have quickly gotten long both gold (NYSEARCA:GLD) and silver (NYSEARCA:SLV). This is expected - money managers typically behave like trend followers and add to longs as price rises. Silver is actually now a very crowded long among money managers.

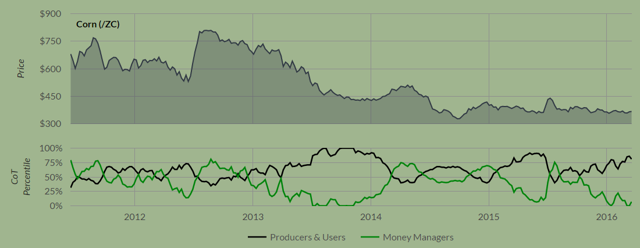

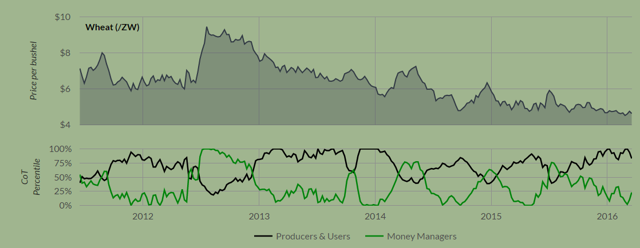

Producers & users are very long agricultural commodities, specifically corn (NYSEARCA:CORN) and wheat (NYSEARCA:WEAT).

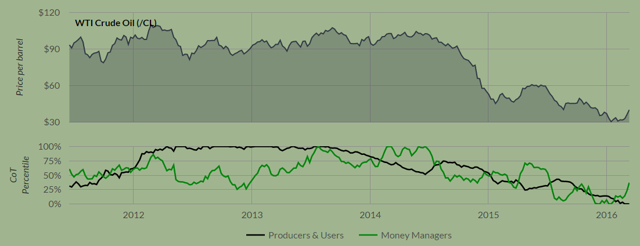

Money managers have continued to cover their huge short position in WTI crude (NYSEARCA:USO). They are now as long as they were at the top of the bounce last May. It is notable that producers and users remain extremely short.

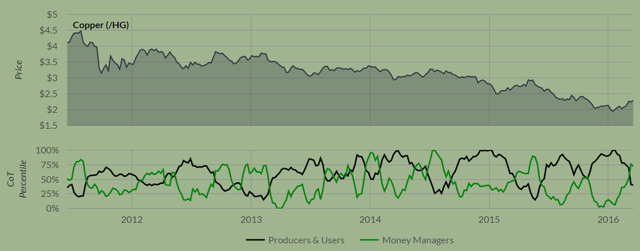

Money managers have also aggressively gotten long copper futures (NYSEARCA:JJC).

Currencies

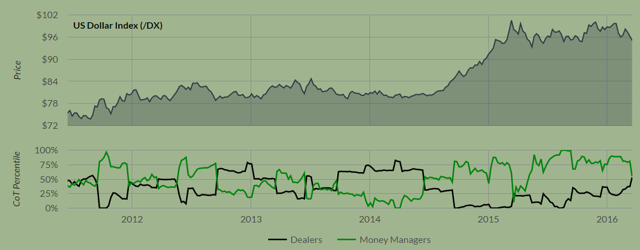

No true extreme positioning. Money managers have cut their long exposure to the U.S. Dollar Index (NYSEARCA:UUP).

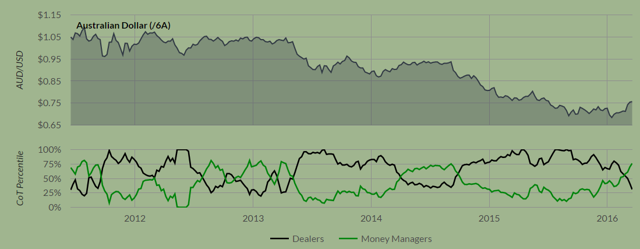

Money managers have piled into the Australian Dollar (NYSEARCA:FXA).

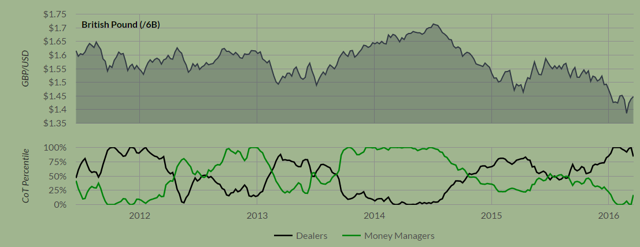

Money managers are still very short the British pound (NYSEARCA:FXB).

Stocks

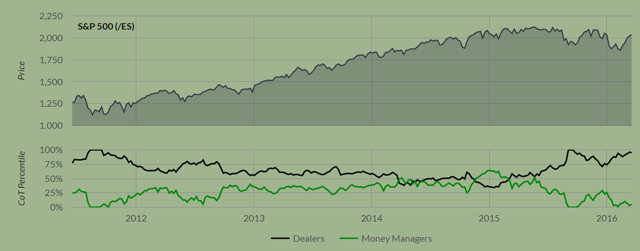

Positioning within stock futures (NYSEARCA:SPY) still defies expectations. Last fall, money managers got extremely short all U.S. equity futures like they were in February of this year. The difference is that during last October's 10%+ rally, money managers covered some of their short. This time around, they have stayed persistently short.

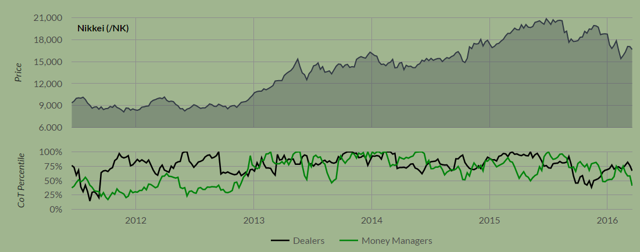

Money managers have actually been getting more short the Nikkei (NYSEARCA:EWJ) as it's bounced.

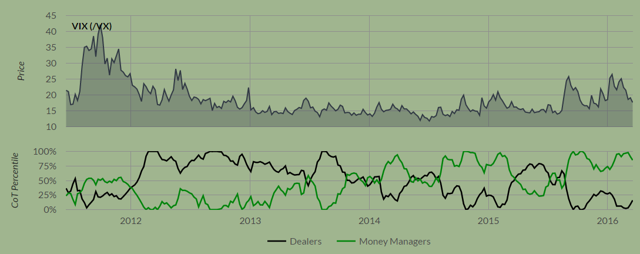

Finally, money managers are very long VIX futures (NYSEARCA:VXX). This goes hand in hand with their equity short. Historically, money managers getting crowded in a long vol trade has marked short-term tops in the VIX. The -45% five-week drop in spot VIX has been the biggest ever, so it's surprising to see money managers only cut their bullish positioning by a bit.

Conclusion

- Money managers have gotten much more bullish on crude oil, gold, silver, and copper.

- Commodity producers and users are extremely long natural gas and cotton.

- Money managers have stayed short U.S. stocks, covering very little during the recent bounce.

If you've got any questions about CoT data, don't hesitate to leave me a comment below.