Staffing is a great business when it's run well, and can be downright tragic when it's not. While Kelly Services (NASDAQ:NASDAQ:KELYA) (NASDAQ:NASDAQ:KELYB) is not the worst-run company in the space, neither is it anywhere close to the best, despite having founded the entire industry in 1946. Shareholders who have been patiently waiting for better margins since the bottom of the crisis are still waiting, while the better-run peer firms have returned to 3-4% margins.

While management does deserve some credit for making some progress in 2015, from my point of view, it's nowhere near enough to make the stock look like a good buy. In fact, with pricing discipline in this fragmented, commoditized industry having remained surprisingly strong over the past few years despite the Affordable Care Act, a shoe may be about to drop thanks to oil/manufacturing weakness.

Ultimately, while Kelly offers plenty of upside if it can materially improve margins, that's a story that has neither played out well for Kelly shareholders nor those of numerous other underperforming staffing companies - and I don't think industry dynamics make this a favorable time to make a contrarian "this time it's different" bet.

Margins Will Continue To Be Challenging

To the extent that there's a bull case on Kelly, it's mostly based on the company's theoretical ability to achieve better margins. Indeed, for quite a while, Kelly had guided to an eventual return on sales (i.e. operating margin) of 4% amidst a stronger economic recovery.

Not only has that not happened, but management has seemingly lost all hope of getting there in any reasonable time frame. As CEO Carl Camden put it on the Q3 call in November (you can find the transcript here on Seeking Alpha):

Obviously you remember where we talked about a 4% return, which was looking at a traditional rebound from a recession. Didn't see the same, some of the industry shifts when we've put out that number that we've experienced now. It's just -- it's different. So in reference to the 4% return on sales number, no, I'm not particularly willing to put out that number.

As I'll touch on in the valuation section, guidance for 2016 does call for some operating margin expansion - but despite the significant cost-cutting program enacted last year, we're still nowhere near 4% and seemingly not likely to get there.

Moreover, the company doesn't operate in a vacuum, and one issue I would watch very closely (if you're a prospective bull) is pricing pressure. I'm actually surprised at how well pricing discipline has held up in the staffing industry over the past few years, what with the challenges of ACA and a recovery that hasn't exactly been gangbusters.

On top of that, the severe decline in oil and gas (a historical strong point for Kelly) and the follow-on "industrial recession" that many manufacturing companies are going through hardly bodes well for pricing. To this end, I thought the comments by Manpower (NYSE:MAN) CEO Jonas Prising on the Q4 call were quite troubling:

I would say that at this point, the pricing behavior overall is still rational, although in some geographies and in deal specific cases it can be quite aggressive. So that's something that we are very aware of and I think we've managed that balance between pricing discipline and volume very well during 2015.

Now, as I mentioned earlier to a previous question, one of the areas that we are looking to make sure that we have the right balance is in the US on the Manpower side specifically. Where clearly, we're seeing the manufacturing slow down, come in, and we want to make sure that we anticipate and that we are at the market rate there. So that's something that we're looking into to make sure that we strike the right balance between volume and pricing.

This is not a threat to take lightly for several reasons. First, Manpower prides itself on being very disciplined on price, so if it's thinking of taking a step back to maintain volumes, that may be indicative of potentially worrisome trends in the market. Second, given their size and reputation, they may be enough to swing the market towards more competitive pricing in response.

Indeed, Manpower has much more room than Kelly to take a step back on margins to keep volumes up, if that is the route it chooses to go. One of the facts I find most interesting is that despite Kelly's gross margins being within spitting distance of Manpower's over the past few years, it has consistently failed to post anywhere near the same operating margins:

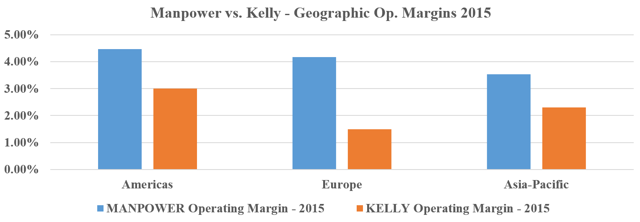

As such, it's not like you can't generate better margins in this environment - for whatever reason, Kelly just isn't. Drilling down a little bit, Manpower posts substantially better margins across all geographies; I prepared the chart below as a visual aid.

Source: author's own work based on Manpower/Kelly filings

Now, there are certainly plenty of nuances here - beyond mix, this is also painting geographies with broad strokes; each company has different exposures and reports them in a different way. For example, Manpower includes the Middle East in its Asia segment, while Kelly includes it in Europe, and Manpower also separates Northern and Southern Europe, which I aggregated for the purpose of this analysis. (For more details, please see pages 22-29 of Manpower's annual report).

Don't get bogged down in the details, though - the fact remains that Manpower not only has substantially better total margins, but it also posts better segment-level margins in its lowest-margin geography (Asia-Pac) than Kelly does in its best geography (the Americas). While I'm focusing on Manpower, other big companies in the space such as Randstad (OTCPK:RANJF) are also posting substantially better margins. So Kelly's problems don't appear to be just the product of a tough macro-environment. Nor can you attribute it to lack of scale, as you can with some of the smaller companies in the space - at $5.5 billion in revenue, you should already be able to extract scale efficiencies.

Valuation: Where's The Beef?

I think almost everyone is in agreement that Kelly, like other companies in the staffing industry, is not going to see dramatic revenue growth, given its relative maturity. Instead, the focus is on whether conscious cost control can ensure that modest incremental gross profits drop to the bottom line. Even if you ignore the pricing threat I discussed previously, this just doesn't seem like a good bet to make.

It's tempting to point to the higher margins others are achieving in the space as evidence that Kelly can get there too, but this is a thesis you could have made pretty much every year since the crisis, and you would have been wrong every single time. It's not just Kelly, either - as I touched on in my writeups of Ciber (NYSE:CBR) and Volt Information Sciences (NYSEMKT:VISI), if it were as easy as waving your magic margin wand and getting to "industry-level" profitability, those companies - not to mention Hudson Global (NASDAQ:HSON) - would already be there.

Yet all those firms are still posting margins that can only charitably be described as "tepid" after years of restructuring, much to the chagrin of the activists battering at the door with pitchforks and torches. With Kelly already having gone through its own round of cost cuts, it's not clear what else management really has left to do at this point besides try to watch every nickel and dime.

The operating/gross margin disparity often leads investors to think buyout, but the firms I mentioned previously would be more digestible bites, with activist pressure to boot, and they have yet to attract interest. (That doesn't surprise me - why bother with the headache?) As for Kelly, given the legacy of the company's controlling shareholder, I view a buyout as even more unlikely.

In the meanwhile, that leaves Kelly looking pretty expensive. The only analyst whose estimates are published is calling for $1.60 EPS in 2016, and that's roughly in line with my own calculations based on management's guidance (I come out at $1.55). 12x EPS isn't a stratospheric multiple, but neither does it seem cheap to me in light of Kelly's lack of revenue growth opportunities, nonexistent competitive advantage, the risk of potentially significant pricing pressure, and poor margin execution over the past five years. I would also point out that Kelly's net income is benefiting from a significantly lower-than-statutory tax rate (20%) thanks to the extension of the Work Opportunity Tax Credit through 2019, making the multiple even higher (if you assume the credit will not be extended forever).

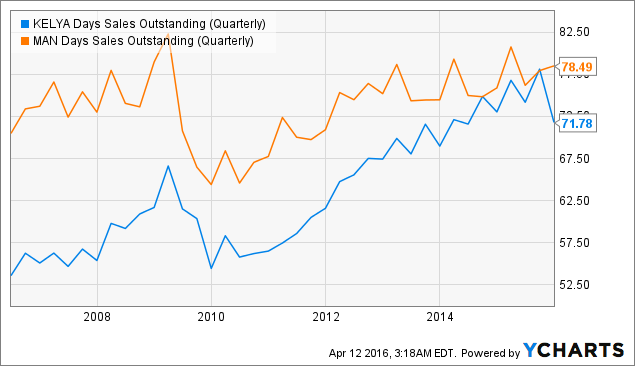

Finally, I know some bulls have also pointed to the company's asset-rich balance sheet as a potential backstop for valuation - indeed, tangible book value as of 12/31 appears to be around $21 (versus the current price of around $19). I don't think this argument's logic makes much sense, though; a significant investment in receivables is part and parcel of the staffing business, and I view it as extraordinarily unlikely that Kelly could get a whole lot of capital back out of receivables. Indeed, going back to Manpower as a comp, if there's anything you can give Kelly credit for, it's somewhat decent receivables management:

Finally, while the company has ambitions of expanding its higher-margin Professional and Technical (PT) and Outsourcing and Consulting Group (OCG), two-thirds of revenues are still driven by low-skill Commercial staffing (think data entry, telemarketing, etc.). While OCG is posting good growth, PT really isn't, and the mix hasn't changed dramatically over the past few years. I do think the company can continue to make progress here, but over the span of a reasonable investment horizon, I don't think it's really going to move the needle given the sheer size of their commercial business.

Wrapping It Up

Kelly Services is essentially a directional bet on management's ability to drive materially higher margins - if you believe they can do this, shares are worth much more than what they're trading for; if you don't, shares are worth significantly less than they're trading for.

Unfortunately, with the better-run firms already achieving margins that are pretty much the peak of what you can expect out of the staffing industry, it seems more likely that pricing discipline will eventually erode and prevent Kelly from driving superior returns. Couple that with execution that hasn't been great to begin with, and I think investors should look elsewhere - and preferably outside the staffing industry entirely - for better opportunities.

Disclaimer: Investing is inherently subjective and this article expresses opinions. Any investment involves substantial risks, including the complete loss of capital. Any forecasts or estimates are for illustrative purpose only. Use of this opinion is at your own risk and proper due diligence should be done prior to making any investment decision. Positions in securities mentioned are disclosed; however, the author may continue to transact in any securities without further disclosure.

This is not an offer to sell or a solicitation of an offer to buy any security. All expressions of opinion are subject to change without notice and the author does not undertake to update or supplement this piece or any of the information contained herein. All the information presented is presented "as is," without warranty of any kind. The author makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use.