Following the winding down of government broadband stimulus mandated by the American Recovery and Reinvestment Act of 2009 which led to a slowdown in sales growth (~16% in '13, ~5% in '14, ~1.6% in '15), Calix (NYSE:NYSE:CALX) ("Calix", "CALX", or "the Company") has sorely disappointed longs in recent quarters. Management has remained firm on their stance that a sustained and pronounced reinvigoration in top-line growth is just around the corner, but their statements appear to be falling on deaf ears.

Post-3Q '15, shares fell 24% on soft 4Q guidance which suggested the possibility of customers delaying capital spending, which undoubtedly worried investors. While 4Q saw strong FCC CAF II orders, quarterly revenues declined ~6% y/y, suggesting that consistent growth was still elusive, resulting in shares selling off ~14%. The sharp sell-offs can be seen below.

Source: Finbox.io

1Q '16 was uneventful, save for management guiding 2Q '16 sales to be between $104m and $108m, which at the mid-point suggests ~7% y/y growth, highlighting that the Company's growth trajectory would be much stronger going forward. Executives also implied that OpEx should moderate once the Occam litigation is over - which should be around 3Q '16; the Company filed with the SEC on April 18 showing that it had signed a memorandum of understanding regarding the litigation settlement.

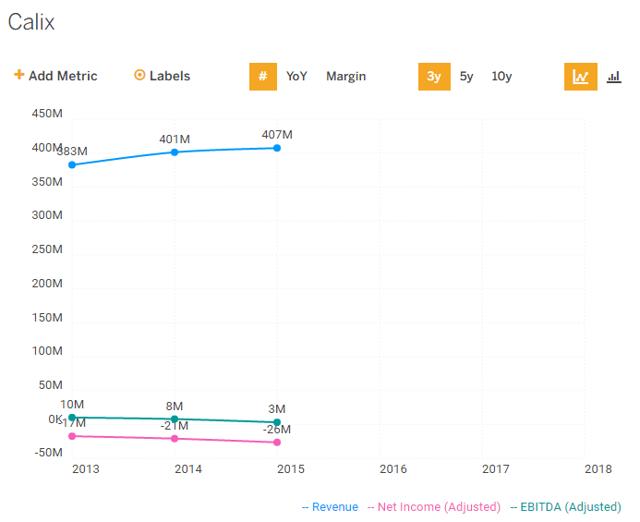

However, like the story of the boy who cried wolf, investors are not buying it; shares have hardly moved since the 1Q '16 report. It is clear that the market is skeptical about two things: 1) the likelihood of continued sales growth, and 2) the moderation of OpEx going forward. More broadly, investors are still undecided over whether the Company can ever be profitable - as seen below, despite growing revenue in recent years, EBITDA and net income are still going in the wrong direction.

Source: Finbox.io

Commentary From Dycom Suggests That Sales Growth Will Accelerate

While the more developed areas of the U.S. has access to fast broadband speeds, the same cannot be said for the rural cities. But, reaching rural cities are much more expensive. With that in mind, the FCC came up with the Connect America Fund ("CAF"), which is now in Phase II. This is likely CALX's most important growth driver going forward.

Simply put, CAF II provides subsidies to telecoms and carriers who are willing to target underserved parts of the country. Most of the players that are willing to target these markets are tier 2 and tier 3 carriers - the markets are fairly small relative to the size of tier 1 carriers, hence their limited interest. As a result, most of the CAF II funds have gone (or are going) to the tier 2 and tier 3 carriers.

As for the market for broadband access equipment, Alcatel-Lucent serves the tier 1s, while Calix and close peer Adtran (NASDAQ:ADTN) more or less split the tier 2 and tier 3 carrier market between themselves, though both share a tier 1 customer - CenturyLink.

There is reason to believe that CALX will be a disproportionate beneficiary of CAF II subsidies as compared to ADTN.

CALX has grown revenues from ~$345m to ~$407m while ADTN's declined from ~$717m to ~$600m over the 2011-2015 period. Moving on to specific geographies, domestic revenue for ADTN has not grown for the past 3-4 years while the opposite can be said for CALX.

Clearly, CALX has been mainly focused on the U.S. market in recent years (though it has begun to increase its presence internationally through the Ericsson deal in 2012 and is working on strengthening its foothold in numerous non-U.S. markets such as Asia, Europe, and Latin America), while ADTN has mostly focused on international opportunities.

The result of this focus by CALX on the U.S. market can be seen from recent releases such as the AXOS software (which appears well-received, with 25 customers deploying the operating system since release) and the invitation to join the ONOS project as a collaborator working to develop an interface to enable open app development for access networks. The AXOS software in particular seems highly compelling, due to its hardware independency which not only reduces operational complexity for customers, but also helps them mitigate the risk of being tied to any one hardware manufacturer. Another example of its effort that has seen some success is the GigaCenter solution which allowed CALX to enter the customer premises equipment market.

ADTN has innovated some as well, but its efforts do not seem to be as successful as CALX, evident from the divergence in the path of their respective top-lines. Thus, it seems fair to conclude that CALX has probably taken meaningful share from ADTN in the U.S. and hence it is likely to be a disproportionate beneficiary of incoming CAF II subsidies. That said, it is unlikely that carriers would choose CALX as the sole supplier; carriers like to dual-source (from both CALX and ADTN) for very good reasons - such as encouraging competition amongst suppliers thus ensuring continued innovation and reducing supply risk.

So, it is clear that there is a significant growth opportunity here, but the question is when it will materialize. As I alluded to earlier, the market initially hoped that growth would materialize in the later quarters of fiscal '15, but this turned out to be too optimistic. Naturally, management has lost some credibility in recent quarters as their commentary has heightened market expectations, but was not delivered on. Granted, we cannot entirely blame management for this, given that the timing of CAF II subsidies and the eventual orders by carriers is out of their control.

So if we can't trust management to give us an accurate timeframe for sales growth, who can we turn to? Fortunately for us, there are numerous data points from third parties that suggest that growth is just around the corner.

While I am bearish on Dycom, the firm does offer useful information in the context of CALX. It is important to understand Dycom's position in the value chain. It is in the business of digging trenches and laying cable, amongst other related activities. The key thing to note is that these activities have to be carried out before carriers order broadband access equipment to set up their networks. Essentially, Dycom comes one step before CALX in the value chain and thus its operating data can be used as a reasonable leading indicator of demand for CALX's products.

And by all accounts, Dycom is growing - and fast. Its revenues have grown at 15%-30% rates in recent years and seem poised to grow further, a point that is supported by its exploding backlog which grew ~$2b y/y and ~$1b sequentially, amounting to ~$5b as of 2Q '16. 3Q '16 results which were released a few weeks back tell a similar story - organic revenues grew ~29% y/y, and backlog continued growing, with an additional ~$600m added during the quarter bringing the total to ~$5.6b. Commentary from management suggests that this trend should continue:

Revenues and opportunities driven by this industry standard accelerated meaningfully during the third quarter of fiscal 2016. Customers are continuing to reveal with more specificity multiyear initiatives that are being implemented and managed on a market-by-market basis.

As our calendar 2016 performance-to-date and outlook clearly demonstrate, we are currently in the early stages of a massive investment cycle in wireline networks, which is already more meaningful than then one that occurred for us in the 1990s. Only a remarkably stubborn and protean incredulity could fail to recognize this."

Moreover, on a 9-month basis, Dycom reported that CenturyLink's contribution to revenue grew from 13.7% to 14.7%. With overall revenue growing, it is clear that CenturyLink is increasing its capital spending. With CenturyLink being CALX's largest customer (~22% of revenues), this data point is certainly highly encouraging.

Expenses Should Moderate In Upcoming Quarters

So, revenues should grow going forward. But bears will cite that while CALX has grown sales in recent years, expenses have grown faster. Thus, it does not seem as if the growth in the top-line will be accretive to the bottom-line. The market certainly echoes this view, as the stock has yet to see substantial appreciation despite top-line growth.

However, such a view neglects to consider the highly probable scenario where expenses moderate going forward. Management has repeatedly emphasized this point in recent quarters. While it is quite clear that it is hard to trust management on their projections of revenue, expenses are something that is certainly within their control, unlike revenue.

In recent years, while ADTN has maintained OpEx spending - it has ranged from $225m-$250m, CALX, on the other hand, has substantially increased OpEx expenditures - the number has grown from ~$172m in 2011 to ~$217m in 2015.

The outcome is like you would expect - ADTN maintenance of OpEx spending has resulted in revenue losses, while CALX's increases has brought revenue gains. Thing is, I am quite confident that CALX's current OpEx levels is able to support substantially greater revenue levels.

To back up this statement, I turn to ADTN's cost structure. At ADTN, OpEx has remained quite steady as discussed. While it has grown in terms of percentage of sales (due to falling sales), absolute growth is not as great.

In 2011, ADTN's OpEx was ~$225m while its revenues were ~$717m, implying that every ~31 cents in OpEx can support a dollar of sales. OpEx has increased since 2011 to ~$250m-$260m, but revenue has declined. Current OpEx is likely able to support sales greater than the ~$717m achieved in 2011.

If we apply this to CALX, its ~$217m in OpEx should be able to support ~$700m in sales, or sales ~70% greater than the current ~$415m trailing 12-month figure.

Is this a fair comparison? I believe it is, because ADTN bears striking similarities to CALX. They both attack the same markets (broadband access equipment), serve the same customers (CenturyLink is their largest, and they both serve tier 2 and tier 3 carriers), and have fairly similar revenue levels (CALX's ~$417m to ADTN's ~$600m).

Perhaps the only difference between the two is their international exposure. ADTN's is ~30% of sales while CALX's is ~12%. This is also reflected in their gross margins. ADTN's management has mentioned before that international sales garner roughly 30% gross margins while domestic sales earn approximately 50%. As a result, ADTN's overall gross margins are ~44% while CALX's are ~46%.

It is hard to imagine the cost structure being substantially different in the U.S. and internationally - the business model remains the same domestically and abroad. Additionally, CALX has initiatives in store to increase their international presence, so over time it will become more similar to ADTN. Stated simply, international exposure is not a significant difference, and as a result, I believe that the OpEx comparison is a fair one.

I would note that 2Q '16 guidance of $52m-$53m in OpEx implies a ~$210m run-rate at the mid-point on ~7% higher y/y revenue, which should puzzle bears and acts as further support for my assertion.

Valuation

So it is quite clear that growth is on the horizon and current OpEx spending should be able to support sales considerably higher than the current run-rate. What could numbers look like three years later?

Lets say sales grow by 50% by then to ~$622m, gross margins remain at 46%, and OpEx stays at ~$220m (recall that current OpEx should be able to support ~70% greater sales). After-tax earnings will then be ~$43m (assuming a 35% tax rate), or ~$0.88 per share on ~48.6m diluted shares outstanding. I note that actual earnings would be ~$66m or ~$1.36 per share, due to the presence of ~$674m in federal and state NOLs (~$552m federal, ~$122m state) eliminating the need to pay taxes.

Applying a 15x multiple on the after-tax earnings figure, which conservatively implies low-growth into perpetuity on a 10% discount rate, implies a ~$13.20 stock in 2019. Discounting that back to 2016 using the 10% rate gets us to ~$9.90, or ~40% upside from current levels.

This math does not include the value of NOLs. Due to the extent of the Company's NOLs, it will not be paying much, if any, in the way of taxes for many years. Note that the federal NOLs start expiring between 2019 through 2035, while the state NOLs start expiring between 2016 through 2035. If we account for the NOLs, a 15x multiple on ~$1.36 in EPS discounted back to 2016 would imply a fair value of roughly $15.30, or ~1.2x the current share price.

50% sales growth might appear a tall order in isolation, but it certainly seems much more achievable given the numbers that Dycom has been posting in recent quarters - ultimately, my 2019 sales estimate might even seem too pessimistic.

Moreover, broadly speaking, the sell-side does not appreciate the potential for explosive growth - most are modeling high single-digit growth at best for '16/'17. Morgan Stanley seems quite pessimistic, modeling ~5% and ~4% top-line growth for said years, while Cowen appears a tad more upbeat, expecting ~7% growth for both years.

In my view, the sell-side is reluctant to raise their revenue estimates largely due to the uncertainty of the timing of CAF II subsidies flowing through to CALX. Needless to say, this should change when analysts get more clarity as the Company surprises on growth over the next few quarters, which I expect.

CAF II is primarily a domestic initiative, and the domestic business garners higher gross margins relative to international, so CALX should see its gross margins expand from here on out. But, to be conservative, I am not modeling gross margin expansion.

One might be skeptical of OpEx moderation given the Company's history - in the years subsequent to the 2009 broadband stimulus, OpEx still remained stubbornly high, but this was due to CALX investing for future growth.

The Company has also been repurchasing shares so the 2019 diluted share count should be substantially lower.

A 15x multiple suggesting a ~$9.90 stock also implies ~1.18x price/sales (on ~48.6m shares outstanding and ~$407m in 2015 sales), which is meaningfully lower than ADTN's ~1.56x, and hence seems a reasonable expectation as it fairly reflects the current unprofitability of the Company, in my view.

Downside, Catalysts, Risks

What could downside be? In my view, not so much. The market is already pricing CALX as if it is unlikely to be profitable for the foreseeable future - at first sight, this seems fair considering that the Company has incurred operating losses since inception. So if growth does not show up and revenue thus stagnates, unprofitability will continue.

But, the share price shouldn't go down much, because there isn't a change in narrative. Big share price movements require a major change in market perception, and in the event growth does not materialize, the narrative - CALX is unprofitable - doesn't change much. This speaks to the asymmetry of the opportunity.

I would note that while CALX is unprofitable, the Company does generate meaningful free cash flow - 5-year FCF ending 2015 is averaging ~$14m - that it has been using to repurchase shares.

Moreover, if growth doesn't show up, CALX can reduce OpEx substantially (probably close to ADTN's current OpEx levels, as a percentage of sales), and become profitable - so it is not like profitability will be forever elusive.

Regardless, I think that the market views CALX as structurally unprofitable. Indeed, this has to be the case given the wide divergence in valuation between CALX and ADTN on a price/sales basis. However, it appears to me that the market's view is incorrect as it does not consider the fact that CALX is taking an investment-first, profitability-second approach.

Clearly, CALX has been investing in its salesforce and infrastructure - its growth in OpEx reflects this. The Company is essentially betting that it would be well-rewarded for this investment when growth finally arrives. The market has punished CALX for this, pricing it at a massive discount to ADTN on a price/sales basis.

On the other hand, ADTN has taken the opposite approach. In order to remain profitable, it has not grown OpEx in anticipation of an explosion in telecom/carrier capital spending. This will undoubtedly bite them in the behind. Yet, the market has priced ADTN as if growth has already arrived, rewarding it with a ~1.56x price/sales valuation (its P/E multiple is even more generous).

Viewed in this manner, we know which is likely to be the better bet going forward. Major catalysts that should drive a re-rating primarily revolve around accelerating top-line growth and controlled OpEx. As for risks, the most pertinent of which is a scenario where telecoms/carriers delay capital spending, pushing it out to later quarters. However, this seems unlikely given that operating data from Dycom indicates that the process is already underway.

To sum up, Calix is under-earning and there are numerous reasons to believe margins will expand meaningfully going forward, enabling the Company to turn profitable on a net basis. The market appears to be pricing CALX purely off its headline financials, seemingly unable to differentiate between a structurally unprofitable firm and one who is committed to take short-term pain in order to create long-term value.

The stock is worth just a tad south of $10 per share, not including the value of its substantial federal/state NOL hoard. Downside is protected by an already-pessimistic market perception, along with the fact that the Company trades at a large discount to its closest peer. I expect shares of CALX to start seeing signs of life as the firm starts to surprise in the following quarters.