"The root of all superstition is that men observe when a thing hits, but not when it misses." - Francis Bacon

Looking with interest our anticipated weakness in USD/JPY coming to bear fruit from 107 since our last post to 109.11, and given we decided to start writing our conversation on Friday the 13th of May, which, for some people, is clearly of "significance", particularly for Stevie Wonder given it is birthday and that we share the 13th as the day, not the month or year for our respective birthdays, we could not resist but pay homage to this great singer once again (see our previous related Stevie Wonder 2013 reference "Misstra Know-it-all") by making a reference to his 1972 "Superstition" song in our title analogy. The song was Stevie Wonder's first number-one single since the live version of "Fingertips Pt. 2" topped the Billboard Hot 100 in 1963. The song's lyrics are chiefly concerned with superstitions, mentioning several popular superstitious fables throughout the song, and deal with the negative effects superstitious beliefs can bring:

"When you believe in things that you don't understand,

Then you suffer" - Stevie Wonder, Superstition lyrics

Obviously our "superstitious" beliefs since early 2016 have not been that "negative" from a P&L perspective rest assured given we have been advocating going long the 30 year US Treasuries as well as gold and gold miners for a while since the end of 2015, meaning for us that, when you believe in things you actually do understand such as "The return of the Gibson paradox" as per our 2013 rambling, you do not suffer; on the contrary, you thrive:

"Gold price and real interest rates are highly negatively correlated - when rates go down, gold goes up. When real interest rates are below 2%, then you get bull market in gold, but when you get positive real interest rates, which has been the case with the rally we saw in the 10 year US government bond getting close to 3% before receding, then of course, gold prices went down as a consequence of the interest rate impact." - Macronomics, October 2013

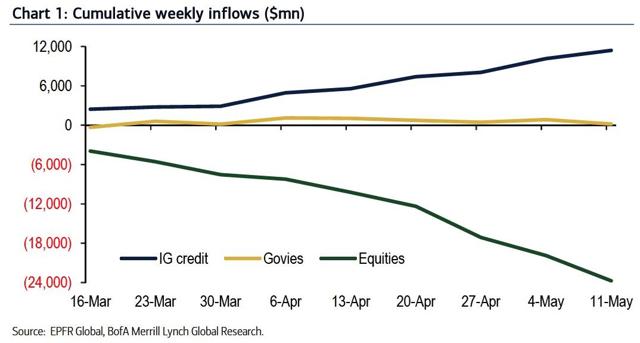

Whereas some people have been rightly "Superstitious" over time when it comes to "Sell in May and go away", from the latest raft of "flow data" it seems that there is a continuation in the "Great Rotation" from "equities" into "bonds", particularly in "Investment Grade" credit, confirming our recent musings on the subject.

When it comes to "Mathematics" and "Superstitions" relating to Friday the 13th, the interval between two Fridays the 13th is respectively 27, 90, 181, 244, 272 or 426 days. Therefore there can be an interval of more than a year between two Fridays the 13th. Interestingly enough it happened on the 13th of August 1999 and the 13th of October 2000. What we find amusing is that the infamous "Dot-com" bubble saw the NASDAQ peak on Friday the 10th of March 2000 at 5132.52, very close to the middle of this rare interval and the birthday of yours truly which was on the following Monday. Given next Friday the 13th will be next January, could it be that we will experience the "peak of the market" in the middle of both dates therefore on Monday the 12th of September this year? We wonder and yet it seems we ramble again, this time towards "Superstition" and are left "guessing".

In this week's conversation, we would like to look at the narrowing gap between US and European Investment Grade Credit as well as the impact of the ECB's global corporate bond buying binge programme aka CSPP (Corporate Sector Purchase Programme) to "credit quality". We will also as well "revisit" our US CCC "credit canary" indicator.

Synopsis:

- Macro and Credit - When the ECB starts playing with "credit quality"

- Macro and Credit - The "CCC credit canary" is still pointing towards "exhaustion" in the credit cycle

- Final chart: The world was poorer in terms of yield in the government space, thanks to the ECB it's spreading into Euro denominated corporate credit

- Macro and Credit - When the ECB starts playing with "credit quality"

One of the prime effect of the "buying corporate credit binge" from the ECB has led to a significant increase in effectively "zero coupon issuance" in the Investment Grade space such as the latest 2020 issue from Unilever as per our most recent conversation:

"To paraphrase du Pont de Nemours, in forcing credit investors to exchange an interest-bearing proof of debt for another which bears no interest (recent issues in the European Investment Grade land are zero coupons...), you will have borrowed at the sword point of the ECB." - source Macronomics, May 2016

We also added at the time:

"The recent decision by the ECB will no doubt boost the rally into credit in Europe into "overdrive" and as expecting we are already seeing more and more large corporate issuers issuing de facto "zero coupon" thanks to our "Generous Gambler" aka Mario Draghi. As we pointed out in our previous missive before going for our R&R, it seems to us that the ECB is failing because it is enticing the money "uphill" namely into "bond speculation" where all "the fun is", not downhill, to the real economy. Flow wise this exactly what is happening. The "fun" is in the bond market and particularly in the European investment grade market" - source Macronomics, May 2016

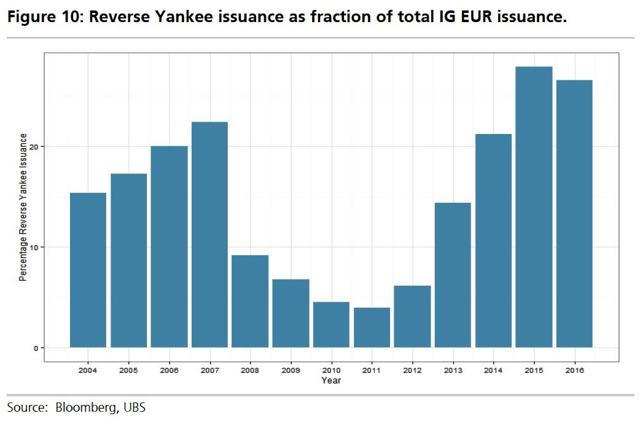

What is of interest is that thanks to its global corporate program, not only EM Corporate will benefit from the ECB's "generosity" which will no doubt trigger "mis-allocation", but, US issuers have been coming in drove to European shores thanks to "Reverse Yankees" issuance.

When it comes to issuance, obviously from a "flow perspective", at least in Europe, Investment Grade credit has been the prime beneficiary of the latest policy as indicated in UBS Global Credit Comment note on EUR credit from the 10th of May entitled "Who's issuing and what are they doing with the capital?":

"Euro IG issuance strong, HY weak

The ECB CSPP has given the Euro IG primary market a kick start in March. We have since seen a pick up in BBB and BB issuance coupled with a tightening of spreads and smaller new issue premiums. Issuance in the Auto and Telco sectors YTD is already above the total issuance for 2015. There have been surprisingly few debut issuers in IG and we do not expect a radical change in issuer behavior on the back of CSPP. HY issuance has failed to benefit and is lagging far behind IG and last year's issuance.

What is being done with capital?

Issuance programs and borrowing needs are usually pre-determined, so we don't expect CSPP to radically alter issuer behaviour. We will probably have to wait until these recent borrowings filter through the cash flow statements to find a real trend.

We have looked at the cost of capital of corporates refinancing themselves via bonds compared to dividends yields. Here, we see that the majority of 2016 issuers have a much higher dividend yield than bond yield." - source UBS

As expected, the "yield hunters" have been front-running the ECB's move which have led to a significant compression in credit spreads in the process.

What is also of interest to us is that given the on-going deleveraging of the European banking sector, there is of course a transformation of the "corporate funding process" given that thanks to banks bloated balance sheets and on-going reduction of assets, issuers have to rely more on the bond market rather than on the traditional loan market, which in some way marks an "Americanization" of the European corporate bond market as indicated by UBS in their note:

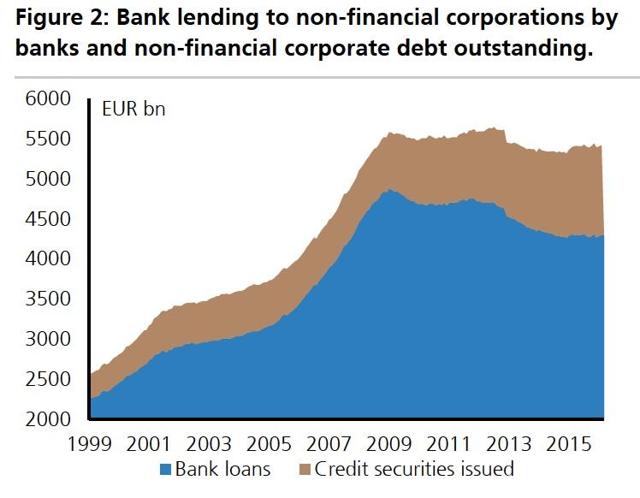

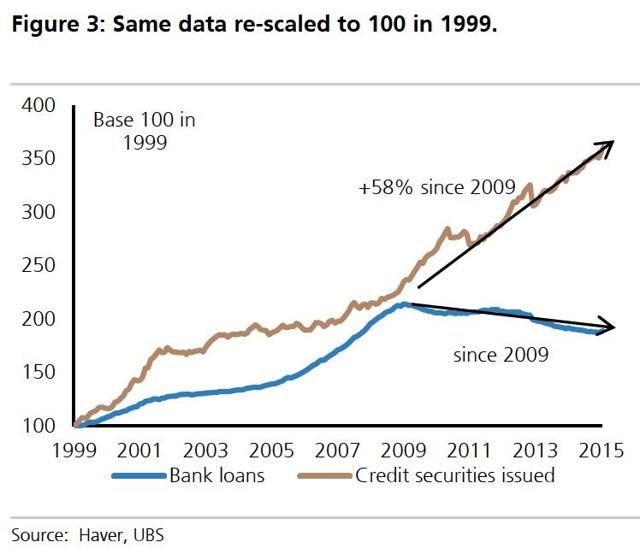

"The slow transformation of capital structure in Europe from bank loans to credit continues. Although about 79% of funding is still from banks (Figure 2) the trend toward a more US-like funding model is clearly underway after an acceleration in 2009.

Structurally this transition could be helpful for growth in the Eurozone as bank balance sheets could be freed up to fund SMEs rather than mid- to large-cap firms (for example see this speech by Yves Mersch in 2014). The ECB is therefore likely to remain supportive of this structural transformation.

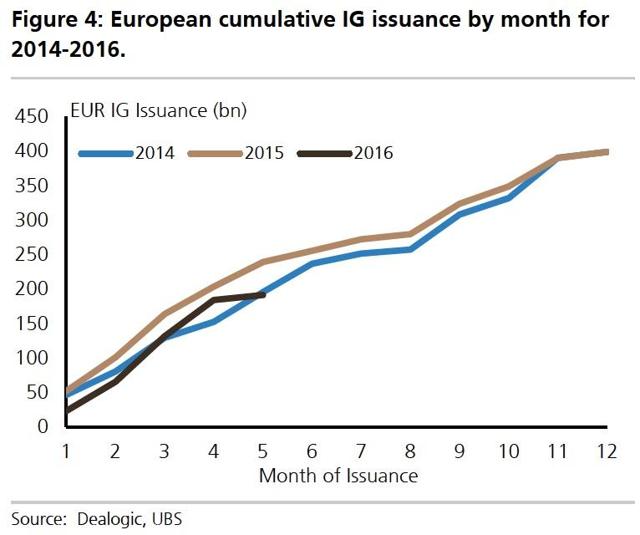

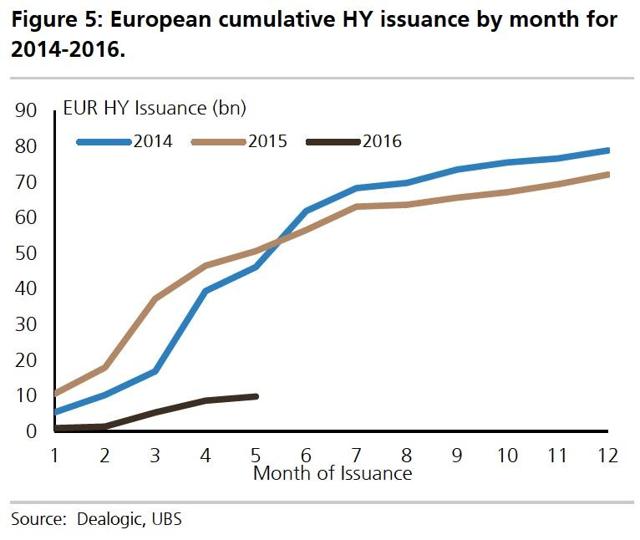

The structural trend is clear, but how are we doing so far in 2016? There is good news and bad news: IG is keeping track with 2014 and 2015 (Figure 4) whereas HY is lagging far behind (Figure 5).

Euro IG issuance over the first four months of 2016 was €191 bn, the second highest figure on record for the first four months of the year. Issuance in April was the largest in any April since 1999. Up until early March, 2016 issuance was below last year for the same period. Then came the announcement by the ECB to include non-bank corporate bonds into the QE programme, which proved to be a game changer. Issuance picked up sharply and the week following that announcement was the largest week of issuance on record at ~€30 bn. For more information on the ECB CSPP please refer to our earlier publication (ECB CSPP: Additional details). In contrast HY lags far behind previous years, with €9.8 bn printed to the end of May which is just a fifth of issuance to end of May in 2014 (€46.1 bn) and 2015 (€50.6 bn).

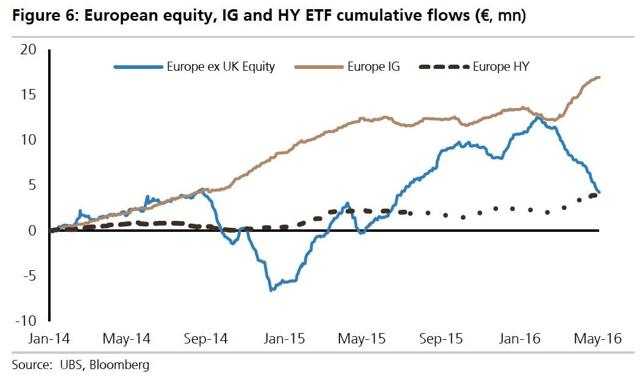

European credit has benefitted from an increase in popularity this year amongst ETF investors. Fund flow data shows that ETF investors returned to European credit funds in March, following nine months of flat AUM. The €1 bn March inflow into European HY ETFs was the largest on record.

At the same time, the concession on new paper has been eroding given this sharp increase since March. Yields have fallen and the gap between corporate and government bond yields has been squeezed. We have seen A1/A+ rated corporate issuers print paper with a 0% coupon and 0.08% yield in April.

Although issuance terms are clearly better since CSPP was announced, we have not seen a radical change in issuer behavior. Issuance programs and borrowing needs are usually pre-determined, and we do not think this will lead to a substantial increase in debut issuers." - source UBS

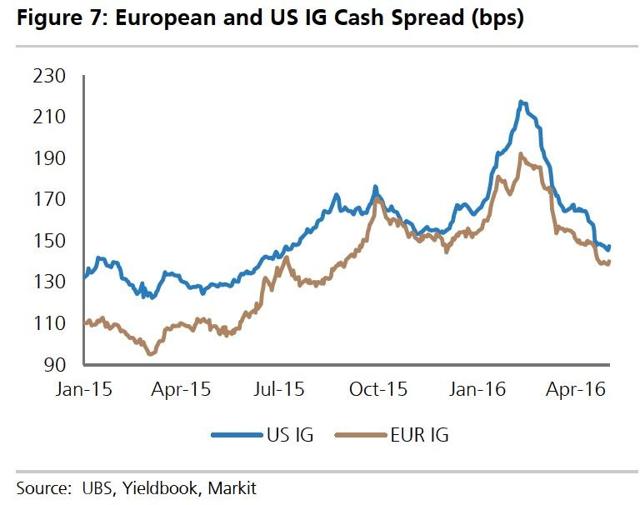

Whereas we indicated in April in our conversation "Paradise Lost" and also in early March in our conversation "The Paradox of value" that the US investment grade market was no doubt the only game in town when one looks at the performance of the asset class relative to US High Yield; it seems to us that, relative to European Investment Grade, it has lost some of it appeal as clearly indicated in the gap closing between US and European Investment Grade as per UBS's note:

- source UBS

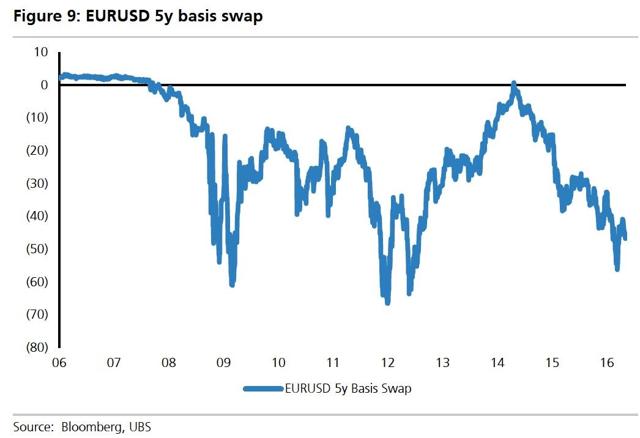

This is most likely due to global issuers such as US issuers conceding to the siren call of the ECB which thanks to the current level of the strong negative EUR/USD basis seems to be irresistible as per UBS's note:

"US issuers benefitting from low European rates

At the moment the EURUSD basis swap is strongly negative, but given the yield differential between the US and Europe it is still relatively cheap for US issuers to swap their liabilities from EUR back to USD (Figure 9).

Combined with a central bank that is not only keeping risk-free rates low but also offering to buy the bonds of foreign issuers (assuming they meet eligibility requirements) this makes a compelling case for US issuers. It also allows for diversification of funding.

Over the last three years reverse Yankee issuance has been around a fifth to a quarter of all IG EUR issuance. This year the reverse Yankee issuance year to date is close to the total issuance for the whole of last year so it looks like US issuers are making use of the favorable conditions in the Eurozone.

These issues could also qualify for the CSPP provided the criteria is met, including issuing the notes in euros through a local European subsidiary." - source UBS

So not only is the ECB continuing to support the "deleveraging" process of the financial sector in Europe and providing "cheap financing" to both European Governments and Corporates alike, it is now as well providing "cheap funding" to the rest of the corporate world! It seems that the terms we used last week about an "epic credit bubble" forming are nowhere close to just "superstition".

From a "flow perspective" as we pointed out last week, the "fun" continues to flow "uphill", leading to a "frenzy" in bond market speculation, but for now, not really flowing "downhill", to repeat ourselves, to the real economy. This buying spree is materializing in "flows" as indicated by Bank of America Merrill Lynch in their Follow the Flow note from the 13th of May entitled "IG credit in the limelight":

"The X factor

High grade credit has definitely got the X factor, as the ECB embarks on corporate- QE from next month. Flows into the asset class saw a strong U-turn over the past nine weeks. Outflows seen over the first weeks of the year are now almost erased.

On the contrary outflows continue from equity funds, as investors struggle to see inflation or earnings picking up any time soon. Moreover, on the other side of the high quality fixed income spectrum, government bond funds have barely seen any inflows in the same period as high-grade credit is in the limelight.

High grade funds had yet another week of inflows, the ninth in a row. On the other hand, high yield fund flows turned negative, erasing the gains from the previous couple of weeks. This was the highest outflow from the asset class in six weeks.

Government bond fund flows remained volatile, recording an outflow over the past week (after a brief week of inflow), the highest in nine weeks.

Away from QE eligible assets, equity fund flows recorded their fourteenth week of consecutive outflows, the longest streak since 2007. Last week's outflow raised the total outflows for the year to over $31bn." - source Bank of America Merrill Lynch.

From a "flow perspective" and "leverage cycle" and "relative value", European High Yield boast more favors from investors although it offers lower credit spreads (but less leverage than US High Yield) as well as strong support from retail inflows into ETFs. It seems the "Great Rotation" from equities to bonds is running unabated making so far "flow wise" Investment Grade" the big winner of this "flow process"; no superstition there, just plain facts.

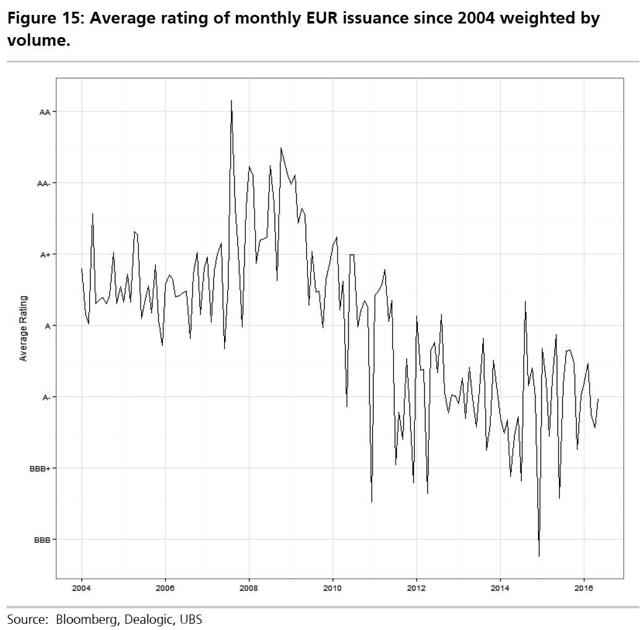

But if indeed ECB is playing the "pumping up the issuance volume" game in the credit space, then something is going to give, and that is credit quality given in most recent years CFOs in Europe have been more "defensive" of their balance sheets compared to the US and its "buybacks binge" financed by "cheap credit" (hence a faster rise in leverage and deterioration of credit metrics). When it comes to the "quality risk factor", we have to agree with UBS's take from their recent note:

"Deterioration of credit quality

As the European credit market has matured and grown since 2004 the quality of credit issuance can be broken into three phases. From 2004 to 2009 average credit quality improved slightly from A, peaking at AA- in 2009. In the next phase from 2009 to 2014 average credit ratings fell to BBB. In the third phase since 2014 credit quality has been on a slowly improving trend. But as we have noted above after the ECB's announcement of the CSPP quality has ticked downwards slightly to an average of BBB+. This recent trend is also visible in Figure 20 which shows issuance broken down by rating in the form of a heat map. Please refer to our recent piece on the credit quality of the iBoxx universe; European Credit: Fallen angels or rising stars?

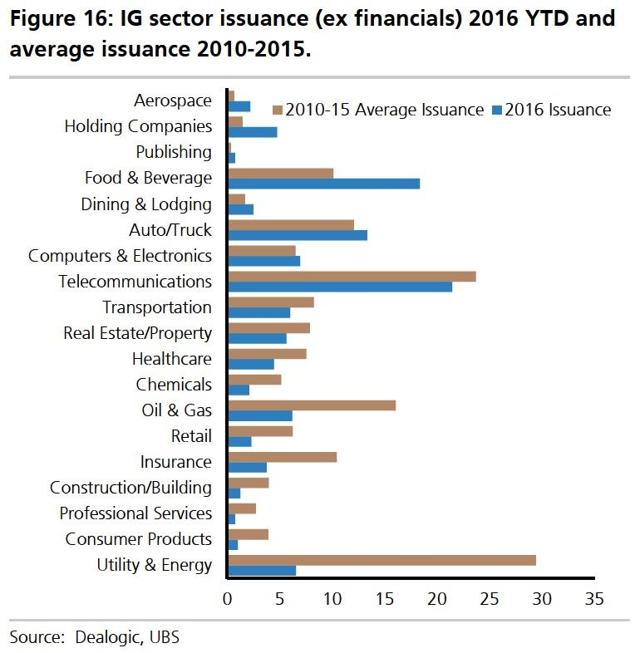

Which sectors are lagging/leading issuance in 2016?

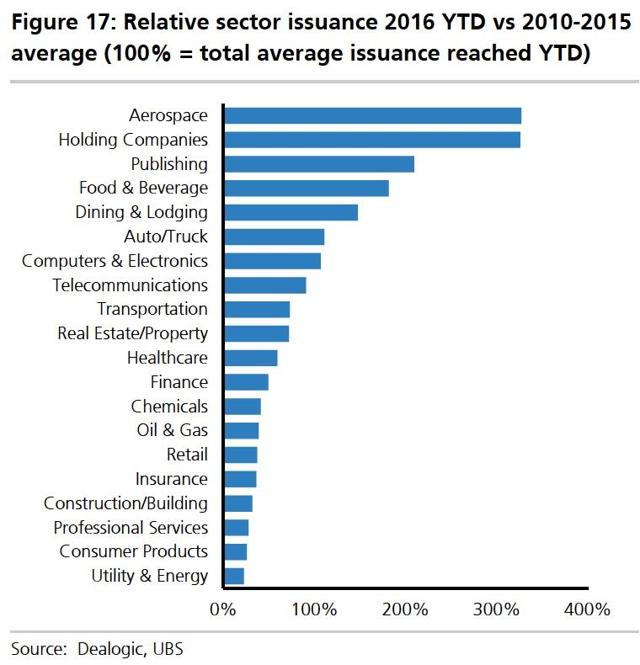

We are wary of a situation in which new issues are concentrated in one sector, as we saw in the US with energy producers over the last few years. This often signals a mis-allocation of capital and may end with a sharp correction as business conditions change adversely for that sector and capital is withdrawn, as occurred in the energy sector in the US. European sector issuance seems to be fairly well diversified. In Figure 16 is YTD issuance for each sector (excluding Financials) vs the average amount issued per year from 2010-2015.

Figure 17 shows the sectors sorted as a ratio such that 100% means we have reached the year total average issuance already in March.

- source UBS

Thanks to NIRP and its QE, the ECB is now following the same Fed path in encouraging "oversupply" and a "credit binge" which will no doubt entice further "mis-allocation" of capital in conjunction with a deterioration in credit quality and credit metrics it seems, no "superstition" there either we think.

Moving on to our "CCC credit canary" indicator which we have discussed on numerous occasions, whereas High Yield in Europe is still supported by "flows", particularly in ETFs as discussed above, the fall in issuance in this bucket, in conjunction with a significant drop in CLO issuance point, we think towards exhaustion in the credit cycle.

- Macro and Credit - The "CCC credit canary"is still pointing towards "exhaustion" in the credit cycle

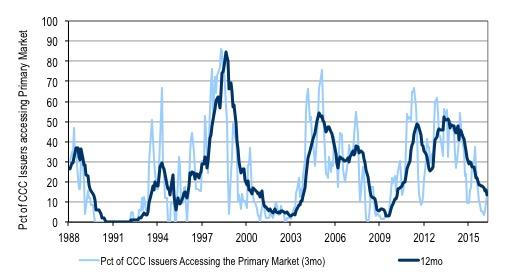

As we pointed out in October 2015 conversation "Bouncing bomb", low quality speculative grade net issuance has fallen sharply in a replay of late 2007 as the stimulative effects of past Fed quantitative easing wears off as shown in a recent chart from Bank of America Merrill Lynch's monthly chart book:

- source Bank of America Merrill Lynch

As we pointed out last week in our conversation "Sympathetic detonation":

"Every single time the "CCC Credit Canaries" have been less and less "able" to tap the primary markets, the High Yield default rate went significantly upwards. As we have told you before, cost of capital, "hiking" or "not hiking" by the Fed is going up in an environment where issuers have weaker fundamentals, falling EBITDA and higher leverage which is not a good "credit recipe" for "total return players" (which by the way have a significant exposure in dollar terms) as well as for "forward returns" on the asset class itself." - source Macronomics

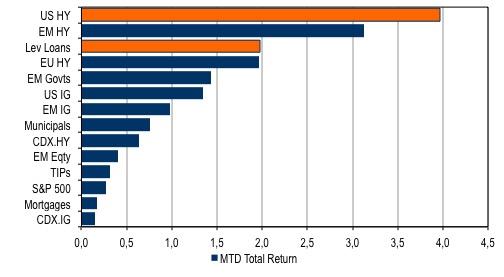

While the rally seen as of late has been "significant" in terms of performance as shown in the below table from Bank of America Merrill Lynch displaying the month to date returns for the month of April, "flows" in US High Yield are indicating further deterioration ahead and one would be wise to starting taking his chips out of the proverbial poker table we think, us not being "superstitious" but, you might be running out of "luck" soon:

- source Bank of America Merrill Lynch

"Flow" wise, apart from Europe, as far as US High Yield is concerned, is showing "contagion" from the ETF sphere (The iShares iBoxx High Yield Corporate Bond ETF (HYG), the largest high-yield ETF, had $3.6 billion in redemptions in six days ending May 6) to the mutual funds sphere according to Bank of America Merrill Lynch High Yield Flow Report from the 12th of May entitled "Outflows spread to open-ended funds":

"HY non-ETFs see first outflow since Feb 17th

US HY recognized its second consecutive weekly outflow, again led by ETFs which lost $691mn or -1.8%. As was the case last week, the ETF redemptions were limited to HYG with other notable HY ETFs not experiencing equivalent outflows. As such, we believe these redemptions were used to gain exposure to the underlying bonds making up the ETF and do not consider it an overly bearish signal for the market. However, open-ended funds also experienced net redemptions last week with a $91mn (-0.1%) outflow, their second negative print since February and third consecutive weekly decline. In our opinion, the outflows from open-end funds are a much more negative sign and provide yet another reason why we believe the recent rally may have already seen its end." - source Bank of America Merrill Lynch

Given the significant performance of High Yield during the month of April, it would be reasonable we think to start booking some profit.

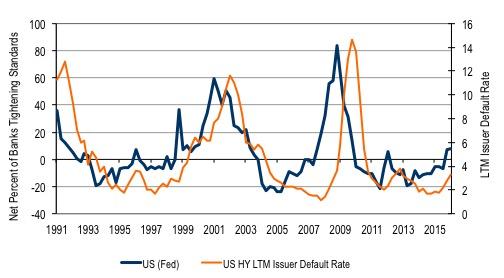

Also, the latest Senior Loan Officer Lending survey points towards additional tightening. Deterioration in non-bank lending standards illustrate an overall tightness in US financial conditions and therefore signal a downside growth risk to the US economy. At least this is exactly what the flattening of the US 2-10 yield curve is telling you as of late! The tightening in lending conditions can be seen below in another chart from Bank of America Merrill Lynch:

- source Bank of America Merrill Lynch

With tighter lending conditions default rates may rise materially through 2016, which will continue to weigh significantly on US High Yield and the issue is not confined only to the Energy sector.

But, as pointed out in our October 2015 conversation, simply tracking bank lending standards is not sufficient to gauge how the corporate credit cycle is evolving hence our "CCC credit canary" issuance indicator. Also, in our conversation "The False Alarm" in October 2013 we stated:

"If we take CCC Default Rate Cyclicality as an early indicative of a shorter credit cycle, then it is the rating bucket to watch going forward

Why the CCC bucket? Because there has been this time around a very high percentage of CCC rated issuers accessing the primary market in High Yield.

A rise in defaults would likely be the consequences of a deterioration in credit availability. Credit ratings are in fact a lagging indicator." - source Macronomics

We will reiterate our 2013 advice for credit investors: watch CCC default rate going forward. Because it matters, more and more.

In relation to our "CCC credit canary" concerns, we read with interest UBS's take from their Global Credit Comment note from the 10th of May entitled "Decoding the US triple C debt concerns":

"Decoding the US triple C debt concerns

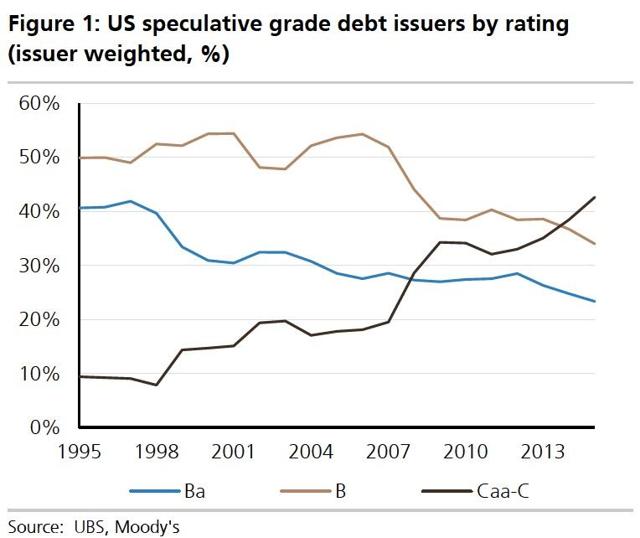

The amount of lower quality, risky corporate debt is a crucial input to assessing the inherent structural risks in global credit markets. In rating agency parlance this is synonymous with the proportion of triple C rated debt, and the bulk of which lies in the US. Our prior research has flagged the substantial rise in triple C issuers outstanding since the 1990s, peaking last year at 42% of all issuers, up from 14% and 18% in 1999 and 2006, respectively(Figure 1).

That said, investors have consistently pointed to lower estimates in the mid double digits and inquired about how to reconcile the stark divergence. Below we decode the discrepancies and discuss the key takeaways.

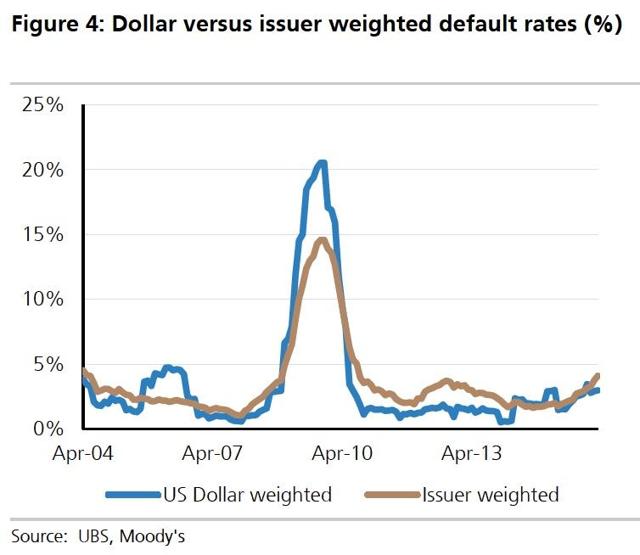

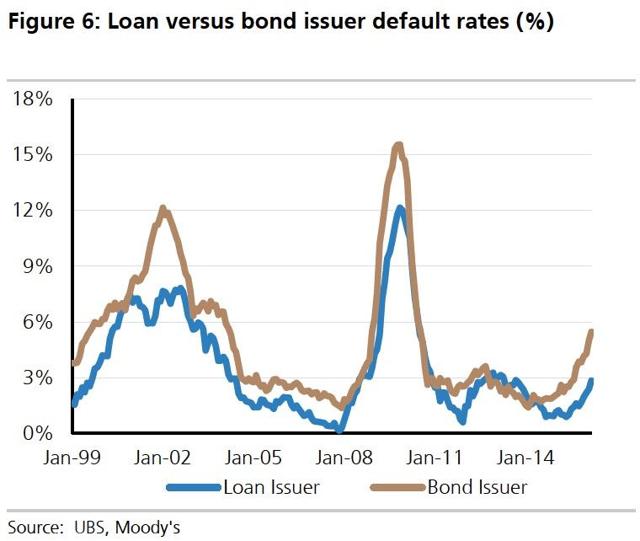

In short, the current estimates are lower if one considers only the high yield bond universe, utilizes index (or average) ratings and weights the universe by debt outstanding. This mosaic suggests triple C concentrations in the 15% context, above the 12% and 9% observed in 2006 and 1999, respectively, but below the 30% peak in 2008. We attempt to build on to that lower estimate using different permutations around the calculation for triple Cs to illustrate the components; i.e., we can perform a rough sum-of-the-parts analysis to build up from 15% to 42%.First, calculating triple Cs based on issuer versus debt weightings accounts for roughly 8% of the difference. This likely reflects the reality that abnormally low yields and robust credit inflows allowed more issuers to tap speculative grade bond and loan markets; given rating agencies assign ratings based on business and financial risk profiles, smaller firms by nature suffer more on the business risk profile assessment. However, we do not take much comfort in this fact in that we struggle to envision an environment where smaller defaults do not cascade or coincide with larger defaults. We view the surge in smaller lower quality issuers as consistent with commensurate increases in other non-index eligible corporate funding such as private placements, P2P and like non-traditional issuance that has manifested itself to satiate the reach for yield. And historically, issuer and debt weighted default rates have been fairly highly correlated (Figure 4).

Second, our analysis suggests about 8% of the differential is due to index or average versus Moody's ratings. How can Moody's ratings suggest nearly 50% more triple Cs than that of S&P/Fitch (on a debt weighted basis)? Macroeconomic assumptions do not appear to differ materially; neither is particularly non-consensus in their economic or profit assumptions. It is not the case of one industry or sector (e.g., energy, metals/mining) that largely explains the discrepancy; in aggregate, commodity-related industries only comprise about 30% of all triple Cs (and the result is similar whether we use index or Moody's ratings). Nor do differing recovery ratings appear to be a key factor. In short, Moody's may take a more conservative approach, but it appears broad-based and not unwarranted. Perhaps they are closer to in-line with market expectations, but by nature rating agencies are never ahead - but rather typically woefully behind.

Third, the remaining 11% is due to inclusion of HY bonds and leveraged loans versus HY bonds alone. The LL universe expanded aggressively in the prior cycle driven by LBO activity, and the space grew substantially again driven by sponsor-led M&A and releveraging actions. In practice, many leveraged loans rated single B effectively encompass issuers with triple C default characteristics offset by secured collateral to lower the loss in default.

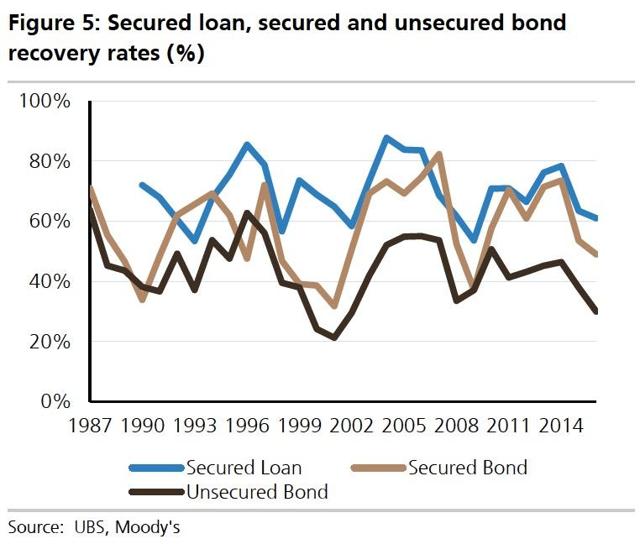

But will the theory work in practice? There are some reservations. First, realized recovery rates are already disappointing expectations. Trailing 12-month secured loan recoveries are averaging $57 (versus $70 modelled), while unsecured bond recoveries are $25 (versus $40 assumed) even absent a high default, recessionary environment. Part of this is due to peak earnings and multiples facilitating excessive corporate leverage, a phenomenon we have documented previously which ultimately depresses recovery rates based on normalized firm values. Second, the number of covenant-lite loans has risen from 20% to 70% in this cycle. These structures are largely untested, but they typically lack proper covenant and collateral packages. The risk is that these loans recover more akin to secured bonds (averaging $47) than secured loans (averaging $57, Figure 5).

Third, the number of loan-only leveraged loans have risen from 5% to 30% post-crisis. These are loans without bonds to absorb losses below them and, in turn, could suffer lower recovery rates. Fourth, we believe leveraged lending and other regulations will tighten funding requirements for distressed borrowers in a downturn. The basic premise is banks are crucial providers of liquidity in stress as they are less mark-to-market sensitive; conversely, many new capital providers stepping in will not have such a luxury. And finally, recovery rates are strongly negatively correlated with default rates, which we expect to be near record levels given the higher proportion of lower quality bonds and loans and high degree of default correlation (Figure 6).

Distressed supply will come not only from advanced, but increasingly from emerging markets given structural risks in EM corporates.

In short, most metrics of lower rated debt in this cycle are above to materially above that witnessed in prior cycles at this stage. Investors analyzing the lower versus higher estimates should largely dismiss differences due to semantics such as rating agency selection or default weightings, in our view, which account for roughly three-fifths of the total. While it is true that roughly two-fifths are due to the surge in (lower quality) leveraged loan issuers, we do not take too much comfort in trading higher default risk for lower losses in default as we feel the latter will likely disappoint versus expected recoveries - akin to what is precisely happening now." - source UBS

It is not a question about being "superstitious" but given the "size" of our "CCC credit canary" in conjunction with Cov-lite loans, and we would like to repeat what we said in our conversation from May 2015 entitled "Cushing's syndrome":

"On the subject of "Overmedication", for us it means that the fall in interest rates increases bond prices companies have on their balance sheets, exactly like inflation (superior to what an increase of 2% to 3% of productivity and progress) destroys the veracity of a balance sheet for non-financial assets meaning that in the next downturn, we expect the recovery rates to be much lower than in previous cycles!" - source Macronomics, May 2015

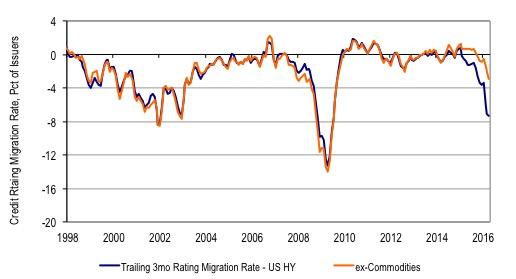

Furthermore the strong "relief" rally in the High Yield Energy sector doesn't change our opinion in the lateness of the stage we are in the credit cycle. We can also point to another chart from Bank of America Merrill Lynch that clearly shows the deteriorating trend in US High Yield. For instance the chart below shows the trailing 3 month migration rate for US Investment Grade and US High Yield:

- source Bank of America Merrill Lynch

So one might rightly ask, where do we go from here with your "CCC credit canary"? We would like to point out to Bank of America Merrill Lynch's take from their recent High Yield Strategy Chartbook note from the 4th of May entitled "Back to where we started":

"Where do we go from here?

Perhaps nothing illustrates the irony of this rally better than recent bankruptcies of EXXI and MPO. These issuers ultimately succumbed to the oil glut, filing for Chapter 11 protection in April, even as their bonds rallied hard, with their single B bonds springing up 20 points from their Feb 11 lows until default. Other defaulters such as CHK too saw their exchanged bonds jump up to 60 points. Note that virtually nothing has changed in the context of default probabilities in the Energy space, as it would perhaps require oil sustainably above $50/bbl to alter any of their fates. Which begs the question, how long can a rally based on recoveries alone last? Not much longer in our opinion. Having said that, rising oil could continue to push even ex-energy spreads tighter. However in the absence of solid fundamentals (more below), we think that this too will be short lived and the high correlation of non-commodity HY with oil will ultimately fade.

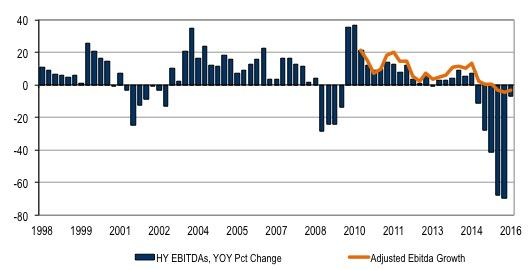

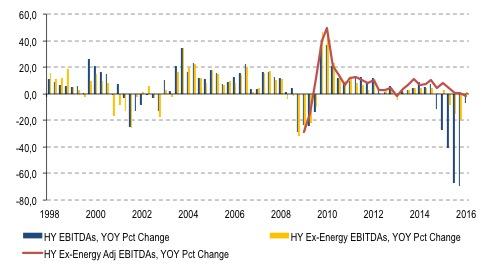

An early read of Q1'16 suggests more deterioration of HY balance sheets. With a little over 100 reporters, YoY revenue growth is -0.3% (5th consecutive -ve quarter) while YoY EBITDA growth is -7.0% (6th consecutive -ve quarter). Ex-energy, YoY revenue growth is nearly flat while YoY EBITDA growth is slightly positive. Adjusted EBITDA YoY growth numbers too are underwhelming, with US HY posting its 3rd consecutive -ve quarter, and ex-energy growth turning negative for the first time since Q1 2013.

We are back to where we were in HY spreads four months ago, but our message hasn't changed. In the context of poor HY fundamentals, lack of liquidity and rising defaults, central banks are the last remaining pillars of support for risk assets. Yes, they have surprised us so far this year in their ability to remain dovish, but even so, plenty headwinds remain and risk assets have more reasons to sell off than rally, especially from these levels. As such we view this rally as temporary and believe we could retest 9% yields on an ex-energy basis again this year." - source Bank of America Merrill Lynch

So, when you believe in things you actually do understand, therefore, you are not being "superstitious", you can indeed sidestep upcoming "risk-off" in the US High Yield space we think.

As far as credit is concerned in general and with the ECB's backstop in particular, pushing you to invest in "zero-coupon" investment grade credit at the point of the sword, as per our final chart, negative yields are not only spreading into the European Government Bond space, they are as well spreading into the Corporate credit space.

- Final chart: The world was poorer in terms of yield in the government space, thanks to the ECB it's spreading into Euro denominated corporate credit

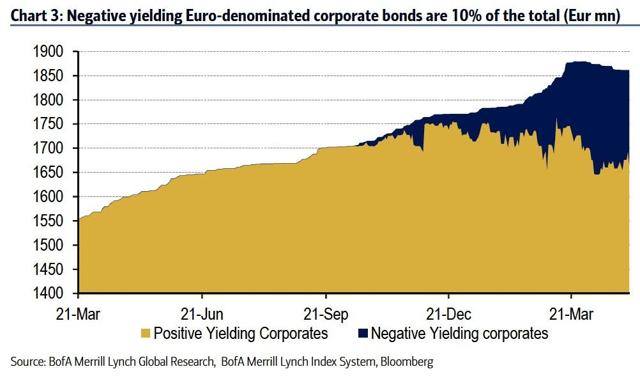

While in our previous conversation we started indicating how pandemic the NIRP virus had become in the Fixed Income world and in particular in the Government bond space in Europe, the ECB's CSPP is indeed accelerating the spread of the Negative Yield virus now to the Corporate sector as indicated by the below chart from Bank of America Merrill Lynch displaying the impacted on Euro denominated credit from their EM Credit Global note from the 9th of May entitled "ECB buying is positive for EM corporates":

"ECB says 'go' to more negative yielding corporate bonds

How low can spreads for IG corporates go? Chart 3 below shows that already, about 10% of Euro-denominated corporates are negative-yielding, or close to EUR200bn. This number could move meaningfully higher once buying begins.

The quantity of negative yielding assets globally has reached almost EUR10trn, or about 24% of global EUR assets. The figure was about 13% at FYE15 and 11% at FYE14. This figure includes sovereign debt eligible for purchase (see BofAML index GFIM).

- source Bank of America Merrill Lynch

Just because we wrote this conversation on Friday the 13th and born on a "13th" day, for us, it isn't a question of being "superstitious" but, we do think this "epic bond bubble" will end badly...

"I had only one superstition. I made sure to touch all the bases when I hit a home run." - Babe Ruth

Stay tuned!