The railroad industry is extremely durable, and Union Pacific (NYSE:UNP) has proven to be no exception since its founding in the 1860s.

Railcars are a critical mode of transportation and move about 40% of U.S. freight as measured in ton-miles (the length freight travels). Without companies like Union Pacific, the country's supply chain could not operate.

Perhaps it is no surprise why Warren Buffett acquired leading railroad company Burlington Northern Santa Fe (BNSF) in 2010 for $34 billion, adding the company to Berkshire Hathaway's portfolio of high quality dividend stocks.

Union Pacific shares a number of qualities with BNSF and should be of interest to long-term dividend growth investors, especially since the stock has pulled back on weak commodity fundamentals.

Business Overview

Union Pacific owns and operates over 32,000 miles of railroads linking 23 states in the western two-thirds of the United States.

Its railways connect with all of the major ports on the West Coast and Gulf Coast and serve many of the fastest-growing cities in the country. Union Pacific's rail network also connects with some of Canada's railways and all of Mexico's major gateways.

The company serves approximately 10,000 customers across a variety of industries including agriculture (17% of 2015 freight revenue), automotive (11%), chemicals (17%), coal (16%), industrial (19%), and intermodal (20%).

Business Analysis: Union Pacific

U.S. railroads were financially and operationally challenged under stringent government oversight until the Staggers Rail Act of 1980 deregulated the industry.

According to the Federal Railroad Administration, prior to 1980, railroads had little flexibility in pricing their services and restructuring their operations to become more efficient.

During periods of inflation, regulation slowed down rate adjustments that railroad operators could realize, crimping profits and causing a number of railways to declare bankruptcy.

In the 30 years leading up to 1980, railroads saw their share of revenue ton-miles plunge from 56.1% to 37.5%. The outlook was bleak.

The Staggers Rail Act of 1980 changed everything. Railroads implemented market-based pricing schemes on many routes, invested over $500 billion in capital improvements and maintenance to improve productivity, and train accident rates fell by 65% from 1981 to 2009.

Impressively, the lack of government oversight resulted in freight rates declining by 0.5% per year compared to an increase of nearly 3% per year in the five years leading up to act's passage in 1980.

The industry's market share also increased back to 40% of ton-miles and has remained stable. Today, about 20% of railway traffic is still regulated where competition is not deemed to be effective enough to protect shippers.

Throughout the last several decades, the railroad industry has significantly consolidated in an effort to further improve productivity, raise profit margins, and better combat alternative modes of transportation (e.g. trucks).

Of the 140,000 rail miles in the U.S. today, Union Pacific, BNSF, and Norfolk Southern account for more than 84,000 miles (over 60% of total rail miles).

The barriers to entry in the industry are high because building and maintaining railroads is extremely capital intensive.

While most types of businesses will spend between 2-4% of their total sales on capital expenditures to maintain and grow their operations, Union Pacific expects spending to average around 16-17% of revenue.

Over the last decade alone, Union Pacific has invested $33 billion in its rail network to maintain and upgrade its transportation infrastructure.

Smaller operators cannot match the company's spending, and Union Pacific's routes present another barrier to entry.

Simply put, the market is only big enough to support a small handful of operators in most areas because it is so expensive to build and maintain a railroad.

The large incumbents have the scale and efficiencies needed to underprice potential new entrants and remain in control of their key markets.

There are also only so many major transportation hubs and consumer markets, further limiting competition.

Union Pacific has the best access to Gulf and West Coast ports and is the only railroad that serves all six major rail gateways between the U.S. and Mexico. Through rail industry partnerships, the company can also access roughly 90% of the population in North America.

Major railroad operators have enjoyed strong pricing power due to many of the factors discussed above.

From 2012 through 2015, Union Pacific's average annual pricing gain was 3.6%, and the company continues to realize pricing improvements even despite the current slump in commodity shipments.

Thanks to consistent pricing gains and efficiency improvements, Union Pacific improved its operating ratio from 87.5% in 2004 to 63.1% in 2015.

The company expects volume growth, core pricing increases, and productivity gains to further improve its operating ratio to 60% on a full year basis by 2019.

Looking even longer term, Union Pacific began its "G55 + 0" initiative in the fall of 2015. This program has a goal of achieving a 55% operating ratio over time with a goal of zero injuries.

As long as Union Pacific continues to invest in its infrastructure to maintain leading safety and efficiency metrics, it's hard to imagine new rail competition disrupting its business.

The company's competitive advantages should only strengthen in future years as it invests to become safer, more efficient, and extremely productive.

Finally, it's worth acknowledging the long-term durability of the railroad industry. Freight volumes generally follow population growth over long periods of time.

According to the Federal Railroad Administration, the U.S. freight system will enjoy a 22% increase in the total amount of tonnage its moves between 2010 and 2035 as the U.S. population expands.

There will always be a need to connect consumers with agricultural, industrial, manufacturing, and logistics centers across the country. As a best-in-class operator with hard-to-replicate assets, Union Pacific will be there to meet this major need.

Key Risks

Union Pacific's stock slumped over 30% in 2015, driven by a 6% volume decline and an unfavorable shift in business mix. Each of the company's business groups recorded a decline in freight revenues except for automotive.

The slump in grain prices, plunge in the price of oil, strengthening U.S. dollar, and continued decline in the use of coal all contributed to Union Pacific's weakness in 2015.

While I view railroads as having an economic moat, that doesn't mean demand for their services is inelastic. Macro volatility can whip quarterly results around and should be expected with an investment in Union Pacific.

However, in most cases, macro volatility (and potential safety or operational hiccups) shouldn't impact the company's long-term earnings power.

Coal could prove to be an exception. Union Pacific transports coal to power companies and industrial facilities and generated 16% of its freight revenue last year from the commodity.

Freight revenue from coal shipments fell by 22% in 2015 and show no sign of recovering - maybe ever.

Coal as a percentage of U.S. electricity generation fell from 38.5% in 2014 to about 33% in 2015. The Energy Information Association projects that coal will only comprise 31% of U.S. electricity generation in 2016.

The shift away from coal is being driven by new power plant emission regulations and low natural gas prices, which are accelerating the shift of electricity generation away from coal to natural gas.

While no one knows when and where coal fundamentals will begin to stabilize (coal will likely remain an important source of power generation), investors are very aware of the headwind at this point.

At less than 15% of total freight revenue in the first quarter of 2016, Union Pacific's exposure to coal looks increasingly manageable.

While there is risk that the company overinvested and might have too much capacity the next few years, it has so far done an excellent job tightening up its costs in response to the challenging operating environment.

Union Pacific's operating ratio continues improving, and the company remains in good financial health.

Aside from the secular decline in coal, competition from other modes of transportation could pose a threat to Union Pacific's long-term earnings power if they take share away from railroads.

Trucks, barges, ships, planes, and pipelines all compete with railroads to efficiently and reliably transport goods.

Rail transportation has been, and will likely continue to be, the best option for shipping bulk commodities such as grain, construction materials, and energy products.

These materials have a high weight-to-price ratio and generally do not require time-sensitive deliveries. Railroads can transport these bulk materials using less fuel than trucks over long distances and are usually faster than using waterways, which face physical limitations. I expect rail's market share of ton-miles to remain stable around 40% just like it has for a couple of decades.

Overall, barring a secular decline in commodity consumption, it's hard to find many risks that could impair Union Pacific's long-term earnings power.

The next few quarters could remain rocky as unpredictable commodity markets fluctuate, but that has no bearing on Union Pacific's competitive advantages.

Dividend Analysis: Union Pacific

We analyze 25+ years of dividend data and 10+ years of fundamental data to understand the safety and growth prospects of a dividend.

Dividend Safety Score

Our Safety Score answers the question, "Is the current dividend payment safe?" We look at factors such as current and historical EPS and FCF payout ratios, debt levels, free cash flow generation, industry cyclicality, ROIC trends, and more. Scores of 50 are average, 75 or higher is very good, and 25 or lower is considered weak.

Despite the slump in commodities, Union Pacific's dividend payment looks very safe. The company's solid Dividend Safety Score of 84 is driven by its relatively low payout ratio, excellent free cash flow generation, stable returns, and reasonable balance sheet.

Before diving in to the company's status today, conservative dividend investors might wonder why Union Pacific cut its dividend by more than half in 1998. After all, there are many blue chip dividend stocks with better long-term track records of reliable dividend payments.

The issue that impacted Union Pacific in 1998 isn't one that will likely be repeated. The company had acquired Southern Pacific Rail Corporation for $5.4 billion in 1996 and faced substantial operational challenges on a major track.

Congestion had become a big problem on the single-direction track following the acquisition, resulting in lost sales as customers turned to more reliable operators.

Union Pacific ultimately issued up to $1 billion in equity-related securities and cut its dividend to rebuild part of its railway. The company had been operating at a loss during this period.

Today, there are no such operational issues facing the company, and the business is in much better financial health. Given its size, another large merger is also unlikely.

Since the dividend cut in 1998, Union Pacific has paid uninterrupted dividends and increased its dividend each year since 2007.

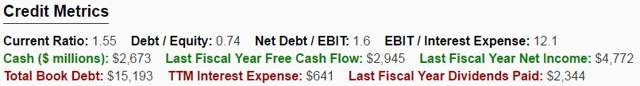

Union Pacific targets a dividend payout ratio of about 35%, and the company's earnings payout ratio sits at 41% on a trailing 12-months basis.

This is a healthy payout ratio for just about any type of company and maintains a reasonable margin of safety for an economy-sensitive business such as Union Pacific. Even if earnings were unexpectedly cut in half, Union Pacific's payout ratio would be under 85%.

Over the last decade, Union Pacific's earnings payout ratio has generally remained between 20% and 30%, highlighting the stability of its earnings and dividend growth. Even during the financial crisis we can see that Union Pacific's payout ratio only increased from 21% in 2008 to 29% in 2009.

Source: Simply Safe Dividends

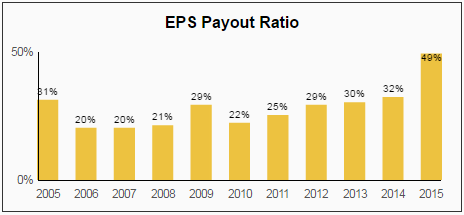

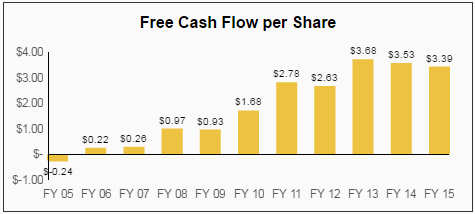

The company's free cash flow payout ratio has been a bit lumpier, underscoring the capital intensity of the business.

Source: Simply Safe Dividends

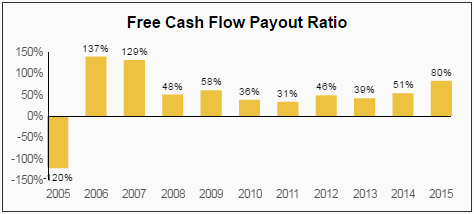

Another factor impacting dividend safety is how a business performed during the last economic shock. Union Pacific saw its sales fall by 21% during the last recession. However, its cost controls were exceptional.

Management was able to hold free cash flow per share nearly steady in fiscal year 2009 and contained the company's drop in earnings per share to just 17%. As a result, Union Pacific was able to squeeze out a moderate dividend increase during the downturn.

Union Pacific's stock also returned -23% in 2008, which outperformed the S&P 500 by 14%. While cyclical companies score lower for Dividend Safety, Union Pacific fared reasonable well during the last recession, all things considered.

Source: Simply Safe Dividends

Free cash flow is one of the most important financial metrics to understand for successful dividend investing. Without free cash flow, a company cannot sustainably pay dividends. As seen below, Union Pacific has generated consistent free cash flow. While railroads require substantial capital to build and maintain, they throw off a lot of cash. As Union Pacific continues increasing prices and investing in more efficient operations, cash flow generation should remain strong to support the dividend.

Source: Simply Safe Dividends

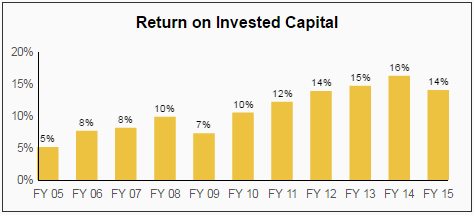

Union Pacific has steadily improved its return on invested capital over the last decade. The company's stable returns in the mid-teens suggest that it has an economic moat and enable it to compound its earnings faster than other lower-returning businesses. A relatively high and stable return can also indicate that a company's dividend payment is of higher quality.

Source: Simply Safe Dividends

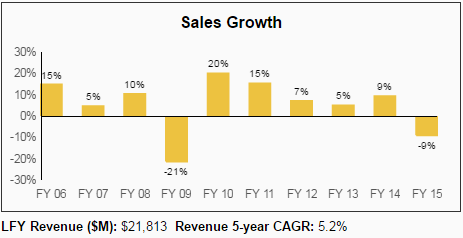

Reviewing a company's balance sheet is also essential to assess dividend safety, especially for macro-sensitive stocks. Companies will always make interest and debt payments before paying a dividend.

Union Pacific's financial leverage looks reasonable. As seen below, the company could cover its entire net debt with cash on hand and just 1.6 years' worth of earnings before interest and taxes (EBIT). Union Pacific also maintains investment grade credit ratings.

Source: Simply Safe Dividends

Overall, Union Pacific appears to have one of the safest dividend payments in the market. The company has healthy payout ratios, generates predictable free cash flow, and has demonstrated an excellent ability to pullback on costs when times get tough.

Dividend Growth Score

Our Growth Score answers the question, "How fast is the dividend likely to grow?" It considers many of the same fundamental factors as the Safety Score but places more weight on growth-centric metrics like sales and earnings growth and payout ratios. Scores of 50 are average, 75 or higher is very good, and 25 or lower is considered weak.

Union Pacific has a Dividend Growth Score of 66, which suggests that its dividend growth potential is somewhat above-average.

The company has paid uninterrupted dividends since 1998 and increased its dividend every year since 2007.

The company increased its total declared dividends per share by 15% in 2015 and has compounded its dividend by 22% per year over its last 10 fiscal years.

Source: Simply Safe Dividends

Despite the company's strong historical dividend growth, I expect dividend growth to moderate to a mid-single digit rate over the near term because of the macro challenges facing the business.

Valuation

Shares of Union Pacific trade at a forward-looking P/E ratio of 17.3 and have a dividend yield of 2.5%, which is higher than their five-year average dividend yield of 2%.

Over the long term, I believe Union Pacific's earnings can grow at a 6-8% annual rate, which is about half as fast as the company's earnings have grown over the last five years.

Freight demand should increase with population growth over time, and Union Pacific's business model employs a good amount of operating leverage to realize faster earnings growth.

Under these assumptions, the stock appears to offer annual total return potential of 9-11% per year (2.5% dividend yield plus 6-8% annual earnings growth).

The stock doesn't look like a bargain today, but it does appear to be reasonably priced considering its high business quality.

If commodity headwinds intensify and further pressure the business, Union Pacific's stock could become very attractively priced for new investment money.

Conclusion

Union Pacific is a durable company that is sensitive to economic growth and a number of different commodity markets.

While current macro conditions are far from ideal and could certainly get worse from here (no one knows), the long-term outlook remains stable in my view.

Freight demand should continue to expand with population growth, and Union Pacific's railroads will likely remain an essential component of our country's supply chain for many years to come.

As long as we are not on the brink of another recession or a bigger bust in commodity markets, Union Pacific appears to be reasonably priced for long-term dividend growth investors seeking exposure to industrial-sensitive stocks. It's the type of company I like to own in our Top 20 Dividend Stocks portfolio.