Universal Insurance Holdings (NYSE:UVE), may be one of the best buy and hold value investments on the market currently. Why? First some background...

Business Description:

Universal Insurance Holdings is one of the largest property and casualty insurers in Florida.

UVE ended 2015 with only 16% of their insured value coming from states other than Florida. They are attempting to grow this number rapidly to geographically diversify their revenue base.

Currently, UVE primarily sells insurance products through a network of independent agents. However, on April 5th they announced Universal Direct, a Direct-To-Consumer Platform for the sale of homeowners insurance. Direct-To-Consumer sales may accelerate growth outside of the Florida market.

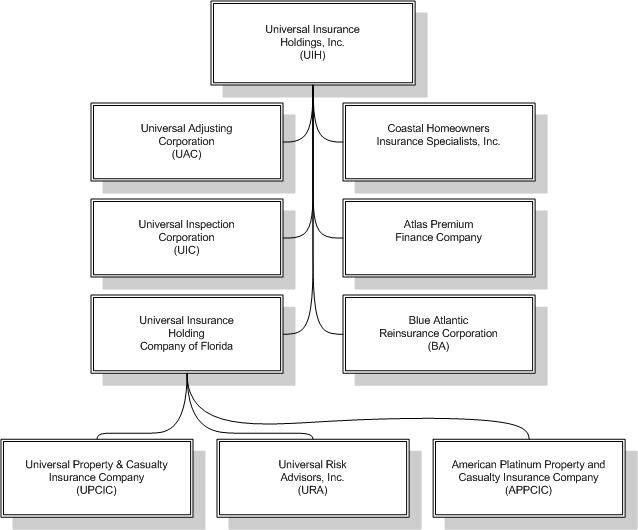

Structurally, UVE is a Vertically Integrated Holding Company with multiple subsidiaries.

UVEs two main subsidiaries are UPCIC & APPCIC:

- Universal Property and Casualty Insurance Company (UPCIC); UPCIC focuses on writing property and homeowners policies. As of this writing, UPCIC is licensed to write insurance in: Florida, Delaware, Georgia, Hawaii, Indiana, Maryland, Massachusetts, Minnesota, North Carolina, Pennsylvania, Alabama, Michigan, New Hampshire, Virginia, West Virginia, New York, New Jersey, and South Carolina.

- American Platinum Property and Casualty Insurance Company (APPCIC); APPCIC focuses on writing property and homeowners policies for Florida homes valued at more than a million dollars. UPCIC does not currently attempt to target this market.

Growth:

- UVE's Annual EPS has gone from $0.44 in 2006 to $2.97 in 2015, a 10-year annualized growth rate of 21.04%. The last five years, EPS growth has accelerated going from $0.50 in 2011 to $2.97 in 2015, a five-year annualized growth rate of 42.81%. Growth is accelerating largely due to share buybacks over the last three years, and an improved Net Margin.

- Revenues have gone from $65.10 million in 2006 to $546.5 million in 2015, a 10-year annualized growth rate of 23.71%. The last five years have seen Revenue go from $225.90 million in 2011 to $546.50 million today, a five-year annualized growth rate of 19.33%. While the growth rate in total revenue may have slowed slightly it is still very healthy.

- Net Income has gone from $17.20 million in 2006 to $106.50 million in 2015, a 10-year annualized growth rate of 20%. Over the last five years, Net Income has moved from $20.10 million in 2011 to $106.50, a five-year annualized growth rate of 39.58%.

There has not been significant hurricane activity in Florida since 2004. This lull has helped drive profitability. At some point, they will probably have a significant Florida Hurricane Season which will affect EPS for a time.

Being a fairly small company, I think they are likely to be able to sustain double-digit growth in all of the above areas for many years.

Debt:

UVE reported $24.10 million in long-term debt on their most recent 10-K. This is a very manageable debt level. Reported long-term debt levels over the last ten years have ranged from $20.20 - $37.40 million.

Valuation:

- Earnings Yield is currently above 17%.

- Current P/E is below 6.

- The Annual Dividend is expected to be $0.56 per share in 2016. Above a 3% Yield at current prices.

- I estimate current per share Intrinsic Value to be $50-$60. This provides a significant margin of safety at current levels.

It is the combination of high sustained growth rates, and low share price that make UVE such an interesting opportunity.

Shareholder Friendliness:

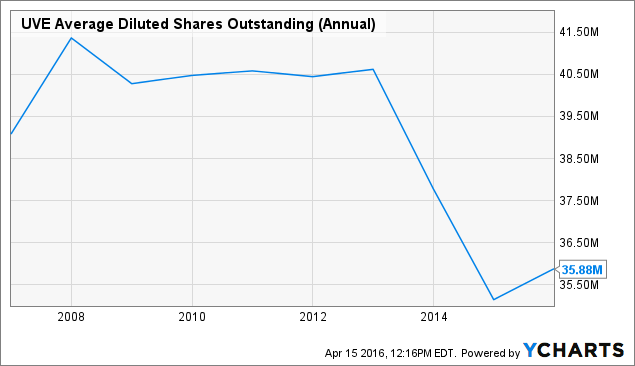

Over the last four years, UVE has brought their Diluted Average Shares Outstanding from 40.6 million to 35.9 million shares outstanding. UVE has the capability to continue sales growth while spending on shareholder-friendly policies like buybacks and dividends, and management uses it.

UVE Average Diluted Shares Outstanding (Annual) data by YCharts

Risks:

Why such seemingly delicious value? A recent short attack prompted by Anthony Bozza's private presentation at the Robin Hood Investors Conference has led to a massive slide in share price. Shares have gone from the low $30s in mid-November 2015 to current levels.

UVE data by YCharts

If their short thesis is correct, then a significant Category 4 Florida Hurricane could wipe the company out entirely. However, if no major hurricanes affect operations in Florida during the 2016 season, as shorts cover the share price will likely return to pre-short attack levels (low $30s) by year-end.

Many of the central claims made by the Shorts appear to me to be either factually inaccurate or overblown. Readers will certainly do well to study their claims and UVE's rebuttal in great detail. The inaccuracy of certain claims made by the shorts are the key to UVE being a tremendous value opportunity versus a terrifying value trap.

It is strongly encouraged that investors read UVE's 10-K for a more complete list of business risks.

Summary:

As with virtually every true value opportunity, there is a high degree of pessimism and uncertainty surrounding the stock. Hyperbolic uncertainty and pessimism are what creates opportunities for the enterprising value investor. I believe UVE to be a tremendous buy and hold opportunity at current levels with a nice dividend to collect while waiting for the market to see reason.

UVE may see further share price declines over the short-term, but if current growth trends continue, longer term investors will likely be very satisfied.