As we sit here in May of 2016, what should we expect from the economy? First-quarter GDP missed the already low expectations by clocking in at 0.5% growth. It will be interesting to see how that number gets revised. Fourth-quarter GDP was 1.4%. These results should not be surprising given that companies reported falling earnings for the fourth consecutive quarter. Clearly, after years of soft monetary policy that moved the Fed's balance sheet to 25% the size of the entire U.S. economy, we are not hitting escape velocity. What will the central bank wizards think of next?

The Japanese central bank wizards think so much of their abilities that they are now one of the biggest investors in that country's stock market. With increasing ownership of private enterprises, what's to prevent an extension of this action towards outright nationalization? While there is certainly hyperbole with that question, it is a stealth way towards that outcome. In the case of the Bank of Japan, its balance sheet is now 77% of that country's GDP. See any problems with that?

Japan now also has to contend with the outcome of the G20 conclave in Shanghai in February where the financial wizards decided that the Chinese yuan needed weakening to help their soft economy. Rather than a direct devaluation of the Chinese currency, as occurred in August of 2015, it was thought best to strengthen the currency of China's biggest trading partners, Japan and Europe. A lack of commentary by the ECB head also created the sense that their QE artillery was going to take a break. These machinations have the effect of weakening the yuan at the expense of the dollar and yet somehow obscure the sleight of hand. The wizards were afraid of another equity market tumble as occurred late last summer.

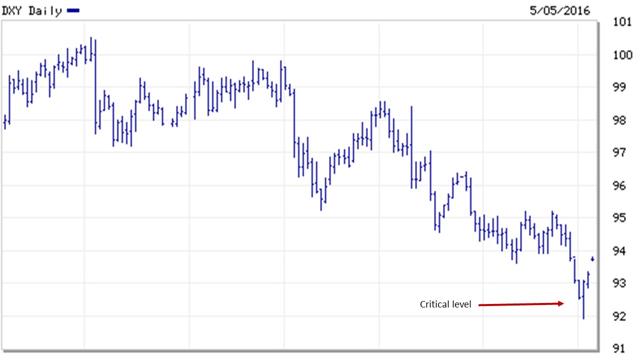

In the world of floating exchange rates, currency manipulations are a zero-sum game. One country's gain is another's loss. Since the G20 meeting, the dollar has weakened while the euro and yen have strengthened. Is this the start of a new trend down in the dollar? The dollar has a very important level in the mid-92 range (U.S. Dollar Index) that will make that determination. This is the low of 2015. This week the greenback made a low around 92 intraday, but bounced very quickly from that level to close at 93.76 on May 5th.

If you have an export-led economy where your GDP is reliant on exchange rates (think China), a change in currency rates, to quote Sheryl Crow, will do you good. For the U.S., not so much, though exporters in this country would certainly welcome it. The bulk of Fed policy is based on growing the economy. While that was not its original charter, it dominates its thinking. What exactly is GDP?

Gross Domestic Product (GDP) is based on population and productivity.

Change in GDP = Change in Population + Change in Productivity

Where: Population is the working-age population

If we want to increase GDP, which is what the Fed wizards target at 2%, we need to increase the working-age population and/or increase productivity. In my book E$caping Oz: Navigating the crisis, I noted in Chapter 4 how there were important economic cycles which ended in 2000. Contained within these cycles were GDP, industrial production, and capacity utilization. I posited that the post-2000 cycle would reflect much slower growth. Central banks rather than let economies progress organically through this slower growth period, chose massive intervention. Their success has been muted by forces larger than themselves.

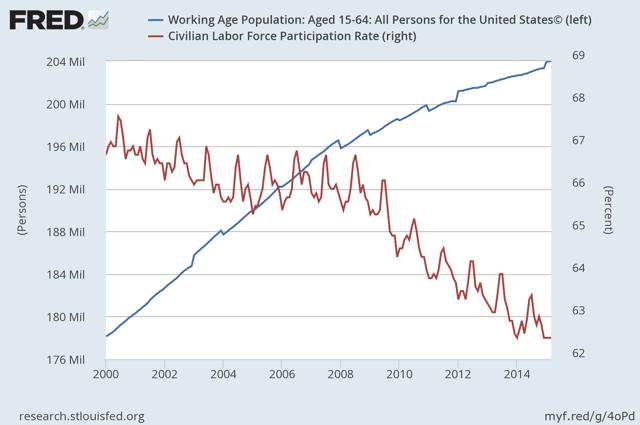

The chart below shows the working-age population and the civilian labor force participation rate. This chart illustrates one of the challenges to increasing GDP. While the working age population has increased, a smaller percentage of them are actually in the game, so to speak.

One might surmise that the participation rate is falling because more people are retiring. Since the early 1990s, however, more people, 55 and older, have participated in the labor force. There are other noteworthy trends. A smaller percentage of those with bachelor's degrees and younger folks (20-24) are in the labor force since the 2008 recession. This is likely the result of more people in that group being in school and consequently not finding suitable work. There are other factors at play here including disability and caring for family members. The bottom line is that the population component of our GDP equation is not helping the cause.

There are other headwinds to the population component. The graying of America over the next couple of decades will place more burden on the traditional working-age population. That is, the percentage of those 65 and over relative to the working-age population will increase. This demographic reality will be instructive not only for GDP expectation, but also for fiscal policy as well.

Now let's take a look at the other part of the equation, productivity. In its simplest terms, productivity measures the efficiency of converting inputs to outputs. If a worker produced 10 widgets last year and this year produces 20 widgets with the same labor input, their productivity increased by 100%. Since the Great Recession of 2008, productivity growth has dropped to levels not seen since the stagflation of the 1970s.

Economists will suggest that a reduction in productivity growth is due to a lack of capital investment. The elixir for this illness is a steady diet of low interest rates. The theory is that the low interest rates encourage greater investment by business. Sound familiar? But it has not worked out this way for the wizards. Instead, corporate debt has increased to record levels, fostering share buybacks and consolidation. The path of least resistance is to buy the competition and acquire debt to do so. So instead of businesses investing for the future, they are levitating equity prices.

The other problem with productivity growth is that since the U.S. produces fewer goods, more of the economy is dependent on the services sector. I would submit that it is more difficult to achieve productivity gains through this sector. Early in my career, I worked in hospital management where we had to measure productivity for various departments. Benchmarks were established that determined how many labor hours were required to perform a particular service. If fewer hours were required in a given period, a department was deemed to be more productive than the expectation. This of course varied and it was not uncommon for departments to request a revision of the benchmark. The point here is that measuring productivity in the services sector is not an exact science.

Consider also that productivity gains in the services sector could come at the expense of reduced labor inputs. Minimum wage legislation and other regulation will impact labor force participation in the services sector. Think about your visit to grocery stores or the large hardware chains where you can act as your own cashier due to automation.

Leveling population growth and other demographic factors will constrain the GDP number. Near to intermediate term, the economy will also lag with productivity growth even if we can be totally accurate in its measurement. So much corporate debt has been acquired, which will need refinancing at potentially higher rates, and with shrinking earnings, that future capital investment will be muted.

The unemployment rate likely bottomed and corporate earnings are lagging. Industrial production has fallen for seven consecutive months on a year-over-year basis. The IMF and World Bank have cut their forecasts for 2016 and 2017. World trade fell on a volume and dollar basis in the early part of 2016. Import and export activity in the U.S. fell as well. These are all recessionary harbingers.

In an effort to grow the economy, the central bank wizards have taken to quantitative easing, zero interest rate policies, and even the folly of negative interest rate policy. This has led to a path of destruction for saving and investment and inflation of financial assets.

Don't look for the next president, whether Democratic or Republican, to reverse this trend. Most politicians do not understand the adverse effects created by central bank policy, and I don't anticipate that changing in this election cycle. The reality is that we've experienced low growth in other periods of our economic history. The difference now is the overhang of debt and the massively bloated central bank balance sheets and the artificial markets. What will history say about the Fed's performance? Historians will conclude that they should have stopped pressing buttons and pushing levers.